At Davies Wealth Management, we understand that financial planning for high-net-worth individuals requires a unique approach. The complexities of substantial assets, diverse investment portfolios, and intricate tax considerations demand specialized strategies.

Our team of experts is dedicated to crafting tailored financial plans that address the specific needs of high-net-worth clients. In this post, we’ll explore the key components and advanced strategies essential for effective wealth management in this exclusive segment.

What Makes High-Net-Worth Financial Planning Unique?

High-net-worth individuals (HNWIs) face a distinct set of financial challenges that require specialized planning and strategies. These clients often have intricate financial landscapes that demand a more nuanced approach.

Complex Asset Structures

HNWIs typically own a diverse array of assets, from traditional stocks and bonds to alternative investments like private equity, hedge funds, and real estate. Asset allocation is essentially the art and science of spreading investments among different types of assets such as stocks, bonds, real estate, and cash. This complexity necessitates sophisticated asset allocation strategies that balance risk and return across various asset classes.

Tax Optimization Mastery

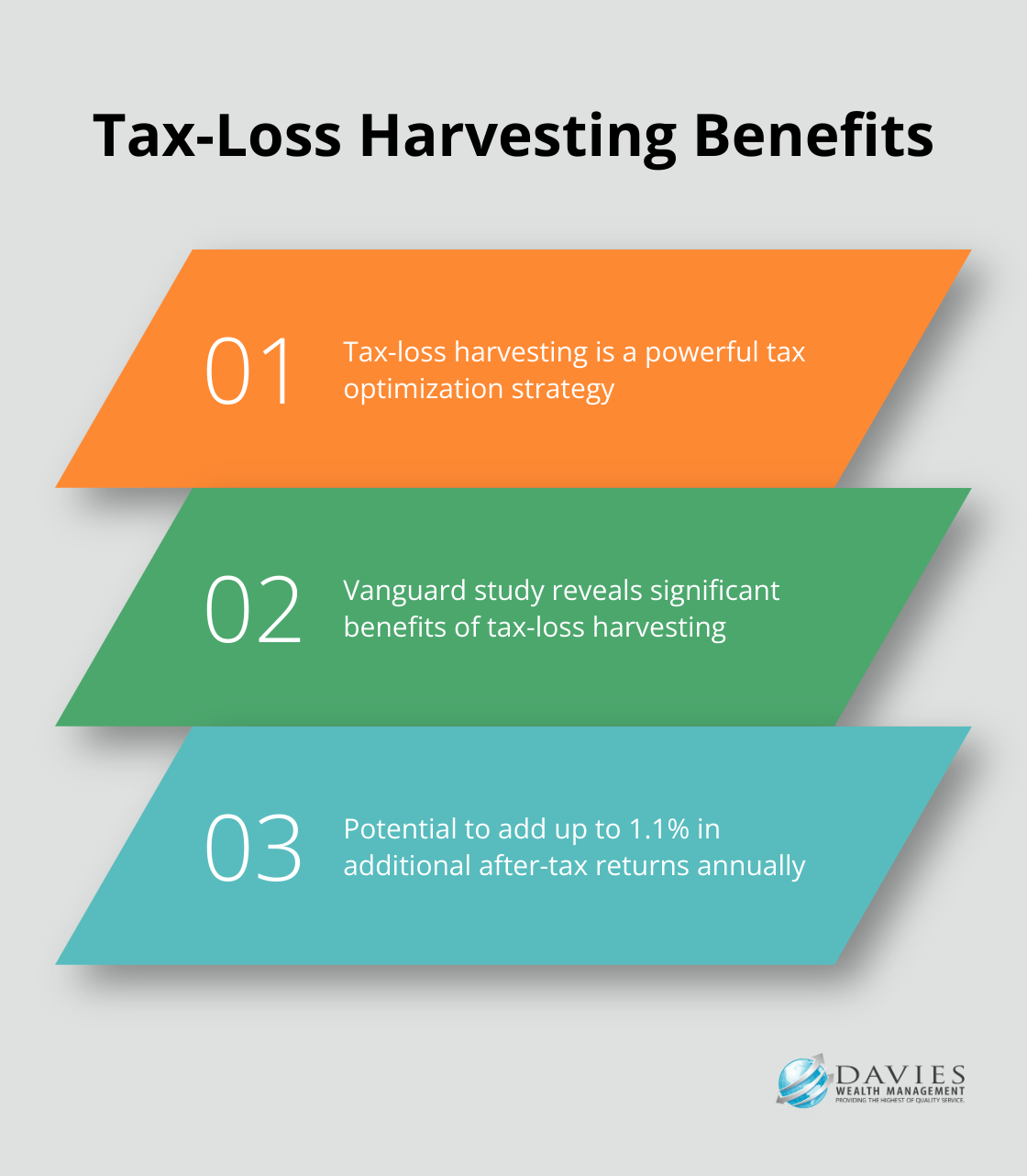

Tax planning is a critical component of wealth management for HNWIs. The tax code offers numerous opportunities for high-income earners to minimize their tax burden legally. Strategies such as tax-loss harvesting can be used to strategically sell assets at a loss, offsetting capital gains and lowering tax obligations.

Comprehensive Estate Planning

Estate planning for HNWIs extends beyond simple wills. It often involves the creation of complex trust structures, implementation of gifting strategies, and consideration of philanthropic goals. Estate planning is crucial for high net worth individuals, focusing on asset protection, tax minimization, and legacy preservation.

Risk Mitigation for Substantial Assets

Risk management takes on new dimensions for HNWIs. Beyond market risk, these individuals must consider liability protection, reputation management, and even cybersecurity threats. Specialized insurance products (such as umbrella policies and directors and officers insurance) play a crucial role in protecting substantial assets.

Tailored Approach for Professional Athletes

Professional athletes represent a unique subset of high-net-worth individuals. Their financial situations often involve short career spans and fluctuating incomes. This requires specialized strategies to manage current wealth while securing long-term financial stability. Financial advisors must address the complexities of contract negotiations, endorsement deals, and post-career income planning.

The next chapter will explore the key components that form the foundation of a robust financial plan for high-net-worth individuals. These elements work in concert to address the unique challenges and opportunities presented by substantial wealth.

Building Your High-Net-Worth Financial Blueprint

At Davies Wealth Management, we recognize that a financial plan for high-net-worth individuals requires a multifaceted approach. Our experience shows that a well-structured plan must address several key areas simultaneously to ensure comprehensive wealth management.

Optimize Asset Allocation

A cornerstone of any high-net-worth financial plan is a robust asset allocation strategy. This strategy extends beyond simple diversification across stocks and bonds. For our clients, we often recommend a mix that includes alternative investments such as private equity, hedge funds, and real estate. A 2023 study by Preqin projects alternative assets under management to reach $23.21 trillion by 2026, highlighting their growing importance in wealth management.

We typically balance the portfolio to align with each client’s risk tolerance and long-term objectives. For instance, a client nearing retirement might have a portfolio weighted more heavily towards income-generating assets, while a younger high-net-worth individual might prefer growth-oriented investments.

Maximize Tax Efficiency

Tax optimization plays a vital role in wealth preservation. We employ various strategies to minimize tax liabilities, such as tax-loss harvesting and strategic use of municipal bonds. A study by Vanguard found that tax-loss harvesting can add up to 1.1% in additional after-tax returns annually.

For our high-income clients, we often explore opportunities in Qualified Opportunity Zones, which may provide a tax incentive for private, long-term investment in economically distressed communities.

Plan for a Luxurious Retirement

Retirement planning for high-net-worth individuals often focuses less on accumulation and more on distribution strategies. We help our clients develop plans that maintain their lifestyle while minimizing tax impact. This might involve a combination of Roth conversions, strategic withdrawals from various account types, and timing Social Security benefits for optimal results.

Integrate Philanthropy

Many high-net-worth clients are passionate about giving back. We help them create strategic philanthropic plans that align with their values while maximizing tax benefits. This often involves setting up donor-advised funds or private foundations. The compound annual growth rate in contributions to donor-advised funds at Community Foundations from 2019 to 2023 is 3.5 percent.

Ensure Business Continuity

For clients who are business owners, succession planning forms a critical component of their financial strategy. We work closely with them to develop plans that ensure a smooth transition of their business, whether to family members or external buyers. This process often involves valuation assessments, tax planning, and sometimes the creation of trusts to facilitate the transfer.

The next chapter will explore advanced financial strategies that high-net-worth individuals can leverage to further enhance their wealth management approach.

Advanced Strategies for High-Net-Worth Wealth Management

At Davies Wealth Management, we recognize that high-net-worth individuals require sophisticated financial strategies to optimize their wealth. Our approach extends beyond traditional investment methods, incorporating advanced techniques that can significantly enhance portfolio performance and wealth preservation.

Alternative Investments

Alternative investments play a crucial role in diversifying high-net-worth portfolios. By adding diversifying assets, portfolio drawdowns could be shallower and allow wealth to compound more steadily.

Private equity offers unique opportunities for substantial returns. However, we advise caution due to their illiquid nature and higher risk profile.

Real estate investment trusts (REITs) present another avenue for portfolio diversification, offering both income and potential for capital appreciation.

Trust Structures and Family Office Services

For high-net-worth individuals, trusts serve as an effective tool to manage and protect assets. Irrevocable trusts can provide significant tax benefits and asset protection. They offer a powerful tool for estate planning, providing structured wealth transfer.

Family office services offer a comprehensive approach to wealth management for high-net-worth families. These services include investment management, tax planning, philanthropy coordination, and succession planning.

International Tax Planning

International tax planning has become increasingly important for high-net-worth individuals with global assets. This development underscores the need for transparent and compliant international tax strategies.

Offshore considerations can offer opportunities for tax efficiency and asset protection. However, we advise careful navigation of these waters.

Risk Mitigation Through Insurance and Asset Protection

Comprehensive risk management is paramount for high-net-worth individuals. This includes exploring key insurance tips, essential coverage options, and aligning wealth with a comprehensive risk management plan.

For business owners or corporate board members, Directors and Officers (D&O) insurance is often essential.

Cybersecurity has emerged as a significant risk area for high-net-worth individuals. We work with clients to assess their digital vulnerabilities and implement appropriate protective measures.

Final Thoughts

Financial planning for high-net-worth individuals requires specialized knowledge and expertise. The unique challenges faced by this group demand a tailored approach that goes beyond traditional financial planning methods. At Davies Wealth Management, we understand the intricacies of managing substantial wealth and craft personalized financial strategies that address the specific needs of high-net-worth clients.

Working with specialized wealth management professionals offers numerous benefits. These experts possess in-depth knowledge of advanced financial strategies, alternative investments, and tax optimization techniques that can enhance wealth preservation and growth. They stay informed about changing regulations and market conditions, ensuring that your financial plan remains relevant and effective.

Financial planning for high-net-worth individuals is not a one-time event. The financial landscape evolves constantly, and personal circumstances change over time. We at Davies Wealth Management provide ongoing support and guidance to our clients, continuously monitoring and adjusting strategies to respond to market shifts, regulatory changes, and evolving personal goals (while maintaining a proactive approach to wealth management).

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply