Long-term investment strategies are the cornerstone of building lasting wealth. At Davies Wealth Management, we’ve seen firsthand how these approaches can transform financial futures.

Contrary to popular belief, successful long-term investing isn’t about timing the market or chasing hot trends. It’s about creating a solid plan, diversifying wisely, and having the discipline to stick to your strategy through market ups and downs.

What Is Long-Term Investing?

Definition and Time Horizon

Long-term investing involves holding assets for extended periods, typically five years or more. This strategy focuses on sustained growth rather than short-term gains. At Davies Wealth Management, we often observe better results from this approach compared to short-term trading.

The Power of Compound Interest

Compound interest stands as a primary benefit of long-term investing. A study illustrates this power: a $10,000 investment in the S&P 500 index with dividend payments reinvested and allowed to compound over time would be worth more than $1,500,000 today.

Navigating Market Volatility

Long-term strategies help investors withstand short-term market fluctuations. Historical data reveals that the S&P 500 has experienced an average intra-year decline of 14.2% since 1980. This fact underscores the importance of maintaining investments through market turbulence.

Dispelling Common Myths

Many investors believe they can effectively time the market. However, a Dalbar Inc. study found that the average investor’s portfolio lagged the performance of the S&P 500 by more than 2.1 percentage points through June 30, largely due to poor market timing decisions. At Davies Wealth Management, we emphasize the futility of predicting short-term market movements.

Another misconception portrays long-term investing as passive. In reality, it requires active management and periodic rebalancing. We recommend an annual portfolio review (at minimum) to ensure alignment with your goals and risk tolerance.

Tax Efficiency and Cost Savings

Long-term investing offers tax efficiency. In the U.S., long-term capital gains incur lower tax rates than short-term gains. Additionally, frequent trading results in higher transaction costs. A Vanguard study found that investors can save up to 0.75% annually by minimizing portfolio turnover.

Long-term investing embodies strategic patience, not a set-it-and-forget-it mentality. Understanding its principles and benefits allows investors to build wealth more effectively over time. As we move forward, let’s explore the key components that form the foundation of successful long-term investment strategies.

Building Your Investment Foundation: Key Components for Long-Term Success

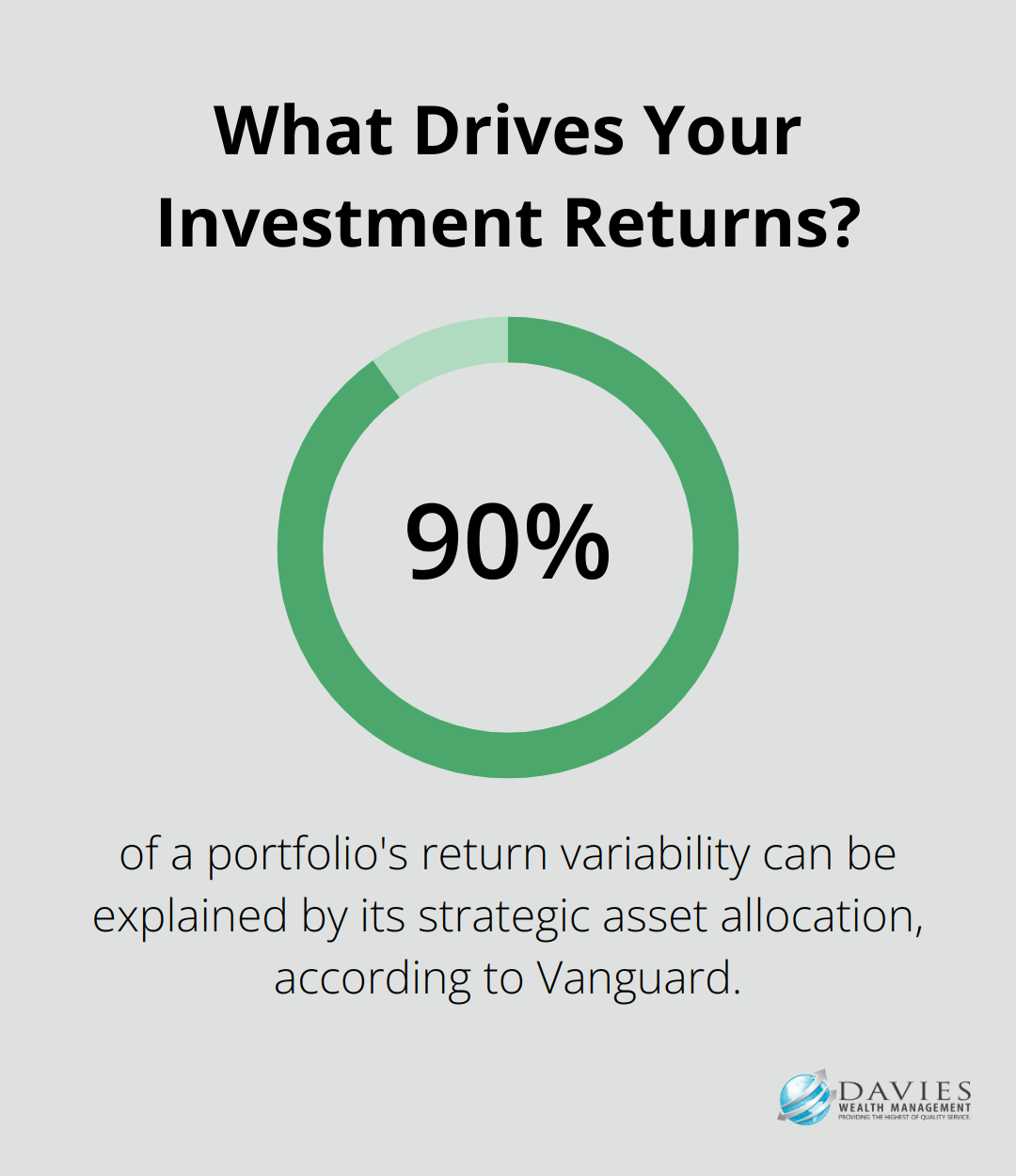

Strategic Asset Allocation

Asset allocation forms the cornerstone of any effective long-term investment strategy. It involves the division of your investment portfolio among different asset categories, such as stocks, bonds, and cash. Vanguard has found that more than 90% of a portfolio’s return variability can be explained by its strategic asset allocation.

We recommend that you tailor your asset allocation to your specific financial goals and risk tolerance. A young professional might opt for a more aggressive allocation with a higher percentage of stocks, while someone nearing retirement might prefer a more conservative mix with a larger proportion of bonds.

Diversification: Your Safety Net

Diversification complements asset allocation. It spreads your investments within each asset class to reduce risk. Instead of investing in just a few individual stocks, consider a broad market index fund that covers hundreds or thousands of companies.

A well-diversified portfolio typically includes a mix of domestic and international investments, as well as exposure to different sectors and company sizes. This approach may lead to better opportunities, enjoyment in researching new assets, and higher risk-adjusted returns.

Risk Management and Regular Rebalancing

Effective risk management requires regular assessment and adjustment of your portfolio to maintain your desired level of risk. Market movements can cause your asset allocation to drift from your original targets. For example, if stocks perform exceptionally well, they may end up representing a larger portion of your portfolio than intended, potentially increasing your overall risk.

We advise our clients to rebalance their portfolios at least annually. This process involves the sale of some of your best-performing assets and the purchase of more underperforming ones to bring your allocation back in line with your targets. While it may seem counterintuitive, this disciplined approach helps you buy low and sell high over time.

Tax-Efficient Investing

Maximization of after-tax returns plays a vital role in long-term wealth accumulation. Several tax-efficient investing techniques can help:

- Asset location: Place tax-inefficient investments (like bonds) in tax-advantaged accounts and more tax-efficient investments (like stocks) in taxable accounts.

- Tax-loss harvesting: Strategically sell investments at a loss to offset capital gains and reduce your tax bill.

- Use of tax-advantaged accounts: Maximize contributions to accounts like 401(k)s, IRAs, and Roth IRAs to benefit from tax-deferred or tax-free growth.

- Long-term investment holding: This strategy not only aligns with a long-term investment philosophy but also takes advantage of preferential long-term capital gains tax rates.

The implementation of these key components lays a solid foundation for long-term investment success. These strategies require ongoing monitoring and adjustment to ensure they continue to serve your evolving financial needs and goals. In the next section, we’ll explore how to put these strategies into action and create a personalized long-term investment plan.

How to Implement Your Long-Term Investment Strategy

Define Clear, Measurable Financial Goals

The foundation of any successful investment strategy starts with well-defined financial objectives. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Instead of a vague goal like “save for retirement,” try something more concrete like “accumulate $1.5 million in retirement savings by age 65.”

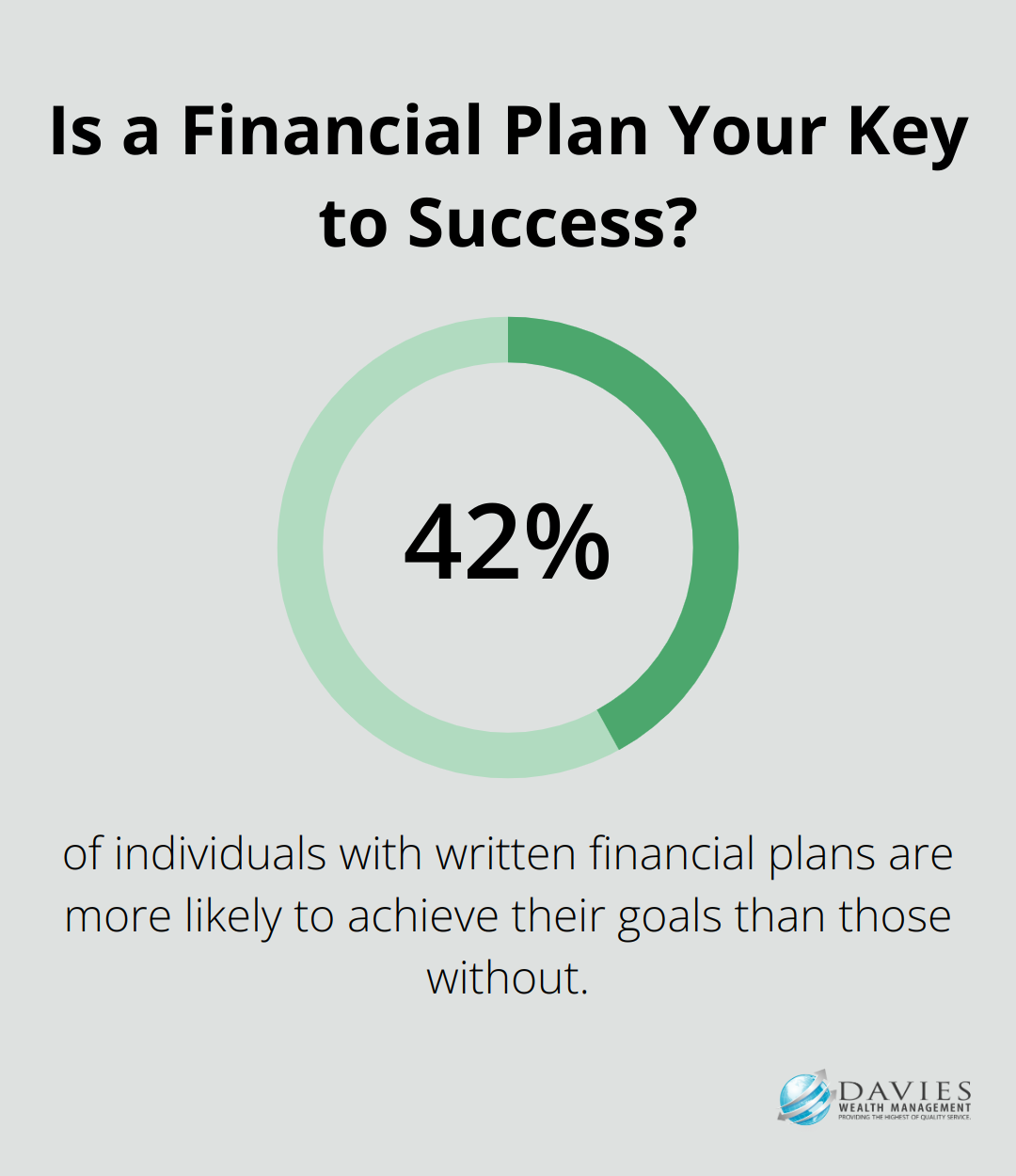

Research from the Journal of Financial Planning indicates that individuals who set specific financial goals are more likely to achieve them. Those with written financial plans are 42% more likely to achieve their goals than those without.

Choose Appropriate Investment Vehicles

After you establish your goals, select the appropriate investment vehicles. This decision should align with your risk tolerance, time horizon, and financial objectives.

For long-term growth, a diversified portfolio of low-cost index funds or exchange-traded funds (ETFs) often provides a solid foundation. These funds offer broad market exposure and typically have lower fees than actively managed funds. A study by S&P Dow Jones Indices revealed that over a 15-year period, 92.43% of large-cap funds, 95.13% of mid-cap funds, and 93.89% of small-cap funds underperformed their respective benchmarks.

For tax-efficient investing, utilize accounts like 401(k)s, IRAs, and Roth IRAs. These accounts offer tax advantages that can significantly boost your long-term returns. The tax-free growth potential of a Roth IRA can be particularly powerful for young investors with a long time horizon.

Use Dollar-Cost Averaging

Dollar-cost averaging is a powerful technique for implementing your long-term investment strategy. This approach involves investing a fixed amount of money at regular intervals, regardless of market conditions. An investor who implements a 12-month DCA strategy is essentially decreasing the overall risk of the portfolio via the higher allocation to cash during that period.

While it doesn’t guarantee better returns, it can help mitigate the risk of making poor timing decisions based on emotions.

Adapt to Market Changes

Long-term investing doesn’t require constant portfolio tinkering, but it’s important to stay informed about market trends and economic conditions. Review your investment strategy regularly to ensure it still aligns with your goals and risk tolerance.

Major life events (such as marriage, the birth of a child, or a career change) may necessitate adjustments to your strategy. Similarly, significant market shifts or changes in economic conditions might warrant a review of your asset allocation.

An annual portfolio review (at minimum) allows you to rebalance your portfolio if needed, ensuring your asset allocation remains in line with your long-term goals.

Work with a Financial Advisor

Implementing a long-term investment strategy can be complex. A financial advisor can provide valuable guidance, help you navigate market changes, and ensure your strategy remains aligned with your goals. If you’re considering working with an advisor, Davies Wealth Management offers expertise in long-term investment strategies and personalized financial planning.

Final Thoughts

Long-term investment strategies form the foundation of financial success. These strategies encompass compound interest, strategic asset allocation, and diversification to create a robust investment approach. Patience and discipline play a vital role in long-term investing, as investors who maintain a steady course during market volatility often achieve their financial goals.

Regular portfolio rebalancing and tax-efficient investing techniques help maintain an effective long-term strategy. These practices ensure that investments remain aligned with goals and risk tolerance over time. Setting clear, measurable financial goals and choosing appropriate investment vehicles that align with objectives mark the first steps in implementing a successful strategy.

Davies Wealth Management offers expert advice tailored to your unique financial situation for those seeking personalized guidance in crafting and implementing long-term investment strategies. Our team of professionals can help you navigate the complexities of long-term investing, ensuring that your financial plan meets your specific needs and goals. Take action today to secure your financial future and watch your investments grow over time.

Leave a Reply