At Davies Wealth Management, we understand that setting financial goals is a cornerstone of successful wealth management for ultra-high-net-worth individuals. However, not all goals are created equal.

SMART financial goals provide a structured approach to wealth preservation and growth, tailored to the unique needs of high-net-worth clients. This framework ensures that objectives are Specific, Measurable, Achievable, Relevant, and Time-bound, maximizing the potential for success in complex financial landscapes.

What Are SMART Goals for Ultra-High-Net-Worth Clients?

At Davies Wealth Management, we’ve discovered that SMART goals revolutionize financial planning for ultra-high-net-worth individuals. SMART (Specific, Measurable, Achievable, Relevant, and Time-bound) transforms vague financial aspirations into concrete, actionable plans.

Tailoring SMART Goals for the Ultra-Wealthy

Ultra-high-net-worth clients require unique SMART goals. High-net-worth financial planning involves expert advisors who consider key factors specific to wealthy individuals. Precision and ambition, while maintaining realism, are key.

Measuring Success in High-Stakes Environments

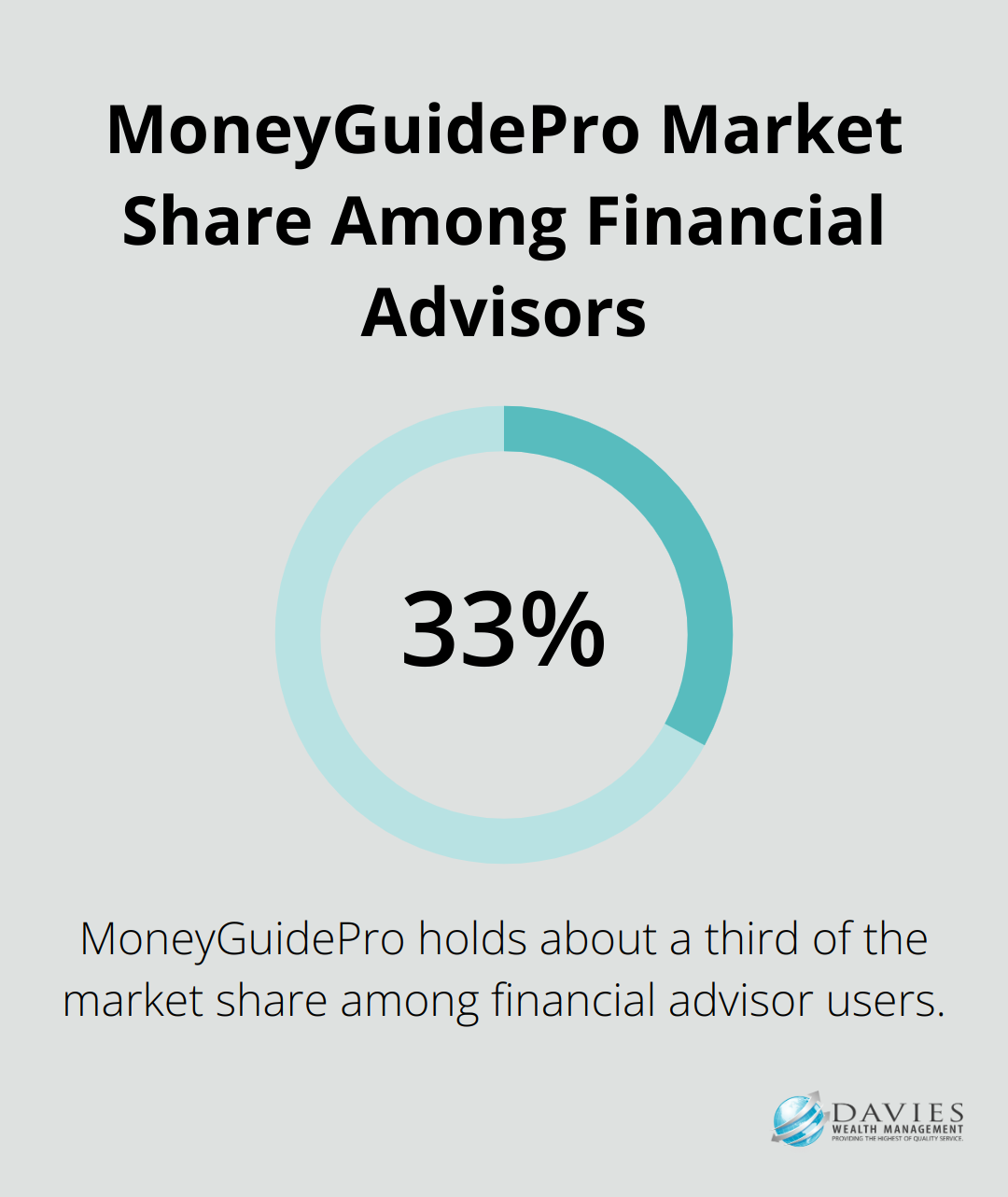

Measurability becomes critical when managing substantial wealth. MoneyGuidePro, holding about a third of the market share of financial advisor users in 2023, is one of the sophisticated tools that help monitor progress. These tools can assist in tracking various financial objectives and their outcomes.

Achieving the Extraordinary

Ultra-high-net-worth individuals possess more resources, but setting achievable goals still demands careful consideration. Thorough market analyses and risk assessments precede financial objectives. This might involve targeting a specific growth rate in a diversified portfolio, balancing ambition with market realities.

Aligning Wealth with Values

Relevance remains paramount for ultra-high-net-worth clients. Goals should reflect personal values and long-term visions. A client passionate about technology might set a goal to invest in emerging tech startups over a defined period, aligning their wealth with their interests and potential market trends.

Time-Bound Strategies for Lasting Impact

Time-bound goals create urgency and prioritize actions. A client might establish a family foundation within a specific timeframe, complete with a governance structure and impact measurement system. This clear timeline drives decision-making and ensures consistent progress evaluation.

SMART goals extend beyond wealth accumulation; they encompass strategic wealth management and impactful legacy creation. Wealth management strategies for high-net-worth individuals often include diversification, tax efficiency, estate planning, risk management, and philanthropy. This framework empowers ultra-high-net-worth individuals to transform their financial landscape, ensuring their wealth serves their highest aspirations and values. As we move forward, we’ll explore the key financial areas where SMART goal setting proves particularly effective for ultra-high-net-worth clients.

Optimizing Financial Strategies for Ultra-High-Net-Worth Clients

At Davies Wealth Management, we identify key financial areas where SMART goal setting proves particularly effective for ultra-high-net-worth clients. These areas require meticulous planning and execution to maximize wealth preservation and growth.

Investment Portfolio Optimization

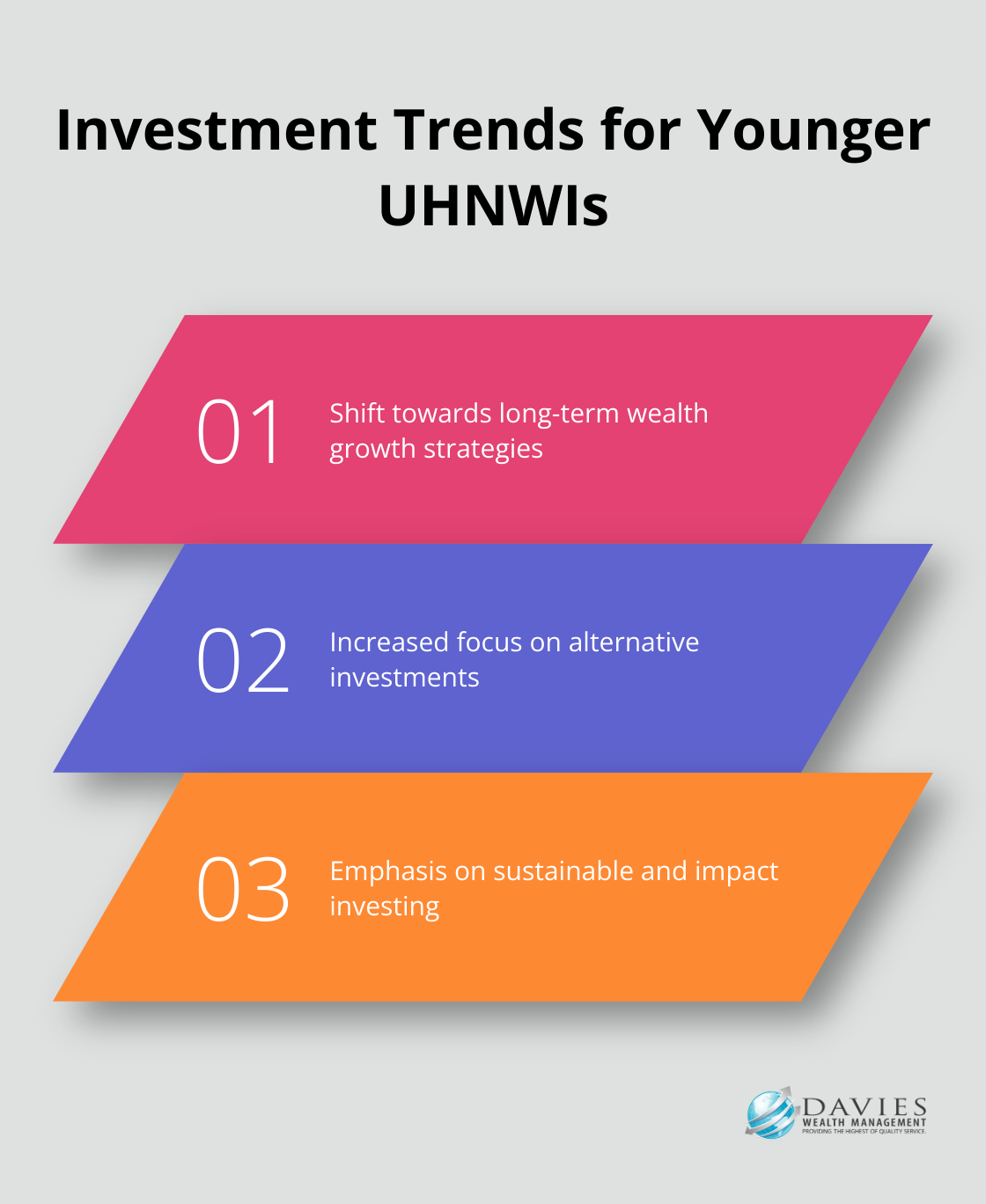

Investment portfolio optimization stands as a critical component of wealth management for ultra-high-net-worth individuals. With a growing population of younger, self-made ultra-high-net-worth individuals (UHNWIs), investment styles are shifting in focus to long-term wealth growth. We believe in tailoring these allocations to each client’s unique circumstances and risk tolerance.

One effective strategy sets a SMART goal of increasing alternative investments from 6% to 10% of the portfolio within 18 months. This could involve exploration of private equity opportunities, which have shown potential to outperform traditional investments like the S&P 500 over extended periods. For instance, a client might invest $5 million in a specific private equity fund focusing on emerging technologies by the end of the fiscal year.

Tax Efficiency and Estate Planning

Tax efficiency remains paramount for ultra-high-net-worth clients. Leveraging Tax-Deferred Accounts is one of the advanced tax strategies tailored specifically for high-net-worth individuals.

For estate planning, a SMART goal might transfer $20 million to a family trust over five years to minimize estate tax liability. This goal should include a detailed timeline for asset transfers and regular reviews with legal and financial advisors. Therefore, incorporation of a next-generation wealth education strategy into the estate plan becomes essential.

Philanthropic Initiatives and Impact Investing

Philanthropy and impact investing grow increasingly important for ultra-high-net-worth individuals. An increase in young HNW and UHNW donors engaging with family offices, philanthropic advisors and other specialists has been observed to ensure their philanthropic efforts are effective.

For philanthropic initiatives, a client might establish a private foundation with an initial endowment of $50 million within 18 months, complete with a governance structure and impact measurement system. This aligns with the growing trend of strategic philanthropy among ultra-high-net-worth individuals.

These financial areas interconnect and require a holistic approach. Our team of experts works closely with clients to develop and implement SMART goals across these key areas, ensuring that their wealth management strategy remains comprehensive, aligns with their values, and positions for long-term success. The next section will explore how professional guidance plays a vital role in implementing these SMART financial goals effectively.

Implementing SMART Financial Goals for Ultra-High-Net-Worth Clients

The Power of Professional Collaboration

Ultra-high-net-worth individuals benefit from working with experienced wealth managers and financial advisors. These professionals bring expertise to navigate complex financial landscapes. By creating a mutually beneficial relationship, advisors can gain access to a steady pipeline of affluent clients while strengthening their expertise. This partnership ensures that SMART goals are not only set but also strategically pursued.

Advanced Financial Technologies

The financial industry has experienced a surge in technological advancements. Sophisticated portfolio management software and AI-driven analytics tools have become essential for implementing and tracking SMART goals. BlackRock’s Aladdin platform is a portfolio management software that provides investment professionals a way to view and manage daily investments. These tools enable wealth managers to make data-driven decisions and adjust strategies promptly.

Balancing Short-Term and Long-Term Objectives

One of the most challenging aspects of implementing SMART goals is to strike the right balance between short-term needs and long-term aspirations. Ultra-high-net-worth clients often have complex financial needs that span generations. Nearly two in three investors want to leave a legacy, highlighting the importance of long-term planning. However, this must align with more immediate financial objectives. A multi-tiered approach sets interconnected SMART goals that address both immediate and future needs.

Regular Review and Adjustment

SMART goals require regular review and adjustment to remain effective. Financial landscapes change, and goals must adapt accordingly. Wealth managers should schedule quarterly or bi-annual reviews with clients to assess progress, identify challenges, and make informed decisions that align with financial objectives. This proactive approach ensures that SMART goals remain relevant and achievable.

Educating the Next Generation

For many ultra-high-net-worth clients, wealth preservation extends beyond their lifetime. Implementing SMART goals should include educating the next generation about financial responsibility and wealth management. This might involve setting up family governance structures, organizing financial literacy workshops, or creating mentorship programs. Such initiatives ensure that the family’s wealth and values persist through generations.

Final Thoughts

SMART financial goals transform abstract aspirations into concrete plans for ultra-high-net-worth individuals. These goals drive wealth preservation and growth through specificity, measurability, achievability, relevance, and time-bound parameters. Professional guidance from wealth managers and financial advisors proves invaluable in crafting and implementing these tailored objectives.

Ultra-high-net-worth clients benefit from proactive goal-setting and regular financial reviews. The dynamic nature of the financial world necessitates consistent reassessment and adjustment of goals to align with changing market conditions and personal circumstances. This approach ensures wealth management strategies remain in sync with long-term visions and values.

Davies Wealth Management specializes in guiding ultra-high-net-worth individuals through comprehensive financial goal-setting. Our expert team develops personalized strategies that address all aspects of wealth management (including investment optimization, tax efficiency, and estate planning). We help clients set and achieve financial goals that secure their legacy for generations to come.

Leave a Reply