At Davies Wealth Management, we understand that succession planning is a critical aspect of long-term business success. A well-crafted succession plan ensures the smooth transition of leadership and preserves the company’s legacy.

Unfortunately, many business owners overlook this vital process, putting their organizations at risk. In this post, we’ll guide you through the essential steps to develop an effective business succession plan that safeguards your company’s future.

Why Succession Planning Matters

The Hidden Costs of Neglecting Succession Planning

Succession planning is a strategic process that ensures the continuity and stability of a business when key leaders depart. Many business owners underestimate its importance. A 2022 MassMutual study revealed that only 35% of small and mid-sized businesses have started succession planning, with a mere 8% having a complete written plan. This lack of preparation can lead to significant financial losses. Poor succession planning can result in poor performance by outsider CEOs and loss of C-suite intellectual capital at firms.

Preserving Your Business Legacy

A well-structured succession plan does more than just name a successor. It ensures that your company’s values, culture, and strategic vision continue long after you’ve stepped down. This is particularly important for family-owned businesses (which make up 90% of U.S. small businesses). However, only 30% of these businesses survive into the second generation, according to the Small Business Administration (SBA).

Mitigating Risks and Ensuring Stability

Without a succession plan, your business faces numerous risks. These include leadership gaps, loss of key clients, and potential disputes among stakeholders. Many business owners may not be able to sell their businesses when they’re ready because they’re not taking critical steps toward a transition. This underscores the importance of having a comprehensive exit strategy that considers not just ownership transition, but also the interests of employees and the community.

Attracting and Retaining Top Talent

An effective succession plan can be a powerful tool for talent retention. It demonstrates to high-potential employees that there are clear paths for advancement within the organization. This can significantly boost employee engagement and productivity. Gallup research shows that companies with strong succession planning practices tend to outperform their peers in these areas.

The Role of Professional Guidance

Developing a comprehensive succession plan requires expertise and careful consideration of various factors (legal, financial, and operational). Professional advisors can provide valuable insights and guidance throughout this process. They can help you navigate complex issues, identify potential successors, and create a plan that aligns with your business goals and personal objectives.

As we move forward, let’s explore the key components that make up a successful succession plan and how you can implement them effectively in your business.

Building Your Succession Blueprint

Identifying Future Leaders

The first step in crafting a solid succession plan requires the identification of potential successors. This process involves more than selecting the most senior employees. It demands a thorough assessment of skills, leadership potential, and cultural fit. Effective succession planning can allow an organization to strategically plan for the future and diversify its leadership team.

To identify future leaders, implement regular talent reviews and use tools like the 9-box grid to evaluate performance and potential. Encourage cross-functional experiences to broaden skill sets and provide stretch assignments to test leadership capabilities.

Defining Roles and Expectations

After the identification of potential successors, the establishment of clear roles and responsibilities becomes paramount. This clarity prevents confusion and conflict during the transition period.

Create detailed job descriptions for key positions, outlining not just tasks but also the competencies and leadership qualities required. Develop Individual Development Plans (IDPs) for each successor, aligning their growth with the organization’s needs.

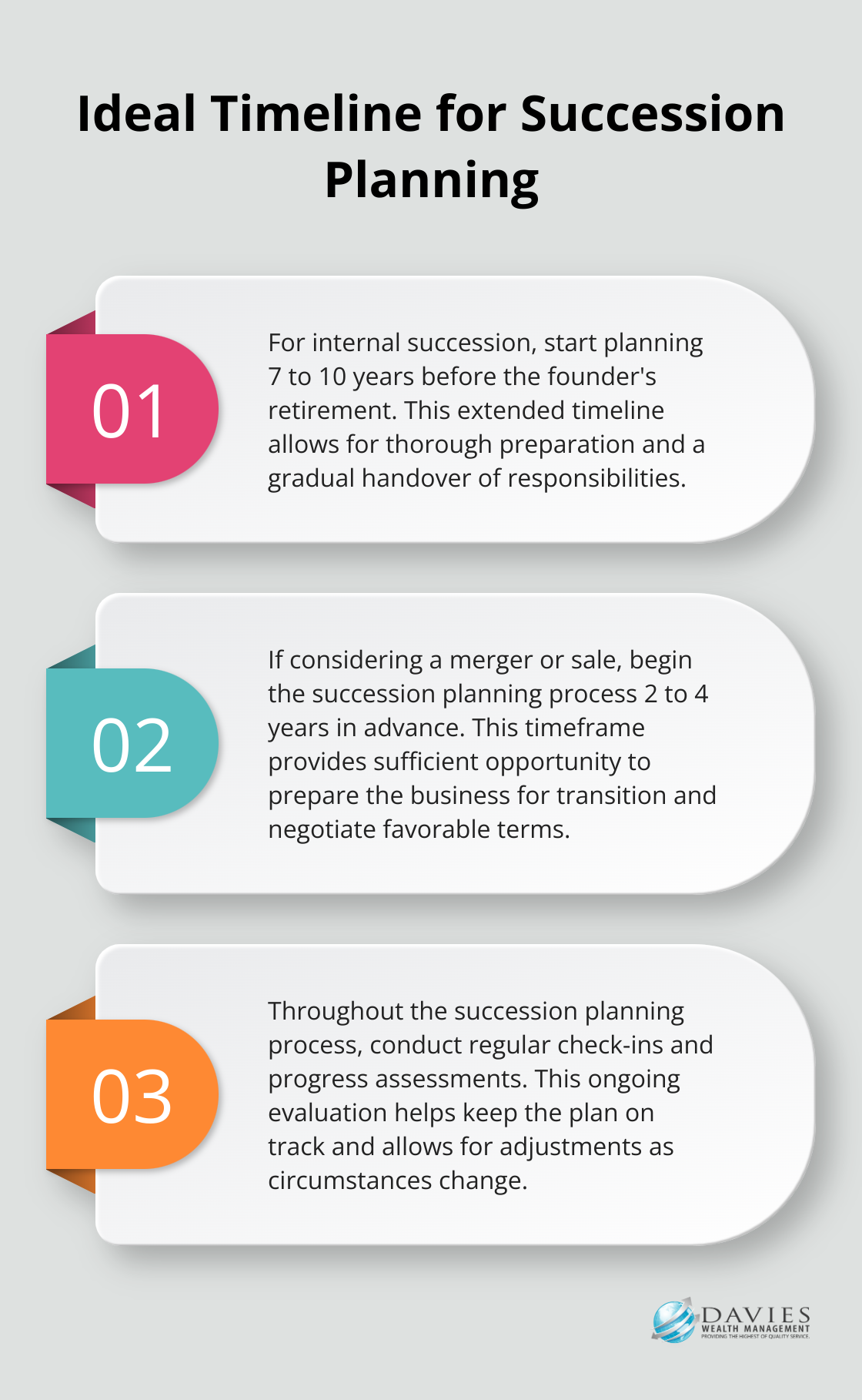

Setting a Realistic Timeline

A well-structured timeline ensures a smooth leadership transition. Succession planning ideally starts seven to ten years before the founder’s retirement for internal succession, or two to four years for a merger/sale. This timeframe allows for thorough preparation and gradual handover of responsibilities.

Break down the transition process into phases, each with specific milestones and objectives. Regular check-ins and progress assessments keep the plan on track. Flexibility remains key – prepare to adjust the timeline as circumstances change.

Addressing Financial and Legal Aspects

The financial and legal considerations of succession planning present complex challenges (requiring expert guidance). A PwC survey revealed that in 2021, only 34% of family businesses had a robust, documented and communicated succession plan in place, potentially leading to significant tax implications and legal disputes.

Work with financial advisors and legal experts to structure the transfer of ownership (whether it’s a sale, gifting of shares, or other arrangements). Consider the tax implications of different succession strategies and ensure compliance with relevant regulations.

The development of these key components sets the foundation for a robust succession plan. The next section will explore the practical steps to implement your succession plan effectively, ensuring a seamless transition and continued business success.

Turning Your Succession Plan into Action

Engage Your Stakeholders

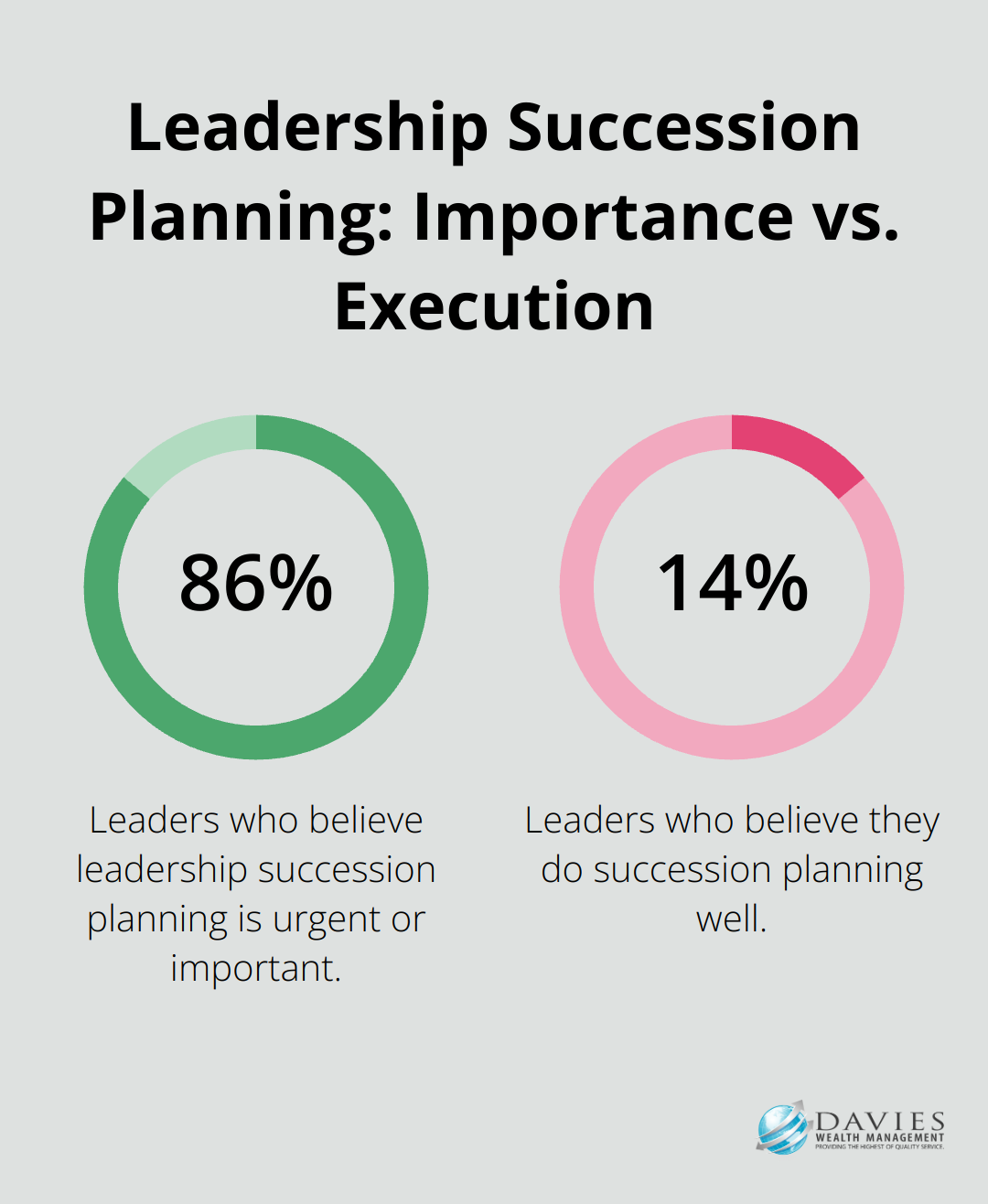

The first step in implementation requires clear communication with all stakeholders. This includes potential successors, employees, board members, and key clients. A study by Deloitte found that 86% of leaders believe leadership succession planning is urgent or important, yet only 14% believe they do it well. This gap often stems from poor communication.

Hold a company-wide meeting to announce the succession plan. Be transparent about the process and timeline. Address concerns and questions openly. For family businesses, this step proves essential to maintain family harmony and business continuity.

Develop Your Future Leaders

With stakeholders on board, prepare your identified successors. Organizations plan to develop leaders to meet the talent management needs and employee concerns of today, especially as we enter the third year of the pandemic.

Implement a structured mentoring program where current leaders work closely with their potential successors. Provide stretch assignments that allow future leaders to tackle challenges similar to those they’ll face in their new roles. Consider external leadership training programs to fill skill gaps.

Keep Your Plan Dynamic

A succession plan isn’t a static document. It needs regular review and updates.

Set up quarterly meetings to assess the progress of potential successors and the overall health of your succession strategy. Use metrics like internal promotion rates and retention of high-potential employees to gauge effectiveness. Adjust your plan based on changes in your business environment or the performance of your succession candidates.

Navigate the Challenges

Implementing a succession plan often uncovers unexpected obstacles. A common challenge is resistance from current leaders who may feel threatened by the process. Address this by emphasizing how succession planning benefits the entire organization, not just individuals.

Another frequent hurdle is the emotional aspect of letting go, especially for founders or long-time leaders. Executive coaching can help leaders leverage strengths, mitigate derailers, and unleash their potential to accelerate performance and profitability.

Try to build flexibility into your plan to account for unforeseen circumstances. The COVID-19 pandemic, for instance, forced many businesses to rapidly reevaluate their financial planning strategies.

Final Thoughts

Succession planning forms the foundation of long-term business success. It ensures the continuity of your company’s values, culture, and vision beyond leadership changes. A well-crafted plan identifies and nurtures potential leaders, establishes clear roles, and sets realistic timelines for transitions.

Financial and legal aspects require careful consideration in succession planning. Engaging experts helps navigate ownership transfers, tax implications, and regulatory compliance. Clear communication with all stakeholders and ongoing development of chosen successors are essential for successful implementation.

We at Davies Wealth Management understand the complexities of succession planning. Our team provides guidance to develop and implement robust strategies for business owners and professional athletes alike. Visit Davies Wealth Management to learn how we can help secure your business’s future with a comprehensive succession plan.

Leave a Reply