International investing opens up a world of opportunities for savvy investors seeking to diversify their portfolios. At Davies Wealth Management, we’ve seen firsthand how global diversification can help mitigate risks and potentially enhance returns.

However, navigating the complexities of foreign markets requires careful consideration and strategic planning. This guide will explore the key aspects of international investing and provide practical strategies for success in the global financial landscape.

Why International Investing Matters

The Power of Economic Diversity

International investing expands financial horizons for investors seeking to broaden their portfolios. When you invest internationally, you tap into the economic engines of different countries. This diversity can transform your portfolio. While the U.S. economy might slow down, emerging markets like India or Brazil could experience rapid growth. Spreading investments across various economies reduces the likelihood of feeling the full impact of a downturn in any single market.

Emerging Markets: High Risk, High Reward

Emerging markets offer a unique proposition for investors willing to accept additional risk. These economies, often characterized by rapid industrialization and growing middle classes, can provide substantial returns. However, investors should approach these markets with caution and as part of a balanced strategy. This chart attempts to answer how long you should stay invested to have a high probability of achieving a positive return.

Protection Against Domestic Downturns

No economy remains immune to recessions or market corrections. International diversification can help reduce the impact of market downturns. A case study of the 2008 financial crisis highlights the importance of having a well-diversified investment portfolio to help mitigate the effects of economic challenges.

Capitalizing on Global Innovation

International investing allows participation in global innovation and growth trends. Many groundbreaking technologies and business models emerge from outside the United States. Emerging markets trends for the next decade include innovation, urbanization, and shifting geopolitical and global trade dynamics, which can present unique investment opportunities.

Navigating Challenges in International Investing

International investing presents challenges, including currency fluctuations and geopolitical risks. However, a strategic approach can significantly enhance a portfolio’s resilience and growth potential. The next section will explore key considerations for successful international investing, equipping you with the knowledge to make informed decisions in the global marketplace.

Navigating International Investment Risks

Currency Exchange Rate Fluctuations

International investing exposes portfolios to currency risk. Exchange rate changes can significantly alter returns. For instance, an investment in Japanese stocks might yield lower returns when converted to U.S. dollars if the yen weakens. Investors can mitigate this risk through currency-hedged ETFs or mutual funds, which track the values of overseas securities without exposing investors to excess currency risk.

Political and Economic Stability Assessment

A country’s political and economic landscape profoundly affects investments. Thorough research into a nation’s political system, economic policies, and historical stability is essential before investing. The World Bank’s Ease of Doing Business Index ranks economies on their ease of doing business, from 1–190. A high ranking means the regulatory environment is more conducive to business operations. The Heritage Foundation’s Index of Economic Freedom provides valuable insights into a country’s investment climate. Countries with stable governments and strong economic fundamentals typically offer lower-risk investment opportunities.

Regulatory Differences and Tax Implications

Each country maintains its own set of regulations and tax laws that impact investments. Some nations impose restrictions on foreign ownership in certain industries. Investors may also face withholding taxes on dividends or capital gains. Understanding these implications is critical before investing. Consultation with a tax professional who specializes in international investments ensures compliance and optimizes tax strategy.

Market Liquidity and Transaction Costs

Liquidity varies significantly across international markets. Emerging markets often have lower trading volumes, which can make it challenging to buy or sell large positions without affecting stock prices. Additionally, transaction costs in foreign markets can exceed those in domestic markets. Investors can address these issues by investing through American Depositary Receipts (ADRs) or global ETFs, which often provide better liquidity and lower transaction costs compared to direct foreign stock purchases.

Cultural Nuances and Business Practices

Understanding cultural differences and local business practices is crucial for successful international investing. What works in one market may not translate well to another. Investors should familiarize themselves with local customs, negotiation styles, and business etiquette. This knowledge can help avoid misunderstandings and foster better relationships with local partners or companies.

International investing requires careful consideration of these factors. While risks exist, they can be managed with proper research and strategy. As we move forward, we’ll explore effective strategies for successful international investing that can help you build a robust, globally diversified portfolio.

Mastering Global Investment Strategies

Selecting Appropriate Investment Vehicles

International investing demands a strategic approach to capitalize on global opportunities. Exchange-Traded Funds (ETFs) provide a cost-effective method to gain broad exposure to foreign markets. The iShares MSCI EAFE ETF, for instance, offers access to developed markets outside North America. Actively managed mutual funds can potentially outperform in less efficient markets.

For more targeted exposure, American Depositary Receipts (ADRs) allow investment in individual foreign companies through U.S. exchanges. This reduces currency conversion costs and simplifies tax reporting. Popular ADRs include Alibaba Group and Taiwan Semiconductor Manufacturing Company.

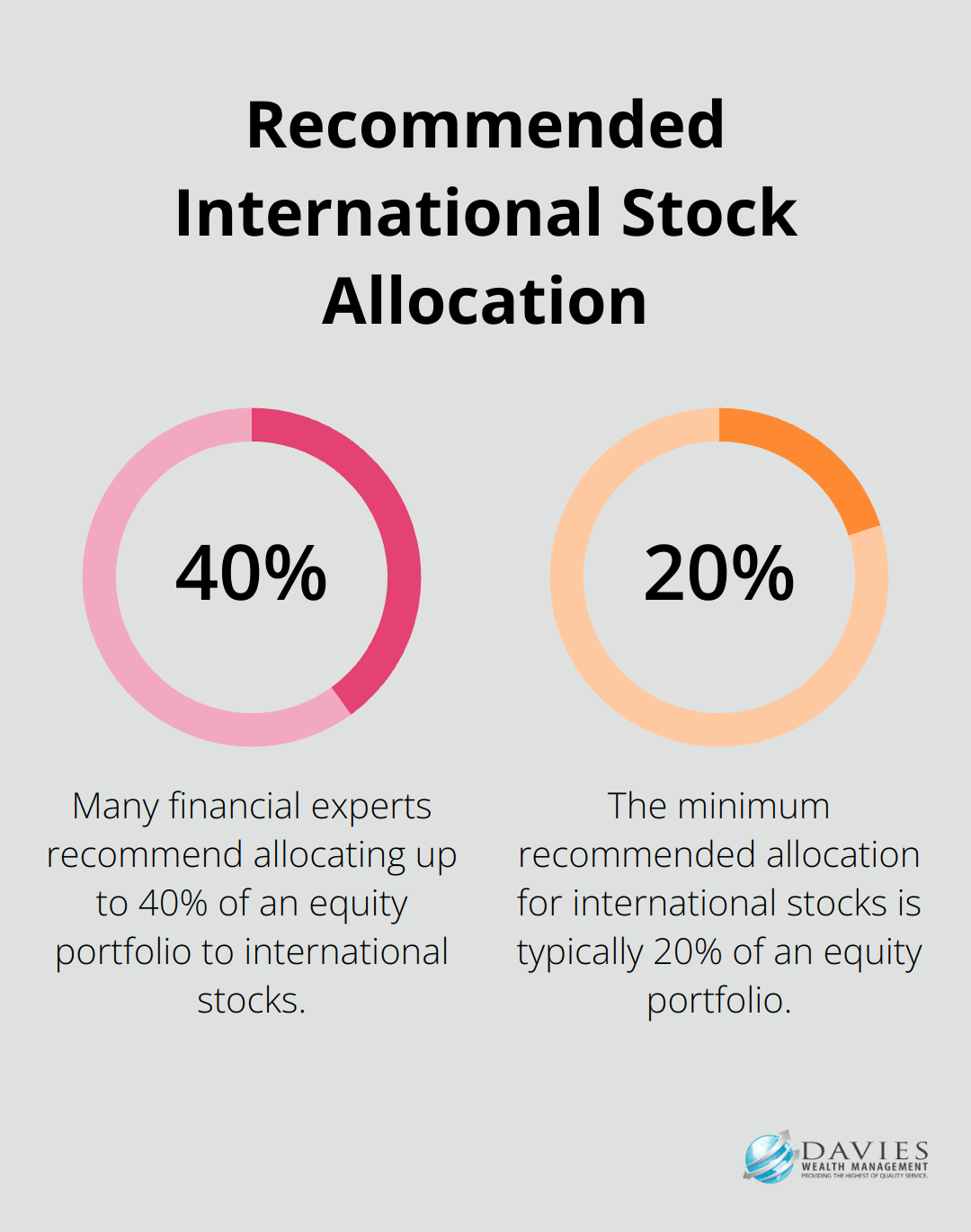

Optimizing Portfolio Allocation

A balanced portfolio between domestic and international assets is essential. Many financial experts recommend allocating 20-40% of an equity portfolio to international stocks. This allocation helps capture global growth opportunities while maintaining a strong domestic base.

Periodic rebalancing of your portfolio maintains your target allocation. Market fluctuations can skew your asset mix over time. If international stocks outperform, their proportion in your portfolio may increase beyond your target allocation. Regular rebalancing (typically annually or semi-annually) helps maintain your desired risk profile.

Leveraging Professional Expertise

Complex international markets often require specialized knowledge. Working with a wealth management firm provides valuable insights and access to sophisticated investment strategies. A team’s expertise in global markets can help identify opportunities that align with your financial goals while managing complex international transactions.

Professional guidance proves particularly beneficial when investing in emerging markets. These markets often have unique regulatory environments and economic dynamics that require in-depth understanding. A wealth manager can help you navigate these complexities and make informed investment decisions.

Managing Currency Risk

International investing exposes portfolios to currency fluctuations. Exchange rate changes can significantly alter returns. An investment in Japanese stocks might yield lower returns when converted to U.S. dollars if the yen weakens. Investors can mitigate this risk through currency-hedged ETFs or mutual funds, which track the values of overseas securities without exposing investors to excess currency risk.

Staying Informed on Global Trends

Successful international investing requires staying up-to-date with global economic and political developments. Subscribe to reputable international news sources and financial publications. Attend webinars or seminars on global investing. This knowledge will help you make informed decisions and adjust your strategy as global conditions change.

Final Thoughts

International investing offers powerful opportunities for portfolio diversification and global growth. Investors who expand beyond local markets can access various economic engines, which enhances returns and mitigates risks. However, this approach presents challenges such as currency fluctuations, political instability, and regulatory differences that shape investment outcomes.

Successful international investing requires a strategic approach and deep understanding of global factors. Investors should select appropriate vehicles (ETFs, ADRs, or mutual funds), maintain balanced portfolio allocation, and stay informed about global economic trends. Regular portfolio rebalancing ensures asset mix alignment with investment goals and risk tolerance.

Davies Wealth Management understands the complexities of international investing and its importance in building robust portfolios. Our expert team provides personalized guidance to help you navigate the global financial landscape. For tailored strategies that align with your financial goals, consider our professional wealth management services.

Leave a Reply