At Davies Wealth Management, we believe retirement planning goes beyond just financial considerations. Holistic retirement planning encompasses every aspect of your future life, from finances to health and personal fulfillment.

This comprehensive approach ensures you’re prepared for all facets of your golden years, not just the monetary side. In this post, we’ll explore how to create a well-rounded retirement strategy that addresses your financial, physical, and emotional needs.

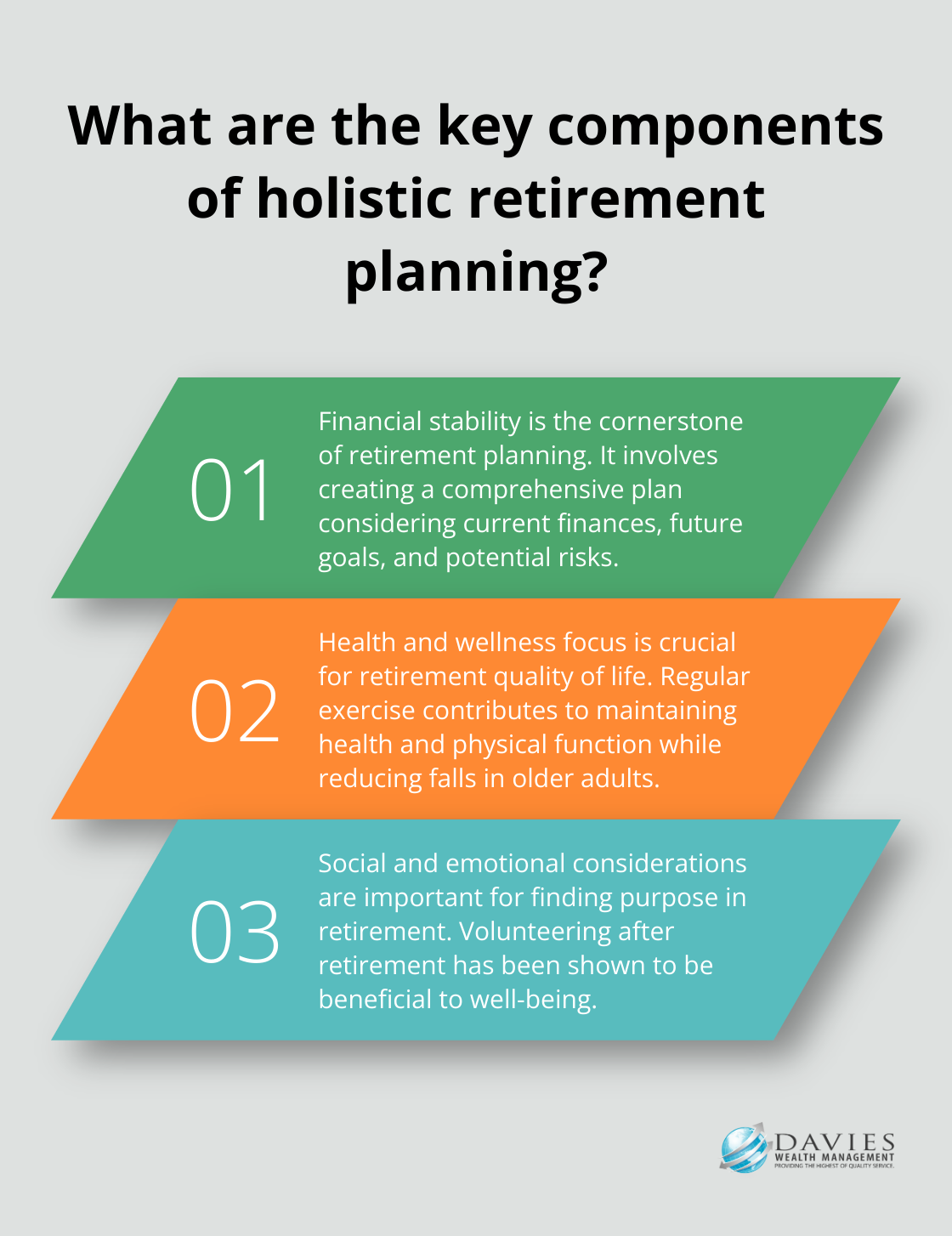

What Is Holistic Retirement Planning?

A Comprehensive Approach

Holistic retirement planning considers all aspects of your life after you stop working. This method leads to more fulfilling retirements for many individuals.

Financial Foundation

The cornerstone of any retirement plan is financial stability. This involves more than just saving money. It’s about creating a comprehensive retirement plan that takes into account your current financial situation, future goals, and potential risks. Diversifying income sources and avoiding common pitfalls are key to ensuring financial stability in retirement.

Health and Wellness Focus

Your health is your wealth, especially in retirement. A holistic plan includes strategies for maintaining both physical and mental well-being. Regular exercise can contribute to maintaining quality of life, health, and physical function while reducing falls in older adults. Incorporating fitness goals into your retirement plan isn’t just good for your body; it’s good for your wallet too.

Social and Emotional Considerations

Retirement isn’t just about having enough money; it’s about finding purpose and joy in your daily life. Volunteering after retirement has been shown to be beneficial to well-being. Your retirement plan should include goals for social engagement, whether that’s through community involvement, family time, or pursuing new hobbies.

Professional Guidance

Creating a holistic retirement plan can be complex. Many individuals benefit from professional guidance to ensure they address all areas of retirement planning effectively. A financial advisor can assess your risk tolerance, time horizon, and financial objectives to create a customized investment plan that aligns with your needs.

Retirement planning isn’t a one-time event. It’s an ongoing process that should evolve as your life changes. Start early and review your plan often. The next section will explore the financial aspects of retirement planning in more detail, providing you with practical strategies to build a solid financial foundation for your golden years.

Building Your Financial Foundation

At Davies Wealth Management, we know that a solid financial foundation forms the bedrock of a comfortable retirement. Let’s explore the key elements that will help you construct a robust financial strategy for your golden years.

Assess Your Current Financial Situation

The first step in creating a strong retirement plan requires a hard look at your current finances. This means you should tally up all your assets, including savings accounts, investment portfolios, real estate, and any other valuable possessions. Don’t forget to account for liabilities such as mortgages, car loans, or credit card debt.

A clear picture of your net worth will help you understand where you stand and what steps you need to take to reach your retirement goals. Tools like personal finance apps or spreadsheets can prove invaluable for tracking your finances. Many individuals find that this process alone can open their eyes and motivate them to take action.

Set Realistic Retirement Goals

After you grasp your current financial situation, you should set realistic retirement goals. This involves estimating your retirement expenses and determining how much income you’ll need to maintain your desired lifestyle.

The 4% rule assumes you withdraw the same amount from your portfolio every year, adjusted for inflation. However, this rule isn’t set in stone and may not suit everyone. Your specific needs and circumstances will dictate your ideal withdrawal rate.

It’s also important to factor in inflation when setting your retirement goals.

Develop a Robust Savings and Investment Strategy

With clear goals in mind, you should develop a savings and investment strategy. This typically involves a mix of retirement accounts such as 401(k)s, IRAs, and taxable investment accounts.

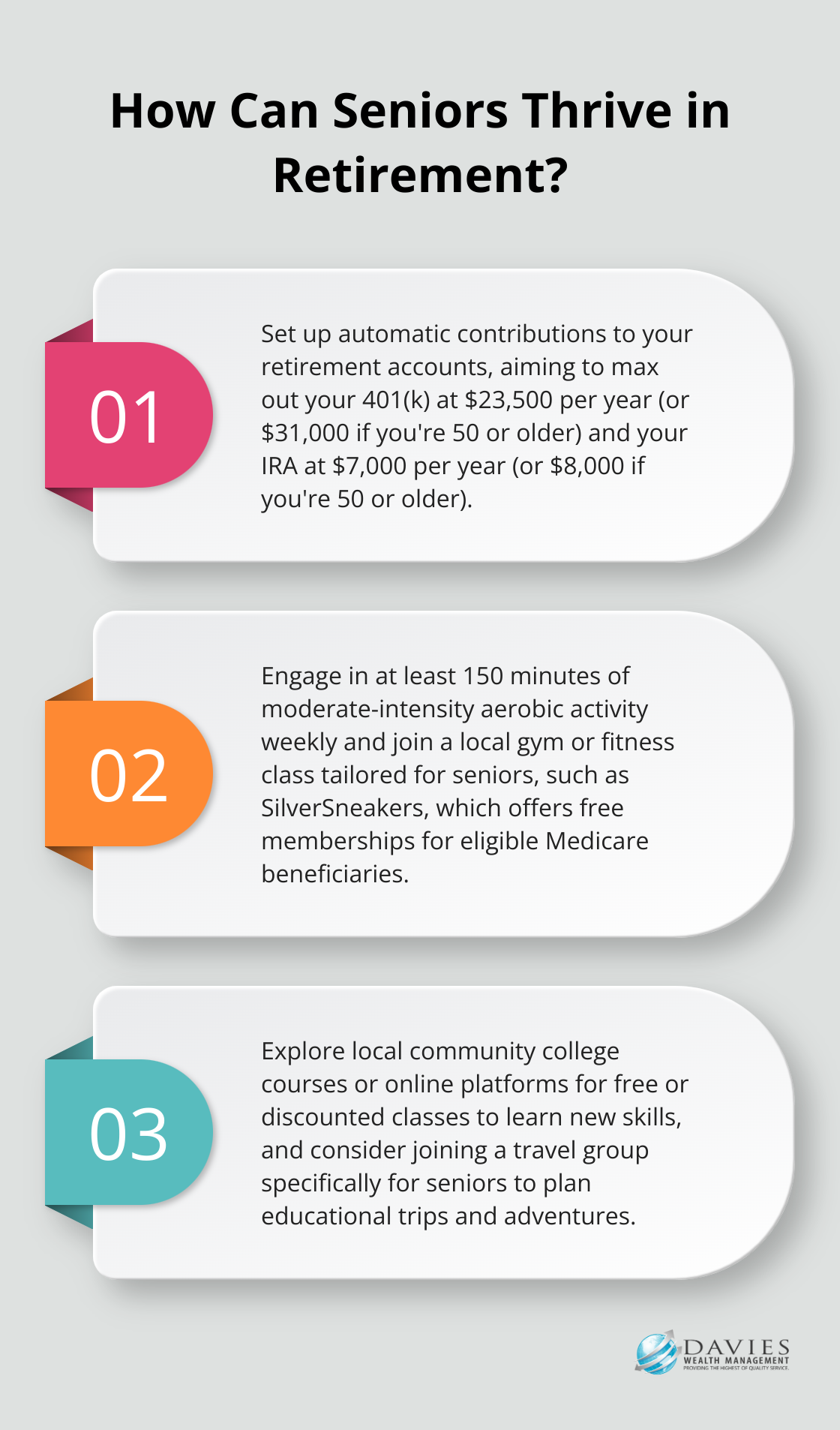

For 2025, the IRS has set the contribution limit for 401(k) plans at $23,500 (with an additional $7,500 catch-up contribution allowed for those 50 and older). For IRAs, the limit is $7,000 (with an extra $1,000 catch-up contribution for those 50+).

Your investment strategy should align with your risk tolerance and time horizon. Generally, as you approach retirement, you’ll want to shift towards more conservative investments to protect your nest egg from market volatility.

Implement Tax-Efficient Strategies

Tax efficiency is an essential aspect of retirement planning that’s often overlooked. Strategies like Roth conversions, tax-loss harvesting, and strategic withdrawals from different account types can significantly impact your after-tax retirement income.

For instance, if you expect to be in a higher tax bracket in retirement, it might make sense to contribute to a Roth IRA or do Roth conversions now. This allows you to pay taxes on the contributions at your current, lower rate and enjoy tax-free withdrawals in retirement.

Plan for Healthcare Costs

Healthcare costs can become a major expense in retirement. According to Fidelity’s 2023 Retiree Health Care Cost Estimate, an average 65-year-old retiring couple may need approximately $157,500 to cover health care expenses in retirement.

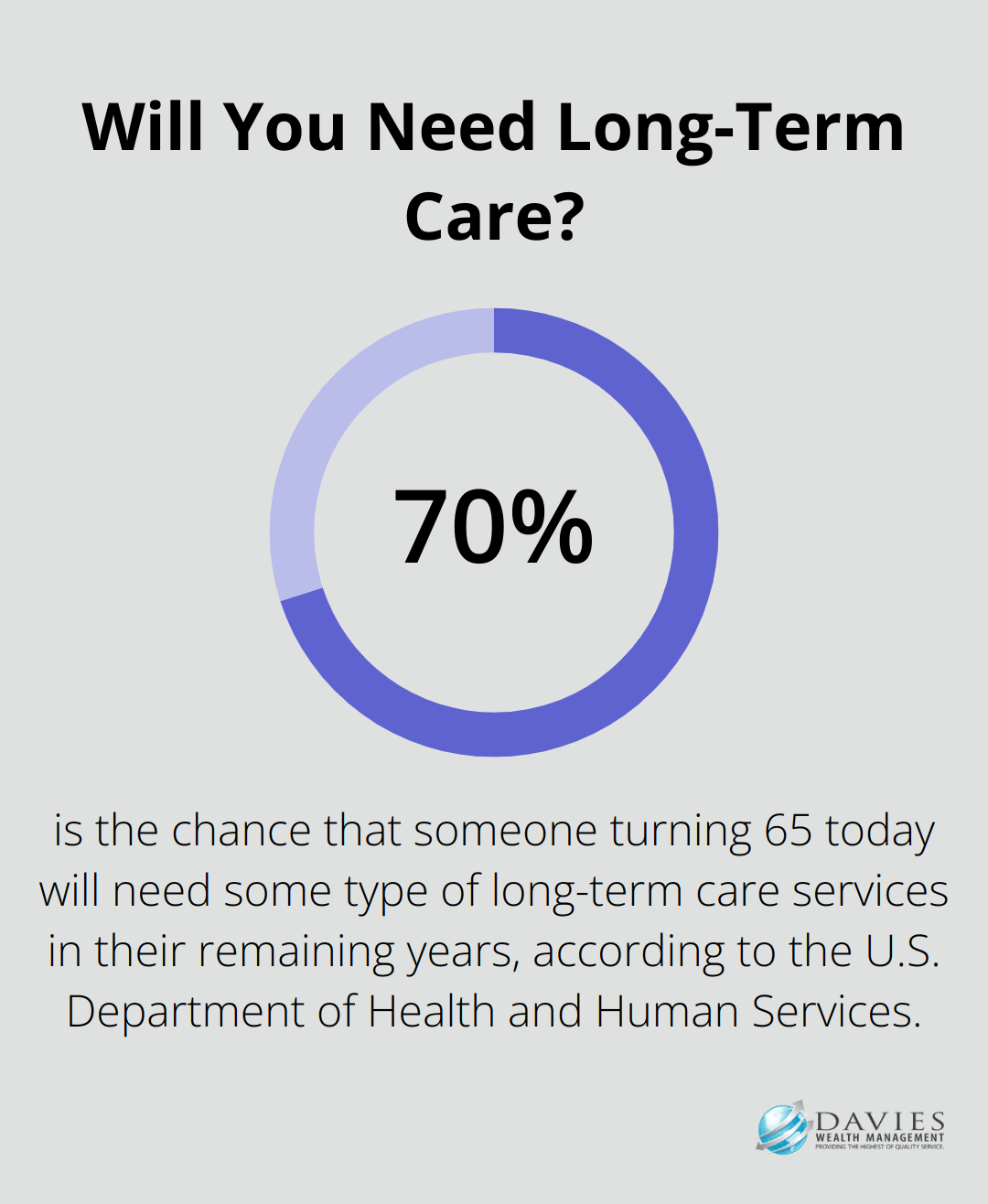

Long-term care is another consideration. The U.S. Department of Health and Human Services states that someone turning 65 today has almost a 70% chance of needing some type of long-term care services in their remaining years. Planning for these potential costs is essential for a comprehensive retirement strategy.

As we move forward, it’s important to consider the non-financial aspects of retirement planning. These elements can greatly impact your overall satisfaction and quality of life during your golden years.

Beyond Finances: Crafting Your Ideal Retirement Lifestyle

Prioritize Health and Wellness

Good health forms the foundation of an enjoyable retirement. Adults aged 65 and older should engage in at least 150 minutes of moderate-intensity aerobic activity weekly, as recommended by the Centers for Disease Control and Prevention. Include muscle-strengthening activities at least twice a week.

Join a local gym or fitness class tailored for seniors. Many communities offer programs like SilverSneakers, which provides free gym memberships and fitness classes for eligible Medicare beneficiaries. Walking, swimming, or yoga offer excellent low-impact options for staying active.

Mental health deserves equal attention. Engage in cognitively stimulating activities to maintain mental acuity. Try puzzles, reading, learning a new language, or taking up a musical instrument to keep your mind sharp. These activities may lower the risk of cognitive decline and dementia.

Build and Maintain Social Connections

Strong social networks contribute significantly to retirement happiness. A study examined the effect of social interaction on life satisfaction in older adults, highlighting the importance of social connections.

To foster social connections, join local clubs or organizations aligned with your interests. Many retirees find fulfillment in volunteer work, which provides both social interaction and a sense of purpose. Websites can help you find opportunities in your area that match your skills and interests.

Technology plays a role in maintaining connections. Learn to use video chat platforms (like Zoom or FaceTime) to stay in touch with family and friends, especially those who live far away.

Explore New Horizons

Retirement offers the perfect opportunity to explore new interests or revisit old passions. Many local community colleges offer free or discounted classes for seniors. Online platforms provide access to thousands of courses from top universities, often at no cost.

Travel remains a popular retirement activity. Join a travel group specifically for seniors, which offers educational travel programs worldwide. If extensive travel isn’t feasible, local day trips or weekend getaways can provide new experiences and adventures.

For those interested in continuing to work part-time or starting a new venture, business startup programs exist specifically for seniors interested in entrepreneurship, teaching entrepreneurship basics for first-timers.

Plan Your Living Arrangements

Your living situation in retirement can significantly impact your quality of life. While many retirees prefer to age in place, others opt for retirement communities that offer a range of amenities and social opportunities.

If you consider moving, research potential locations thoroughly. Factors to consider include proximity to healthcare facilities, cost of living, climate, and available activities. Comprehensive information on various retirement destinations can help inform your decision.

For those who prefer to stay in their current homes, consider future accessibility needs. Simple modifications (like installing grab bars in bathrooms or improving lighting) can make a big difference in safety and comfort as you age.

Crafting a comprehensive retirement plan that aligns with your lifestyle aspirations and financial goals is essential for a fulfilling retirement. A financial advisor can provide valuable guidance in developing strategies tailored to your unique retirement vision.

Final Thoughts

Holistic retirement planning encompasses financial well-being, health, social connections, and personal fulfillment. This comprehensive approach sets the foundation for a truly rewarding retirement experience. We recommend you review and adjust your retirement strategy regularly to ensure it aligns with your current situation and future aspirations.

Professional guidance can provide invaluable insights and help you develop strategies tailored to your unique circumstances. At Davies Wealth Management, we specialize in holistic retirement planning that considers all aspects of your life. Our team of experts can assist you in creating a comprehensive plan that addresses your financial needs, lifestyle goals, and long-term aspirations.

You will invest in your own happiness and security when you take a proactive approach to retirement planning. Start today, and you will pave the way to create the retirement you have always dreamed of. Our team stands ready to help you navigate this important journey towards a fulfilling retirement.

Leave a Reply