At Davies Wealth Management, we understand that preserving wealth goes beyond just accumulating assets. Liquidity management plays a vital role in safeguarding your financial future.

Effective liquidity management ensures you have the flexibility to meet financial obligations, seize opportunities, and weather unexpected storms. In this post, we’ll explore why it’s essential and how to implement strategies that protect and grow your wealth.

What Is Liquidity Management?

The Essence of Liquidity Management

Liquidity planning is ensuring that there are sufficient money for estate taxes and liabilities. It forms the foundation of effective wealth preservation, ensuring you have sufficient cash or easily convertible assets to meet financial obligations and capitalize on opportunities without compromising long-term financial goals.

The Liquidity Balancing Act

Finding the right balance is essential. Insufficient liquidity can force asset sales at inopportune times, potentially at a loss. Conversely, excessive liquidity can result in missed investment opportunities and reduced overall returns.

Liquidity’s Role in Wealth Preservation

Liquidity acts as your financial safety net. It provides flexibility to handle unexpected expenses, take advantage of sudden investment opportunities, and navigate economic downturns without jeopardizing long-term wealth.

Key Components of Effective Liquidity Management

A diversified portfolio with a mix of liquid and illiquid assets is essential. The right balance depends on individual circumstances, but a general guideline suggests having 3-6 months of living expenses in easily accessible funds.

Tools for Managing Liquidity

Modern wealth management employs sophisticated tools to optimize liquidity. Cash management accounts offer higher yields than traditional savings accounts while maintaining easy access to funds. Lines of credit secured by investment portfolios can provide quick access to cash without disrupting long-term investment strategies.

Advanced financial modeling tailors liquidity strategies to each client’s unique situation. This approach ensures that clients (including professional athletes with variable income streams) always have the right amount of liquidity to meet their needs and goals.

As we move forward, let’s explore specific strategies for effective liquidity management that can help safeguard and grow your wealth.

Mastering Liquidity: Practical Strategies for Financial Flexibility

At Davies Wealth Management, we have developed a set of practical strategies to help our clients maintain optimal liquidity. These approaches provide financial flexibility while maximizing wealth preservation.

Diversifying Your Asset Mix

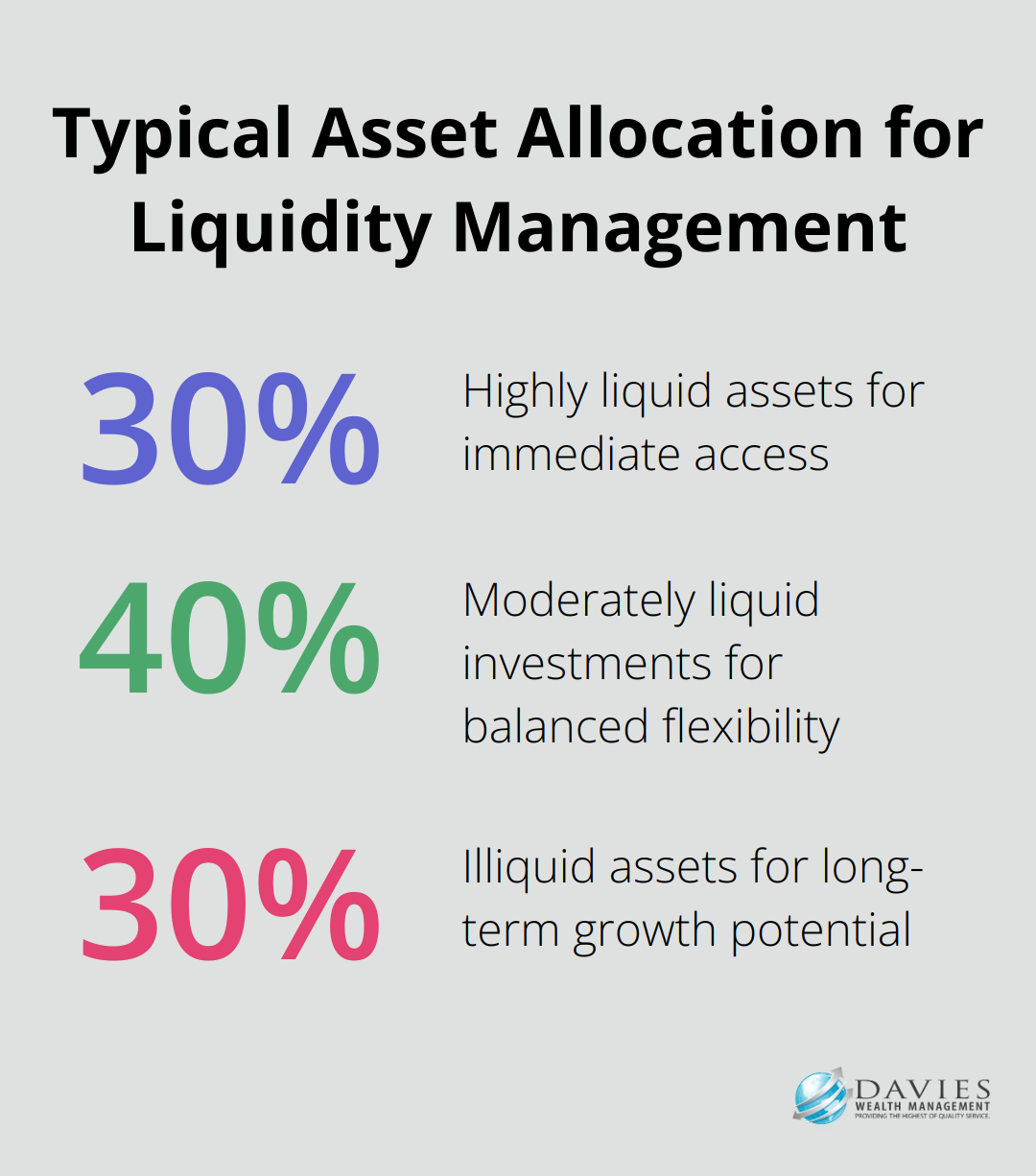

One of the most effective ways to manage liquidity is through strategic asset diversification. We recommend a balanced portfolio that includes a mix of liquid assets (like cash and marketable securities) and less liquid investments (such as real estate or private equity). A typical allocation might include 30% in highly liquid assets, 40% in moderately liquid investments, and 30% in illiquid assets. This balance allows you to access funds when needed while still benefiting from potentially higher returns on longer-term investments.

Building a Robust Emergency Fund

We advise our clients to maintain an emergency fund that’s specifically set aside for unplanned expenses or financial emergencies. This fund should be easily accessible and held in high-yield savings accounts or short-term government securities. For high-net-worth individuals, we might recommend keeping 1-2% of their total portfolio in cash or cash equivalents. This approach provides a buffer against unexpected expenses or income disruptions without compromising long-term investment strategies.

Implementing Advanced Cash Flow Management

Effective cash flow management is essential for maintaining liquidity. We use sophisticated financial modeling tools to forecast cash flows and identify potential shortfalls or surpluses. For our professional athlete clients (who often have irregular income streams), we implement strategies to smooth out cash flow. This might include setting aside a portion of large contract payments or endorsement deals to cover expenses during off-seasons or after retirement.

Leveraging Strategic Credit Solutions

Credit lines and other financial instruments can be powerful tools for managing liquidity. We often recommend establishing a securities-based line of credit, which can potentially be structured in a tax-efficient way, allowing you to more effectively grow and preserve your wealth. This strategy can be particularly useful during market downturns, allowing you to access needed funds without realizing losses on your investments. For instance, a client with a $5 million portfolio might set up a line of credit for 50% of the portfolio value, providing quick access to $2.5 million if needed.

These strategies form the foundation of effective liquidity management. However, the risks associated with poor liquidity management can be severe and far-reaching. In the next section, we will explore these risks in detail and discuss how to mitigate them effectively.

The Hidden Dangers of Poor Liquidity Management

Forced Asset Sales: A Financial Pitfall

Poor liquidity management often leads to the need to sell assets at unfavorable prices. This occurs when liquid assets are insufficient to meet urgent cash needs. During the 2008 financial crisis, many investors sold stocks at rock-bottom prices, locking in substantial losses. To avoid this, investors should maintain a liquidity buffer that enhances financial stability.

Missed Opportunities: The Silent Wealth Eroder

Insufficient liquidity can result in missed lucrative investment opportunities. In rapidly moving markets, the ability to act quickly can make a significant difference. During the March 2020 market downturn, investors with readily available cash purchased high-quality stocks at steep discounts. Those without liquidity missed the subsequent market rally, which saw the S&P 500 notch double-digit positive returns in all but one instance following its worst one-day drops.

Higher Borrowing Costs: The Price of Unpreparedness

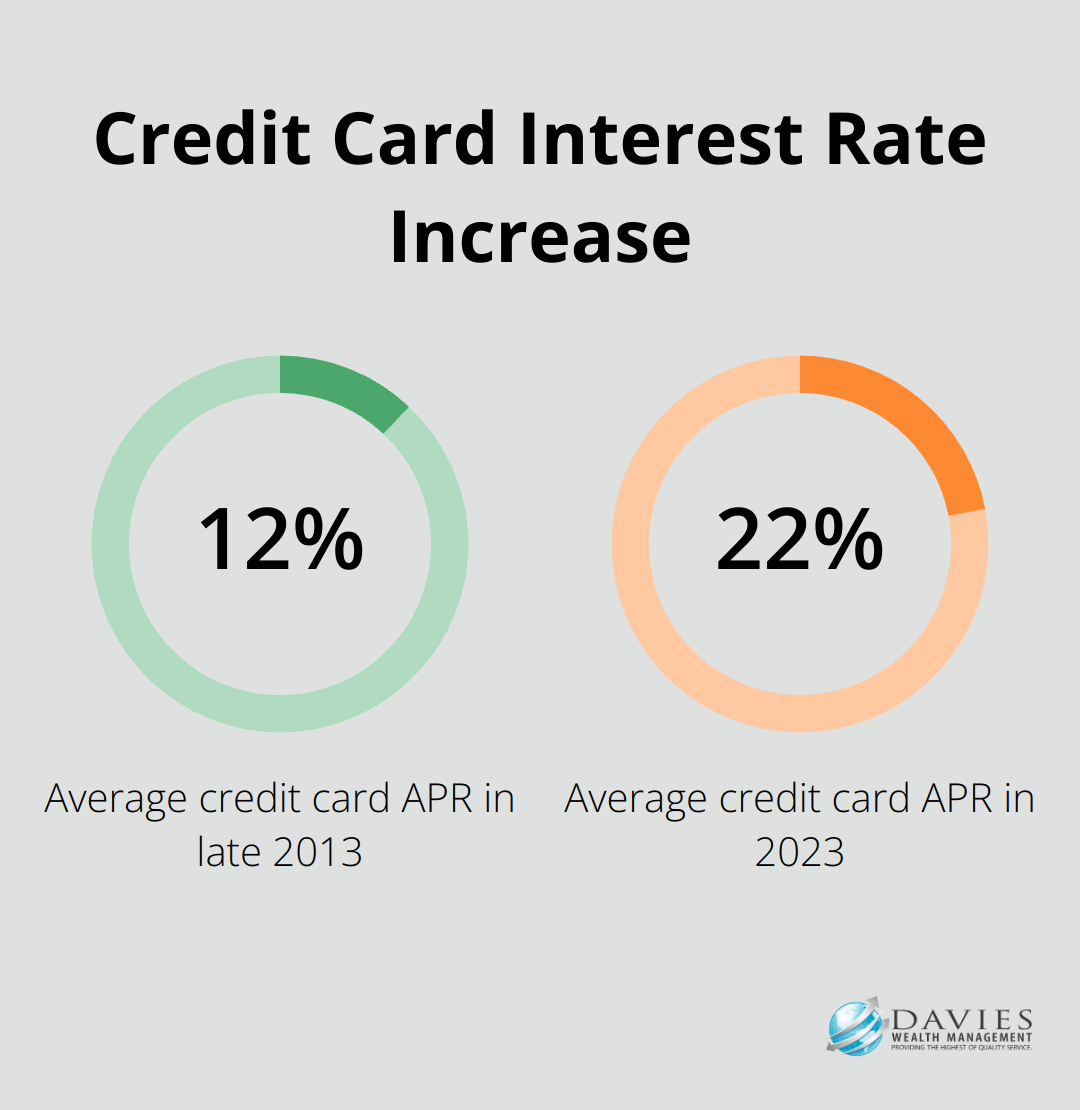

When liquidity is tight, expensive forms of credit become necessary to meet financial obligations. This leads to higher interest expenses and reduced overall returns. A recent report showed that average APRs on credit cards assessed interest have almost doubled from 12.9 percent in late 2013 to 22.8 percent in 2023. Adequate liquidity helps avoid these costly financing options.

Financial Distress: The Ultimate Risk

Poor liquidity management can lead to financial distress or bankruptcy, particularly for high-net-worth individuals with complex financial structures. A sudden market downturn coupled with inadequate liquidity could trigger margin calls or force the liquidation of illiquid assets at fire-sale prices. Regular portfolio stress-testing, which simulates various market scenarios, helps ensure a liquidity strategy can withstand potential shocks.

Proactive Liquidity Management: A Necessity

Proactive liquidity management is essential for navigating financial challenges and seizing opportunities. Regular reviews of liquidity positions allow investors to position themselves for long-term financial success. This approach not only mitigates risks but also enhances the ability to capitalize on favorable market conditions.

Final Thoughts

Liquidity management forms the foundation of effective wealth preservation. We at Davies Wealth Management understand the importance of maintaining the right balance of liquid assets for financial stability and growth. Our strategic approach to liquidity management safeguards wealth against unexpected challenges while positioning clients to seize lucrative opportunities.

We implement diverse strategies to optimize liquidity, including asset mix diversification, emergency fund maintenance, and advanced cash flow management techniques. These methods provide the flexibility needed to navigate complex financial landscapes, especially for high-net-worth individuals and professional athletes with unique income structures (such as seasonal earnings or large contract payments).

Davies Wealth Management specializes in creating tailored liquidity management strategies that align with specific financial situations and goals. Our expertise extends to serving professional athletes, addressing their unique financial challenges with personalized solutions. For expert guidance on optimizing your liquidity position and ensuring long-term financial success, contact Davies Wealth Management today.

Leave a Reply