At Davies Wealth Management, we understand the unique financial challenges faced by high net worth individuals.

Finding the right high net worth financial advisor is a critical step in preserving and growing substantial wealth.

This guide will help you navigate the process of selecting an advisor who can provide the specialized expertise and comprehensive services you need.

What Are High Net Worth Financial Advisory Services?

Definition of High Net Worth Individuals

High net worth financial advisory services cater to individuals with substantial wealth. These services typically define high net worth individuals as those with at least $1 million in liquid assets. The services extend beyond standard financial planning and address complex financial situations that require specialized expertise.

Unique Financial Challenges

High-net-worth individuals often face unique financial challenges. A key consideration among these is liquidity-ensuring access to cash or liquid assets. These challenges often include:

- Management of diverse investment portfolios

- Navigation of complex tax situations

- Planning for multigenerational wealth transfer

The Value of Specialized Financial Advice

Specialized financial advice plays a critical role for high net worth individuals in the effective management and growth of their wealth. Many high-net-worth investors are reconsidering their wealth management relationships as they seek personalized experiences and increased access to products. This preference underscores the importance of personalized service in high net worth financial advisory.

Tax planning stands out as a key area where specialized advice proves invaluable. With complex tax codes and frequent changes in legislation, high net worth individuals need advisors who can navigate these intricacies to minimize tax liabilities and maximize wealth retention.

Comprehensive Wealth Management Approach

A comprehensive wealth management approach forms the foundation of high net worth financial advisory services. This approach integrates various aspects of financial planning, including:

- Investment management

- Estate planning

- Risk management

- Philanthropic strategies

For example, some financial advisory firms (such as Davies Wealth Management) offer tailored solutions for professional athletes, addressing their unique financial challenges such as short career spans and fluctuating income. This level of specialization allows for strategies that align closely with the client’s specific situation and goals.

The Role of Fiduciary Responsibility

High net worth financial advisors often operate under a fiduciary standard, which legally obligates them to act in their clients’ best interests. Fiduciaries can’t recommend products or investments based on the commission they might earn. This responsibility ensures that the advice and recommendations provided prioritize the client’s financial well-being above all else.

As we move forward, it’s essential to understand the key qualities that set apart exceptional high net worth financial advisors. These qualities will help you identify the right professional to guide your financial journey.

What Makes an Exceptional High Net Worth Financial Advisor?

When seeking a financial advisor for high net worth individuals, certain qualities distinguish the exceptional from the average. These attributes play a significant role in effective wealth management for affluent clients.

Depth of Experience in Complex Financial Situations

An exceptional high net worth financial advisor should possess a proven track record of managing substantial wealth. This experience typically spans decades and includes successful navigation through various market conditions. Advisors who guided clients through the 2008 financial crisis and the recent COVID-19 market volatility demonstrate valuable expertise.

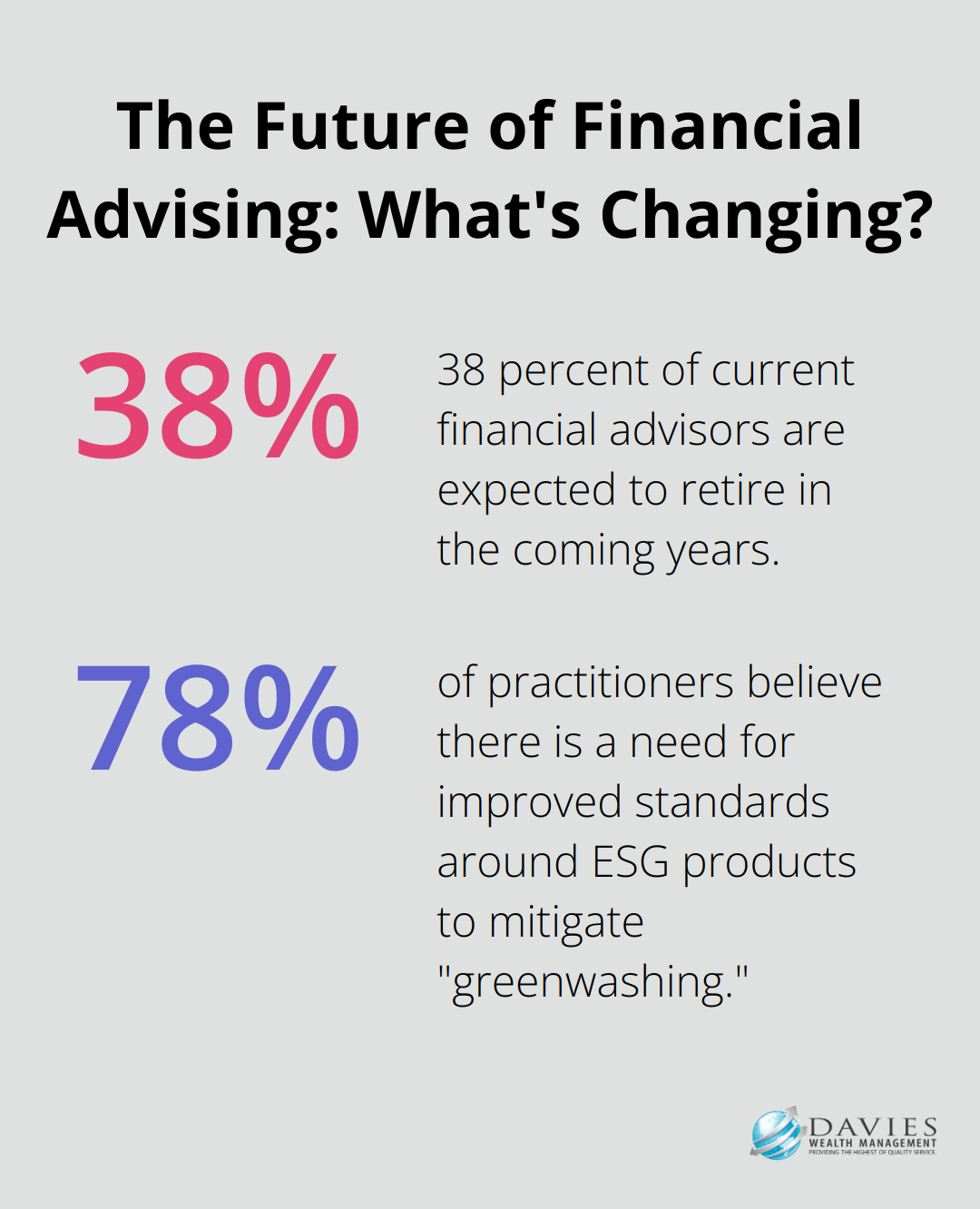

An estimated 110,000 advisors (38 percent of the current total), representing 42 percent of total industry assets, are expected to retire in the coming years. This underscores the importance of finding experienced professionals in this field.

Commitment to Fiduciary Standards

The importance of working with a fiduciary cannot be overstated. A survey found that 78% of practitioners believe there is a need for improved standards around ESG products to mitigate “greenwashing.” This commitment ensures that the advisor’s recommendations always prioritize the client’s best interest, not driven by commissions or other conflicts of interest.

Specialized Expertise for Unique Situations

High net worth individuals often face complex financial situations that require specialized knowledge. For example, professional athletes confront unique challenges such as short career spans and fluctuating income. An advisor with expertise in this area can provide tailored strategies for long-term financial security.

The ability to handle complex tax situations is another important skill. This highlights the need for advisors who can navigate intricate tax laws to optimize wealth preservation.

Access to a Network of Professionals

Top-tier financial advisors don’t work in isolation. They have access to a network of professionals including tax attorneys, estate planning lawyers, and insurance specialists. This network allows for comprehensive financial plan strategies that address all aspects of a client’s financial life.

A 2023 Fidelity survey of financial advisors explored their investment approach and product preferences, highlighting the importance of staying informed about industry trends and best practices.

As you consider these qualities in your search for a high net worth financial advisor, it’s important to understand how to evaluate and choose the right professional for your unique financial situation. The next section will guide you through this process, ensuring you make an informed decision that aligns with your financial goals and needs.

How to Choose Your High Net Worth Financial Advisor

Research Potential Advisors

Start your search by creating a list of potential advisors through recommendations from trusted sources, professional networks, or reputable financial institutions. Look for advisors with relevant certifications such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These credentials indicate a higher level of expertise and commitment to professional standards.

Check the advisor’s background using FINRA’s BrokerCheck tool. This resource provides information about an advisor’s qualifications, employment history, and any disciplinary actions or customer complaints.

Conduct Thorough Interviews

Schedule interviews with potential advisors after you narrow down your list. Prepare a list of questions that address your specific financial concerns and goals. Ask about their experience working with clients in similar financial situations to yours. For instance, if you’re a professional athlete, inquire about their expertise in managing the unique financial challenges athletes face.

During these interviews, observe how well the advisor listens and communicates. A good advisor should explain complex financial concepts in terms you can understand. They should also ask you detailed questions about your financial situation, goals, and risk tolerance.

Evaluate Investment Philosophy and Strategies

Understanding an advisor’s investment philosophy is essential. Ask about their approach to asset allocation, risk management, and portfolio diversification. Inquire about their performance track record (but remember that past performance doesn’t guarantee future results).

A study by Vanguard found that working with a good financial advisor can potentially add about 3% in net returns annually through behavioral coaching, asset allocation, and other factors. This underscores the importance of choosing an advisor with a solid investment strategy.

Understand Fee Structures

Transparency about fees is vital. Ask potential advisors to clearly explain their fee structure. Common models include fee-only (where advisors are paid directly by clients), commission-based (where advisors earn commissions on products they sell), or a combination of both.

Be cautious of advisors who are reluctant to discuss fees or whose fee structure seems overly complex. A trustworthy advisor should be completely transparent about how they’re compensated.

The cheapest option isn’t always the best. Consider the value you’re receiving for the fees you’re paying. An advisor who can provide comprehensive wealth management services (including tax planning, estate planning, and risk management) may be worth a higher fee if they can significantly improve your overall financial picture.

Assess Personalized Approach

High net worth individuals often have complex financial needs that require a personalized approach. Try to find an advisor who tailors their recommendations to each client’s unique financial situation and goals. This approach is particularly valuable for high net worth individuals who often have intricate financial needs.

At Davies Wealth Management, we emphasize a personalized approach to investment strategy, tailoring our recommendations to each client’s unique financial situation and goals. This approach sets us apart from other firms that may offer more generic solutions.

Final Thoughts

Selecting the right high net worth financial advisor will significantly impact your financial future. A qualified advisor must possess extensive experience in managing substantial wealth, demonstrate commitment to fiduciary standards, and offer specialized expertise tailored to your unique financial situation. We recommend you conduct thorough research, ask probing questions during interviews, and carefully assess potential advisors’ investment philosophies and strategies.

The process of finding the right high net worth financial advisor may seem challenging, but it’s an investment in your financial well-being that can yield significant returns. You will set the foundation for long-term financial success and peace of mind by taking the time to carefully select an advisor who aligns with your goals and values. Pay close attention to their fee structure and ensure they provide transparent explanations of their compensation model.

At Davies Wealth Management, we understand the unique challenges faced by high net worth individuals (including professional athletes). Our team of experienced advisors provides personalized, comprehensive wealth management solutions tailored to your specific needs. We invite you to explore how our expertise can help you achieve your financial goals and secure your financial future. Visit Davies Wealth Management to learn more about our services and how we can assist you in navigating your financial journey with confidence.

Leave a Reply