S Corp tax saving strategies can significantly boost your business’s financial health. At Davies Wealth Management, we’ve seen countless entrepreneurs benefit from these powerful tax-reduction techniques.

Navigating the complexities of S Corporation taxation requires expertise, but the potential rewards are substantial. This guide will walk you through the most effective ways to maximize your tax savings as an S Corp owner.

What Is an S Corporation?

The Basics of S Corps

S Corporations (S Corps) offer a unique business structure with significant tax advantages for small businesses. This type of corporation passes corporate income, losses, deductions, and credits through to its shareholders for federal tax purposes. S Corps avoid double taxation on corporate income. Shareholders of S Corps report the flow-through of income and losses on their personal tax returns and pay tax at their individual income tax rates.

Eligibility Requirements

The IRS sets specific criteria for S Corp eligibility:

- The business must be a domestic corporation

- It can have no more than 100 shareholders

- Shareholders must be individuals, certain trusts, or estates

- Shareholders cannot be partnerships, corporations, or non-resident aliens

- The corporation can have only one class of stock

These requirements ensure S Corps maintain a relatively small and simple structure, aligning with their intended purpose of benefiting small businesses.

S Corps vs. Other Business Structures

S Corps provide unique advantages over other business structures. Unlike C Corporations, S Corps avoid double taxation. The business itself is not taxed on its income; instead, the income “passes through” to the shareholders who report it on their individual tax returns.

Compared to sole proprietorships or partnerships, S Corps offer limited liability protection to their owners. Shareholders’ personal assets are generally protected from the company’s debts and liabilities.

A key difference between S Corps and Limited Liability Companies (LLCs) lies in their taxation. While both can offer pass-through taxation, S Corps allow more flexibility in income distribution between salary and dividends. This can lead to significant savings on self-employment taxes for S Corp owners.

Benefits for Professional Athletes

Professional athletes can particularly benefit from the S Corp structure. The S Corp structure allows the owner to mitigate self-employment tax on business profit. S Corp owners are paid through W2 salary and business profit.

Choosing the Right Structure

The optimal business structure depends on your specific situation. While S Corps offer numerous advantages, it’s essential to consider all options. Consulting with a tax professional (such as those at Davies Wealth Management) can help you determine if an S Corp is the best choice for your business. As we move forward, let’s explore the tax advantages of S Corporations in more detail.

Why S Corps Are Tax Powerhouses

The Magic of Pass-Through Taxation

S Corporations offer a treasure trove of tax advantages that can significantly boost your bottom line. These benefits have the potential to transform a business’s financial landscape.

S Corps employ a pass-through taxation model, which means the business itself doesn’t pay federal income taxes. Instead, profits and losses flow directly to shareholders’ personal tax returns. This approach can lead to substantial tax savings, especially for high-earning businesses.

For example, if your S Corp earns $500,000 in a year, that income is reported on your personal tax return (potentially saving you tens of thousands in corporate taxes). The IRS reports that S Corps have become increasingly popular, with over 5 million businesses choosing this structure as of 2018.

Slashing Self-Employment Taxes

One of the most potent tax advantages of S Corps is the potential for reduced self-employment taxes. As an S Corp owner, you can pay yourself a reasonable salary and take the rest of your income as distributions. Only the salary portion is subject to self-employment taxes (currently 15.3% for Social Security and Medicare).

Let’s break it down: If you earn $200,000 from your business, you might pay yourself a $100,000 salary and take $100,000 in distributions. You’d only pay self-employment taxes on the $100,000 salary, potentially saving over $15,000 in taxes compared to a sole proprietorship where all $200,000 would be subject to self-employment tax.

Flexibility in Income Distribution

S Corps offer unparalleled flexibility in how you distribute income. This flexibility allows for strategic tax planning that can lead to significant savings. For instance, you can time distributions to coincide with lower tax brackets or defer income to future years when your tax rate might be lower.

However, it’s important to note that S Corps can have only one class of stock. This limitation affects how income and losses can be distributed among shareholders.

Advantages for Professional Athletes

Professional athletes can particularly benefit from the S Corp structure. The S Corp structure allows the owner to mitigate self-employment tax on business profit. S Corp owners receive payment through W2 salary and business profit, providing a unique opportunity for tax optimization.

Maximizing S Corp Benefits

To fully leverage these S Corp advantages, proper implementation is key. It’s essential to work with experienced financial advisors who understand the intricacies of S Corp taxation and can help create robust, tax-efficient financial strategies. The next section will explore effective S Corp tax strategies in more detail, providing actionable insights to maximize your tax savings.

Mastering S Corp Tax Strategies

Optimizing Salary and Distributions

S Corporations offer powerful tax-saving opportunities. The key lies in striking the right balance between salary and distributions. The IRS mandates S Corp owners to pay themselves a reasonable salary, but beyond this requirement, you have flexibility in structuring your compensation.

Consider this scenario: Your S Corp generates $300,000 in profit. You might opt to pay yourself a $100,000 salary and take the remaining $200,000 as distributions. This approach could result in approximately $15,300 in self-employment tax savings compared to taking the entire amount as salary.

However, exercise caution. The IRS closely examines unreasonably low salaries. A general guideline suggests setting your salary at about 60% of your total compensation, but this can vary based on your industry and role.

Maximizing Deductions

S Corps can reduce their taxable income significantly through various deductions. Common deductible expenses include:

- Home office expenses: Deduct a portion of mortgage interest, property taxes, utilities, and maintenance costs for the part of your home used exclusively for business.

- Vehicle expenses: Choose between deducting actual operating costs or using the standard mileage rate (65.5 cents per mile for 2023).

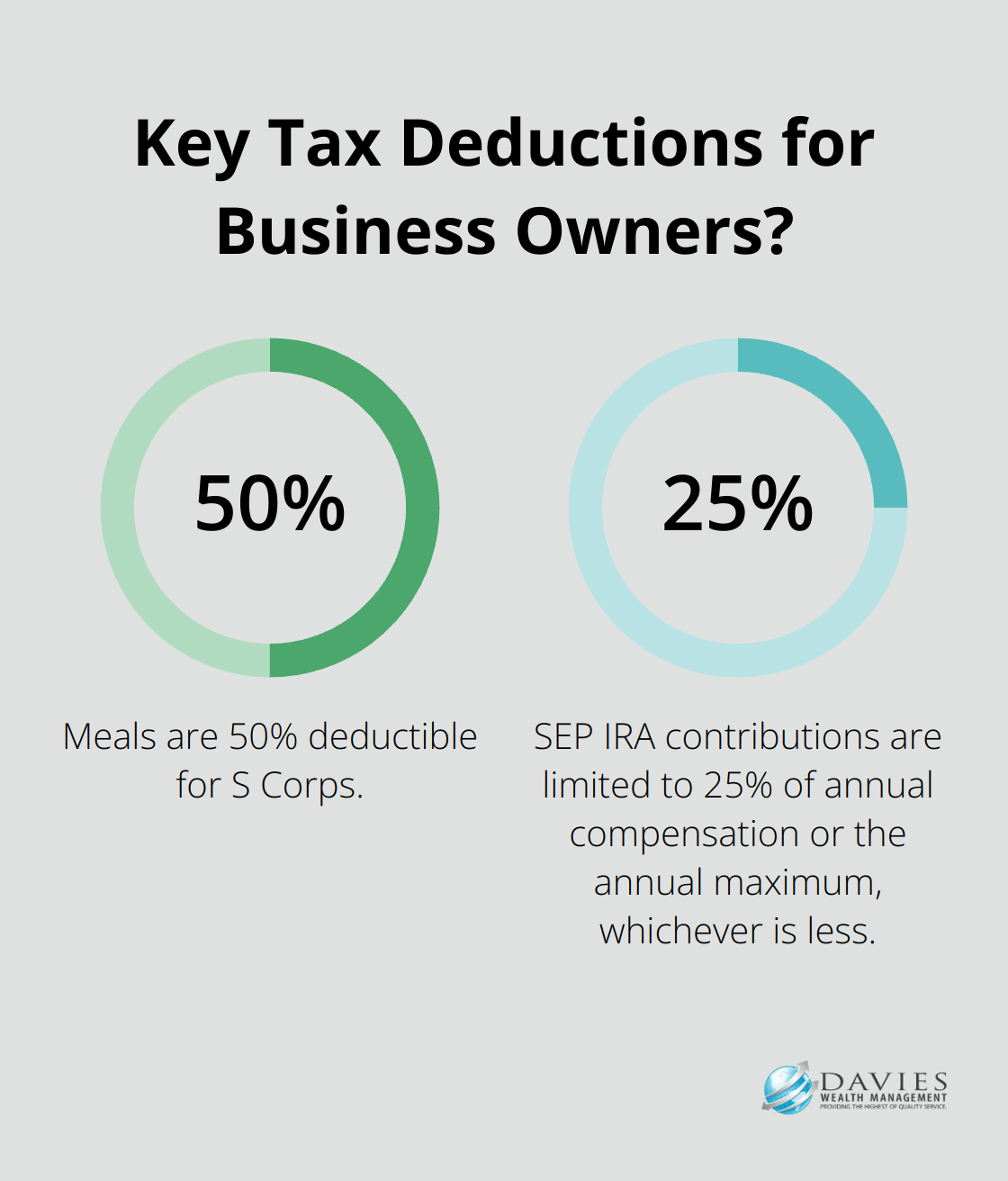

- Travel and meals: Business-related travel expenses are fully deductible, while meals are 50% deductible.

- Professional development: Deduct costs for courses, conferences, and certifications related to your business.

- Marketing and advertising: Fully deduct expenses including website costs, business cards, and promotional materials.

Strategic Timing of Income and Expenses

Timing your income and expenses strategically can lead to substantial tax savings. If you expect to be in a lower tax bracket next year, you might defer some income to the following year. Conversely, if you anticipate being in a higher bracket, you might accelerate income into the current year.

Similarly, you can time your expenses. If you plan a large purchase (like new equipment), making it before the end of the tax year could provide valuable deductions.

Leveraging Retirement Plans

S Corps can establish retirement plans that offer significant tax advantages. A SEP IRA allows you to contribute up to the annual maximum or 25% of your annual compensation, whichever is less. These contributions are tax-deductible for the business and grow tax-deferred until withdrawal.

For even greater savings potential, consider a Solo 401(k). In 2023, you can contribute up to $22,500 as an employee (plus an additional $7,500 if you’re 50 or older), and your S Corp can contribute up to 25% of your compensation.

Health Insurance Premium Deductions

Health insurance premiums paid on behalf of a greater than 2-percent S corporation shareholder-employee are deductible by the S corporation. This deduction is taken as an adjustment to income on your personal tax return, reducing your adjusted gross income.

Implementing these strategies requires careful planning and execution. The potential for tax savings is significant, but it’s important to stay compliant with IRS regulations. Professional guidance from experienced financial advisors can help you navigate these complex strategies and maximize your tax savings while avoiding potential pitfalls.

Final Thoughts

S Corp tax saving strategies offer powerful tools for business owners to optimize their financial position. These strategies provide significant opportunities for tax efficiency through pass-through taxation, reduced self-employment taxes, and maximized deductions. The flexibility in income distribution and strategic timing of income and expenses can lead to substantial savings over time.

Professional guidance becomes invaluable to fully capitalize on these benefits while staying compliant with IRS regulations. Davies Wealth Management specializes in helping business owners, including professional athletes, navigate the complexities of S Corp taxation and develop tailored strategies to maximize their financial outcomes. We can assess your specific circumstances and develop a customized plan that aligns with your goals and maximizes your tax advantages.

The long-term impact of effective S Corp strategies extends far beyond annual tax savings. These approaches can contribute to increased business profitability, enhanced personal wealth accumulation, and improved financial stability. For professional athletes, who often face unique financial challenges, these strategies can particularly benefit in managing short-term earnings and securing long-term financial well-being.

Leave a Reply