At Davies Wealth Management, we understand the unique challenges high-income earners face when planning for retirement. Effective tax strategies can significantly impact your financial future, allowing you to maximize savings and minimize tax liabilities.

In this post, we’ll explore retirement tax strategies for high-income earners, covering everything from tax-advantaged accounts to advanced planning techniques. Our goal is to provide you with actionable insights to optimize your retirement savings and secure your financial well-being.

How Tax-Advantaged Accounts Can Boost Your Retirement Savings

At Davies Wealth Management, we recommend tax-advantaged accounts to maximize retirement savings for our high-income clients. These accounts offer significant tax benefits that can substantially increase your nest egg over time.

Maximize 401(k) and IRA Contributions

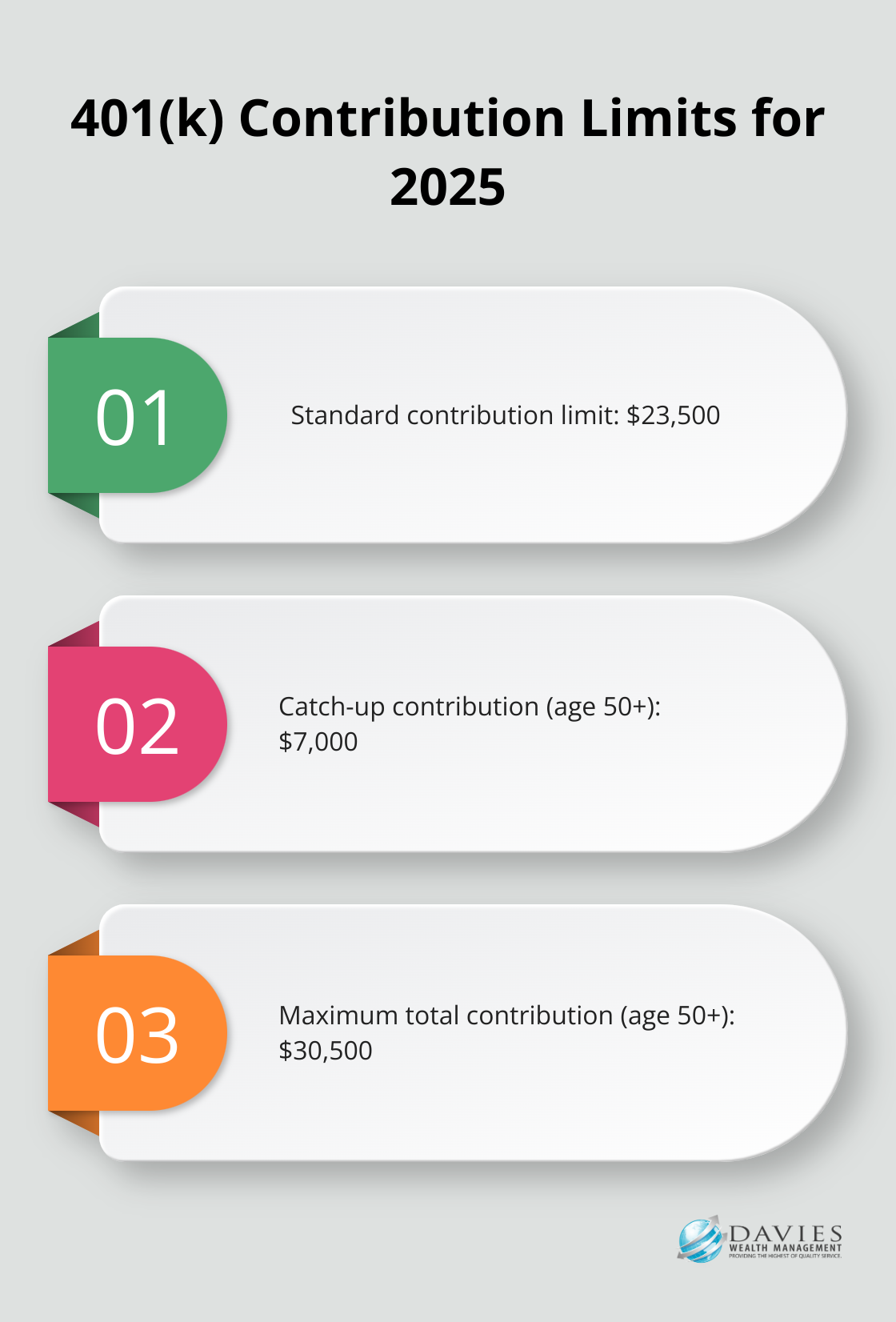

For 2025, the contribution limit for 401(k) plans is $23,500, with an additional $7,000 catch-up contribution for those 50 and older. This means you can potentially save up to $30,500 per year in your 401(k), reducing your taxable income by the same amount. Self-employed individuals or business owners should consider a Solo 401(k), which allows even higher contributions.

Traditional IRA contributions, while potentially not tax-deductible for high-income earners, still offer tax-deferred growth. In 2025, you can contribute up to $7,000 (or $8,000 if you’re 50 or older). Even without the immediate tax deduction, the compounding effect of tax-deferred growth can significantly boost your retirement savings.

Explore Roth Conversion Strategies

High-income earners who exceed the Roth IRA income limits can benefit from a backdoor Roth strategy. This involves making a non-deductible contribution to a traditional IRA and then immediately converting it to a Roth IRA. If you have no other IRA assets other than your after-tax contributions, you can perform the backdoor Roth conversion with no taxes due.

Another powerful strategy is the mega backdoor Roth. If your 401(k) plan allows after-tax contributions and in-service distributions, you can potentially contribute up to $70,000 (the 2025 limit) to your 401(k), then roll the after-tax portion into a Roth IRA. This strategy can dramatically increase your tax-free retirement savings.

Harness the Power of Health Savings Accounts

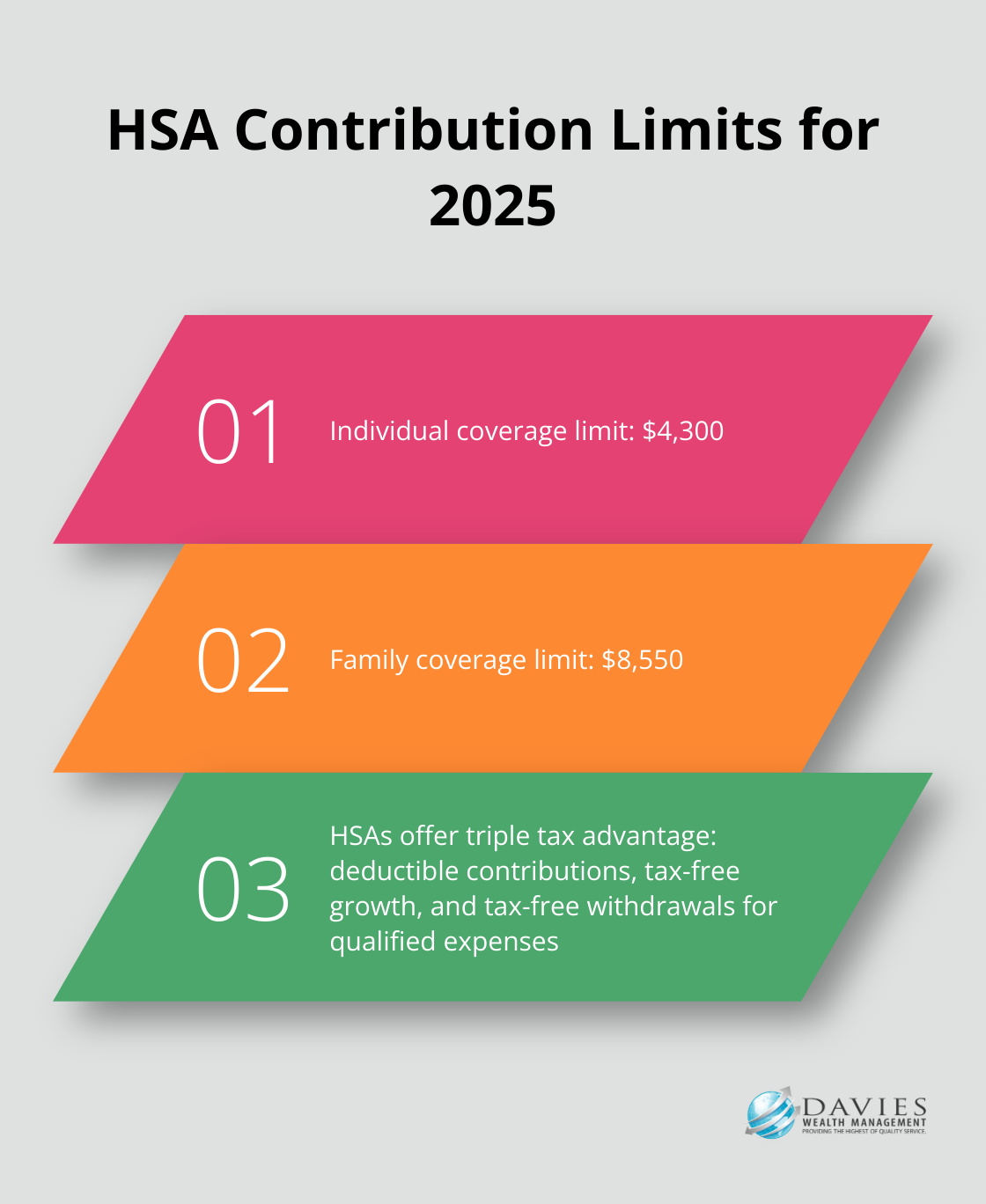

Health Savings Accounts (HSAs) offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2025, you can contribute up to $4,300 if you are covered by a high-deductible health plan just for yourself, or $8,550 if you have coverage for your family.

Many don’t realize that HSAs can be powerful retirement savings tools. Pay medical expenses out of pocket and let your HSA investments grow to build a substantial tax-free fund for healthcare costs in retirement. After age 65, you can withdraw HSA funds for non-medical expenses without penalty, paying only income tax (similar to a traditional IRA).

Strategic use of these tax-advantaged accounts can help you accumulate significant wealth. Maximize contributions across these various accounts and implement advanced strategies like Roth conversions to potentially save hundreds of thousands of dollars in taxes over your lifetime, dramatically boosting your retirement nest egg.

Now that we’ve covered how to maximize your retirement savings through tax-advantaged accounts, let’s turn our attention to strategies that can help reduce your taxable income during retirement.

How to Minimize Taxes in Retirement

Reducing taxable income during retirement preserves wealth and maintains your desired lifestyle. At Davies Wealth Management, we employ several sophisticated techniques to help our high-income clients minimize their tax burden in retirement.

Strategic Asset Location

One of the most effective ways to reduce taxes in retirement is through strategic asset location. This involves choosing where to place your investments based on tax considerations. For example:

- High-growth stocks often perform best in Roth accounts where gains grow tax-free.

- Bonds and other income-producing assets may suit traditional IRAs or 401(k)s better, where income is tax-deferred.

Tax-Loss Harvesting

Tax-loss harvesting is another powerful strategy for reducing taxable income in retirement. This technique involves selling investments that have declined in value to realize losses, which can then offset capital gains or up to $3,000 of ordinary income per year.

Tax-loss harvesting can potentially improve after-tax returns. By realizing, or “harvesting” a loss, investors are able to offset taxes on both gains and income. The sold security is replaced by a similar one, ideally maintaining the desired asset allocation and expected returns.

Qualified Charitable Distributions

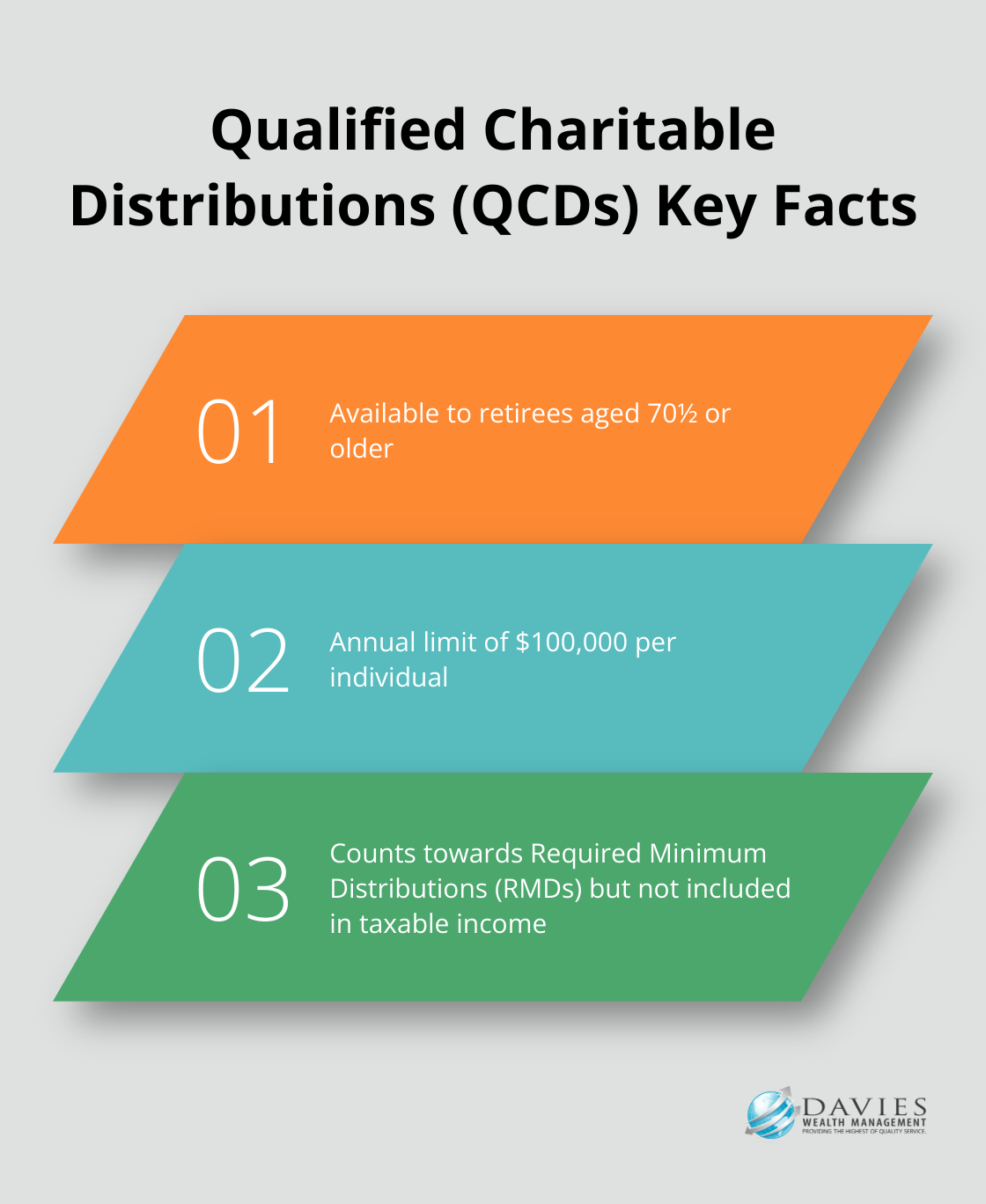

For philanthropically-inclined retirees aged 70½ or older, Qualified Charitable Distributions (QCDs) offer an excellent way to reduce taxable income. QCDs allow you to donate up to $100,000 annually directly from your IRA to qualified charities. These distributions count towards your Required Minimum Distributions (RMDs) but are not included in your taxable income.

For a married couple, if both spouses are eligible, each can exclude up to $100,000 of QCDs from their gross income each year.

Roth Conversion Ladders

Roth conversion ladders provide another tax-saving strategy for retirees. This approach involves converting portions of traditional IRA funds to Roth IRAs over several years, paying taxes on the converted amounts at potentially lower rates. The goal is to minimize the overall tax burden while creating a tax-free income stream for later retirement years.

Managing Social Security Benefits

Careful planning around when to claim Social Security benefits can also impact your retirement tax situation. Delaying benefits until age 70 not only increases your monthly payment but may also reduce the amount of your benefits subject to taxation, depending on your other income sources.

Implementing these strategies requires careful planning and expertise. Professional guidance can help ensure you take full advantage of every opportunity to minimize your tax burden in retirement. As we move forward, let’s explore some advanced tax planning techniques specifically designed for high-income earners.

Advanced Tax Strategies for High-Income Earners

High-income earners face unique challenges in tax planning and wealth preservation. We will explore sophisticated strategies that can significantly impact your financial future.

Deferred Compensation Plans

Deferred compensation plans are part of an employee’s salary that is not paid out or taxed as income until a future date, usually at retirement. These plans allow you to postpone receiving a portion of your income until a later date, typically retirement, when you may be in a lower tax bracket.

Two main types of deferred compensation plans exist: qualified and non-qualified. Qualified plans, like 401(k)s, adhere to ERISA regulations and have contribution limits. Non-qualified plans, such as executive bonus plans or supplemental executive retirement plans (SERPs), offer more flexibility but come with some risks.

It’s important to understand the risks associated with non-qualified plans. Unlike qualified plans, the deferred compensation in non-qualified plans is not protected from the company’s creditors. If the company faces financial difficulties, your deferred compensation could be at risk.

Cash Balance Plans for Business Owners

Cash balance plans can accelerate retirement savings while reducing current tax liabilities for high-income business owners. These plans are a type of defined benefit plan that combines features of both defined benefit and defined contribution plans.

Cash balance plans potentially allow business owners to contribute three or four times the dollar limits of other types of retirement plans such as 401(k)s. This can result in significant tax savings, especially for high-income earners in top tax brackets.

Cash balance plans come with more complexity and higher administrative costs than traditional 401(k) plans. They also require consistent funding and can be less flexible in years when business income fluctuates. It’s important to work with experienced professionals who can help you navigate these complexities.

Private Placement Life Insurance

Private Placement Life Insurance (PPLI) is a beneficial option for individuals with high net worth due to its potential for privacy protection, asset security, and tax advantages. PPLI policies are typically available to accredited investors and offer a way to invest in a wide range of assets, including hedge funds and private equity, in a tax-efficient manner.

The key advantage of PPLI is that the investments within the policy grow tax-free, and if structured correctly, withdrawals can be taken tax-free as well. This can benefit high-income earners who have maxed out their other tax-advantaged investment options.

PPLI is a complex strategy with high minimum investment requirements, typically starting at $1 million or more. It also involves insurance costs and requires careful structuring to ensure compliance with IRS regulations.

These advanced tax planning techniques can help high-income earners build and preserve wealth while navigating the complexities of the tax code. It’s important to work with experienced professionals who can tailor these strategies to your unique financial situation and goals.

Final Thoughts

Retirement tax strategies for high-income earners offer numerous opportunities to maximize wealth and secure financial stability. From tax-advantaged accounts to advanced techniques like strategic asset location and Roth conversion ladders, these approaches can significantly impact your retirement savings. Sophisticated strategies such as deferred compensation plans and private placement life insurance provide additional tools for wealth accumulation and preservation.

Retirement planning is not a one-size-fits-all endeavor, especially for high-income individuals. Your unique financial situation, career trajectory, and long-term goals all play a role in determining the most effective tax strategies for your retirement. Professional guidance is essential when developing your retirement plan due to the complexity of these strategies and the ever-changing landscape of tax laws.

At Davies Wealth Management, we specialize in creating tailored financial solutions for high-income earners (including professional athletes facing unique financial challenges). Our team of experts can help you navigate the intricacies of retirement tax planning, ensuring you make informed decisions that align with your financial objectives. The earlier you start implementing these strategies, the more time your wealth has to grow.

Leave a Reply