In today’s digital age, our online lives have become as valuable as our physical assets. At Davies Wealth Management, we’ve seen a growing need for digital asset estate planning to protect and pass on these virtual possessions.

From cryptocurrencies to social media accounts, digital assets play an increasingly important role in our financial and personal lives. This guide will walk you through the essential steps to include your digital assets in your estate plan, ensuring your online legacy is preserved and distributed according to your wishes.

Understanding Digital Assets in Estate Planning

Defining Digital Assets

Digital assets encompass any electronic records you own or have rights to. These include email accounts, social media profiles, cryptocurrency wallets, and online banking information. Your digital photos, videos, and music libraries also fall under this category.

Types of Digital Assets

The spectrum of digital assets is broad and ever-expanding. Cryptocurrencies (such as Bitcoin and Ethereum) represent just one facet of this diverse landscape. Your Amazon Kindle library, Netflix account, and even airline miles constitute digital assets.

Social media accounts hold significant value, particularly for influencers or business owners who leverage these platforms professionally. Domain names, blogs, and online businesses also represent substantial digital assets that require protection.

The Importance of Digital Assets in Estate Planning

Incorporating digital assets into your estate plan is now a necessity. Without proper planning, your heirs risk losing access to valuable or sentimental digital property. In some instances, they might remain unaware of these assets’ existence.

Consider the potential consequences:

- Cryptocurrency ownership: Your family could lose access to substantial wealth if they lack the necessary information to access your digital wallet.

- Cloud-stored family photos: Precious memories could vanish if your loved ones can’t access your accounts. This ensures that your estate plan accurately reflects your current digital footprint, wishes, and named beneficiaries or legacy contacts.

- Social media accounts: Your online presence could persist after death, potentially causing distress to your loved ones without clear instructions.

Navigating the Complexities

The digital world changes rapidly. Today’s valuable assets might become obsolete tomorrow. This reality underscores the importance of regular reviews and updates to your digital asset inventory and estate plan.

Legal Considerations

The legal landscape surrounding digital assets in estate planning continues to evolve. Many states have adopted laws (such as the Revised Uniform Fiduciary Access to Digital Assets Act) to address these issues. RUFADAA is a law that provides the Executor of an Estate, or an attorney, with access to someone’s online accounts after death or incapacitation. However, the terms of service agreements for various online platforms can complicate matters.

As we move forward, we’ll explore the specific steps you can take to ensure your digital assets receive proper consideration in your estate plan. This process involves creating a comprehensive inventory, determining asset values, and selecting a digital executor to manage these assets after your passing. In the UK, an executor has a general duty to administer the deceased’s estate, which includes identifying and valuing all assets.

How to Incorporate Digital Assets in Your Estate Plan

Creating a Digital Asset Inventory

The first step to include digital assets in your estate plan is to create a thorough inventory. This inventory should list all your digital assets, such as social media accounts, email addresses, cryptocurrency wallets, and online banking information. Don’t overlook less obvious assets like digital music libraries, e-books, or valuable domain names.

A secure password manager can help you store this information safely. These tools allow you to securely share access with your designated digital executor. It’s important to update this inventory every six months to keep it current.

Assessing Digital Asset Value

The next step is to determine the value of your digital assets. Some assets (like cryptocurrencies) have clear monetary value, while others (such as family photos stored in the cloud) hold sentimental value. For business-related digital assets, consider their potential to generate revenue.

Use reputable tracking websites to monitor the current market value of cryptocurrencies. For other assets, factor in potential income (for instance, a monetized YouTube channel) or replacement cost (for a large music or e-book library).

Planning Asset Distribution

After you catalog and value your digital assets, decide how you want to distribute them. You can transfer some assets (like cryptocurrency) to beneficiaries similar to traditional assets. Other assets (such as social media accounts) may require memorialization or deletion according to your wishes.

Be specific in your instructions. If you want certain emails or messages deleted without being read, state this clearly. If you want to maintain your social media accounts as a digital legacy, provide guidelines on how to do this.

Selecting a Digital Executor

The choice of a digital executor is critical. This person should possess both technical knowledge and trustworthiness to navigate the complexities of your digital estate. Your digital executor doesn’t need to be the same person as your traditional executor.

Provide your digital executor with clear, written instructions on how to access and manage your digital assets. Include login information, two-factor authentication details, and specific instructions for each asset.

Legal Considerations

The legal landscape surrounding digital assets in estate planning continues to evolve. Many states have adopted laws (such as the Revised Uniform Fiduciary Access to Digital Assets Act) to address these issues. However, the terms of service agreements for various online platforms can complicate matters.

It’s important to consult with a legal professional who specializes in digital asset estate planning. They can help you navigate the complex legal landscape and ensure your digital assets are properly protected and distributed according to your wishes.

As we move forward, we’ll explore the specific legal considerations you need to keep in mind when including digital assets in your estate plan. This includes understanding federal and state laws, as well as the terms of service agreements for your online accounts.

Navigating Legal Complexities of Digital Assets

Federal and State Laws

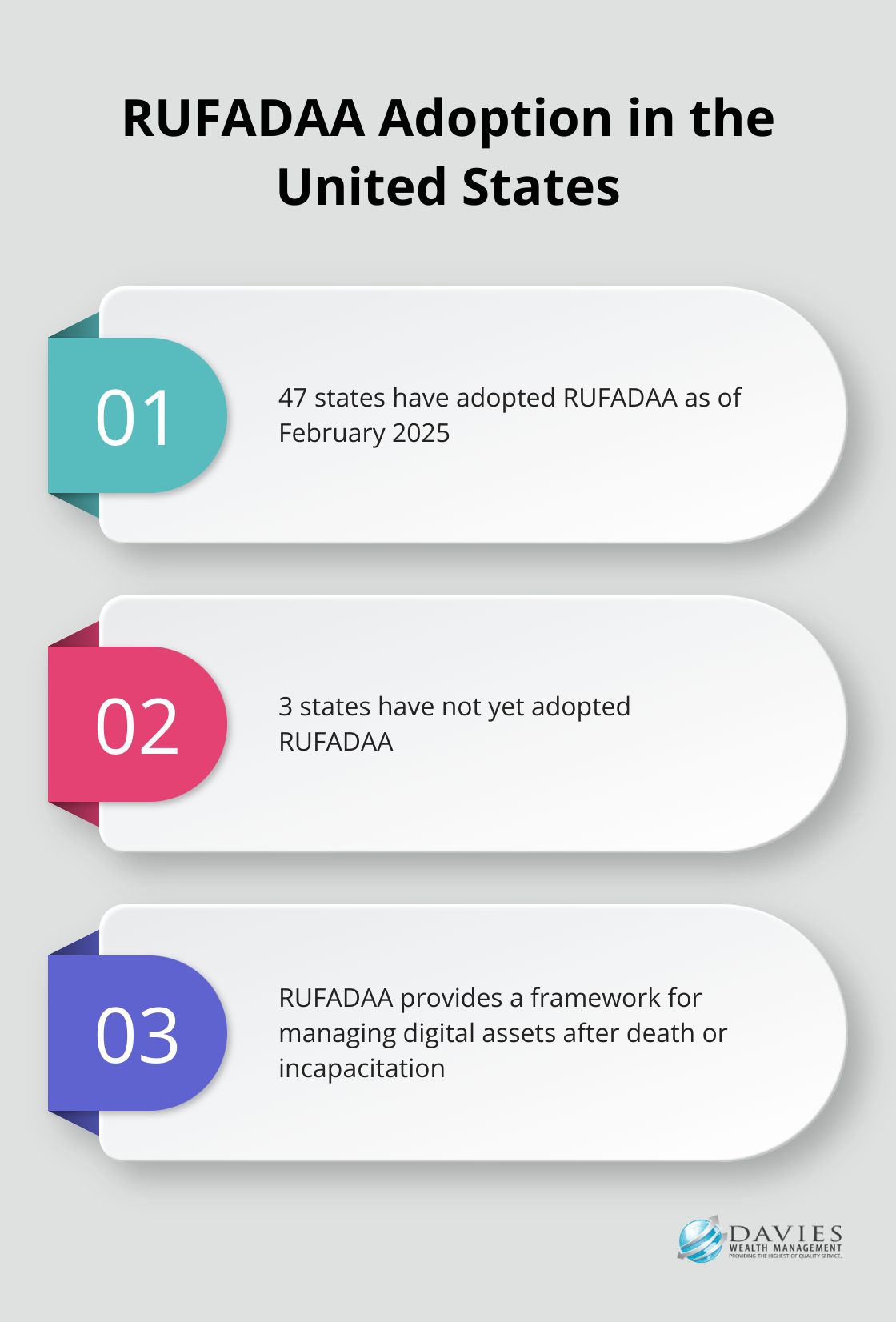

The Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA) has been adopted by 47 states as of February 2025. This act provides a framework for fiduciaries to access and manage digital assets after an individual’s death or incapacitation. RUFADAA prioritizes the account holder’s expressed wishes over other considerations.

If you use an online tool provided by a custodian to specify your preferences for posthumous account access, these instructions will take precedence over any conflicting directions in your will or trust. This highlights the need to review and update your digital asset preferences across various platforms regularly.

Terms of Service Agreements

Many online platforms have strict non-transferability policies that can prevent access to digital assets after death. For example, Apple’s iCloud Terms of Service provide instructions on how to request access to or delete someone’s Apple Account and the data stored with it after they have passed away. Without proper planning, your heirs could lose access to valuable photos, documents, and other digital content stored in your iCloud account.

To address this issue, create a comprehensive inventory of your digital assets, including login credentials and specific instructions for each account. Store this information securely and inform your digital executor how to access it when needed.

Incorporating Digital Assets in Your Will or Trust

Include clear provisions for digital assets in your will or trust. These documents should explicitly grant your executor or trustee the authority to access, manage, and distribute your digital assets. Without this explicit permission, your fiduciaries may face legal obstacles when attempting to access your accounts.

For cryptocurrency holdings, consider using a “dead man’s switch” or similar mechanism to transfer ownership automatically after a period of inactivity. This can help ensure your heirs gain access to these valuable assets without complex legal proceedings.

Specialized Legal Assistance

The legal landscape surrounding digital assets in estate planning continues to evolve. Work with legal professionals who specialize in digital asset estate planning to ensure your digital legacy receives proper protection. These experts can help you navigate the complex legal considerations and create a comprehensive estate plan that addresses both your traditional and digital assets.

Staying Informed and Adaptable

Laws and regulations regarding digital assets change rapidly. Stay informed about new developments and adapt your estate plan accordingly. Regular reviews and updates to your digital asset strategy will help ensure your plan remains effective and legally sound.

Final Thoughts

Digital asset estate planning has become an essential component of modern wealth management. The digital realm now holds significant portions of our lives and assets, which makes it necessary to incorporate these elements into our estate plans. We at Davies Wealth Management recognize the growing importance of digital asset estate planning and our team of experts can help create a comprehensive plan that addresses both traditional and digital assets.

Our personalized advice and strategies are tailored to your specific needs, especially for professional athletes and high-net-worth individuals with complex digital portfolios. We can assist you in developing a robust digital asset inventory, guide you through legal considerations, and ensure your estate plan reflects your wishes for both physical and digital legacies.

Take proactive steps to protect and pass on your online wealth and memories. With proper planning and expert guidance from Davies Wealth Management, you can ensure that your digital legacy is preserved and distributed according to your wishes. This will provide peace of mind for you and your loved ones.

Leave a Reply