Winning the lottery can be a life-changing event, but it also comes with significant financial responsibilities. At Davies Wealth Management, we’ve seen how proper investment advice for lottery winners can make the difference between long-term financial security and squandered opportunities.

This guide will walk you through the essential steps to take after hitting the jackpot, helping you create a solid financial plan and explore smart investment options. We’ll show you how to protect and grow your newfound wealth, ensuring it lasts for generations to come.

First Steps After Your Lottery Win

Secure Your Ticket and Maintain Privacy

When you win the lottery, your first action should be to sign the back of your ticket. This simple step establishes your ownership. Store the ticket in a secure location (such as a bank safe deposit box). Resist the urge to share the news widely. Privacy protection is essential to shield yourself from unwanted attention and potential scams.

Build Your Financial Dream Team

Your next priority should be to assemble a team of financial professionals. This team typically includes a financial advisor, an attorney, and a certified public accountant (CPA). When you select these professionals, look for those with experience in sudden wealth management.

Davies Wealth Management specializes in helping lottery winners navigate their newfound wealth. Our team understands the unique challenges and opportunities that come with a substantial lottery win. We work closely with trusted attorneys and CPAs to provide comprehensive financial guidance.

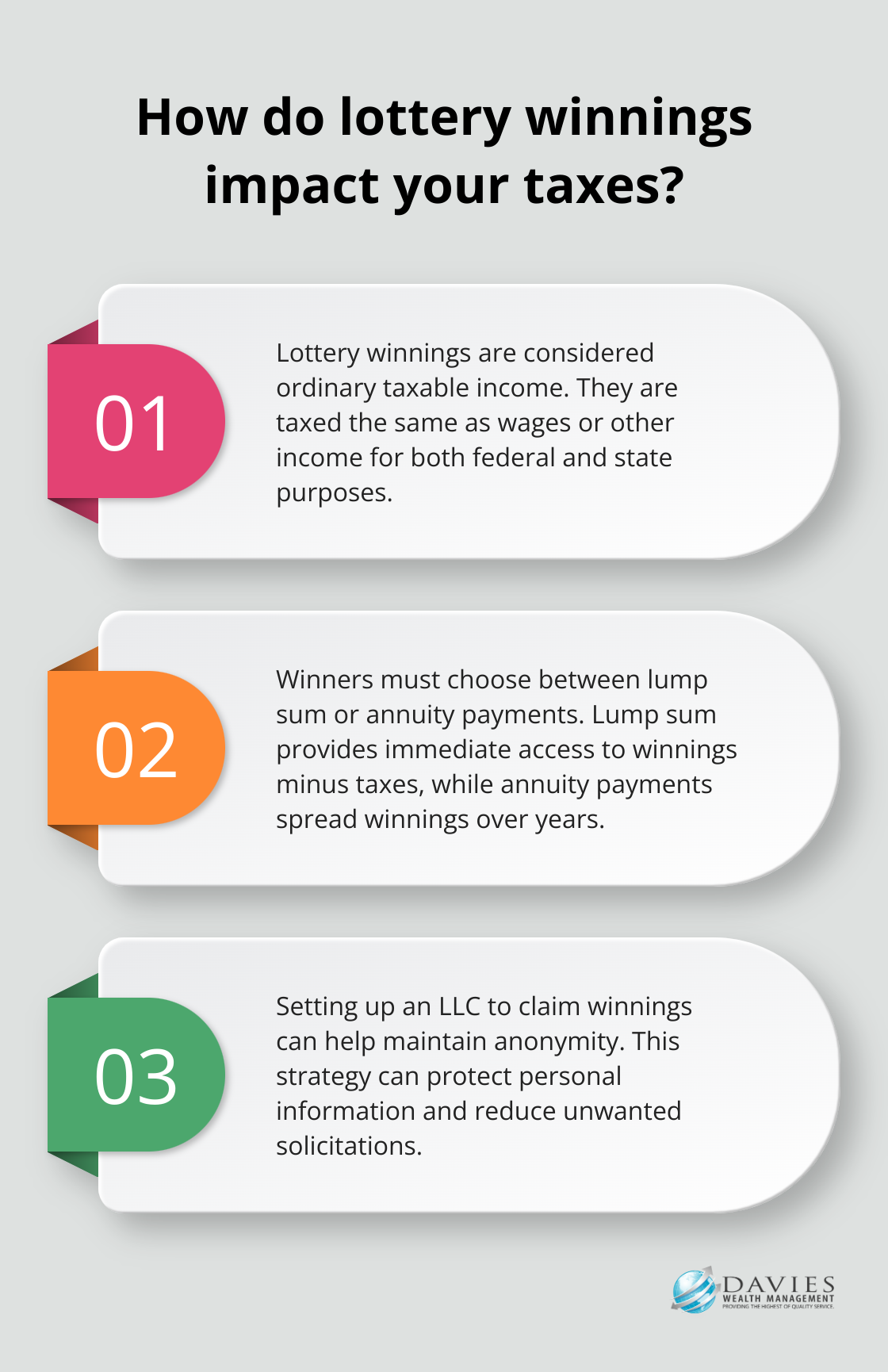

Navigate Tax Implications and Payment Options

Understanding the tax implications of your lottery win is essential. In the United States, lottery winnings are considered ordinary taxable income for both federal and state tax purposes. This means your winnings are taxed the same as your wages or other income.

You’ll need to decide between a lump sum payment or annuity payments. A lump sum gives you immediate access to your entire winnings (minus taxes). Annuity payments spread your winnings over several years, potentially reducing your tax burden.

Your choice depends on various factors, including your age, financial goals, and current tax situation. The team at Davies Wealth Management can help you analyze these options and make the decision that best aligns with your long-term financial objectives.

Protect Your Identity

Lottery winners often become targets for scams, fraud, and unwanted solicitations. Consider setting up an LLC to claim your winnings. This can help maintain your anonymity and protect your personal information. Consult with your legal advisor to determine the best structure for your situation.

Create a Short-Term Financial Plan

While long-term planning is crucial, you also need a short-term plan to manage your immediate financial needs. This might include paying off high-interest debts, setting aside funds for taxes, and creating an emergency fund. A financial advisor can help you prioritize these short-term goals while keeping your long-term objectives in mind.

As you complete these initial steps, you’ll be well-positioned to move forward with creating a comprehensive financial plan that will help you manage and grow your lottery winnings for years to come.

Building Your Financial Fortress

Define Your Financial Objectives

The first step in creating your financial plan is to clearly define your goals. These goals should reflect your personal values and aspirations. Do you want to retire early? Start a business? Leave a legacy for your children? Support charitable causes? A clear set of objectives will guide your wealth management decisions and ensure your money aligns with your life vision.

For example, a recent lottery winner with a passion for environmental conservation might allocate a portion of their winnings to establish a foundation dedicated to protecting endangered species. This fulfills a personal goal and provides significant tax benefits.

Craft a Diversified Investment Strategy

Once you establish your goals, you must develop a diversified investment strategy. Diversification helps manage risk and maximize potential returns. A study by Vanguard found that a well-diversified portfolio can potentially reduce risk by up to 75% compared to a single-stock portfolio.

A mix of asset classes, including stocks, bonds, real estate, and alternative investments, often provides the best balance. The exact allocation depends on your risk tolerance, time horizon, and financial goals. Younger lottery winners might prefer a more aggressive portfolio with a higher allocation to stocks, while those closer to retirement might choose a more conservative approach with a focus on income-generating assets.

Implement Wealth Preservation Techniques

Preserving your wealth is as important as growing it. This involves strategies to protect your assets from inflation, market volatility, and potential legal issues. Wealth preservation strategies include having a financial plan, an emergency fund, investment diversification and insurance.

Another aspect of wealth preservation is insurance. High-net-worth individuals often require specialized insurance products, such as umbrella policies or key person insurance for business owners. These policies provide an additional layer of protection for your assets.

Plan for Tax Efficiency

Tax planning forms a critical component of your financial strategy. Without proper planning, taxes can significantly erode your lottery winnings. Strategies that minimize your tax burden while ensuring compliance with all relevant laws are essential.

One strategy to consider is charitable giving. This allows you to support causes you care about and can provide substantial tax benefits. For example, establishing a donor-advised fund can offer immediate tax deductions while allowing you to recommend grants to support your favorite charities over time.

Conduct Regular Reviews and Adjustments

Your financial plan should not be a static document. Regular reviews ensure your financial strategies remain aligned with your goals and adapt to changing market conditions. This proactive approach helps you stay on track and make informed decisions about your wealth.

With a comprehensive financial plan in place, you’re ready to explore specific investment options that can help grow and protect your lottery winnings. The next section will discuss various investment vehicles suitable for lottery winners, from low-risk options to more sophisticated alternatives.

Where Should Lottery Winners Invest?

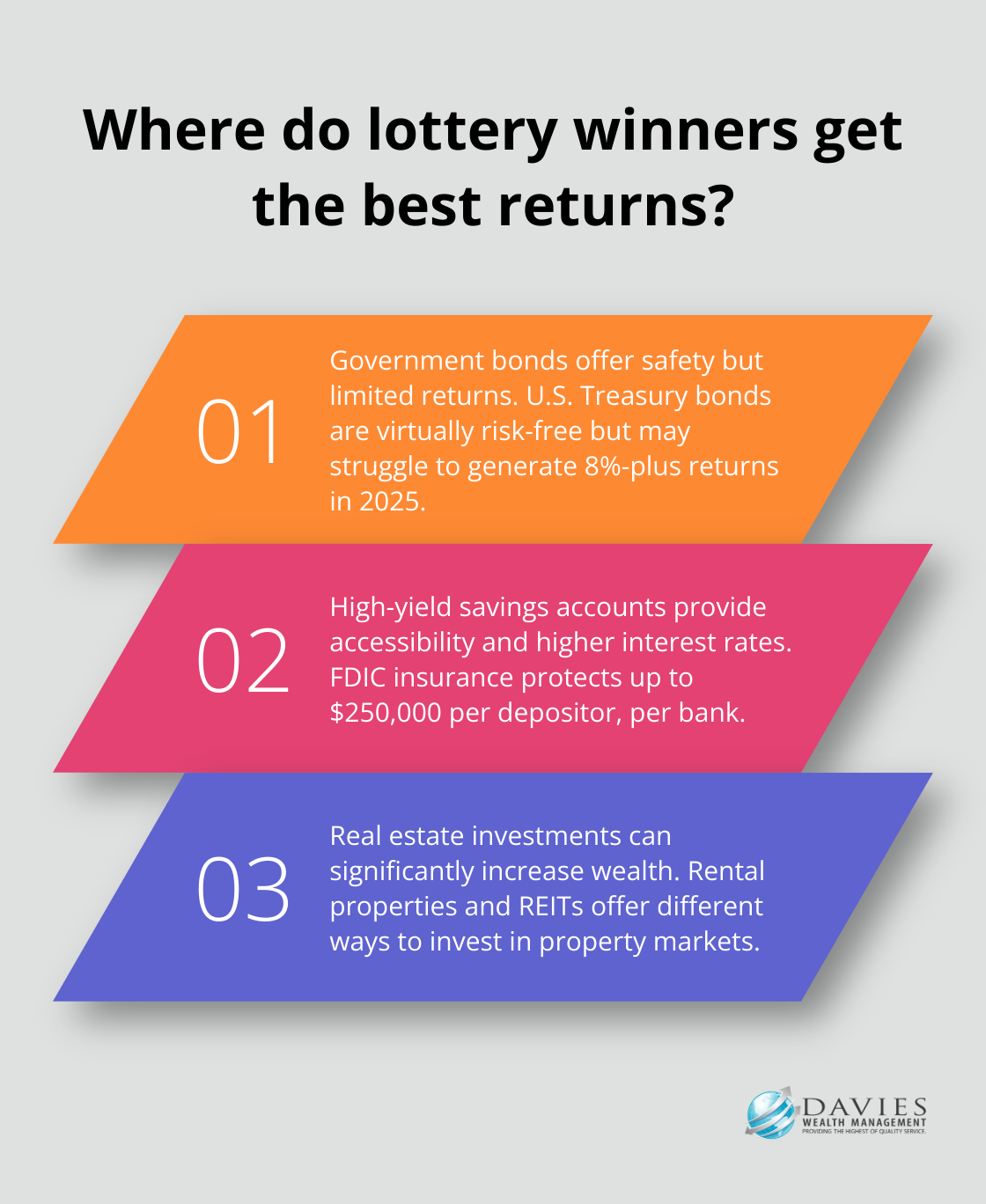

Government Bonds: A Secure Foundation

U.S. Treasury bonds offer one of the safest investment options available. The U.S. government backs these bonds, which makes them virtually risk-free. While the potential to generate 8%-plus returns in 2025 will be challenging, these bonds provide a stable base for your investment portfolio.

High-Yield Savings Accounts: Accessible and Profitable

High-yield savings accounts provide higher interest rates than traditional savings accounts while maintaining easy access to your funds. Some online banks currently offer competitive rates. (It’s important to distribute your funds across multiple banks to stay within FDIC insurance limits, which protect up to $250,000 per depositor, per bank.)

Real Estate: Building Wealth Through Property

Real estate investments can significantly increase a lottery winner’s wealth. You might consider purchasing rental properties in growing markets. Real Estate Investment Trusts (REITs) provide another avenue to invest in property without direct ownership responsibilities.

Stock Market: Capturing Long-Term Growth

The stock market has historically provided strong long-term returns. Index funds, which track broad market indices like the S&P 500, offer a straightforward way to capture market gains. For a more active approach, you might invest in blue-chip stocks – established companies with a history of stable growth and dividend payments.

Alternative Investments: Expanding Beyond Traditional Assets

Lottery winners with a higher risk tolerance might explore alternative investments such as private equity and hedge funds. These investments can offer potentially higher returns but often require significant capital and come with higher fees. (However, past performance doesn’t guarantee future results.)

Final Thoughts

Winning the lottery transforms lives, but requires careful management for long-term financial success. You must secure your ticket, maintain privacy, and assemble a team of trusted financial professionals. A comprehensive strategy with clear goals, diversified investments, and wealth preservation techniques will set you up for success.

Wise investing after a lottery win involves a mix of low-risk options and growth-oriented investments. Government bonds, high-yield savings accounts, real estate, and stocks all play important roles in a balanced portfolio. Alternative investments can also be considered for those with higher risk tolerance.

At Davies Wealth Management, we provide expert investment advice for lottery winners. Our team understands the unique challenges of sudden wealth and develops personalized strategies aligned with your goals. We help you balance enjoyment with wise financial decisions to ensure your lottery winnings create lasting financial security and personal fulfillment.

I’ve always loved playing the lottery, but for years I struggled financially. My friends and family often mocked me, saying I was wasting my hard-earned money on tickets without ever winning. Their words hurt deeply, but I never gave up hope because I was determined to change my story, I searched online for ways to win big. That’s when I came across countless testimonies of people sharing how Lord Bubuza cast a lottery spell for them, revealed the winning numbers, and they hit the jackpot. I reached out to him immediately. To my surprise, he responded and asked me to provide the requirements to cast the spell which I did. After the spell was cast, Lord Bubuza revealed 6 unique numbers to me. I played those exact numbers and to my greatest shock, I won $256 million jackpot. My life has been completely transformed, and words cannot express my gratitude. Please join me in appreciating this powerful man via WhatsApp: +1 365 808 5313 or email: lordbubuzamiraclework @ hotmail . com

I’ve always loved playing the lottery, but for years I struggled financially. My friends and family often mocked me, saying I was wasting my hard-earned money on tickets without ever winning. Their words hurt deeply, but I never gave up hope because I was determined to change my story, I searched online for ways to win big. That’s when I came across countless testimonies of people sharing how Lord Bubuza cast a lottery spell for them, revealed the winning numbers, and they hit the jackpot. I reached out to him immediately. To my surprise, he responded and asked me to provide the requirements to cast the spell which I did. After the spell was cast, Lord Bubuza revealed 6 unique numbers to me. I played those exact numbers and to my greatest shock, I won $256 million jackpot. My life has been completely transformed, and words cannot express my gratitude. Please join me in appreciating this powerful man via WhatsApp: +1 365 808 5313 or email:: lordbubuzamiraclework@hotmail.com

I still can’t believe this actually happened to me. My name is James Clarkson, I’m 20 years old from Carlisle, and I work as a trainee gas engineer. A few months ago, I was struggling financially and feeling completely stuck until I came across Chief Ade, a powerful spell caster. Honestly, I was skeptical at first, but something told me to give it a shot. After reaching out and following his guidance, my life changed in ways I never imagined. Just 48hrs later, I won the £7,533,329 million lottery! I’m still in shock. This blessing has changed my life completely, and I’ll forever be grateful to Chief Ade for making it possible. If you’re thinking about reaching out to him, don’t hesitate. It worked for me, it can work for you too chiefadespellhome@gmail. com …

The sole individual I’m aware of who can provide you with a sure winning lottery number is Meduza. This man assisted me on my lottery win of $112 million dollars here in Arizona, USA through his powerful spell. Email him via: Lordmeduzatemple@ hotmail. com

Personal growth is important for achieving success in life. All these words were shared with me by Meduza, who performed a spell reading for me and created a lottery spell that turned me into a lottery champion of $112 million here in Arizona. Within 48 hours of adhering to all of Meduza’s divine instructions, he granted me the chance to use the divine lottery numbers to enter the lottery after I bought my ticket in Tempe. A week later, I was informed that I had become the fortunate Jackpot winner of the game and this was all made possible by Meduza.. I want to kindly express my gratitude to him for his impactful words and actions. For a transformative opportunity in your life, contact Meduza via his

Website: lordmeduzatemple.com

Email: lordmeduzatemple@hotmail.com

Call or text this Whats_App Number: +1 807 907 2687.

God Bless You Meduza.

I was so lucky to win the $344.6 million prize in the lottery. I have been playing the Powerball lottery for about 20 years, and I hadn’t won a big amount until Dr. Isa helped me with his spiritual winning numbers. I thought it was all fake until he gave me the numbers and directed me on how to play. He assured me that I was going to win and asked me to give him 48 hours to finish his work, which I did. On the third day, he gave me the numbers and provided instructions on how to play, and luckily, I won. I want to let everyone who is reading this know that this spell really works, and you can also be a winner if you give it a try to see for yourself. The moment you contact Dr Isa for help is the end of suffering in your life. He has been helping people around the world, and I’m happy that I’m among those who have benefited from the great work he’s doing. You can reach him if you really want to win the lottery. email: drisaspellcaster@ gmail.com WhatsApp: +2347046030096

I acquired my first home at the beginning of the year. To some, lottery players appear ridiculous, while we view it as a chance for an improved future. I’m known as Megan Taylor and I have played the lottery for ten years, yet I haven’t won anything substantial. In my pursuit of understanding how to win better, I was advised to consult Lord Meduza, the priest who provided me with the precise 6 numbers that helped me secure the Mega Millions jackpot of $277 million after using his spell powers and following his guidance. Lord Meduza services is top notch, and I believe your dreams aren’t finished unless you decide they are. Contact Lord Meduza the priest, and he will assist you in realizing your aspirations.

Email: lordmeduzatemple@hotmail.com

WhatsApp: +1 (807) 798-3042

Website: lordmeduzatemple.com

This year began wonderfully for me as I won the mega millions of $277 million after applying the 6 perfect numbers and guidance provided by Lord Meduza. Certainly, his magical abilities are unmatched. Thank you, sir, and you can reach out to him for assistance through email at: lordmeduzatemple @ hotmail . com

Am so excited to share my testimony of a real spell caster who brought my husband back to me. My husband and I have been married for about 6yrs now. We were happily married with two kids, 3 months ago, I started to notice some strange behavior from him and a few weeks later I found out that my husband is seeing someone else. I became very worried and I needed help. I did all I could to save my marriage but it fail until a friend of mine told me about the wonderful work of Dr Jakuta I contacted him and he assured me that after 24hrs everything will return back to normal, to my greatest surprise my husband came back home and went on his knees was crying begging me for forgiveness I’m so happy right now. Thank you so much Dr Jakuta because ever since then everything has returned back to normal. One message to him today can change your life too for the better. You can contact him via WhatsApp +2349161779461 or Email : doctorjakutaspellcaster24@gmail.com

HOW I WON THE LOTTERY WITH Drherry LOTTERY SPELL AND MY LIFE CHANGED: I’m a 31-year-old from California and I just won $25 million in the lottery. Life was really hard before this and I was constantly struggling to pay my bills. While searching online for ways to turn things around, I came across stories of people saying that Drherry helped them win the lottery. I was curious and decided to give it a try. I reached out to him and he responded quickly. He told me what was needed to cast a lottery spell. After the spell was done, he gave me numbers to play. I used OLG’s Never Miss a Draw subscription and a few days later, I got a call saying I had won $25 million. I was completely shocked and overwhelmed with emotion. I never believed something like this could happen to me. I am truly grateful to Drherry for this incredible blessing. You can contact him via WhatsApp: +12023654871 or email: DrHerry189@gmail.com