At Davies Wealth Management, we understand the critical role of tax planning strategies for companies in maximizing financial efficiency and growth. Effective corporate tax planning can significantly impact a company’s bottom line, providing opportunities for substantial savings and improved cash flow.

In this blog post, we’ll explore key strategies and practical steps to implement robust tax planning measures for your business. From maximizing deductions to leveraging international opportunities, we’ll guide you through the essentials of corporate tax optimization.

What Is Corporate Tax Planning?

The Strategic Importance of Tax Planning

Corporate tax planning is the process of analyzing a company’s financial affairs to minimize tax liabilities while ensuring compliance with tax laws. It’s not just about reducing your tax bill; it’s about optimizing your entire financial structure. A well-executed tax strategy can free up capital for reinvestment, improve cash flow, and enhance overall profitability.

Key Components of Effective Tax Strategies

Successful corporate tax planning involves several critical elements:

- Deep understanding of current tax laws and regulations: The tax code is complex and ever-changing. Staying informed about these changes is essential for identifying opportunities and avoiding pitfalls.

- Careful timing of income recognition and expenses: Strategic timing of when you recognize income or incur expenses can potentially lower your tax liability in a given year. For example, accelerating deductions into the current tax year while deferring income to the next can result in significant tax savings.

- Alignment with overall business strategy: Effective tax planning considers the company’s long-term business goals. This might involve choosing the right business structure, planning for expansion, or preparing for a potential sale or merger.

Debunking Common Misconceptions

Several misconceptions surround corporate tax planning:

- “Tax planning is only for large corporations”: In reality, businesses of all sizes can benefit from strategic tax planning. Even small businesses can save thousands of dollars annually through proper planning.

- “Tax planning equals tax evasion”: This couldn’t be further from the truth. Legitimate tax planning involves using legal methods to minimize tax liability. It’s about working within the framework of the law to optimize your tax position, not circumventing it.

- “Tax planning is a one-time event”: In fact, it’s an ongoing process that requires regular review and adjustment. Tax laws change, businesses evolve, and economic conditions fluctuate. Continuous monitoring and adaptation are essential for maintaining an effective tax strategy.

The Role of Professional Guidance

While understanding the basics of corporate tax planning is valuable, the complexity of tax laws often necessitates professional guidance. Tax professionals can help streamline your tax processes, assist in figuring out tax liability, identify potential savings, and ensure compliance with tax laws.

As we move forward, we’ll explore specific strategies and practical steps to implement robust tax planning measures for your business. From maximizing deductions to leveraging international opportunities, the next section will guide you through the essentials of corporate tax optimization.

How Companies Can Optimize Their Tax Strategies

At Davies Wealth Management, we’ve observed the significant impact of effective tax planning on a company’s financial health. Let’s explore powerful strategies businesses can implement to optimize their tax position and boost their bottom line.

Maximize Tax Deductions and Credits

Companies can reduce their tax burden by taking full advantage of available deductions and credits. The R&D tax credit can transform a company’s financial outlook. The IRS offers two methods to determine credit value, including the Regular Research Credit and Alternative Simplified Credit (ASC). This credit extends beyond tech companies; manufacturers, software developers, and even food producers can potentially benefit.

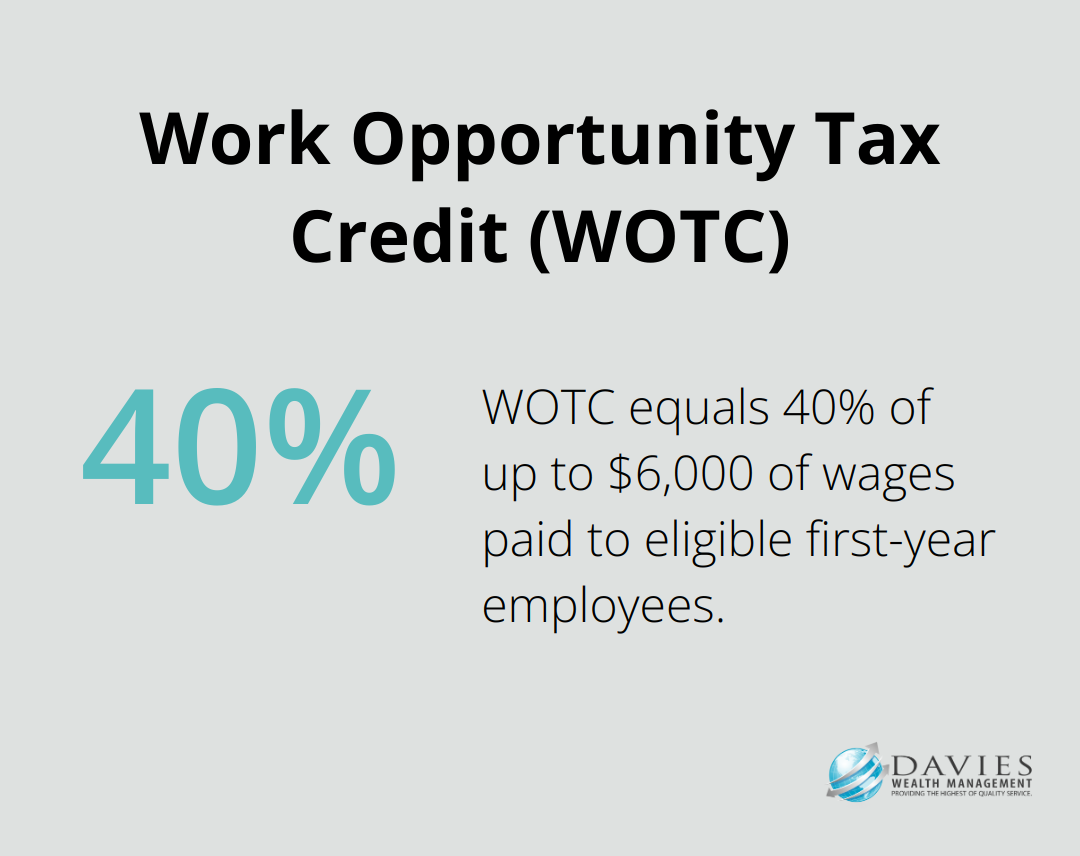

The Work Opportunity Tax Credit (WOTC) presents another often-overlooked opportunity. This federal tax credit encourages employers to hire individuals from certain target groups who have faced consistent employment barriers. In general, the WOTC is equal to 40% of up to $6,000 of wages paid to, or incurred on behalf of, an individual who is in their first year of employment.

Choose the Right Business Structure

A company’s business structure significantly impacts its tax obligations. S Corporations can help owners avoid double taxation on corporate income. Limited Liability Companies (LLCs) offer flexibility in taxation, allowing owners to choose between being taxed as a sole proprietorship, partnership, S Corporation, or C Corporation.

Companies should reassess their business structure regularly as they grow and evolve. A structure that worked for a startup might not offer the most tax-efficient option during scaling.

Time Income and Expenses Strategically

Strategic management of income recognition and expense timing can potentially lower a company’s tax liability. If a company expects to be in a lower tax bracket next year, it might make sense to defer income. Conversely, if a higher bracket is anticipated, accelerating income into the current year could prove beneficial.

The same principle applies to expenses. The Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. Companies can significantly reduce their taxable income in a given year through strategic timing of major purchases.

Explore International Tax Planning Opportunities

For businesses operating internationally, the tax landscape becomes more complex but also offers additional optimization opportunities. Transfer pricing strategies, when implemented correctly, can help multinational companies allocate profits among different jurisdictions in a tax-efficient manner. Multinational groups need to keep in mind that the U.S. transfer pricing documentation requirements are different from the ones used by other countries.

Leveraging tax treaties between countries presents another strategy. These agreements can help prevent double taxation and may offer reduced withholding tax rates on cross-border payments. The U.S. currently maintains tax treaties with over 60 countries, each with its own specific provisions.

The implementation of these strategies requires careful planning and expert knowledge of tax laws. Whether you’re a small business owner or a multinational corporation, optimizing your tax strategy can lead to significant savings and improved financial performance. As we move forward, we’ll explore how companies can put these strategies into action and integrate them into their overall business plan.

How to Implement Effective Tax Planning

Conduct a Comprehensive Tax Audit

The first step to implement effective tax planning is to conduct a thorough tax audit. This process involves an in-depth analysis of your company’s financial records, tax returns, and current tax strategies. A comprehensive audit will uncover areas where you overpay taxes, miss deductions, or face compliance risks.

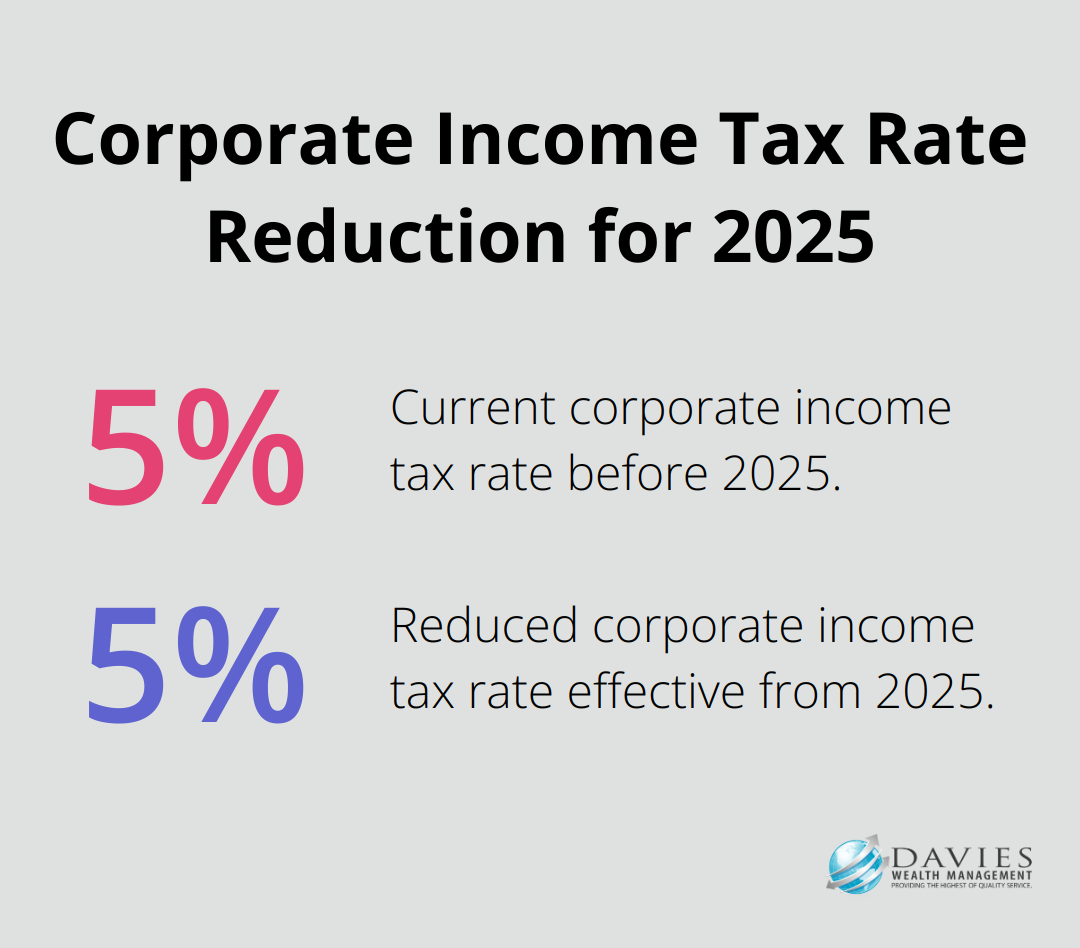

During the audit, focus on your company’s effective tax rate. Effective for tax years beginning on or after January 1, 2025, the corporate income tax rate reduces from 5.39 percent to 5.19 percent. If your rate significantly exceeds this benchmark, it indicates potential for improvement in your tax planning.

Develop a Tailored Tax Planning Roadmap

After completing your audit, create a customized tax planning roadmap. This detailed plan should outline specific strategies, timelines, and goals to optimize your tax position.

Your roadmap must include both short-term tactics and long-term strategies. A short-term tactic might involve accelerating deductions into the current tax year, while a long-term strategy could entail restructuring your business for more favorable tax treatment.

Build flexibility into your plan. Tax laws change frequently, and your business circumstances may shift. A robust tax planning roadmap should adapt to these changes.

Integrate Tax Planning with Business Strategy

Effective tax planning supports your overall business objectives. When you develop tax strategies, consider how they align with your company’s growth plans, investment strategies, and operational goals.

For example, if your company plans to expand internationally, your tax planning should incorporate strategies for managing transfer pricing, foreign tax credits, and treaty benefits. If you consider a merger or acquisition, address the potential tax implications and opportunities associated with the transaction in your tax planning.

Assemble a Skilled Tax Team

Implementation of effective tax planning requires expertise. Small businesses might rely on external tax professionals, while larger companies often benefit from building an in-house tax team. This team should include professionals with diverse skills (tax compliance, tax planning, and international tax expertise).

If you’re not ready to build an in-house team, partner with a reputable tax advisory firm. Davies Wealth Management offers comprehensive tax planning services tailored to your specific needs. Our team of experts stays current with the latest tax laws and regulations, ensuring that your tax strategies remain both effective and compliant.

Stay Informed and Adaptable

Tax laws and regulations evolve constantly. Try to stay informed about these changes and adapt your strategies accordingly. Subscribe to reputable tax publications, attend industry seminars, and maintain open communication with your tax advisors.

Regularly review and update your tax planning strategies. What works today might not be optimal tomorrow. Set aside time each quarter to assess your tax position and make necessary adjustments to your plan.

Final Thoughts

Effective tax planning strategies for companies provide a foundation for financial success in today’s complex business environment. Companies can reduce their tax burden, improve cash flow, and allocate resources more efficiently through strategic approaches. The long-term benefits of robust corporate tax planning extend beyond immediate savings, enhancing competitive edge and supporting growth initiatives.

Tax planning requires continuous attention as the tax landscape evolves with new regulations, incentives, and challenges. Regular reviews and proactive adjustments ensure tax strategies remain compliant and beneficial. At Davies Wealth Management, we understand the intricacies of corporate tax planning and its impact on overall financial health.

Our team of experts helps businesses navigate the complex world of taxation (providing tailored wealth management solutions that align with specific goals and circumstances). We assist small business owners and large corporations in implementing sound tax planning strategies to set the foundation for lasting financial success and growth.

Leave a Reply