Millennials face unique financial challenges, but they also have unprecedented opportunities to build wealth. At Davies Wealth Management, we’ve seen firsthand how the right investment strategies for millennials can make a significant difference in their financial futures.

This guide will explore smart ways for young adults to overcome common barriers and start investing wisely, even with limited resources.

Who Are Millennial Investors?

The Student Debt Challenge

Millennial investors, born between 1981 and 1996, confront unique financial obstacles that influence their wealth-building strategies. One of the most significant hurdles is student loan debt. Federal borrowers aged 25 to 34 owe an average debt of $33,081. This debt burden often postpones major life milestones and affects investment capacity. Research indicates that the continued rise in student debt along with a weak labor market has a long-term impact on the ability of first-time homebuyers to purchase homes.

Economic Volatility and Career Shifts

Millennials entered the workforce during or after the 2008 financial crisis, which has left lasting impacts on their financial outlook. The U.S. Bureau of Labor Statistics indicates that millennials switch jobs an average of four times in their first decade out of college (compared to two job changes for Gen Xers). This career volatility can lead to inconsistent income and complicate long-term financial planning.

The Gig Economy’s Impact

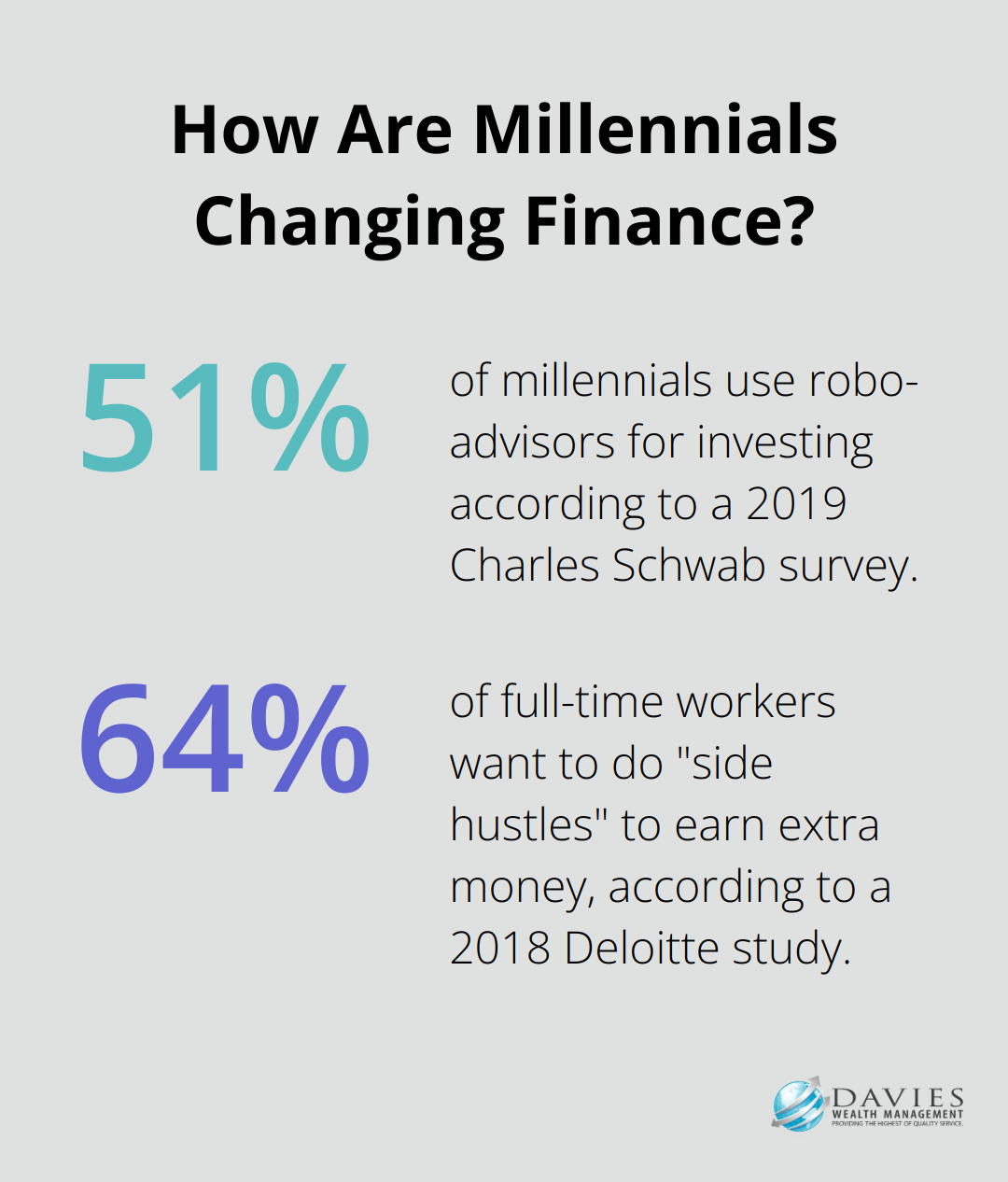

The gig economy has become a significant part of millennial work life. A 2018 Deloitte study revealed that 64% of full-time workers want to do “side hustles” to earn extra money. While this offers flexibility, it also results in less stable income and fewer employer-sponsored benefits, including retirement plans.

Tech-Savvy Investment Approach

Despite these challenges, millennials leverage technology to their advantage in investing. A 2019 Charles Schwab survey showed that 51% of millennials use robo-advisors for investing (compared to 16% of Gen X and 4% of Baby Boomers). This tech-forward approach allows for more accessible and often lower-cost investment options.

Focus on Socially Responsible Investing

Millennials drive the growth in socially responsible investing. According to a Morgan Stanley report, there is significant interest in sustainable investing among individual investors. This trend reshapes the investment landscape, with more funds and companies focusing on environmental, social, and governance (ESG) factors.

These unique characteristics and preferences of millennial investors shape their approach to wealth management. The next section will explore smart investment strategies tailored to address the specific needs of this generation, helping them navigate student debt while building long-term wealth through diversified, socially responsible investment portfolios.

Millennial Investment Strategies That Work

The Power of Compound Interest

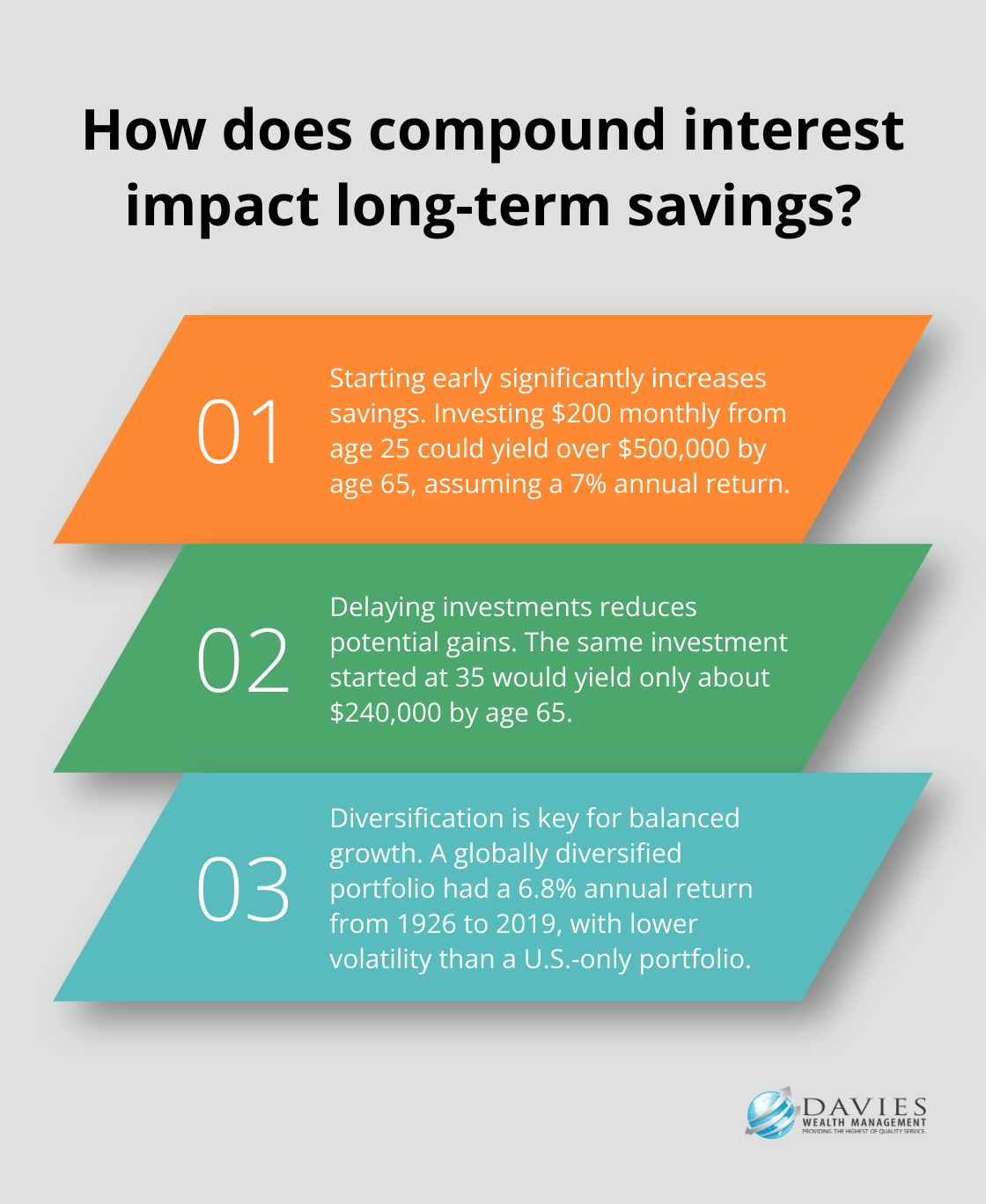

Starting early is a game-changer. Small, consistent investments can grow significantly over time due to compound interest. If you invest $200 monthly starting at age 25 (assuming an average annual return of 7%), you could have over $500,000 by age 65. This same investment started at 35 would yield only about $240,000. The message is clear: start now, even with small amounts.

Diversification: Your Shield Against Market Volatility

A diversified investment portfolio is essential. This doesn’t just mean spreading investments across stocks and bonds. Try a mix that includes domestic and international stocks, bonds, real estate investment trusts (REITs), and even alternative investments like commodities. A globally diversified, balanced portfolio had a 6.8% annual return from 1926 to 2019, with lower volatility than a U.S.-only portfolio.

Maximize Tax Advantages

Tax-advantaged accounts are a smart move for millennials. Prioritize contributing to your employer-sponsored 401(k), especially if there’s a company match (it’s essentially free money). For those without access to a 401(k), or for additional savings, consider a Roth IRA. In 2023, you can contribute up to $6,500 to a Roth IRA if you’re under 50 ($7,500 if you’re 50 or older). The beauty of a Roth IRA is that your earnings grow tax-free, and you can withdraw contributions at any time without penalty.

Embrace Low-Cost Investment Options

Low-cost index funds and ETFs are excellent options for millennial investors. These funds offer broad market exposure at a fraction of the cost of actively managed funds. The average expense ratio for passive index funds was 0.12% in 2020 (compared to 0.62% for actively managed funds). Over time, this difference can significantly impact your returns.

Leverage Technology for Smarter Investing

Robo-advisors and digital platforms have revolutionized investing for millennials. These platforms offer professionally managed portfolios with low minimum investments and fees. Some robo-advisors charge as little as 0.25% annually for management (compared to the 1-2% typically charged by traditional financial advisors). They also provide features like automatic rebalancing and tax-loss harvesting, which can enhance your returns over time.

Each millennial investor has unique needs and goals. While these strategies provide a solid foundation, consulting with a financial advisor to create a personalized investment plan that aligns with your specific situation and long-term objectives is recommended. The next chapter will address common investment barriers and how to overcome them, ensuring you’re well-equipped to navigate the financial landscape confidently.

Breaking Down Investment Barriers

Conquering Investment Fears

Many millennials avoid investing due to misconceptions about risk and complexity. 53% of millennials believe they will save more in 2025, showing an increasing optimism towards financial planning. To overcome investment hesitation, start small. Invest even $50 a month in a low-cost index fund to build confidence and familiarity with the market. Apps like Acorns or Stash allow you to invest spare change, which makes the process less intimidating.

Balancing Present and Future Financial Needs

Millennials often struggle to juggle student loans, rent, and daily expenses while saving for the future. The key is to prioritize. First, build an emergency fund that covers 3-6 months of expenses. Then, allocate a portion of your income to debt repayment and investments. The 50/30/20 rule can serve as a helpful guideline: 50% for necessities, 30% for wants, and 20% for savings and debt repayment. Adjust these percentages based on your specific situation.

Boosting Financial Literacy

Financial education plays a vital role in successful investing. To improve your knowledge, use free resources like Khan Academy’s personal finance courses or the SEC’s Investor.gov website. Follow reputable financial news sources and consider joining investment clubs or forums to learn from peers.

Seeking Professional Guidance

While self-education is valuable, professional advice can provide tailored strategies for your unique financial situation. A financial advisor can help you create a comprehensive investment plan, navigate complex financial decisions, and adjust your strategy as your life circumstances change. If you’re considering professional guidance, Davies Wealth Management offers personalized wealth management solutions for individuals at various stages of their financial journey.

Embracing Technology for Investing

Technology has revolutionized investing, making it more accessible and affordable for millennials. Robo-advisors offer low-cost, automated investment management with many having low- or no-minimum investment requirements. These platforms provide features like automatic rebalancing and tax-loss harvesting, which can enhance your returns over time. However, it’s important to understand the limitations of these tools and consider when human expertise (such as that provided by Davies Wealth Management) might be more beneficial for complex financial situations.

Final Thoughts

Millennials face unique financial challenges but have unprecedented opportunities to build wealth. The key to financial success is to start early, stay committed, and adapt to market changes. Compound interest, diversification, and tax-advantaged accounts form the foundation of smart investing for this generation.

Low-cost investment options and technology have made investing more accessible than ever before. Continuous financial education empowers millennials to make informed decisions and adjust strategies as needed. Taking control of your financial future starts now, regardless of where you are in your career.

At Davies Wealth Management, we understand the unique financial needs of millennials. Our team provides personalized investment strategies for millennials at every stage of life. We help you navigate your financial journey with confidence, ensuring you can build, protect, and transfer your wealth effectively.

Leave a Reply