Creating a solid financial plan is essential for any business’s success and growth. At Davies Wealth Management, we understand the importance of integrating business plan financial planning into your overall strategy.

A well-crafted financial plan serves as a roadmap, guiding your business through various economic landscapes and helping you make informed decisions. This blog post will walk you through the key steps to develop a comprehensive financial plan tailored to your business needs.

Where Do You Stand Financially?

Organize Your Financial Documents

The first step to assess your current financial situation involves collecting all relevant financial documents. This includes bank statements, tax returns, profit and loss statements, balance sheets, and cash flow statements from the past three years. For new businesses, gather all available financial records. A study by the U.S. Small Business Administration reveals that 67.9% of new employer establishments survive their first two years.

Analyze Your Cash Flow

Cash flow analysis forms the backbone of your business’s financial health. Examine your income sources and spending patterns. Identify peak and slow seasons, and determine the cash required to keep your business running smoothly. A study by U.S. Bank found that 82% of small businesses fail due to cash flow issues. To avoid this pitfall, create a detailed cash flow projection for the next 12 months.

Evaluate Revenue Streams

A thorough examination of your revenue streams is essential. Determine which products or services generate the most profit and identify any underperformers. A McKinsey report suggests that top-performing businesses increased their revenues at a median rate of 11 percent per year. Consider diversifying your income sources to create a more stable financial foundation.

Identify Financial Strengths and Weaknesses

Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) focused on your financial situation. This process will help you pinpoint areas of excellence and those that need improvement. For example, you might have a strong cash reserve (strength) but high operational costs (weakness). Understanding these factors will guide your financial planning decisions and help you prioritize your goals.

The insights gained from this comprehensive financial assessment will provide a solid foundation for the next steps in creating your business financial plan. Regular reviews of your financial position will help you stay on track and make informed decisions as your business grows and evolves. Now, let’s move on to setting clear financial goals that align with your newly gained financial insights.

What Are Your Financial Goals?

Define Your Business Objectives

Start by outlining your short-term and long-term business objectives. Short-term goals might include increasing monthly revenue by 15% or reducing operational costs by 10% within the next quarter. Long-term objectives could involve expanding to new markets or doubling your customer base within three years.

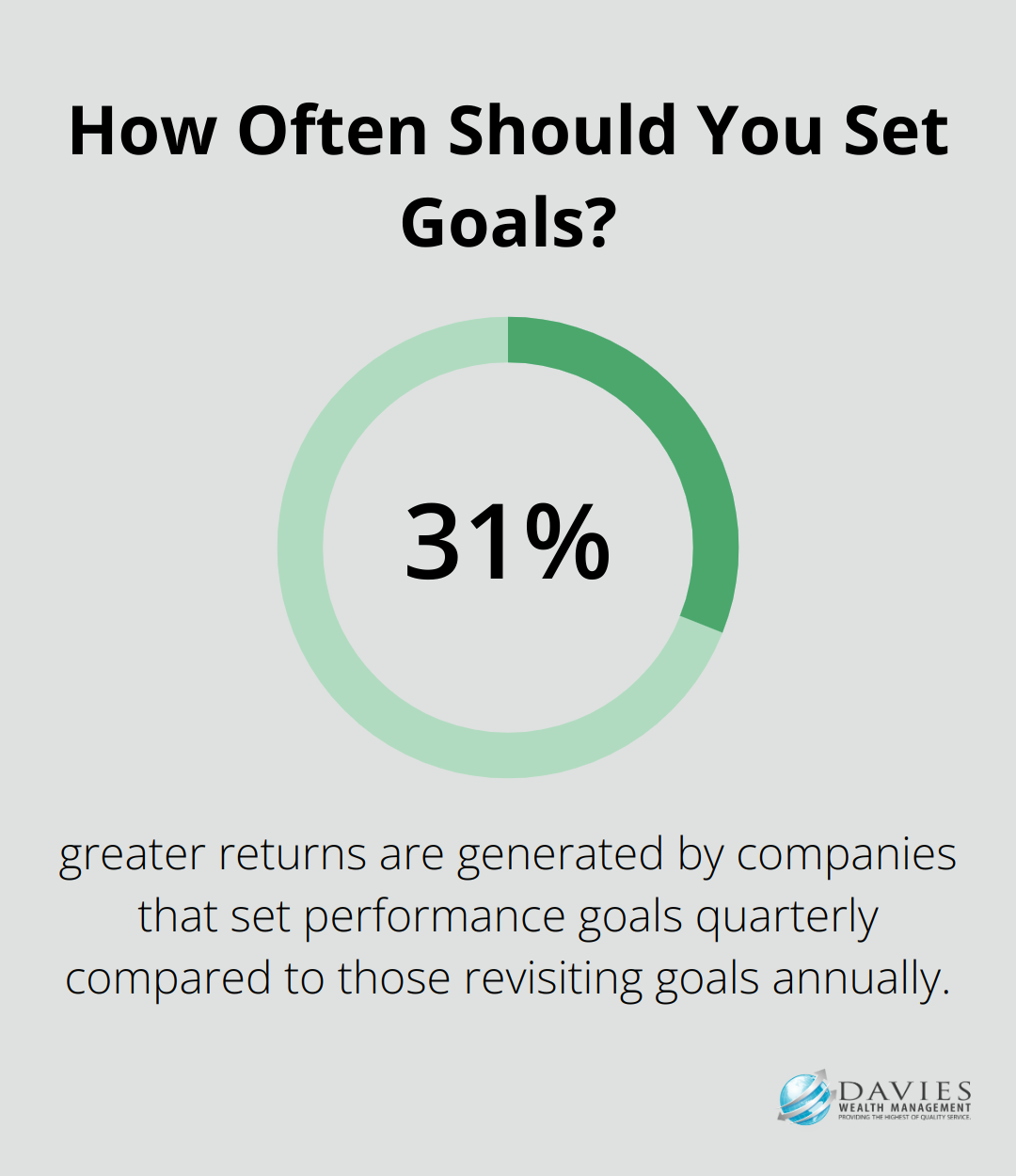

A study found that companies that set performance goals quarterly can generate 31% greater returns than those revisiting goals annually. This underscores the importance of frequent review and adjustment of your objectives.

Create SMART Financial Targets

Transform your business objectives into Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) financial targets. For instance, instead of a vague goal like “increase profits,” set a SMART goal such as “increase net profit margin from 10% to 15% within the next 12 months by optimizing operational efficiency and expanding our high-margin product line.”

Research shows that companies with clearly defined and communicated goals achieve higher returns than companies without them. This highlights the tangible benefits of setting precise financial targets.

Align Goals with Business Strategy

Ensure your financial goals support your overall business strategy. If your strategy focuses on market expansion, your financial goals should include allocating resources for marketing, sales, and potentially new hires. If you aim for product innovation, your financial plan should account for increased R&D spending.

Strong financial planning and analysis can create more organizational alignment, support for leadership, and business growth. This alignment is essential for sustainable growth and success.

When you set your financial goals, consider factors like market trends, competitive landscape, and economic conditions. The U.S. Small Business Administration recommends reviewing your goals at least annually, but quarterly reviews can help you stay agile in rapidly changing markets.

While ambitious goals can drive growth, they must also be realistic. Unrealistic targets can lead to frustration and demotivation. Try to strike the right balance, setting challenging yet achievable financial goals that propel your business forward.

With your financial goals clearly defined and aligned with your business strategy, the next step is to develop concrete strategies to achieve these objectives. Let’s explore how to create a roadmap for financial success in the next section.

Turning Financial Goals into Reality

Create a Realistic Budget

A realistic budget forms the foundation for achieving financial goals. We recommend a zero-based budgeting approach, which requires justification of every expense from scratch. Companies like Guess, Kraft Heinz, and Unilever have successfully used this method to slash costs.

Implement Cost-Cutting Measures

To cut costs effectively, review your expenses thoroughly. Look for opportunities to negotiate better terms with suppliers or switch to cost-effective alternatives. For example, transitioning to cloud-based software solutions can reduce IT costs significantly.

Explore Funding and Investment Options

Consider a mix of traditional and alternative funding sources. While bank loans remain popular, crowdfunding platforms have gained traction, with the global crowdfunding market expected to grow at a compound annual growth rate of 16.7% from 2023 to 2030. For investments, diversification is key.

Establish Financial Policies and Procedures

Clear financial policies and procedures maintain financial discipline. Implement checks and balances, such as requiring dual signatures for large expenditures. Organizations with anti-fraud controls can experience lower fraud losses compared to those without such controls.

Build an Emergency Fund

An emergency fund is essential for business stability. Try to set aside 3-6 months of operating expenses. The Federal Reserve conducts annual Small Business Credit Surveys to assess the financial health and credit needs of small businesses.

For professional athletes (who often have short career spans and fluctuating incomes), we emphasize the importance of a robust financial cushion. We suggest setting aside a higher percentage of earnings during peak years to ensure long-term financial security.

Regular review and adjustment of strategies as market conditions change will position your business for success. The most successful businesses remain agile and responsive to new opportunities and challenges.

Final Thoughts

A comprehensive financial plan forms the cornerstone of any business’s long-term success. We assess your current financial situation, set clear goals, and develop strategies to achieve them. This approach lays a solid foundation for your company’s future and provides a dynamic tool that evolves with your business.

Market conditions, industry trends, and business needs change over time. We review and adjust your financial plan regularly to navigate challenges and seize opportunities as they arise. Our expertise in business plan financial planning allows us to offer tailored solutions that align with your specific situation.

At Davies Wealth Management, we specialize in helping businesses achieve their financial goals (including professional athletes with unique financial needs). We provide comprehensive advice to support your journey to financial success. Visit our website to learn more about how we can assist you in creating a roadmap for your business’s future.

Leave a Reply