Starting your financial planning journey can feel overwhelming, but it’s a crucial step towards securing your financial future. At Davies Wealth Management, we often get asked: “What is the first step of financial planning?”

The truth is, there’s no one-size-fits-all answer. However, understanding your current financial situation is typically a great place to begin. This blog post will guide you through the essential steps to kickstart your financial planning journey and set you on the path to financial success.

What’s Your Financial Snapshot?

Tracking Income and Expenses

The first step to assess your financial health involves tracking your income and expenses. This process requires more than a quick look at your bank statements. We suggest you maintain a detailed record of all money flowing in and out for at least three months. This should include your salary, bonuses, investment income, and any other revenue sources, as well as fixed expenses like rent or mortgage payments, utilities, and discretionary spending on entertainment or dining out.

Many people find success using budgeting or expense-tracking apps to categorize their expenses. The key is to regularly monitor your expenses. Consider setting a schedule for yourself, such as weekly or monthly reviews, to stay on top of your financial situation.

Calculating Net Worth

Your net worth serves as a key indicator of your overall financial health. You can calculate it by listing your assets (what you own), estimating the value of each, and adding up the total. Then, list your liabilities (what you owe) and add up the outstanding balances. Subtract your total liabilities from your total assets to determine your net worth.

Don’t feel discouraged if your net worth is negative, especially if you’re early in your career. The key is to monitor how this number changes over time.

Credit Report and Score Review

Your credit report and score significantly impact your financial life, affecting everything from loan approvals to interest rates. We advise you to review your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) at least annually. Free weekly online credit reports are available from these bureaus.

Pay close attention to any errors or discrepancies in your report. Correcting these errors can significantly improve your credit score.

As for your credit score, try to achieve a FICO score of 700 or higher. This range is considered good to excellent and can qualify you for better interest rates on loans and credit cards. If your score is lower, focus on paying bills on time and reducing credit card balances, as these factors heavily influence your score.

A thorough assessment of these aspects of your financial situation will provide a solid foundation for the next steps in your financial planning journey. With this clear picture of your current financial state, you’re ready to move on to setting clear and achievable financial goals that will guide your path forward.

Set Clear Financial Goals

Define Your Financial Objectives

Start by envisioning your ideal financial future. Do you want to buy a home in the next five years? Do you aim to retire by 55? Perhaps you’re a professional athlete looking to secure your financial future beyond your playing career. Writing down your goals can have multifaceted benefits for your financial planning.

Next, categorize these goals into short-term (1-3 years), medium-term (3-10 years), and long-term (10+ years) objectives. This categorization helps you create a balanced approach to your finances, ensuring you don’t neglect immediate needs while planning for the future.

Prioritize Your Financial Aspirations

Not all financial goals hold equal weight. Some may be urgent, while others are important but less time-sensitive. Rank your goals based on their importance and urgency. For instance, building an emergency fund might take precedence over saving for a luxury vacation. Creating a savings habit is one of the fastest ways to see progress in your financial goals.

Consider using a prioritization matrix. On one axis, rate the importance of each goal from 1-10. On the other axis, rate its urgency. Goals that score high on both axes should become your top priorities.

Create SMART Financial Goals

To increase the likelihood of achieving your financial objectives, make them SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of “save for retirement,” a SMART goal would be “contribute $1,500 monthly to my 401(k) to reach $1 million by age 65.”

Specific: Clearly define what you want to achieve. “Buy a house” becomes “Purchase a 3-bedroom house in [specific area] for around $350,000.”

Measurable: Attach a number to your goal. “Increase savings” becomes “Save 20% of my monthly income.”

Achievable: Ensure your goal is realistic given your current financial situation. If you’re earning $50,000 annually, try to save a percentage that aligns with your income and expenses.

Relevant: Your goal should align with your overall financial plan and life objectives. If you’re planning to start a family, saving for your child’s education might be more relevant than saving for an expensive sports car.

Time-bound: Set a deadline. “Pay off credit card debt” becomes “Pay off $10,000 in credit card debt within 18 months.”

Setting clear, prioritized, and SMART financial goals lays a solid foundation for your financial planning journey. Life changes, and so should your financial objectives. Regularly review and adjust your goals to ensure they remain aligned with your evolving financial situation and life circumstances. With your goals clearly defined, you’re ready to move on to the next step: creating and implementing your financial plan.

How to Build a Solid Financial Foundation

Create Your Emergency Fund

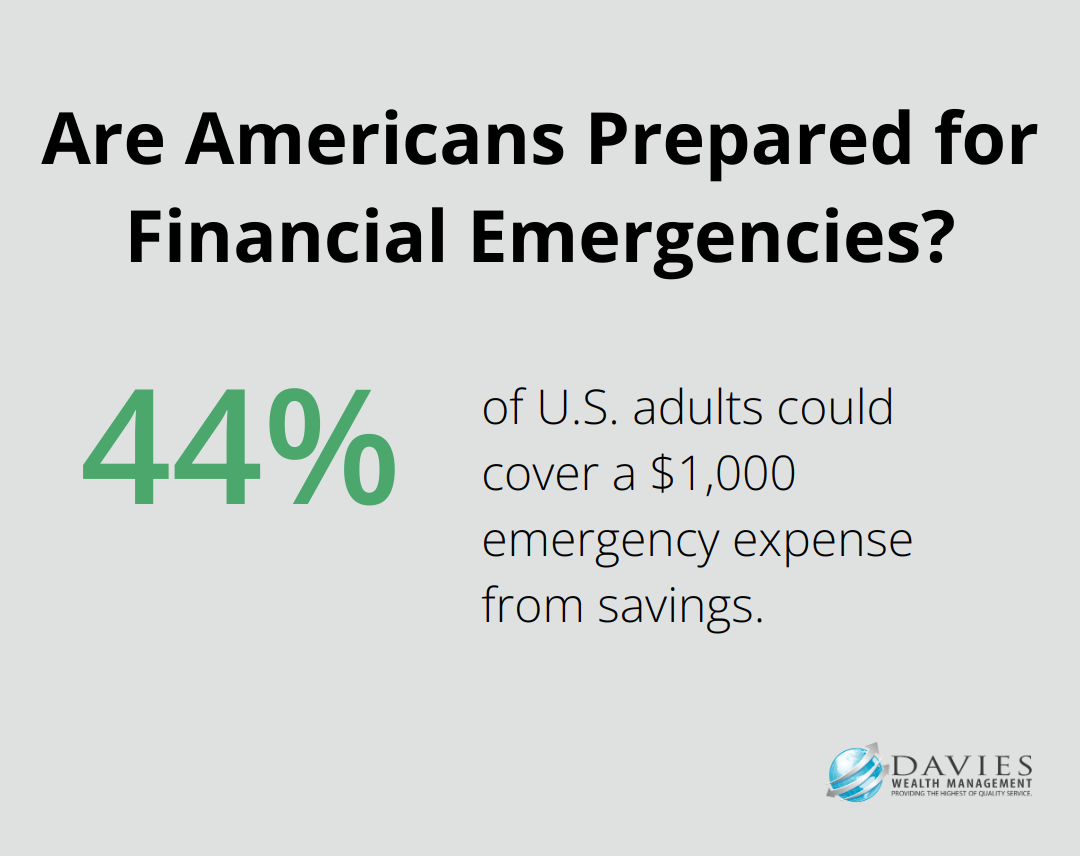

An emergency fund serves as your first line of defense against unexpected financial shocks. Try to save 3-6 months of living expenses. Start small if needed – even $500 can make a difference. A December 2023 Bankrate survey revealed that only 44% of U.S. adults could cover a $1,000 emergency expense from savings. Don’t become part of that statistic.

To build your fund, automate your savings. Set up a separate high-yield savings account and transfer a fixed amount each payday. The “pay yourself first” strategy (treating savings as a non-negotiable expense) often leads to success.

Develop a Debt Repayment Strategy

Debt can significantly hinder financial progress. As of Q3 2023, the average American household carries $7,951 in credit card debt (according to WalletHub). To tackle this, consider the avalanche method: focus on high-interest debts first while making minimum payments on others.

For example, if you have a credit card with 18% APR and a personal loan at 8%, prioritize the credit card. This approach minimizes interest payments over time. However, if you need psychological wins, the snowball method (paying off smallest debts first) can provide motivation.

Start Investing for Growth

Investing plays a key role in long-term wealth building. The S&P 500 has historically returned about 10.473% annually over the last 20 years, as of the end of July 2024. Start with your employer-sponsored retirement plan if available, especially if there’s a match – it’s essentially free money.

For those without employer plans or looking to invest more, consider low-cost index funds or ETFs. These provide broad market exposure with minimal fees. Time in the market beats timing the market. Consistent, long-term investing often outperforms attempts to predict market movements.

Protect Your Assets with Insurance

Insurance forms a critical yet often overlooked aspect of financial planning. At minimum, ensure you have adequate health, auto, and homeowners/renters insurance. For those with dependents, life insurance becomes essential. A general rule of thumb suggests coverage of 10-15 times your annual income.

Don’t overlook disability insurance. The Social Security Administration reports that one in four 20-year-olds will become disabled before reaching retirement age. This coverage can protect your income if you’re unable to work.

Implement Effective Tax Planning

Effective tax planning can significantly impact your financial health. Utilize tax-advantaged accounts like 401(k)s and IRAs. For 2024, you can contribute up to $23,000 to a 401(k) if you’re under 50, and $30,500 if you’re 50 or older.

Consider tax-loss harvesting in taxable investment accounts. This involves selling investments at a loss to offset capital gains, potentially reducing your tax bill. Always consult with a tax professional for personalized advice.

Create and Stick to a Budget

A budget serves as your roadmap to financial success. Track your income and expenses meticulously. The 50/30/20 rule can provide a good starting point: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Use budgeting apps to simplify the process. Regular review becomes key – monthly check-ins help ensure you stay on track and make necessary adjustments.

Final Thoughts

The first step of financial planning involves assessing your current financial situation. This assessment includes evaluating your income, expenses, net worth, and credit health. With this foundation, you can set clear, prioritized financial goals that align with your aspirations and life circumstances.

Financial planning requires ongoing attention and adjustment as your life circumstances and economic conditions change. We recommend you review your financial plan annually or when significant life events occur. As your wealth grows or your situation becomes more complex, professional advice can provide valuable insights.

At Davies Wealth Management, we offer personalized financial planning strategies for individuals, families, businesses, and professional athletes. Our expertise can help you navigate complex financial landscapes and optimize your wealth management approach. Take control of your financial future today by starting your financial planning journey.

Leave a Reply