At Davies Wealth Management, we understand the unique financial challenges faced by families caring for individuals with special needs. Financial planning for special needs families requires a thoughtful and comprehensive approach.

This blog post will guide you through essential steps to secure your family’s financial future while providing the best possible care for your loved one with special needs.

What Are the Financial Challenges for Special Needs Families?

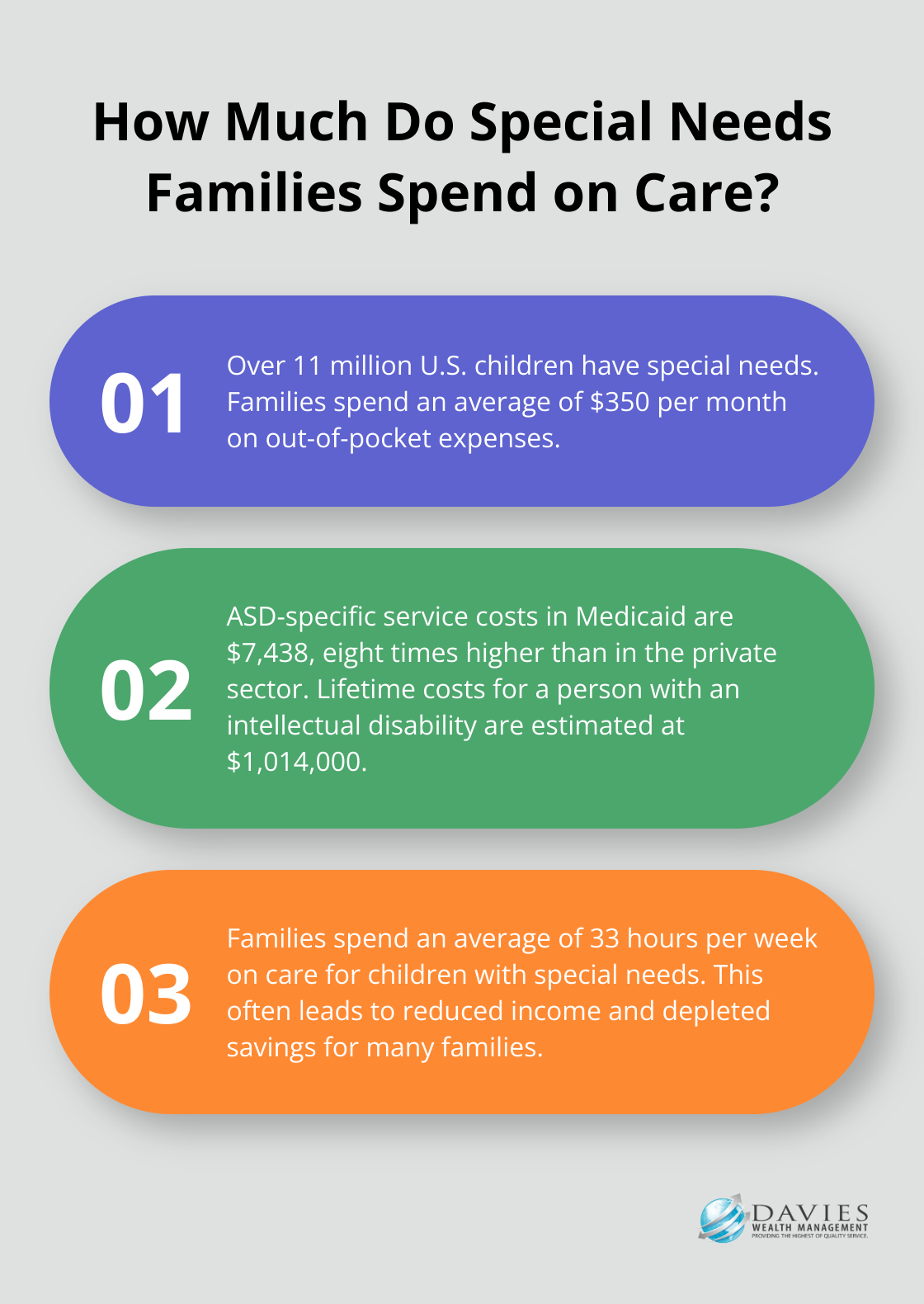

The High Cost of Medical Care and Therapy

Special needs families face significant financial hurdles. Medical expenses often top the list of these challenges. The National Library of Medicine reports that over 11 million children in the U.S. have special needs. Families spend an average of $350 per month on out-of-pocket expenses. For specific conditions, these costs can increase dramatically. ASD-specific service costs were eight times higher in Medicaid than in the private sector ($7,438 vs. $928, p<0.0001).

The Long-Term Care Conundrum

Long-term care planning presents another major financial challenge. Lifetime costs per person with an intellectual disability were estimated at $1,014,000, including $921,000 for persons with cerebral palsy. This staggering figure highlights the need for early and comprehensive financial planning.

The Strain on Family Income

The financial impact of caring for a family member with special needs extends beyond direct medical costs. Many families experience reduced income as one parent may need to cut work hours or leave their job entirely to provide care. The National Library of Medicine reports that families spend an average of 33 hours per week on care for children with special needs.

Depletion of Savings

This reduction in income, coupled with increased expenses, can quickly deplete family savings. Many families exhaust emergency funds and retirement savings to cover immediate care needs. This situation underscores the importance of creating a robust financial plan that addresses both short-term needs and long-term financial security.

Navigating Government Benefits

Understanding and accessing government benefits adds another layer of complexity to financial planning for special needs families. Programs like Supplemental Security Income (SSI) and Medicaid can provide essential support, but they come with strict eligibility requirements. Families must carefully manage their finances to maintain eligibility for these crucial benefits while still planning for their loved one’s future.

The financial challenges faced by special needs families are complex and multifaceted. They require a comprehensive approach to financial planning that takes into account both immediate needs and long-term considerations. In the next section, we’ll explore essential financial planning steps that can help families navigate these challenges and secure their financial future.

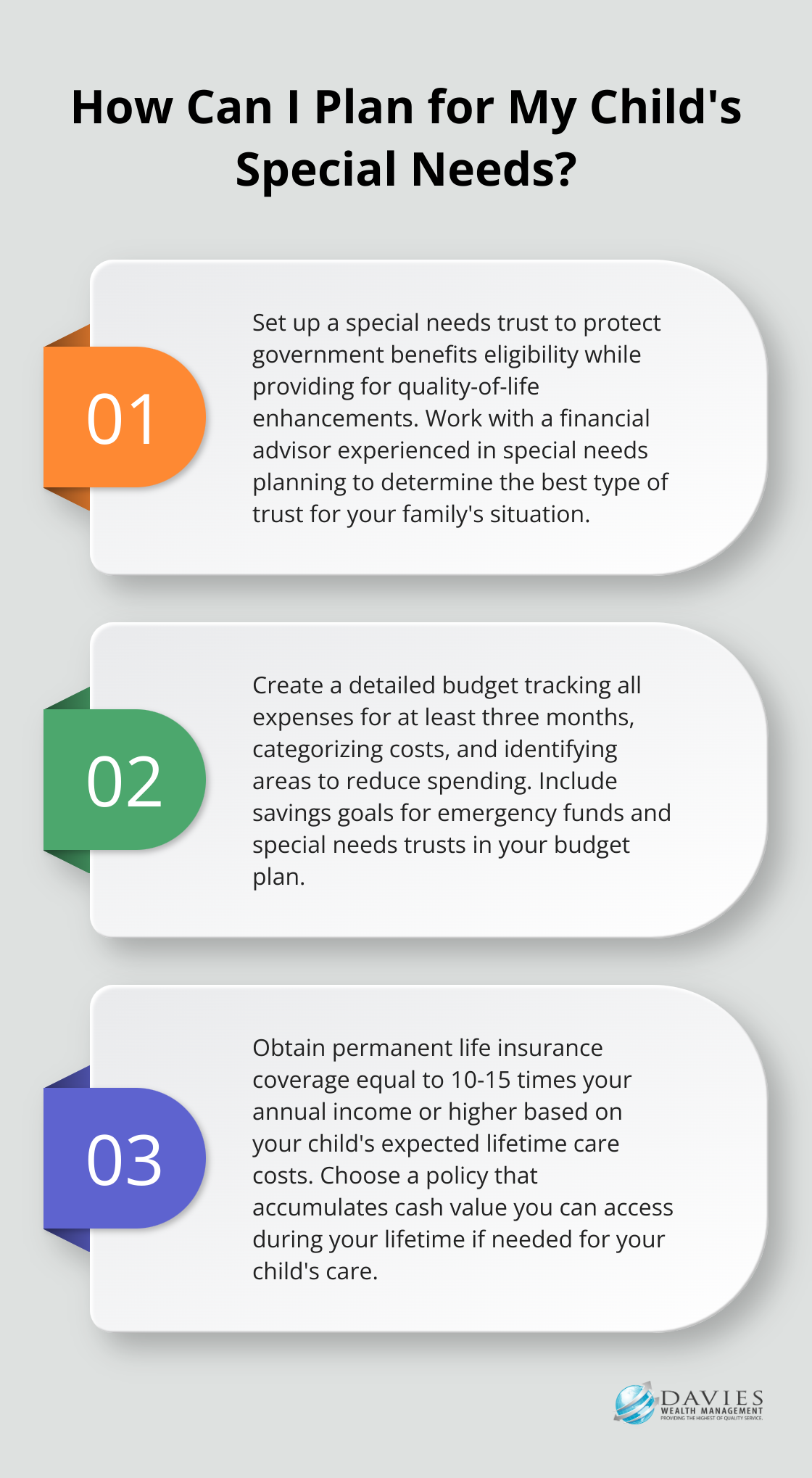

How to Build a Strong Financial Foundation for Special Needs Families

At Davies Wealth Management, we believe that a solid financial foundation is essential for special needs families. This chapter outlines key steps to establish financial stability and security for your loved ones with special needs.

Create a Comprehensive Budget

The first step in building a strong financial foundation is to create a detailed budget. This budget should account for all current expenses, including medical costs, therapies, and specialized equipment. Your budget should also factor in potential future costs, such as long-term care or educational expenses.

To create an effective budget:

- Track all expenses for at least three months

- Categorize your expenses

- Identify areas where you can potentially reduce costs

- Include savings goals (e.g., contributions to an emergency fund or a special needs trust)

Establish a Robust Emergency Fund

An emergency fund is particularly important for special needs families due to the potential for unexpected medical expenses or changes in care needs. Try to save at least six months’ worth of living expenses in an easily accessible savings account. This fund can provide a financial buffer, helping you avoid debt or the need to tap into long-term savings during emergencies.

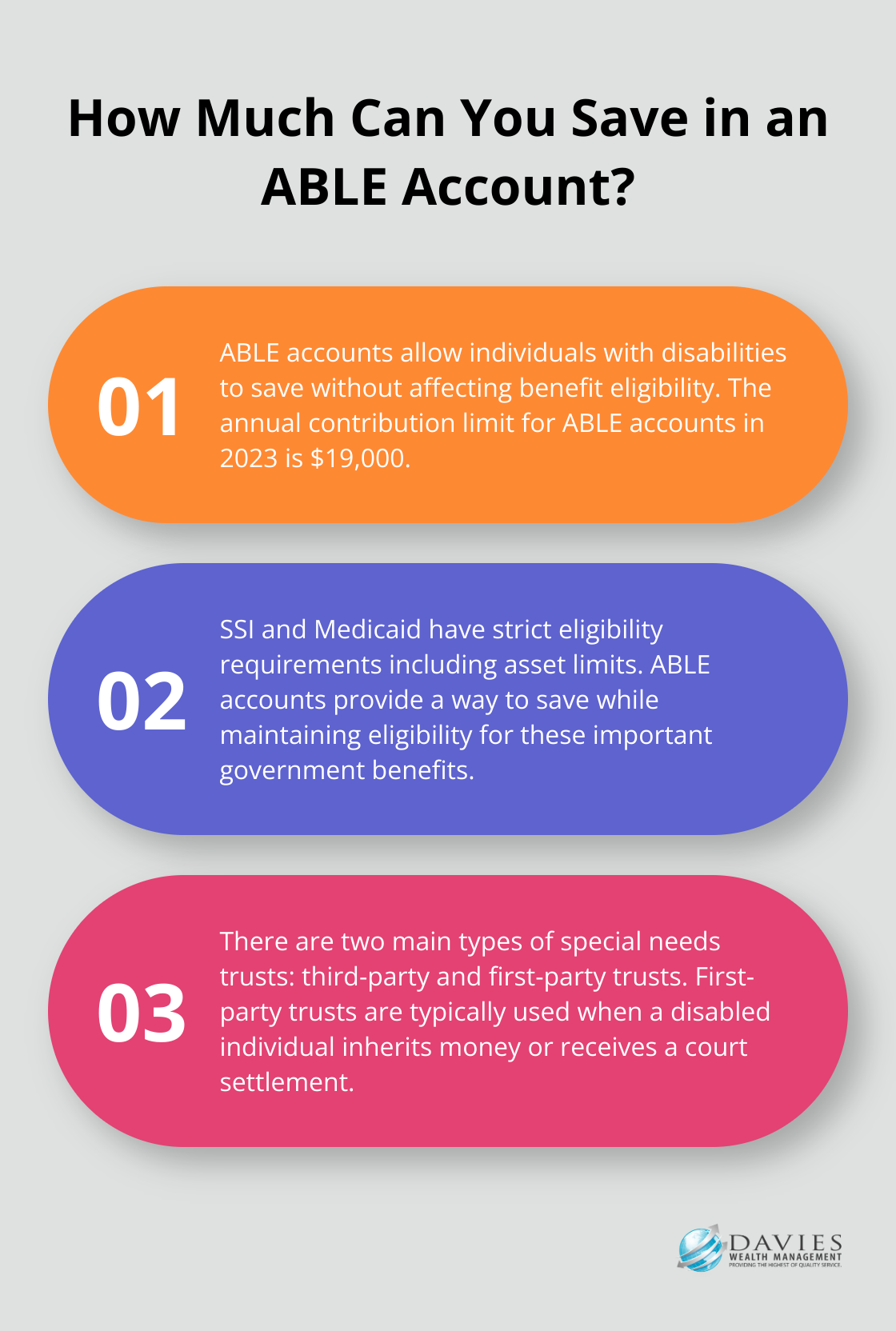

Navigate Government Benefits and Programs

Understanding and accessing government benefits is a critical aspect of financial planning for special needs families. Programs like Supplemental Security Income (SSI) and Medicaid can provide essential support, but they come with strict eligibility requirements.

For SSI, the Social Security Administration provides online tools to help determine eligibility and potential benefit amounts. It’s important to note that SSI has asset limits. Medicaid eligibility varies by state, so check with your state’s Medicaid office for specific requirements.

The ABLE (Achieving a Better Life Experience) Act allows individuals with disabilities to save without affecting their eligibility for government benefits. As of 2023, an annual total of $19,000 can be contributed into the ABLE account by the person with a disability or from friends and family. These accounts can be an excellent tool for managing finances while maintaining benefit eligibility.

Consider Special Needs Trusts

Special needs trusts are a powerful financial planning tool for families with disabled loved ones. These trusts allow you to set aside funds for your family member with special needs without jeopardizing their eligibility for government benefits.

There are two main types of special needs trusts:

- Third-party trusts (funded by family members or other benefactors)

- First-party trusts (funded with the disabled individual’s own assets)

First-party SNTs are most often used when the person with a disability inherits money or property outright, or receives a court settlement.

Each type has its own rules and considerations, so it’s important to work with a financial advisor experienced in special needs planning to determine the best option for your family.

As we move forward, we’ll explore insurance and legal considerations that complement these foundational financial strategies, ensuring comprehensive protection for your special needs family member.

Protecting Your Family’s Future: Insurance and Legal Considerations

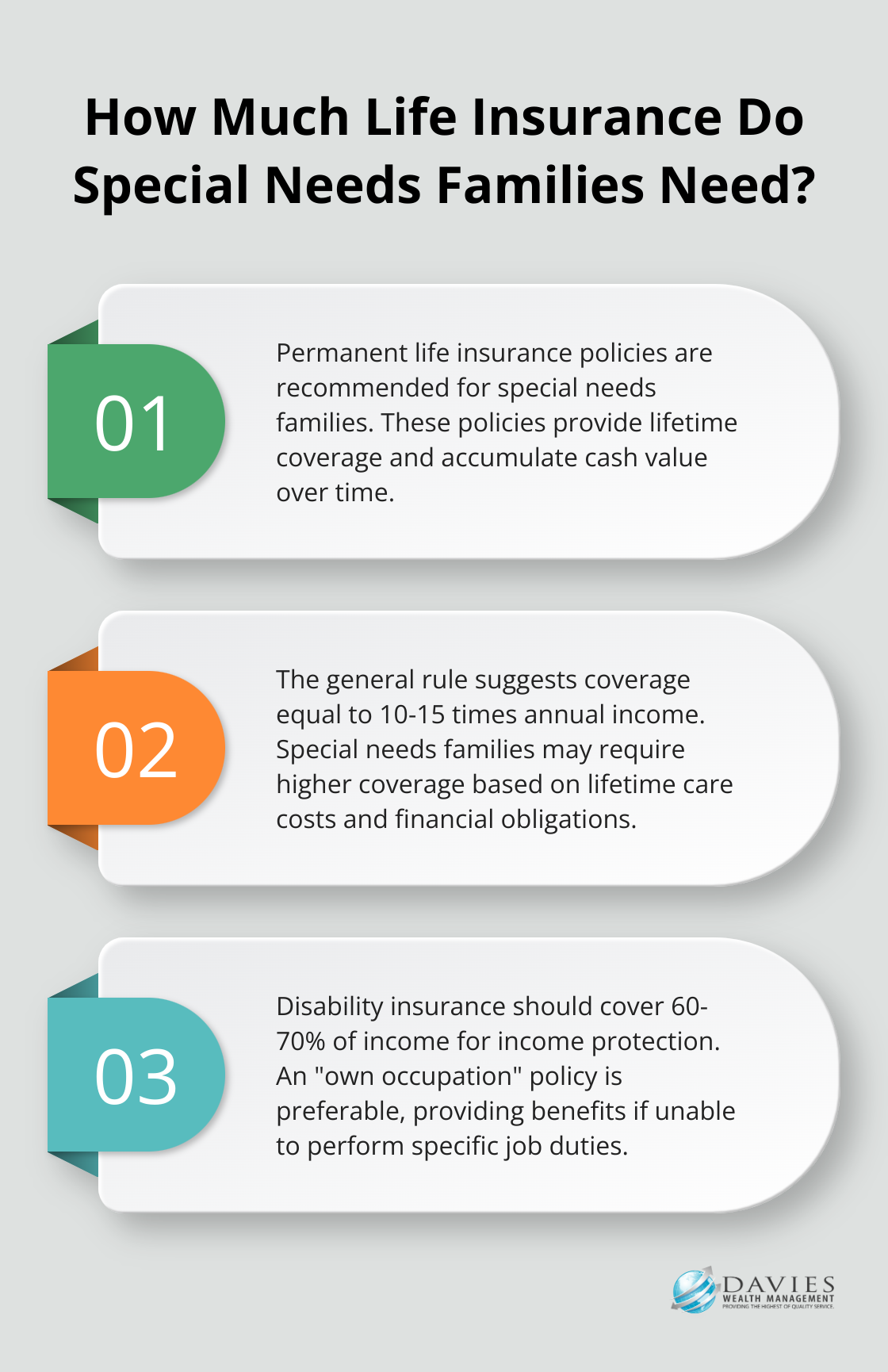

Life Insurance: A Safety Net for Caregivers

Life insurance for the disabled is important for ensuring financial security for special needs families. Understanding the options available and how to navigate them is crucial for families with special needs children.

When selecting a life insurance policy, consider a permanent life insurance policy instead of a term policy. Permanent policies (such as whole life or universal life) provide coverage for your entire lifetime and accumulate cash value over time. You can access this cash value during your lifetime if needed for your child’s care.

The amount of coverage you need depends on various factors, including your child’s expected lifetime care costs, outstanding debts, and your family’s living expenses. A general rule suggests coverage equal to 10-15 times your annual income, but special needs families may require higher coverage. Calculate the additional coverage you may need based on your family’s financial obligations and any other resources, such as retirement benefits and personal assets.

Disability Insurance: Income Protection

Disability insurance protects your income if you become unable to work due to illness or injury. This protection is particularly important for families with special needs children, who often rely heavily on one or both parents’ incomes to cover care costs.

OECD statistics confirm that the United States spends less on disability benefits (as a share of the economy) than most other advanced countries.

When choosing a disability insurance policy, look for one that covers at least 60-70% of your income. Pay attention to the policy’s definition of disability, waiting period before benefits begin, and the benefit period. Try to obtain an “own occupation” policy if possible, as it provides benefits if you can’t perform your specific job, even if you could work in another capacity.

Guardianship and Estate Planning

Estate planning is significant for families with special needs members. It ensures your child’s care continues according to your wishes after you’re gone.

A key component of this planning is establishing guardianship. Legal guardianship for adults with disabilities is an important consideration for families, providing benefits and requiring careful thought.

When choosing a guardian, consider not just who loves your child, but who can best manage their care and advocate for their needs. It’s often advisable to name separate guardians for personal care and financial matters.

Your estate plan should also include a special needs trust. This ensures that any inheritance or life insurance proceeds don’t disqualify your child from government benefits. Properly structured trusts can provide for quality-of-life enhancements while maintaining eligibility for programs like Medicaid and Supplemental Security Income.

Estate planning is not a one-time event. Review and update your plan regularly, especially after major life changes or shifts in your child’s care needs.

Final Thoughts

Financial planning for special needs families requires a comprehensive approach. A strong financial foundation includes a detailed budget, emergency fund, and exploration of government benefits. Special needs trusts and ABLE accounts offer valuable tools for asset management while maintaining eligibility for support programs.

Insurance and estate planning play vital roles in protecting your family’s future. Life insurance provides a safety net for caregivers, while disability insurance safeguards income. Estate planning ensures your child’s care continues according to your wishes, even after you’re gone.

At Davies Wealth Management, we specialize in financial planning for special needs families. Our team offers personalized strategies to help secure your loved one’s future. We understand the unique financial landscape you face and can guide you through each step of the planning process.

Leave a Reply