At Davies Wealth Management, we understand that financial tax planning can be a complex and daunting task for many individuals. Effective tax strategies can significantly impact your overall financial health and future security.

In this post, we’ll explore key approaches to optimize your tax planning, from understanding your current situation to implementing smart strategies. We’ll also discuss how working with a financial advisor can provide personalized guidance to help you navigate the intricacies of tax optimization.

What’s Your Tax Situation?

Identifying Your Income Sources

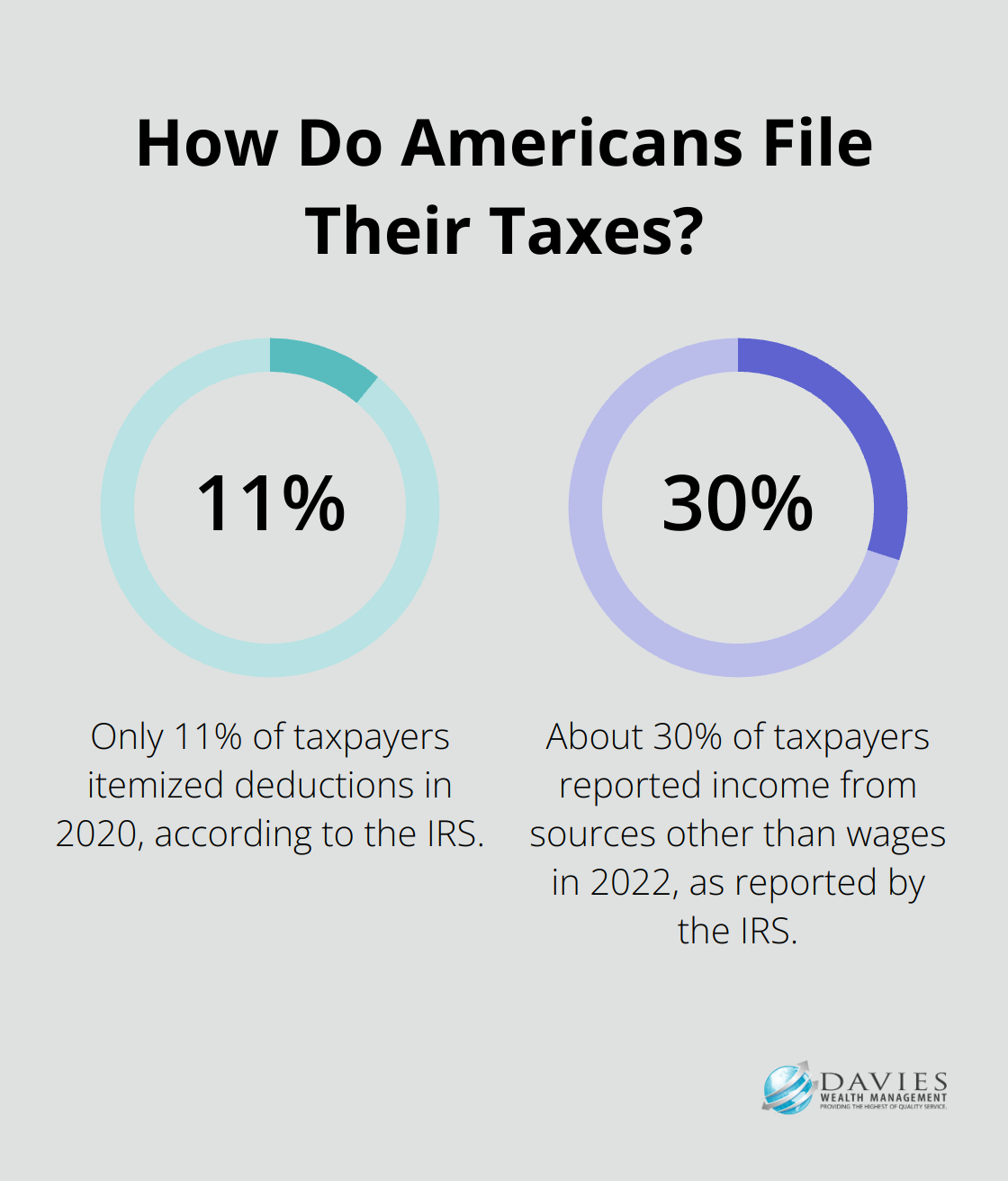

The first step in assessing your tax situation requires you to identify all your income sources. This includes your salary, investment income, rental property income, and any side hustles or freelance work. The IRS reports that in 2022, about 30% of taxpayers reported income from sources other than wages. A comprehensive catalog of all your income streams will equip you to understand your total tax liability and identify potential areas for tax optimization.

Understanding Your Tax Bracket

Your tax bracket determines your overall tax burden. The U.S. uses a progressive tax system, which means higher incomes fall into higher tax brackets. For 2023, seven federal tax brackets exist, ranging from 10% to 37%. These rates apply to taxable income (not your total income). Knowledge of your specific bracket allows you to make informed decisions about income timing and deductions.

Maximizing Deductions and Credits

Deductions and credits can significantly reduce your tax liability, yet many taxpayers overlook potential savings. The IRS reports that in 2020, only about 11% of taxpayers itemized deductions. While the standard deduction has increased in recent years, itemizing may still benefit some taxpayers. Common deductions include mortgage interest, state and local taxes, and charitable contributions. Tax credits (which directly reduce your tax bill) can include the Child Tax Credit, Earned Income Tax Credit, and various education credits.

Unique Considerations for Professional Athletes

Professional athletes often face complex tax situations due to their unique income structures and potential deductions related to training and equipment. Understanding these nuances becomes particularly important for this group. Athletes must consider state taxes for games played in different locations, deductions for agent fees, and potential tax implications of endorsement deals.

The Importance of Regular Tax Reviews

Your tax situation isn’t static; it changes as your life and career evolve. Regular tax reviews help you stay on top of these changes and adapt your strategies accordingly. This proactive approach allows you to take advantage of new tax-saving opportunities as they arise and adjust your financial plans to align with current tax laws.

As we move forward, we’ll explore effective tax planning strategies that can help you optimize your financial situation based on this foundational understanding of your tax landscape.

Smart Moves for Tax Efficiency

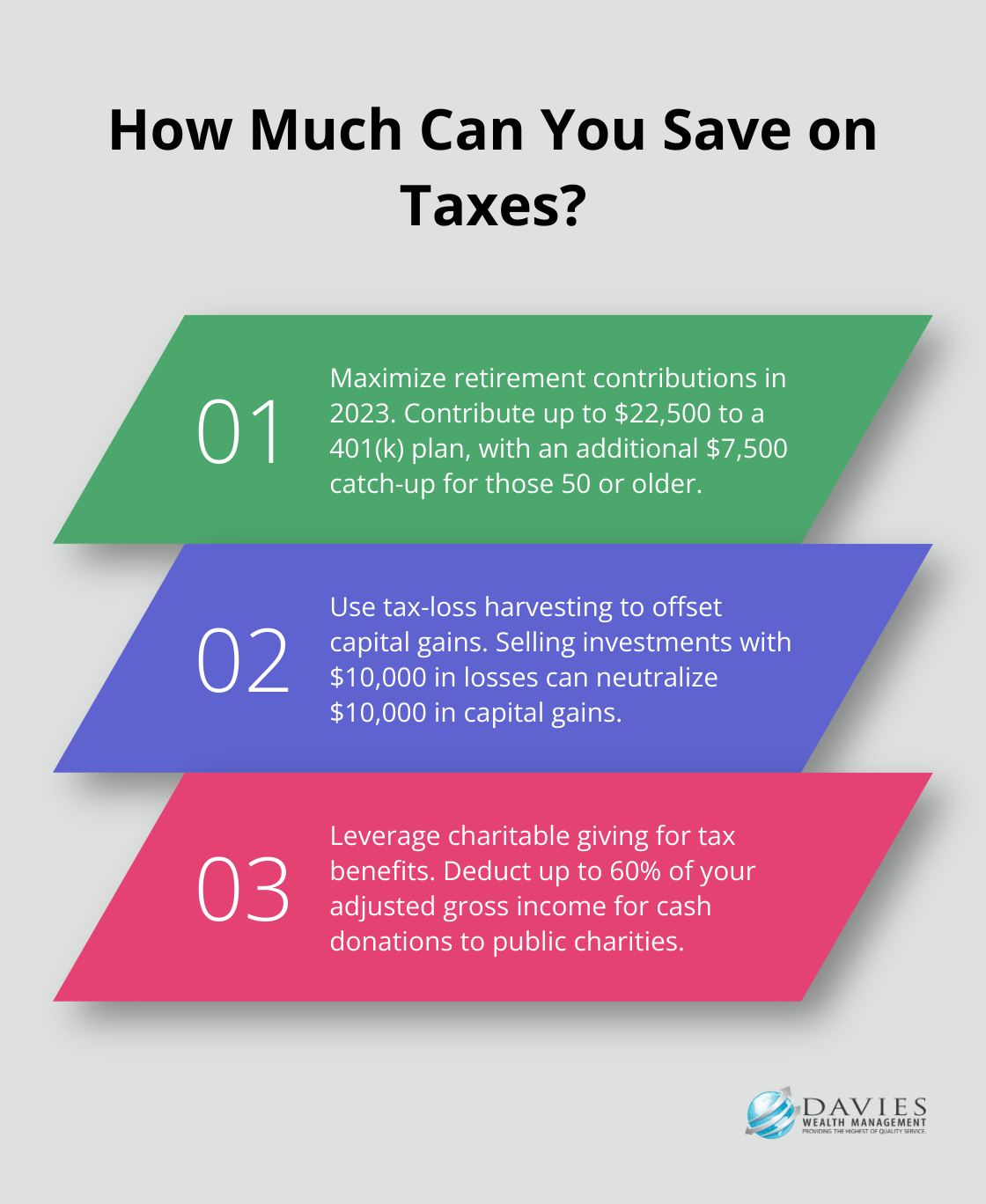

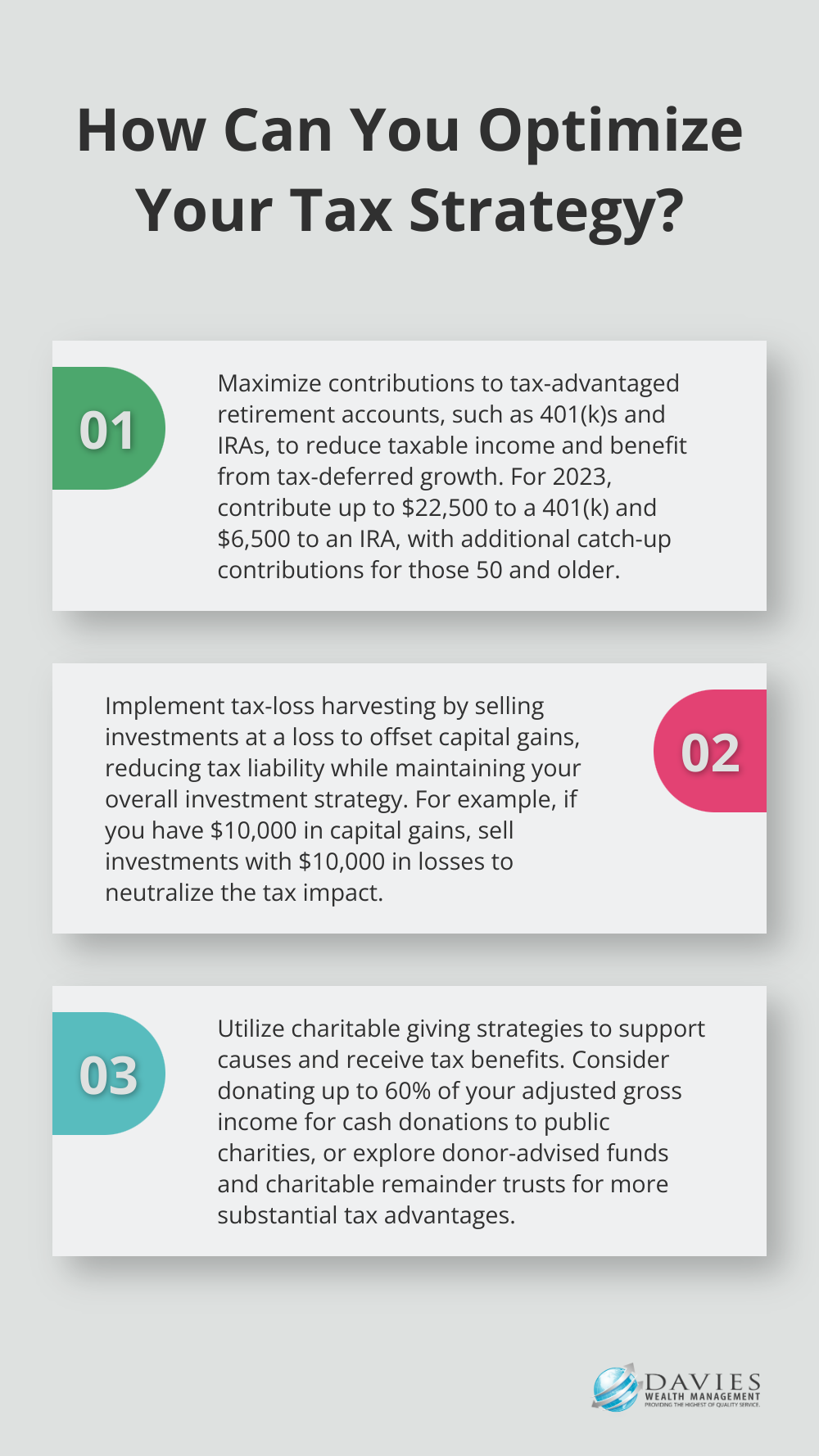

Supercharge Your Retirement Savings

One of the most effective ways to reduce your taxable income is to maximize contributions to tax-advantaged retirement accounts. For 2023, you can contribute up to $22,500 to a 401(k) plan (with an additional $7,500 catch-up contribution if you’re 50 or older). IRAs allow for $6,500 in contributions (with a $1,000 catch-up provision). These contributions lower your current taxable income and grow tax-deferred, potentially saving you thousands in taxes over time.

Strategic Investment Management

Tax-loss harvesting is a powerful technique that involves selling investments at a loss to offset capital gains. This strategy reduces your tax liability while maintaining your overall investment strategy. For instance, if you’ve realized $10,000 in capital gains this year, selling investments with $10,000 in losses can effectively neutralize the tax impact of those gains.

Tax-efficient investing also involves choosing the right types of investments for different account types. For example, holding high-yield bonds or Real Estate Investment Trusts (REITs) in tax-advantaged accounts shields their higher taxable distributions from immediate taxation.

Philanthropy with a Tax Twist

Charitable giving not only supports causes you care about but also provides significant tax benefits. The IRS allows you to deduct charitable contributions up to 60% of your adjusted gross income for cash donations to public charities. For high-net-worth individuals, strategies like donor-advised funds or charitable remainder trusts offer even more substantial tax advantages while fulfilling philanthropic goals.

Tailored Strategies for Professional Athletes

Professional athletes often face unique tax challenges due to multi-state income and fluctuating earnings. A comprehensive tax strategy for athletes should address these complexities, including state tax considerations for games played in different locations, deductions for agent fees, and potential tax implications of endorsement deals.

The Value of Professional Guidance

Tax laws are complex and ever-changing. What works best for one person may not be ideal for another. Working with experienced professionals guides you through the intricacies of tax planning and helps you make informed decisions that align with your overall financial objectives. As we move forward, we’ll explore how partnering with a financial advisor can further enhance your tax planning efforts and optimize your overall financial strategy.

Why Partner with a Financial Advisor for Tax Planning?

Tax planning significantly impacts your financial well-being. While many individuals attempt to navigate this landscape alone, partnering with a financial advisor provides substantial benefits and helps optimize your tax strategy.

Expertise in Complex Tax Laws

Financial advisors who specialize in tax planning stay current with the latest tax laws and regulations. This expertise proves invaluable in an environment where tax codes change frequently. For example, the Tax Cuts and Jobs Act of 2017 brought significant changes to the U.S. tax system, affecting everything from individual tax rates to deductions and credits. A knowledgeable advisor helps you understand how these changes impact your specific situation and adjusts your strategy accordingly.

Personalized Tax Strategies

Every individual’s financial situation is unique, and one-size-fits-all approaches to tax planning often fall short. A financial advisor develops a personalized tax strategy tailored to your specific circumstances, goals, and risk tolerance. This might include strategies such as timing your income and deductions, choosing the right investment vehicles, or structuring your retirement savings to minimize tax liability.

Proactive Planning and Long-Term Perspective

One of the most significant advantages of working with a financial advisor is their ability to take a proactive, long-term approach to tax planning. Rather than simply reacting to your tax situation at the end of each year, an advisor helps you plan throughout the year and even across multiple years. This approach allows for more effective tax management and can lead to substantial savings over time.

Coordination with Other Financial Goals

Effective tax planning doesn’t happen in isolation. It needs integration with your overall financial plan, including retirement planning, estate planning, and investment strategy. A financial advisor ensures that your tax strategy aligns with and supports your broader financial objectives.

Specialized Expertise for Complex Situations

For individuals with complex financial situations (such as business owners, high-net-worth individuals, or professional athletes), the value of a financial advisor becomes even more pronounced. These situations often involve intricate tax considerations that require specialized knowledge.

Professional athletes face unique tax challenges due to multi-state income, signing bonuses, and potential endorsement deals. A financial advisor with expertise in this area navigates these complexities and implements strategies to optimize the athlete’s tax situation.

When selecting a financial advisor for tax planning, look for credentials such as Certified Public Accountant (CPA) or Certified Financial Planner (CFP), as well as experience in tax strategy. It’s also crucial to choose an advisor who takes the time to understand your specific situation and goals, and who can explain complex tax concepts in terms you can understand.

Final Thoughts

Financial tax planning forms a vital part of your overall financial strategy. Understanding your tax situation, implementing effective strategies, and working with a professional advisor can significantly optimize your tax position. Regular tax planning reviews help you stay ahead of changing tax laws and adapt your strategy as your financial situation evolves.

While DIY tax planning is possible, the complexities of tax laws and the potential for significant savings make professional guidance invaluable. A qualified financial advisor can provide personalized strategies tailored to your unique circumstances (whether you’re a business owner, high-net-worth individual, or professional athlete facing multi-state tax issues).

At Davies Wealth Management, we specialize in comprehensive financial planning, including tax optimization strategies. Our team of experts offers personalized advice to help you navigate the intricacies of financial tax planning and achieve your broader financial goals. For tailored solutions that align with your specific needs, visit Davies Wealth Management and take the first step towards optimizing your financial future.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

The content provided by Davies Wealth Management is intended solely for informational purposes and should not be considered as financial, tax, or legal advice. While we strive to offer accurate and timely information, we encourage you to consult with qualified retirement, tax, or legal professionals before making any financial decisions or taking action based on the information presented. Davies Wealth Management assumes no liability for actions taken without seeking individualized professional advice.

Leave a Reply