As business owners, safeguarding your hard-earned wealth is paramount to long-term success and financial security. At Davies Wealth Management, we understand the unique challenges entrepreneurs face when it comes to wealth protection.

This comprehensive guide explores essential strategies for shielding your assets, planning for retirement, and optimizing tax efficiency. We’ll provide actionable insights to help you secure your financial future while growing your business.

How Can Business Owners Protect Their Wealth?

At Davies Wealth Management, we’ve observed how proper wealth protection strategies impact a business owner’s financial future. Let’s explore essential tactics to safeguard your assets and set you up for long-term success.

Separate Personal and Business Finances

Many business owners make the mistake of mixing personal and business assets. This practice can lead to serious legal and financial consequences. To protect your personal wealth, maintain separate bank accounts and credit cards for your business and personal use. This separation simplifies accounting and helps avoid potential IRS audits.

Among those with separate bank accounts for personal and business purposes, 56% use the same bank while 44% use different banks. Ninety-eight percent of small business owners have confidence in their primary bank.

Select the Right Business Structure

The appropriate business structure is a critical step in protecting your personal assets from business liabilities. While many entrepreneurs start as sole proprietors, this structure offers no separation between personal and business assets, leaving you personally liable for all business debts and legal issues.

Forming a Limited Liability Company (LLC) creates a legal separation that can protect your personal assets from business liabilities in most cases. An LLC is a particular business structure that offers the liability protection of a corporation.

Create a Comprehensive Insurance Strategy

A robust insurance plan acts as your financial safety net against unforeseen events. We recommend a tailored approach that includes:

- General Liability Insurance: Protects against common business risks like property damage or bodily injury.

- Professional Liability Insurance: Essential for service-based businesses to guard against claims of negligence or malpractice.

- Property and Casualty Insurance: Safeguards your physical assets from damage or loss.

- Business Interruption Insurance: Covers lost income if your business operations stop.

- Key Person Insurance: Protects your business if a crucial team member becomes unable to work.

Don’t forget about personal insurance coverage as well. A comprehensive umbrella policy can provide an extra layer of protection for your personal assets.

Use Asset Protection Trusts

Asset protection trusts can shield your wealth from potential creditors or legal claims. These trusts separate the beneficial ownership of assets from their legal ownership, making it more difficult for creditors to reach them.

A dynasty trust is ideal for business owners who want to pass down their business and wealth to future generations while minimizing estate and generation-skipping transfer taxes.

As we move forward, let’s explore how business owners can secure their financial future through effective retirement planning strategies.

How Can Business Owners Plan for Retirement?

Planning for retirement as a business owner requires a strategic approach that goes beyond traditional employee retirement plans. The right strategies can significantly impact a business owner’s financial future.

Selecting the Optimal Retirement Plan

Business owners have several retirement plan options, each with unique benefits. The SEP IRA stands out among small business owners due to its high contribution limits and easy setup. For 2024, contributions can reach up to 25% of the employee’s compensation or $69,000, whichever is less.

The Solo 401(k) presents an excellent option for self-employed individuals without employees. This plan allows for both employee and employer contributions, potentially enabling higher retirement savings. In 2024, employee contributions can reach $23,000, plus an additional contribution as an employer (up to a total limit).

Businesses with employees might find a SIMPLE IRA or a traditional 401(k) more appropriate. These plans allow for employee contributions and require employer matches, which can foster a culture of retirement savings within the company.

Expanding Your Investment Horizons

Many business owners rely solely on their business for retirement income, which can be risky. Diversifying investments proves crucial for long-term financial security.

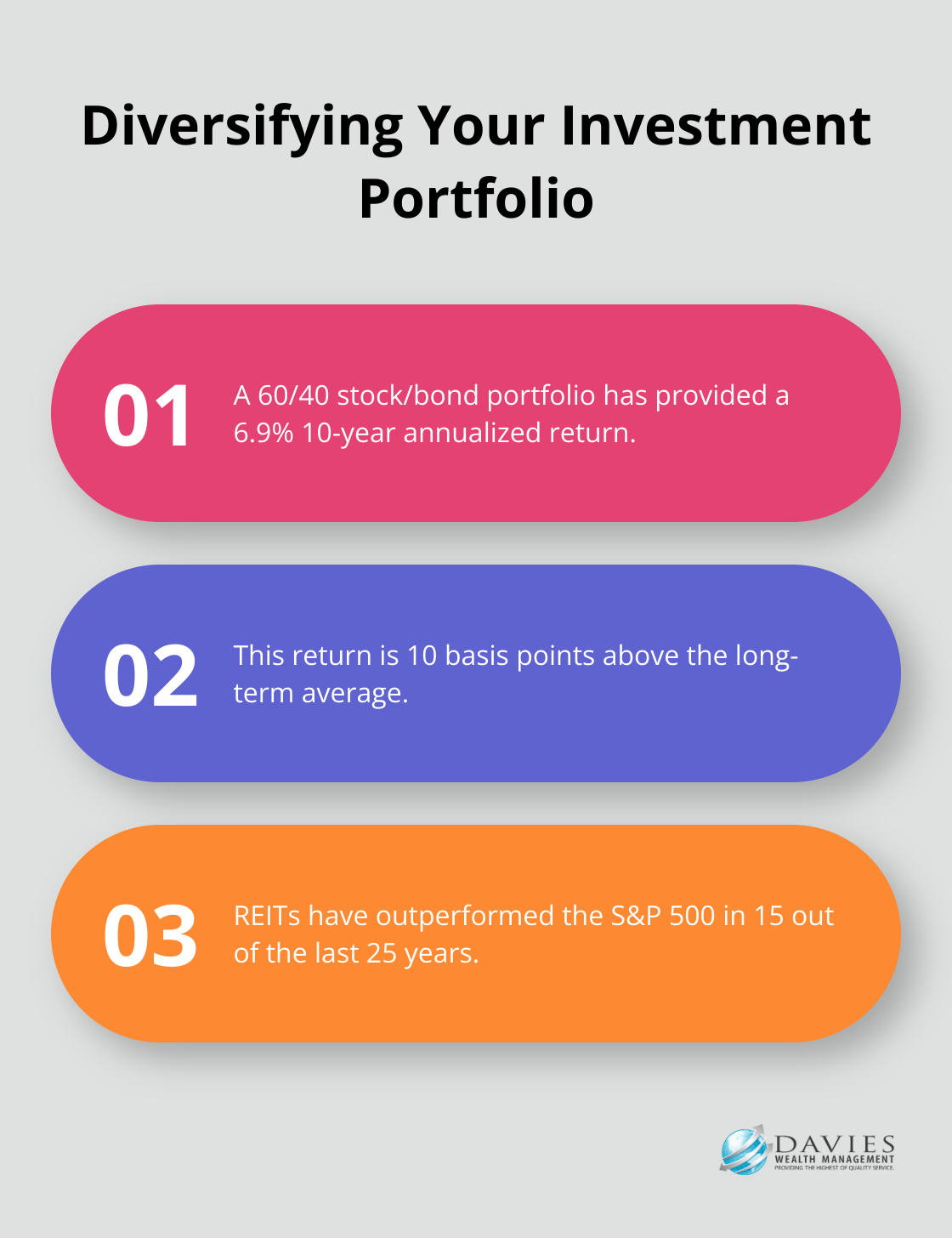

A mix of stocks, bonds, and real estate can provide a well-rounded portfolio. A study by Vanguard shows that a portfolio with 60% stocks and 40% bonds has historically provided a 10-year trailing annualized return of 6.9% over the past decade, 10 basis points above its long-term average.

Real estate can also add value to a retirement portfolio. The National Association of Real Estate Investment Trusts (NAREIT) reports that REITs have outperformed the S&P 500 in total annual returns in 15 out of the last 25 years, providing both income and potential appreciation.

Preparing for Business Transition

A solid succession plan proves essential, whether the plan involves selling the business or passing it to the next generation. The process should start with a professional valuation of the business. The International Business Brokers Association suggests that small businesses typically sell for 2 to 3 times their annual cash flow.

Those considering selling should start preparations 3-5 years in advance. This timeframe allows for improvements to financial records, streamlining of operations, and potential increases in the business’s value.

For those planning to pass the business to family members, establishing a family limited partnership or a trust can help. These structures can minimize estate taxes and ensure a smooth transition of ownership.

Retirement planning for business owners involves complex and highly individualized strategies. Professional guidance can prove invaluable in navigating these complexities and creating a comprehensive retirement plan tailored to each business owner’s unique situation and goals.

As we move forward, let’s explore how business owners can optimize their tax strategies to further protect and grow their wealth.

How Business Owners Can Optimize Their Tax Strategy

At Davies Wealth Management, we know that effective tax planning forms a key part of wealth preservation for business owners. A well-executed tax strategy can significantly impact your bottom line and long-term financial success.

Maximize Business Expense Deductions

Business owners can reduce their tax burden by deducting legitimate business expenses. The IRS allows deductions for ordinary and necessary expenses incurred in running a business. This includes office rent, utilities, employee salaries, and marketing costs.

Meticulous tracking and categorization of expenses throughout the year can maximize deductions and potentially reduce tax burden.

Take Advantage of Tax Credits

Tax credits offer a dollar-for-dollar reduction in tax liability, making them more valuable than deductions. The Research and Development (R&D) Tax Credit allows companies that engage in research and development activities to offset their business’s tax liability.

Optimize Retirement Contributions

Contributions to qualified retirement plans secure your financial future and offer immediate tax benefits. Contributions to a SEP IRA or Solo 401(k) can be deducted from business income, potentially lowering overall tax bills.

Maximizing contributions to these plans can potentially save thousands in taxes while building a retirement nest egg.

Use Tax-Efficient Investment Strategies

Investment decisions can significantly impact tax liability. Tax-loss harvesting (selling underperforming investments to offset gains in other areas of your portfolio) can help reduce overall capital gains tax liability.

Municipal bonds offer another strategy. Certain treasury products and municipal bonds allow investors to avoid paying local, state, or federal taxes, further enhancing returns.

Time Income and Expenses Strategically

Business owners can control when they recognize income and incur expenses. Strategic timing of these events can potentially lower tax liability in a given year.

If you expect to be in a lower tax bracket next year, consider deferring income to the following year. If you anticipate being in a higher bracket, accelerating income into the current year might benefit you.

Successful tax planning requires working with experienced professionals who understand the complexities of business taxation. Tax laws change constantly, and what works for one business owner may not be the best strategy for another. Develop a personalized tax strategy that aligns with your specific business goals and financial situation.

Final Thoughts

Wealth protection for business owners requires a comprehensive approach. Separating personal and business assets, implementing insurance coverage, and planning for retirement all contribute to financial security. Tax-efficient strategies also play a significant role in wealth accumulation and preservation.

Professional guidance proves invaluable when navigating complex financial landscapes. Davies Wealth Management specializes in creating tailored solutions that address the unique needs of business owners. Our team of experts can help develop and implement effective wealth protection strategies.

We encourage all business owners to take proactive steps to secure their financial future. Implementing the strategies discussed in this guide can protect your hard-earned wealth and set you up for long-term success. Contact Davies Wealth Management today to start building a personalized financial strategy that aligns with your goals and circumstances.

Leave a Reply