Wealth preservation is a critical aspect of financial planning that often gets overlooked. At Davies Wealth Management, we understand the importance of safeguarding your hard-earned assets for the long term.

A well-crafted wealth preservation strategy can help protect your financial legacy from market volatility, economic uncertainties, and unforeseen life events. In this post, we’ll explore key components and practical steps to create a robust plan that secures your wealth for generations to come.

What Is Wealth Preservation?

The Essence of Wealth Protection

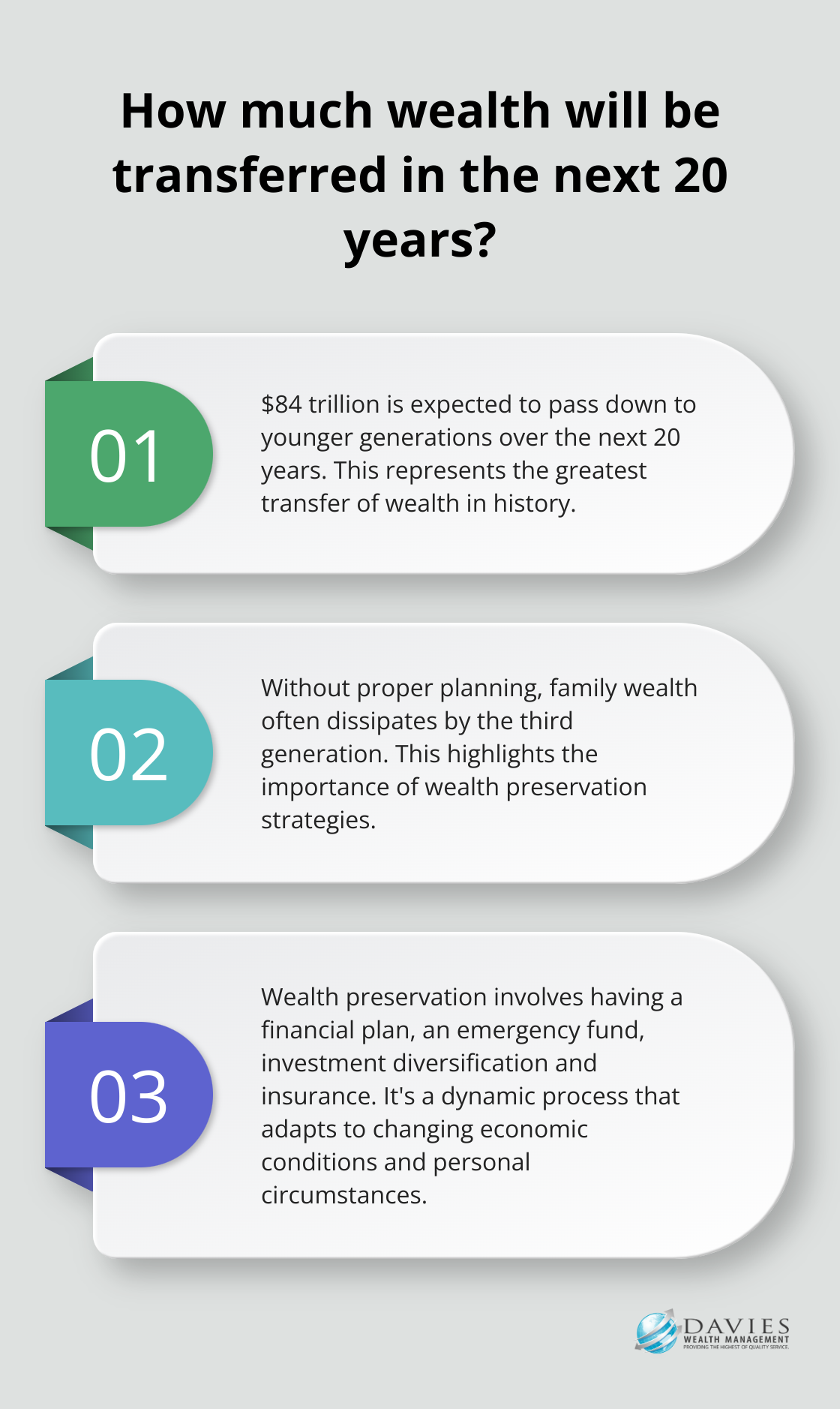

Wealth preservation transcends the simple maintenance of financial status; it involves having a financial plan, an emergency fund, investment diversification and insurance. This dynamic process adapts to changing economic conditions and personal circumstances, creating a financial fortress capable of withstanding economic storms while fostering growth.

The Importance of Preserving Wealth

In today’s volatile economic landscape, wealth preservation takes center stage. Over the next 20 years, the world will experience the greatest transfer of wealth in history with 84 trillion dollars expected to pass down to younger generations. This concern is well-founded; historical data indicates that without proper planning, family wealth often dissipates by the third generation.

Key Components of a Robust Strategy

A successful wealth preservation strategy encompasses several critical elements:

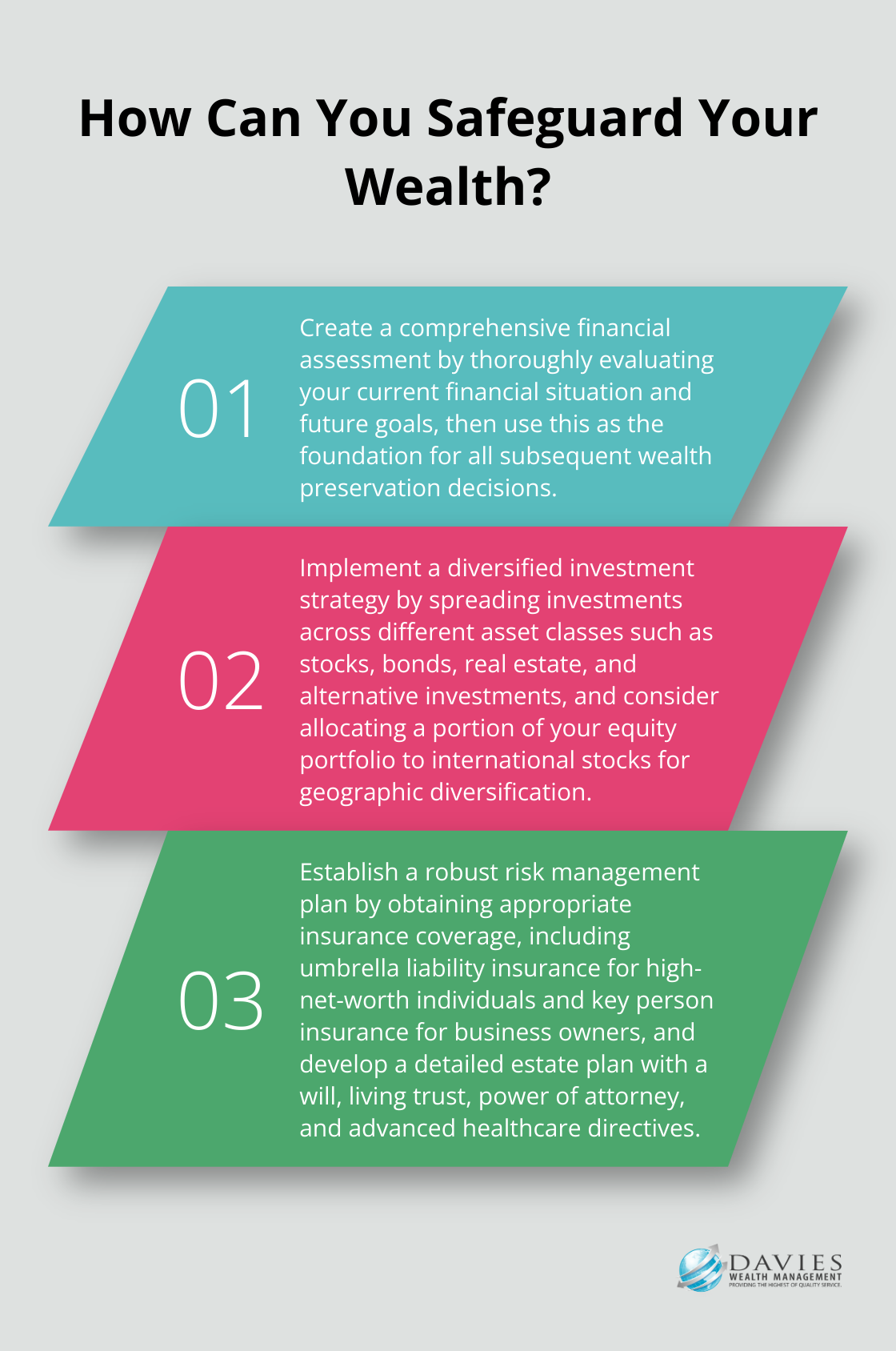

- Comprehensive Financial Assessment: A thorough understanding of your current financial situation and future goals forms the foundation for all subsequent decisions.

- Diversification: The age-old wisdom of not putting all eggs in one basket holds true. A well-diversified portfolio helps mitigate risks associated with market fluctuations and economic downturns.

- Risk Management: This includes not only investment risk but also personal and business risks. Proper insurance coverage (e.g., life, disability, and liability) can protect your assets from unforeseen events.

Tailoring Your Approach

Each individual’s financial situation demands a unique approach. Professional athletes, for instance, require specialized strategies due to their distinctive income patterns and career timelines. These strategies must account for income volatility and high expenses.

Business owners might focus on succession planning and strategies to protect business assets. Individuals nearing retirement may prioritize income generation and estate planning.

The Need for Flexibility

A comprehensive wealth preservation strategy should possess the flexibility to adapt to changing circumstances while maintaining focus on long-term financial goals. It’s not a one-time setup but an ongoing process that requires regular review and adjustment.

As we move forward, let’s explore the cornerstone of any robust wealth preservation strategy: diversification. This powerful tool spreads risk and maximizes potential returns across various asset classes and geographic regions.

How to Diversify Your Wealth

Spreading Investments Across Asset Classes

Diversification forms the foundation of a robust wealth preservation strategy. History has shown that diversification can lower risk without lowering returns, and thus can be a powerful tool when creating a plan to preserve and grow wealth. A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and alternative investments.

Real estate investment trusts (REITs) offer another avenue for diversification. REITs provide steady income and potential for capital appreciation.

Going Global with Your Investments

Geographic diversification plays a vital role in wealth preservation. Adding international assets to your investment strategy can potentially enhance your portfolio’s resilience and generate additional growth. Investing in international markets can offset risks associated with domestic economic downturns.

Many financial advisors suggest allocating a portion of an equity portfolio to international stocks (depending on risk tolerance and financial goals). This approach helps capture growth opportunities in emerging markets while balancing the stability of developed markets.

Balancing Growth and Stability

Preserving wealth requires a balance between growth and stability. A balanced approach combines growth-oriented investments with stable, income-producing assets. Dividend-paying stocks, for instance, provide both growth potential and regular income.

For those nearing retirement, increasing allocation to bonds and other fixed-income securities can provide stability.

Tailoring Diversification to Individual Needs

Each investor’s situation demands a unique approach to diversification. Professional athletes, for example, require specialized strategies due to their short career windows and fluctuating incomes. Business owners might focus on diversifying outside their primary business to spread risk.

A qualified financial advisor can help create a diversified portfolio that aligns with specific financial goals, risk tolerance, and time horizon. Whether you’re planning for long-term growth or seeking to preserve wealth in retirement, a tailored diversification strategy can help protect and grow your assets over time.

As we move forward, let’s explore another critical aspect of wealth preservation: risk management strategies. These strategies complement diversification efforts and provide an additional layer of protection for your hard-earned wealth.

Safeguarding Your Wealth: Comprehensive Risk Management Strategies

Insurance: Your Financial Shield

Insurance serves as a critical defense against unforeseen events that could erode your wealth. In 2022, global insurance premiums reached $6.3 trillion, underscoring the growing recognition of insurance’s role in financial security.

High-net-worth individuals often require more than standard policies. Umbrella liability insurance provides additional coverage beyond primary policies, which proves invaluable in today’s litigious society where a single lawsuit could wipe out years of wealth accumulation.

Business owners should consider key person insurance. This policy protects your company if a crucial team member dies or becomes disabled. The proceeds can help cover lost revenue and the costs of finding and training a replacement.

Estate Planning: Preserving Wealth Across Generations

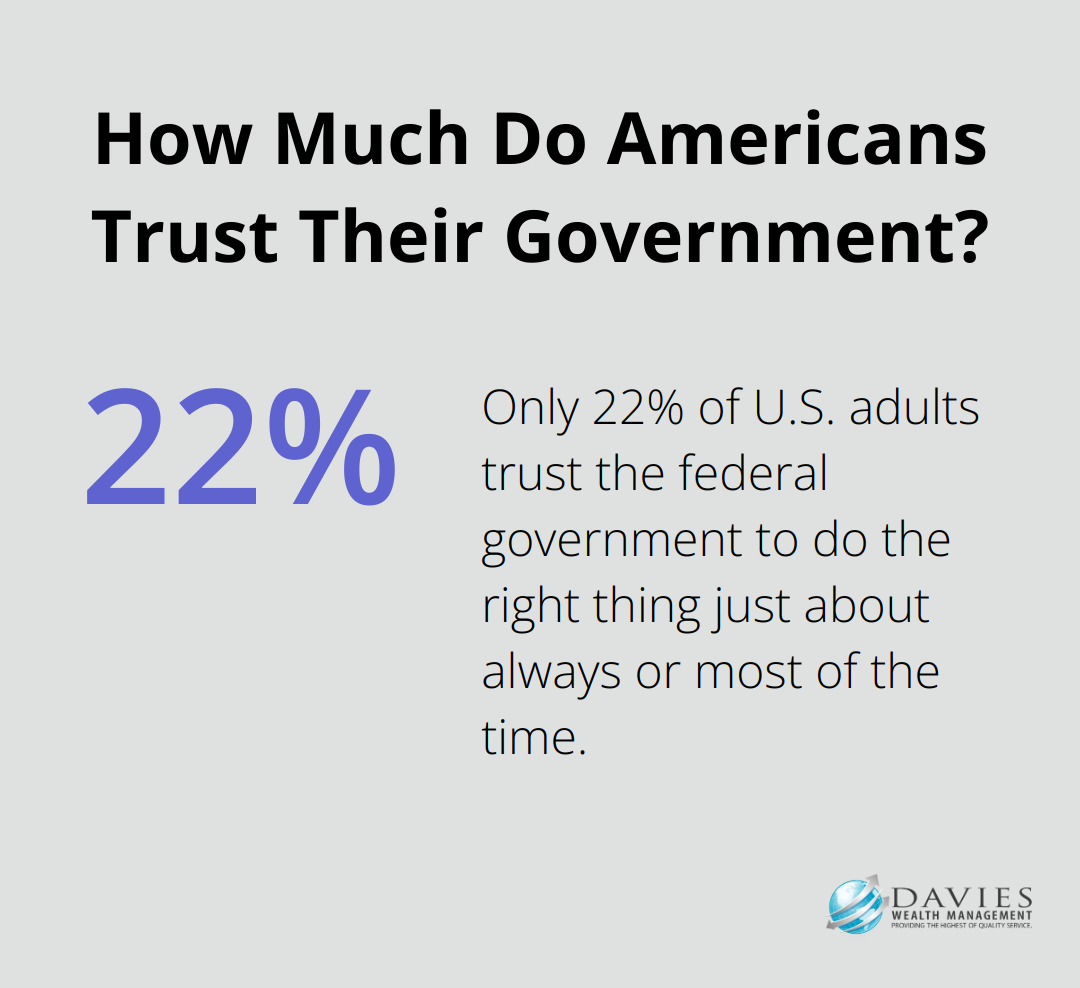

Estate planning plays a vital role in wealth preservation. A survey revealed that only 22% of U.S. adults said they trust the federal government to do the right thing just about always or most of the time, which could impact estate planning decisions.

A robust estate plan should include:

- A will or living trust to dictate asset distribution

- Power of attorney for financial and healthcare decisions

- Advanced healthcare directives

For substantial estates, irrevocable trusts provide tax benefits and protect assets from creditors. Family limited partnerships (FLPs) offer another tool to consider, especially for family-owned businesses.

Tax-Efficient Investing: Minimizing Liabilities

Reducing tax liabilities is essential for wealth preservation. The top 1 percent of taxpayers paid a 23.1 percent average rate in 2024. Strategic tax planning can significantly reduce this burden.

Asset location proves effective – placing investments in accounts based on their tax treatment. For example, hold high-yield bonds in tax-advantaged accounts like IRAs, while keeping growth stocks in taxable accounts to benefit from lower long-term capital gains rates.

Municipal bonds offer tax-free income. In 2022, the municipal bond market was valued at $4 trillion, providing a wide range of investment options.

For those with charitable inclinations, donor-advised funds provide immediate tax benefits while allowing for future charitable giving. This strategy can be particularly effective in high-income years.

Tailored Strategies for Unique Situations

Professional athletes face specific risks associated with short career spans and fluctuating incomes. A comprehensive risk management strategy for athletes should address these unique challenges, ensuring financial security both during and after their playing careers.

Davies Wealth Management specializes in creating customized risk management strategies that align with each client’s unique financial situation. Our expertise in serving professional athletes allows us to address the specific risks associated with their careers effectively.

Final Thoughts

A robust wealth preservation strategy protects your financial future through diversification and comprehensive risk management. Your unique financial situation, goals, and risk tolerance should shape your personalized approach. We at Davies Wealth Management craft tailored wealth preservation strategies that address the specific needs of our clients, including professional athletes with unique financial challenges.

Our team of experts helps you navigate the complexities of wealth management. We provide clear, actionable solutions to build, protect, and transfer your wealth with confidence. Regular reviews and adjustments ensure your plan remains aligned with your evolving needs and changing market conditions.

Take the first step towards securing your wealth by partnering with Davies Wealth Management. Our personalized approach and expertise in creating comprehensive wealth preservation strategies can help you achieve your financial goals. We strive to ensure a lasting legacy for generations to come.

Leave a Reply