At Davies Wealth Management, we understand that financial planning for young adults can seem daunting. However, starting early is key to building a secure financial future.

In this guide, we’ll walk you through the essential steps to kickstart your financial journey. From setting goals to investing wisely, we’ll provide practical advice to help you make informed decisions about your money.

What Are the Financial Planning Basics?

Financial planning forms the foundation of a secure financial future. Understanding these basics will set young adults on the right path for their financial journey.

Set Clear Financial Goals

The first step in financial planning involves defining your goals. These can range from short-term objectives like saving for a vacation to long-term aspirations such as buying a home or retiring comfortably. Set S.M.A.R.T. financial goals: Specific, Measurable, Achievable, Relevant, and Time-bound. This clarity will guide your financial decisions and motivate you to stay on track.

Master the Art of Budgeting

Budgeting is essential for financial success. Start by tracking your income and expenses for a month. Use apps like Mint or YNAB (You Need A Budget) to categorize your spending. Try to follow the 50-30-20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This simple framework can help you balance your current lifestyle with future financial security.

Harness the Power of Early Saving and Investing

Time is your greatest asset when it comes to building wealth. Thanks to compound interest, even small amounts invested early can grow significantly over time. Use a compound interest calculator to see how your savings can grow over time with regular contributions. This illustrates why starting early is so important.

Consider opening a high-yield savings account for your emergency fund and short-term goals. For long-term objectives, look into low-cost index funds or ETFs that offer broad market exposure. If your employer offers a 401(k) with matching contributions, make sure you contribute enough to get the full match – it’s essentially free money.

Develop a Personalized Investment Strategy

Creating an investment strategy that aligns with your unique goals and risk tolerance is key. Whether you’re a young professional or a professional athlete with complex financial needs, it’s important to navigate the world of investing and make informed decisions about your financial future.

Financial planning is an ongoing process. Regularly review and adjust your plan as your life circumstances and goals evolve. Mastering these basics – goal setting, budgeting, and early saving and investing – will lay a solid foundation for long-term financial success.

As you move forward in your financial journey, it’s important to build on this foundation. Let’s explore how to create a strong financial base in the next section.

How to Build a Solid Financial Base

Creating Your Financial Safety Net

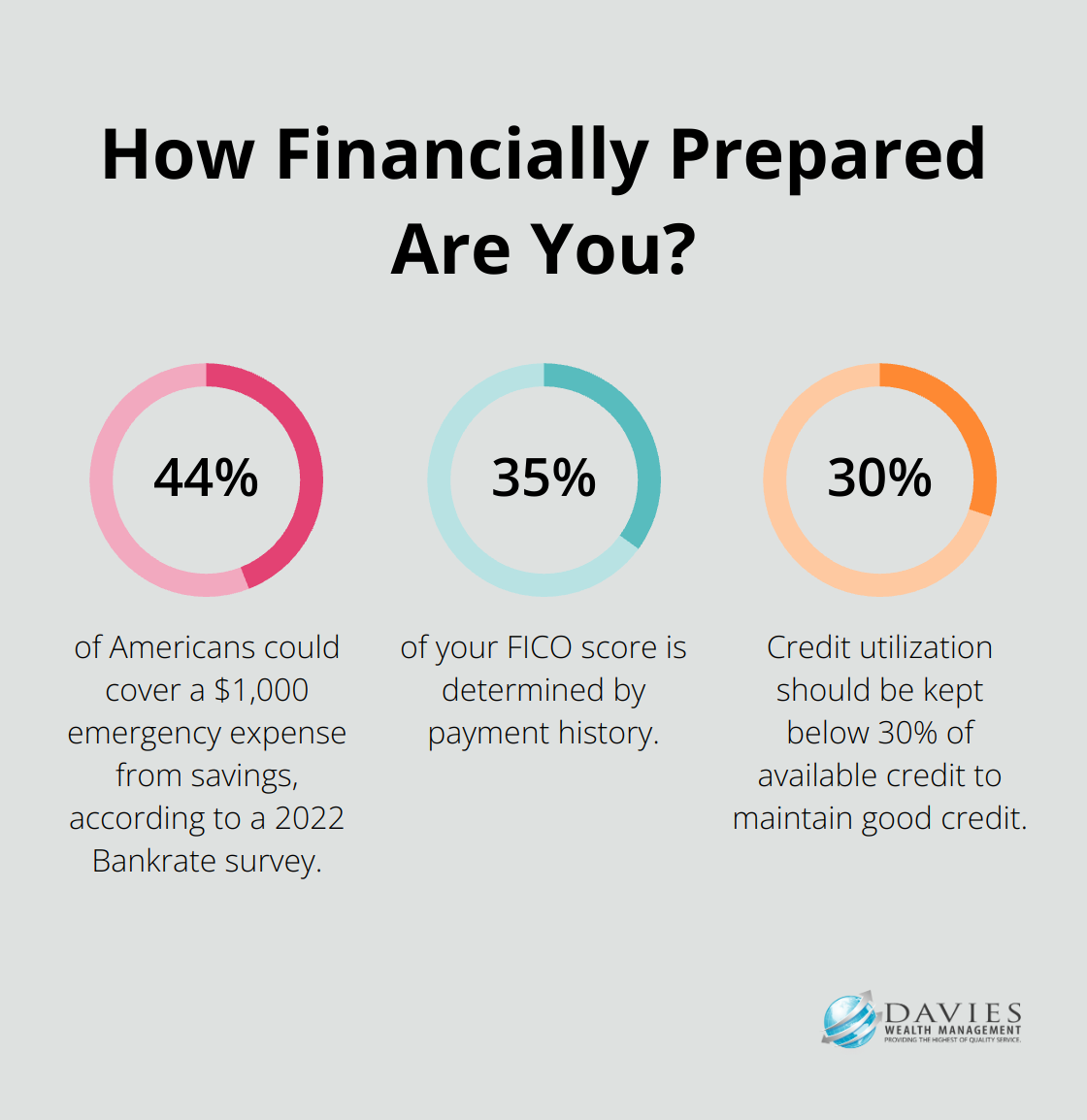

An emergency fund provides a buffer that allows you to handle unexpected expenses without disrupting your financial goals. We recommend you save 3-6 months of living expenses in a readily accessible account. Start small if needed – even $500 can make a difference in an emergency. Set up a monthly transfer to a high-yield savings account to automate your savings. A 2022 Bankrate survey revealed that only 44% of Americans could cover a $1,000 emergency expense from savings, which underscores the importance of this financial cushion.

Tackling Debt Strategically

Debt, especially high-interest debt, can significantly hinder your financial progress. List all your debts, including student loans, credit cards, and personal loans. Pay off high-interest debt first while making minimum payments on others. For student loans, explore income-driven repayment plans or refinancing options to potentially lower your monthly payments. Student loan debt in the United States totals $1.773 trillion, emphasizing the need for a solid repayment strategy.

Building a Strong Credit Profile

Your credit score plays a vital role in your financial life, affecting everything from loan approvals to interest rates. To build and maintain good credit:

- Pay all bills on time – payment history accounts for 35% of your FICO score.

- Keep credit utilization below 30% of your available credit.

- Avoid opening multiple new credit accounts in a short period.

- Check your credit report regularly for errors – you’re entitled to one free report annually from each major credit bureau.

According to Experian, the average FICO score in the U.S. reached 714 in 2023 (an all-time high). Try to reach or exceed this benchmark to unlock better financial opportunities.

Tailored Strategies for High-Income Earners

For professional athletes and high-income earners, these principles remain important but require more nuanced strategies. Specialized firms like Davies Wealth Management create tailored plans that address the unique financial challenges faced by athletes and high-net-worth individuals. These plans ensure their financial foundation is robust enough to support their specific lifestyle and career trajectories.

Consistency is Key

Focus on these three key areas – emergency savings, debt management, and credit building – to create a solid financial base that supports your long-term financial goals. Building this foundation takes time and consistency, but the payoff in financial security and peace of mind proves invaluable.

As you establish your financial foundation, the next step involves looking towards the future and making your money work for you. Let’s explore how to invest wisely and plan for long-term financial success.

How to Invest for Long-Term Growth

Diversify Your Investment Portfolio

Portfolio diversification is a key to long-term investment success. A well-diversified portfolio includes a mix of stocks, bonds, and potentially, alternative investments. Stocks offer high return potential with higher risk. Bonds provide stability and regular income. Mutual funds and Exchange-Traded Funds (ETFs) offer instant diversification and professional management.

Young adults benefit from a higher allocation to stocks due to their longer investment horizon. The S&P 500 (representing 500 of the largest U.S. companies) has historically returned about 10% annually before inflation. (Remember, past performance doesn’t guarantee future results.)

Maximize Retirement Accounts

Retirement accounts build long-term wealth. If your employer offers a 401(k) plan, contribute enough to get the full company match. The average 401(k) balance was $141,542 in 2021, an increase of about 10% from 2020. Increase your contributions to boost this figure over time.

Open an Individual Retirement Account (IRA) in addition to your 401(k). A Roth IRA benefits young adults particularly. While you make contributions with after-tax dollars, withdrawals in retirement are tax-free. In 2024, you can contribute up to $7,000 to an IRA if you’re under 50.

Plan for Major Life Goals

Invest for goals beyond retirement, such as buying a home or starting a business. For goals 5-10 years away, consider a mix of stocks and bonds. Focus on more conservative investments for nearer-term goals to protect your principal.

If you want to buy a home, start saving for a down payment early. The median home price in the U.S. was $423,200 in Q4 2023 according to the Federal Reserve Bank of St. Louis. Try to save at least 20% for a down payment to avoid private mortgage insurance.

Seek Professional Guidance

Navigate the investment landscape with expert help. Financial advisors create comprehensive investment strategies that align with your unique goals and risk tolerance. Whether you’re a young professional or a professional athlete with complex financial needs, professional guidance helps build a secure financial future.

If you’re considering a wealth management firm, Davies Wealth Management offers tailored solutions for various clients, including specialized services for professional athletes. Their expertise in addressing unique financial challenges makes them a top choice among competitors.

Retirement planning will likely be one of the most important components of your overall financial plan throughout your career. It’s also the best time to develop sound financial habits by preparing a budget, establishing a saving pattern, setting financial goals, and following a wise investment strategy.

Final Thoughts

Starting financial planning as a young adult will impact your future significantly. You set yourself up for long-term success and financial security when you take control of your finances early. The power of compound interest makes even small, consistent investments in your 20s and 30s grow significantly over time, potentially leading to a comfortable retirement.

Time stands as your greatest asset in wealth building. The earlier you start to save and invest, the more time your money has to grow. This principle applies to retirement savings and other financial goals like buying a home or starting a business. You lay the groundwork for a lifetime of financial stability when you develop good financial habits now.

The world of finance can seem complex, but you don’t have to navigate it alone. Professional advice proves invaluable, especially as your financial situation becomes more complex. At Davies Wealth Management, we offer tailored solutions to help you achieve your unique financial goals (including financial planning for young adults). Our expertise extends to serving professional athletes, addressing their specific financial challenges and opportunities.

Leave a Reply