At Davies Wealth Management, we understand that creating a sustainable retirement income strategy is a top priority for many of our clients. Retirement income planning requires careful consideration of various factors to ensure financial security throughout your golden years.

This blog post will guide you through the essential steps to develop a robust and sustainable retirement income strategy. We’ll explore how to assess your needs, diversify income sources, and implement effective withdrawal strategies to help you achieve your retirement goals.

What Are Your Retirement Income Needs?

Assessing Your Current Lifestyle

To create a sustainable retirement income strategy, you must first understand your financial requirements. This process starts with a thorough evaluation of your current spending habits. We recommend tracking your expenses for at least three months to gain an accurate picture. Include all costs, from housing and utilities to discretionary spending like entertainment and travel. This exercise often reveals surprising patterns. For example, a study by the Employee Benefit Research Institute found that households aged 65-74 spend an average of $48,885 annually.

Projecting Future Expenses

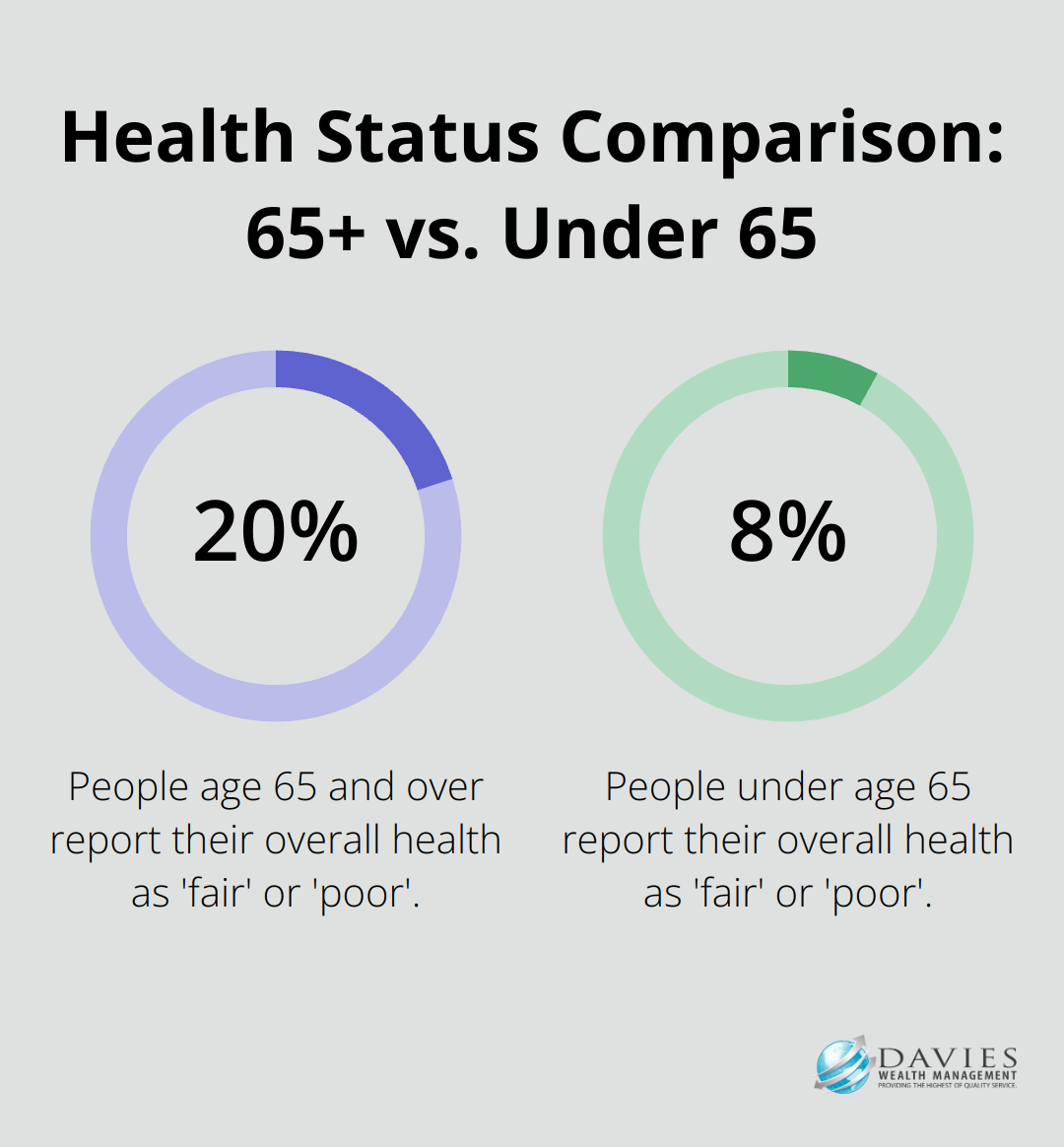

After assessing your current lifestyle, you should consider how your expenses might change in retirement. Some costs may decrease (e.g., commuting or work-related expenses), while others might increase (such as healthcare or leisure activities). Among people age 65 and over, 20% report their overall health as “fair” or “poor” compared to 8% of people under age 65. This information underscores the importance of factoring in potential increases in certain expense categories.

Factoring in Inflation and Unexpected Costs

Inflation plays a significant role in retirement planning. The historical average inflation rate is around 3% annually, which means your purchasing power could halve in about 24 years. You must build this into your calculations to ensure your retirement income keeps pace with rising costs. Additionally, it’s prudent to set aside funds for unexpected expenses. A Fidelity study suggests that the average American estimates health care costs in retirement will be about $75,000, which is less than half of Fidelity’s calculation.

Personalizing Your Retirement Income Needs

Your retirement income needs are unique to you. While general guidelines provide a helpful starting point, they’re no substitute for a personalized analysis. Whether you’re a professional athlete with a short career span or a business owner looking to transition, a tailored plan that accounts for your specific circumstances and goals is essential.

Utilizing Professional Tools and Expertise

Many people underestimate their retirement income needs by 20% or more. To avoid this pitfall, consider working with financial professionals who use sophisticated planning tools to project these needs accurately. At Davies Wealth Management, we specialize in creating personalized retirement strategies that take into account all aspects of your financial life.

As we move forward, it’s important to consider how to diversify your income sources to create a sustainable retirement strategy. Let’s explore the various options available to ensure a steady income stream throughout your golden years.

How to Diversify Your Retirement Income

Maximize Social Security Benefits

Social Security remains a cornerstone of retirement income for many Americans. Current estimates suggest a 2.57% COLA increase for 2025, which would add approximately $50 per month to benefits. You can optimize your Social Security strategy to increase your lifetime benefits significantly. If you delay your claim until age 70, you can boost your monthly benefit by a certain percentage for each month you delay starting your benefits beyond full retirement age. This strategy can benefit those with longer life expectancies or those who can afford to wait.

Explore Pension Plans and Annuities

Traditional pension plans, while less common, can provide a reliable income stream in retirement. If you have access to a pension, you should carefully consider your payout options. Some plans offer a lump sum, while others provide monthly payments. Each option has its advantages and disadvantages, and the right choice depends on your individual circumstances.

Annuities can serve as a supplement or alternative to pensions. These insurance products can provide a guaranteed income stream for life, which helps to mitigate longevity risk. However, annuities come with complexities and fees, so you must understand the terms before purchasing.

Leverage Your Investment Portfolio

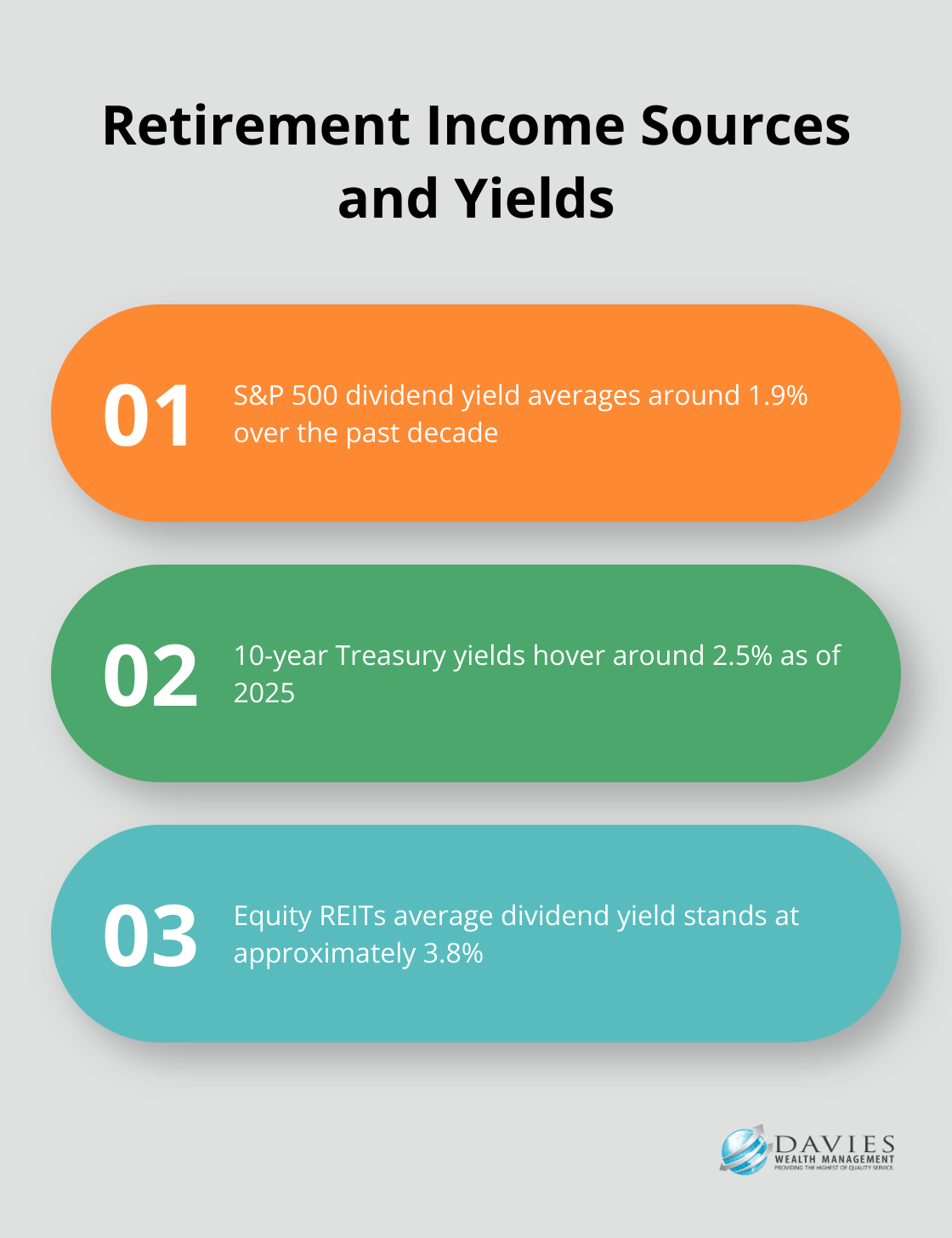

A well-diversified investment portfolio can generate income through dividends, interest, and capital gains. Dividend-paying stocks, for instance, can provide a steady income stream that often increases over time. The S&P 500 dividend yield has averaged around 1.9% over the past decade, offering a potential source of passive income.

Bonds and other fixed-income securities can also play a vital role in your retirement income strategy. While yields have been historically low in recent years, they still offer more stability compared to stocks. As of 2025, 10-year Treasury yields hover around 2.5%, providing a baseline for fixed-income returns.

Consider Real Estate Investments

Real estate can add value to your retirement income strategy. Rental properties can provide a steady income stream, with potential for appreciation over time. According to the U.S. Census Bureau, the median gross rent in the United States was $1,348 from 2019-2023, highlighting the income potential of real estate investments.

However, being a landlord comes with responsibilities and risks. Alternative options like Real Estate Investment Trusts (REITs) can offer exposure to real estate markets without the hassles of property management. As of 2025, the average dividend yield for equity REITs stands at approximately 3.8%, offering an attractive income option for retirees.

Tailor Your Income Strategy

Each person’s situation is unique. Professional athletes often face distinct challenges due to their short career spans and potentially high, but variable, income. Business owners might have different needs based on their company’s structure and succession plans. Individuals from various backgrounds will have diverse requirements for their retirement income strategies.

Now that we’ve explored various income sources, it’s time to discuss how to implement sustainable withdrawal strategies to ensure your retirement savings last throughout your golden years.

How to Withdraw Retirement Funds Sustainably

Creating a sustainable withdrawal strategy is important for making your retirement savings last. A proper plan can significantly impact your financial security during retirement.

The 4% Rule: A Starting Point

The 4% rule is a widely recommended strategy that provides a steady and sustainable income stream. Introduced by financial advisor William Bengen in 1994, it suggests withdrawing 4% of your retirement portfolio in the first year and adjusting for inflation thereafter. This rule is intended to make your retirement savings last for approximately 30 years. While this rule provides a simple starting point, it’s not a one-size-fits-all solution. Market conditions, life expectancy, and personal circumstances can all affect its effectiveness.

In periods of low returns or high inflation, a 4% withdrawal rate might deplete your savings too quickly. Conversely, in favorable market conditions, you might be able to withdraw more without jeopardizing your long-term financial security.

Dynamic Withdrawal Strategies

Instead of rigidly adhering to a fixed percentage, consider adopting a dynamic withdrawal strategy. This approach allows you to adjust your withdrawal rate based on market performance and personal needs.

One method is the “guardrails” strategy, where you increase withdrawals when your portfolio performs well and decrease them during market downturns. For example, you might set a baseline withdrawal rate of 4%, but allow it to fluctuate between 3% and 5% depending on your portfolio’s performance.

Another approach is the “floor and ceiling” method. Here, you establish a minimum withdrawal amount to cover essential expenses (the floor) and a maximum amount for discretionary spending (the ceiling). This strategy helps ensure your basic needs are always met while allowing for flexibility in lifestyle spending.

The Bucket Strategy: Balancing Needs and Growth

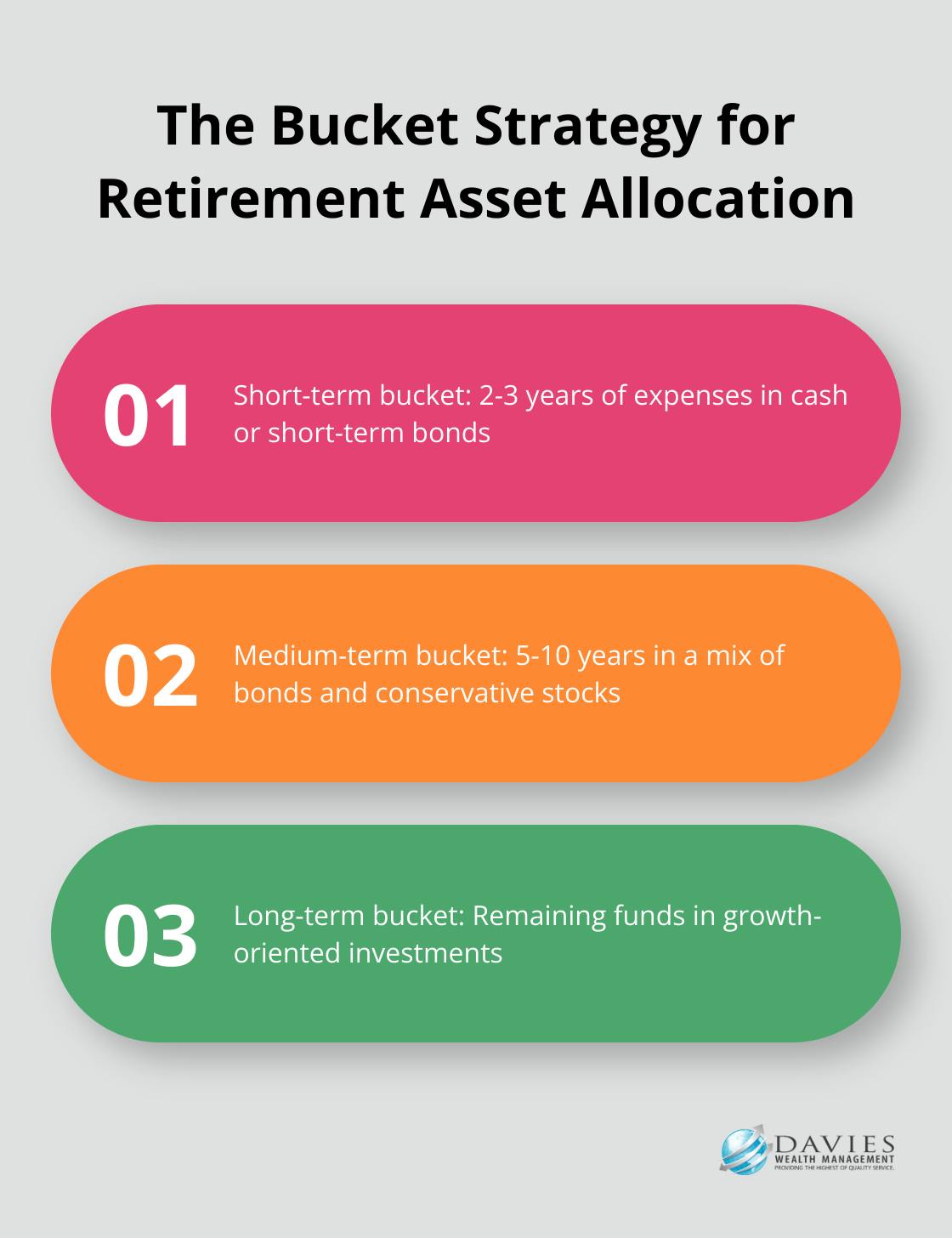

The bucket strategy for retirement asset allocation helps create a diversified portfolio with different time frames to meet income retirement needs. This approach involves dividing your retirement assets into different “buckets” based on when you’ll need the money. Typically, this includes a short-term bucket for immediate expenses, a medium-term bucket for the next 5-10 years, and a long-term bucket for later in retirement.

You might keep 2-3 years of expenses in cash or short-term bonds (Bucket 1), 5-10 years in a mix of bonds and conservative stocks (Bucket 2), and the rest in growth-oriented investments (Bucket 3). This approach can help you weather market volatility while still maintaining growth potential for the long term.

Optimizing Tax Efficiency in Withdrawals

The order in which you withdraw from different account types can significantly impact your tax burden in retirement. Generally, it’s advisable to start with taxable accounts, then tax-deferred accounts (like traditional IRAs and 401(k)s), and finally tax-free accounts (like Roth IRAs).

However, this sequence isn’t set in stone. In some years, it might make sense to tap into tax-deferred accounts to fill up lower tax brackets. For instance, if your taxable income is low in a particular year, you might consider converting some traditional IRA funds to a Roth IRA, paying taxes at a lower rate now to enjoy tax-free withdrawals later.

Personalized Strategies for Unique Situations

Every individual’s retirement situation is unique. Professional athletes, for example, often face distinct challenges due to their short career spans and potentially high, but variable, income. Business owners might have different needs based on their company’s structure and succession plans.

Davies Wealth Management specializes in creating personalized withdrawal strategies that align with unique financial situations and goals. We work closely with clients to develop plans that adapt to changing circumstances and market conditions, helping to ensure retirement savings support the desired lifestyle throughout the golden years.

Final Thoughts

Creating a sustainable retirement income strategy requires a personalized approach tailored to your unique circumstances and goals. Your retirement income plan should adapt to your specific situation, whether you’re a professional athlete with a short career span or a business owner planning for succession. We recommend you review and adjust your strategy at least annually to ensure it remains aligned with your changing needs and market conditions.

Professional guidance can help you navigate the complexities of retirement planning and optimize your retirement income. At Davies Wealth Management, we specialize in creating comprehensive, personalized retirement income strategies that adapt to your unique situation. Our expertise in investment management, tax-efficient strategies, and estate planning can help you secure your financial future.

A well-crafted retirement income strategy provides peace of mind and financial security throughout your golden years. You can face the future with confidence by taking a proactive, personalized approach to retirement planning. Your financial needs will be met for years to come with a solid retirement income plan in place.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

Tweets by TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply