At Davies Wealth Management, we believe financial literacy is the cornerstone of building long-term wealth. It’s the key that unlocks smart money decisions and paves the way for financial success.

Financial literacy empowers individuals to make informed choices about budgeting, saving, investing, and managing debt. In this post, we’ll explore why it’s essential and provide practical strategies to boost your financial knowledge.

What Is Financial Literacy?

Definition and Importance

Financial literacy is the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing. It’s a fundamental skill that empowers individuals to make informed decisions about their money and build long-term wealth.

Key Components of Financial Literacy

Financial literacy encompasses several key components:

- Budgeting: Creating and adhering to a financial plan

- Saving and Investing: Understanding different investment vehicles and strategies

- Credit and Debt Management: Grasping the concepts of borrowing and repayment

- Risk Management: Comprehending financial concepts such as compound interest, inflation, and diversification

A study by the TIAA Institute found that only 19% of millennials could answer basic finance questions correctly. This statistic highlights the urgent need for improved financial education across all age groups.

Real-World Impact

The impact of financial literacy on personal wealth is significant and far-reaching. Individuals with strong financial literacy skills make better financial decisions, which leads to improved financial outcomes over time.

For example, the 2022 Federal Reserve report revealed that 8 percent of non-retired adults tapped their retirement savings. This statistic underscores the importance of financial literacy in planning for the future and building long-term wealth.

Practical Steps to Enhance Financial Literacy

Improving your financial literacy doesn’t have to be overwhelming. You can start with these practical steps:

- Track your monthly expenses and create a budget (this simple act can provide valuable insights into your spending habits)

- Set money aside for unexpected costs and emergencies

- Stay informed about financial markets and regulations (they are constantly evolving, so continuous learning is essential)

Financial literacy is not just about accumulating knowledge-it’s about applying that knowledge to make better financial decisions. The next chapter will explore specific strategies to improve your financial literacy and set you on the path to long-term wealth building.

Building Your Financial Foundation

Mastering Your Money Flow

The first step in building financial literacy is to understand your cash flow. Track every dollar you earn and spend for a month. This exercise often reveals surprising spending patterns. Budgeting apps like Mint or YNAB simplify this process. Once you have a clear picture of your finances, create a realistic budget that aligns with your financial goals.

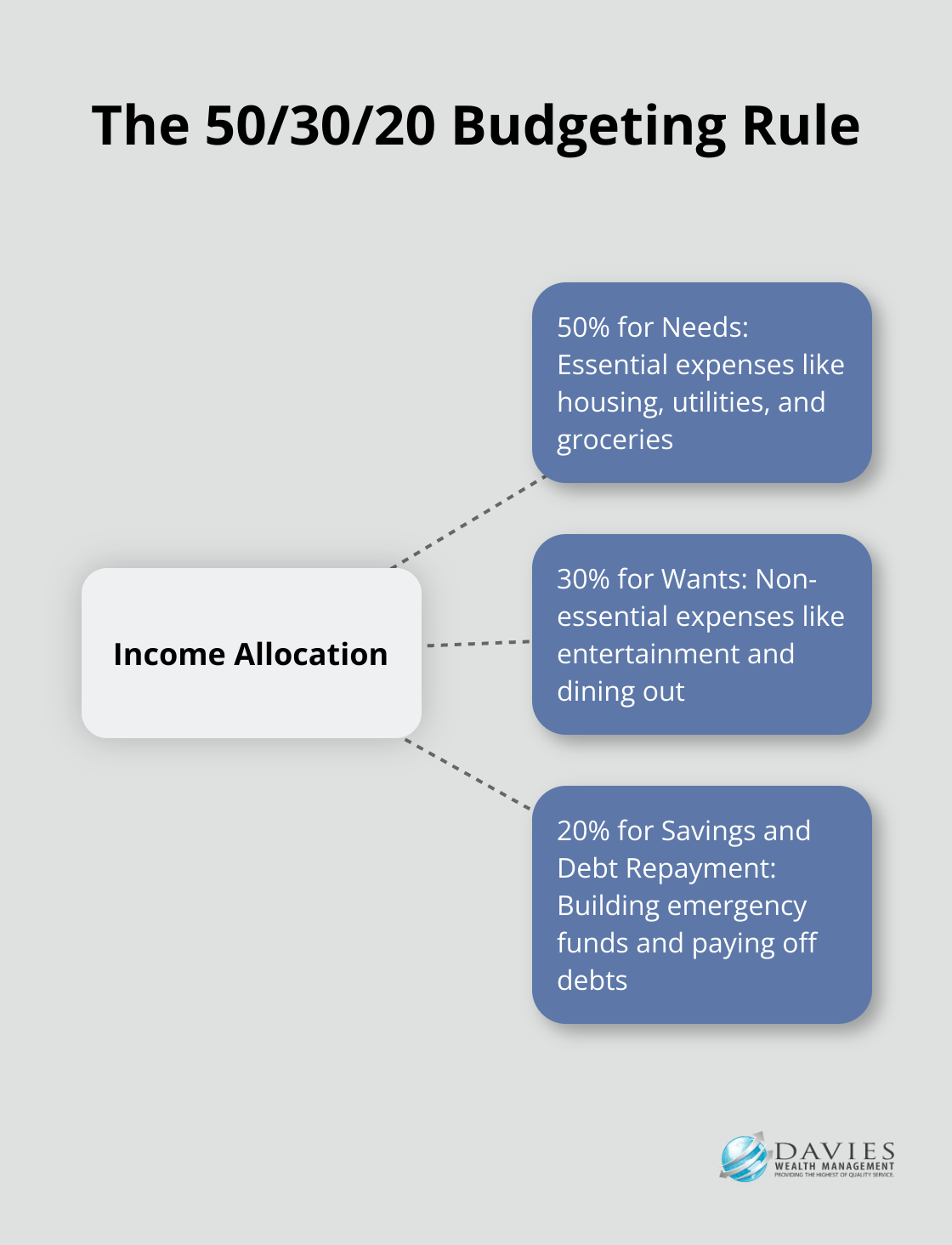

A practical tip: allocate your income using the 50/30/20 rule (50% for needs, 30% for wants, and 20% for savings and debt repayment). This simple framework can help you maintain financial balance and prioritize your spending.

Growing Your Wealth

Building long-term wealth involves being smart about credit card debt, leaving room to save and invest, starting to save and invest regularly, and considering starting with your 401(k) and IRA. Establish an emergency fund with 3-6 months of living expenses. This financial cushion provides peace of mind and prevents you from derailing your long-term plans due to unexpected events.

When it comes to investing, diversification is key. Consider a mix of stocks, bonds, and real estate to spread your risk. If you’re new to investing, low-cost index funds are an excellent starting point. They offer broad market exposure and have historically outperformed many actively managed funds.

Managing Debt Wisely

Understanding credit and debt management is vital for financial health. Pay your credit card balance in full each month to avoid high-interest charges. If you have multiple debts, consider using the debt avalanche method: focus on paying off the highest-interest debt first while making minimum payments on others.

For those with student loans, explore income-driven repayment plans or refinancing options to potentially lower your monthly payments. Not all debt is bad. Mortgages and business loans can be strategic tools for building wealth when used wisely.

Protecting Your Financial Future

Insurance and risk management are often overlooked aspects of financial literacy. Adequate insurance coverage protects your wealth from unforeseen events. Review your policies annually to ensure they still meet your needs.

Consider disability insurance, which protects your income if you’re unable to work. For professional athletes, specialized insurance strategies can include exploring a permanent total disability (PTD) insurance policy to financially protect against career-ending injuries.

Continuous Learning and Adaptation

Financial literacy is an ongoing process that requires continuous learning and adaptation. Stay informed about financial markets, tax laws, and economic trends. Attend workshops, read financial publications, and follow reputable financial experts on social media.

As you progress on your financial journey, you’ll find that mastering these building blocks of financial literacy sets a solid foundation for long-term wealth building. The next chapter will explore specific strategies to further improve your financial literacy and accelerate your path to financial success.

Boosting Your Financial IQ

Leverage Digital Learning Platforms

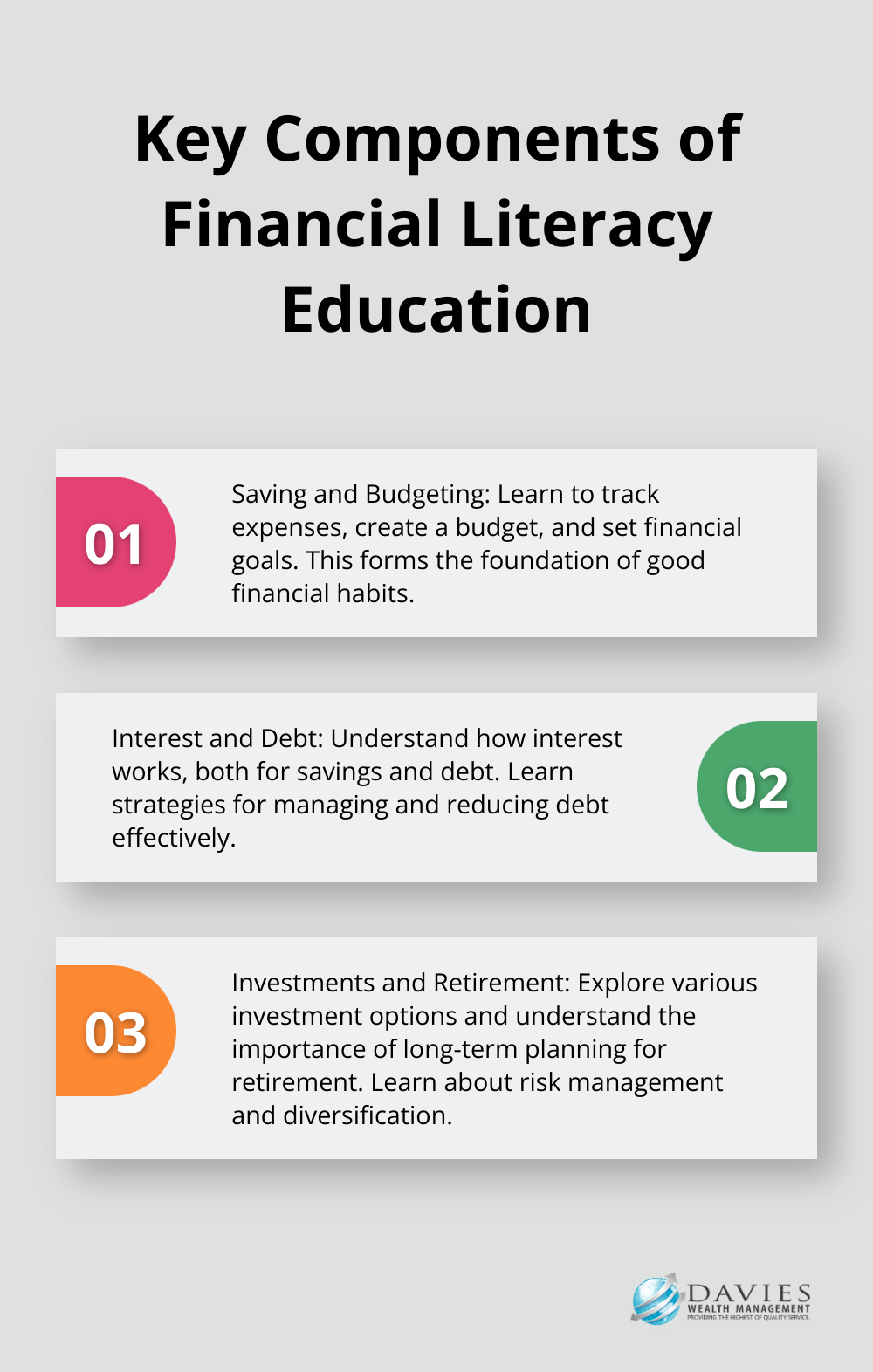

The internet offers a wealth of financial education resources. Websites like Khan Academy provide free courses on various financial topics, including saving and budgeting, interest and debt, investments and retirement, and income and benefits. These platforms allow you to learn at your own pace and focus on areas where you need the most improvement.

Engage with Financial Professionals

While self-study is valuable, personalized advice from experienced professionals can be invaluable. Professional financial advisors can provide insights tailored to your specific goals and challenges. When choosing a financial advisor, consider opting for a fee-only advisor and be prepared to discuss your financial plans and budget.

Implement Hands-On Money Management

Theory is important, but practice is where real learning happens. Start by creating a detailed budget using tools like You Need A Budget (YNAB) or Personal Capital. These apps not only help you track your spending but also provide insights into your financial habits.

Next, set up a small investment portfolio. Many brokerages now offer fractional shares, allowing you to invest in high-priced stocks with as little as $5. This hands-on experience will teach you about market fluctuations, diversification, and the importance of long-term thinking in investing.

Attend Workshops and Seminars

Financial workshops and seminars offer opportunities to learn from experts and network with like-minded individuals. These events often cover specific topics in depth (such as retirement planning or tax strategies) and allow you to ask questions directly to financial professionals.

Try to attend at least one financial workshop or seminar per year. Many local banks, credit unions, and community centers offer free or low-cost financial education events.

Stay Informed with Financial News

Keeping up with financial news helps you understand broader economic trends that can impact your personal finances. Subscribe to reputable financial news sources (like The Wall Street Journal or Bloomberg) and dedicate time each week to reading about current financial events.

You can also follow financial experts on social media platforms for quick insights and tips. However, always verify information from multiple sources before making any financial decisions based on social media advice.

Final Thoughts

Financial literacy forms the foundation for long-term wealth building. It equips individuals with the tools to make informed financial decisions and secure their financial future. The benefits of financial literacy extend beyond bank accounts, preparing people to navigate economic uncertainties and seize investment opportunities.

We encourage you to take action on your financial literacy journey. Start by tracking expenses, creating a budget, and investing (even small amounts). Continuous education through online resources, workshops, and professional advice will enhance your financial knowledge and decision-making skills.

At Davies Wealth Management, we support individuals, families, and professional athletes to achieve their financial goals. Our expertise in investment management, retirement planning, and tax-efficient strategies can guide you toward financial literacy and long-term wealth building. Take the first step today for a more secure financial future.

Leave a Reply