Choosing the right financial advisor for your 401k can significantly impact your retirement savings. At Davies Wealth Management, we understand the importance of this decision and its long-term consequences.

A skilled financial advisor for 401k plans can help you navigate complex investment options, optimize your portfolio, and maximize your retirement savings potential. This guide will provide you with essential insights to help you select the best advisor for your unique financial situation and goals.

What Does a 401k Financial Advisor Do?

Navigating Investment Options

A 401k financial advisor helps you understand and select appropriate investment options within your plan. They may consult on 401(k) plan design, handle plan amendments, and help select qualified recordkeepers and TPAs – including overseeing the RFP process. A skilled advisor assesses your risk tolerance, time horizon, and financial goals to recommend a diversified portfolio that aligns with your needs.

Optimizing Contribution Strategies

Financial advisors assist in developing contribution strategies that maximize your retirement savings. They help you determine the optimal contribution rate, considering factors such as employer matching, tax implications, and your overall financial situation. A Vanguard analysis demonstrates that financial advice adds value for participants who’ve saved more, and less, than baseline.

Monitoring and Rebalancing

Regular monitoring and rebalancing of your 401k portfolio maintains an appropriate asset allocation over time. Rebalancing your portfolio-buying or selling asset classes to restore your portfolio to your original target allocation-is an important step in controlling risk. This proactive approach can mitigate potential losses and capitalize on market opportunities.

Providing Education and Support

Financial advisors serve as valuable resources for ongoing education and support. They explain complex financial concepts, keep you informed about market trends, and provide guidance during periods of market volatility. This education empowers you to make more informed decisions about your retirement savings and helps you stay committed to your long-term financial goals.

Tailoring Strategies to Individual Needs

Every investor has unique financial circumstances and goals. A 401k financial advisor tailors strategies to your specific situation, considering factors such as your age, income, risk tolerance, and retirement timeline. This personalized approach (which may include tax-efficient strategies and estate planning considerations) ensures that your 401k plan aligns with your broader financial objectives.

As we move forward, it’s important to understand the key qualifications you should look for when selecting a 401k financial advisor. These qualifications will help ensure that you receive expert guidance tailored to your specific needs and goals.

What Qualifications Should Your 401k Advisor Have?

Professional Certifications

When you select a financial advisor for your 401k plan, you should look for specific qualifications that ensure they have the expertise to manage your retirement savings effectively. The Certified Financial Planner (CFP) designation stands out as a mark of excellence in financial planning. CFP professionals complete a CFP Board Registered Education Program, pass the CFP® Exam, hold or earn a 4-year degree, and demonstrate financial planning experience.

Another valuable credential is the Chartered Financial Analyst (CFA) designation, which demonstrates expertise in investment analysis and portfolio management. Advisors with a CFA charter possess a deep understanding of financial markets and can provide sophisticated investment strategies for your 401k.

Specialized Retirement Planning Experience

Beyond certifications, you should seek advisors with specific experience in retirement planning and 401k management. Ask potential advisors about their track record in helping clients optimize their 401k plans. Inquire about their years of experience working with 401k plans and the strategies they’ve employed to maximize returns and minimize risks for their clients.

An advisor with a proven history of successful 401k management will navigate the complexities of your retirement plan more effectively. They should provide concrete examples of how they’ve helped clients in situations similar to yours.

Fiduciary Responsibility

The most important qualification to look for in a 401k advisor is their commitment to fiduciary responsibility. A fiduciary must act in your best interests, not their own. This means they must recommend investments and strategies that benefit you, regardless of any potential commissions or personal gain.

When you interview potential advisors, ask directly if they are fiduciaries. If they hesitate or avoid the question, consider it a red flag. Many reputable firms (including Davies Wealth Management) take their fiduciary duty seriously and always prioritize their clients’ interests above all else.

Ongoing Education and Industry Knowledge

The financial industry evolves rapidly, with new regulations, investment products, and strategies emerging regularly. Your 401k advisor should demonstrate a commitment to ongoing education and staying current with industry trends. Continuing education helps advisors stay current with industry trends and regulations, enhance their professional credibility and reputation, and improve client trust.

Communication Skills and Availability

Effective communication is vital in the advisor-client relationship. Your 401k advisor should explain complex financial concepts in terms you understand. They should also be readily available to answer your questions and address your concerns. During the selection process, evaluate the advisor’s communication style and responsiveness to determine if it aligns with your preferences.

As you consider these qualifications, you’ll want to prepare a list of questions to ask potential advisors. These questions will help you gauge their expertise, approach, and fit for your specific needs.

Essential Questions for Potential 401k Advisors

Investment Philosophy and Strategy

Ask about the advisor’s investment philosophy and strategy. A competent advisor should explain their approach to 401k management clearly. They might focus on low-cost index funds or actively managed funds. Ask how they adapt their strategy to different market conditions and economic cycles.

A Morningstar study revealed that more than 30% of active funds in Europe outperformed their passive rivals over one year, higher than a year earlier. This statistic underscores the importance of understanding your advisor’s stance on active vs. passive investing.

Fee Structure and Compensation

Understanding the fee structure is important. Ask for a detailed breakdown of all costs associated with their services. These may include management fees, transaction costs, and any hidden charges. A transparent advisor will provide this information readily.

According to a 2024 report, assets managed by SEC registered investment advisers rose by 12.6% in 2023, rebounding from difficult market conditions the previous year. However, fees can vary widely, so it’s essential to understand exactly what you’re paying for.

Communication and Availability

Effective communication forms the foundation of a successful advisor-client relationship. Ask about their preferred method of communication and how often they typically interact with clients. Inquire about their response time to urgent queries and how they keep clients informed about market changes or portfolio adjustments.

A 2022 J.D. Power study found that client satisfaction increases by 30% when advisors proactively reach out during market volatility. This underscores the importance of regular, proactive communication from your advisor.

Track Record and References

Don’t hesitate to ask for concrete examples of their success in managing 401k plans. Request case studies or references from current clients with similar financial situations to yours. While past performance doesn’t guarantee future results, it can provide insights into the advisor’s capabilities.

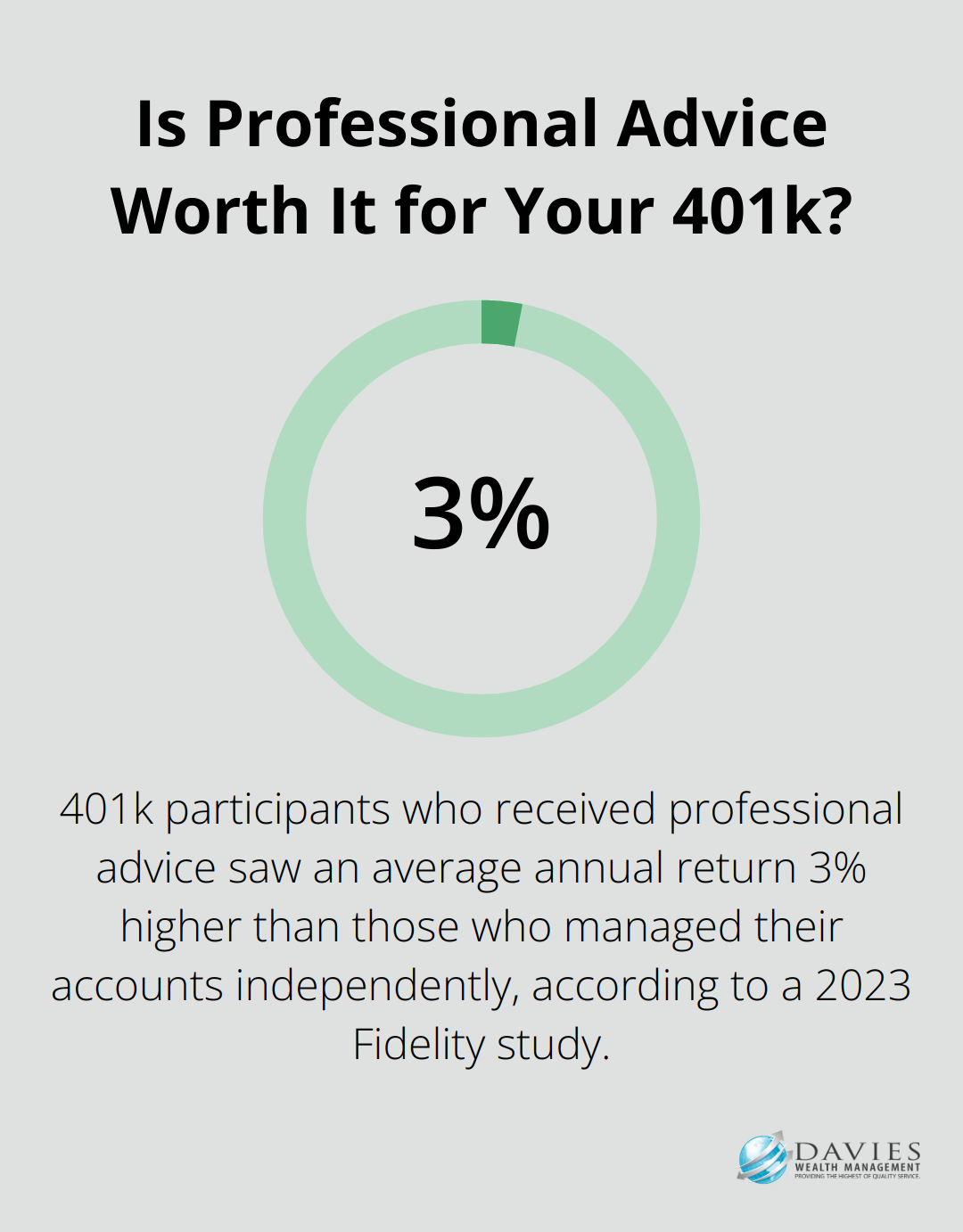

A 2023 Fidelity study revealed that 401k participants who received professional advice saw an average annual return 3% higher than those who managed their accounts independently. This highlights the potential value of working with a skilled advisor.

Fiduciary Responsibility

Ask potential advisors if they act as fiduciaries. A fiduciary must act in your best interests, not their own. This means they must recommend investments and strategies that benefit you, regardless of any potential commissions or personal gain. If an advisor hesitates or avoids this question, consider it a red flag.

When selecting a financial advisor, it’s crucial to set realistic goals and understand your financial goals to ensure the best fit for your needs.

Final Thoughts

Selecting the right financial advisor for your 401k will significantly impact your retirement savings and overall financial well-being. A skilled advisor brings expertise in navigating complex investment options, optimizing contribution strategies, and providing ongoing education and support. Their guidance can help you make informed decisions, maximize your retirement savings potential, and adapt your strategy as your financial situation evolves.

The long-term impact of working with a qualified 401k financial advisor cannot be overstated. With their professional insights, you can potentially achieve higher returns, minimize risks, and build a more secure financial future. Their expertise in areas such as asset allocation, tax efficiency, and market trends can make a substantial difference in your retirement outcomes.

We at Davies Wealth Management understand the importance of this decision and commit to providing personalized, expert guidance for your 401k management. Our team of experienced professionals dedicates itself to helping you navigate the complexities of retirement planning and achieve your financial goals. Contact Davies Wealth Management to learn how our tailored approach to financial planning can help you build a robust retirement strategy and secure your financial future.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply