At Davies Wealth Management, we understand that budgeting and financial planning are essential for achieving long-term financial success. Many people view budgeting as a restrictive practice, but it’s actually a powerful tool that provides clarity and control over your finances.

A well-crafted budget serves as the foundation for all your financial decisions, helping you allocate resources effectively and work towards your goals. In this post, we’ll explore the key components of budgeting and share practical tips to help you create and maintain a budget that works for you.

Why Is Budgeting Essential?

The Real Purpose of Budgeting

Budgeting is not about restricting your spending. It’s about understanding where your money goes and aligning your spending with your values and goals. A well-crafted budget acts as a financial roadmap, guiding you towards your objectives while giving you control over your finances.

Budgeting’s Impact on Financial Health

Budgeting contributes significantly to overall financial well-being. A study by the National Foundation for Credit Counseling reveals that only 42% of Americans have a budget and keep track of their spending. This sense of control often leads to reduced stress and better financial decision-making.

Moreover, budgeting helps identify areas where you might overspend. Many people are surprised to find they spend an average of $3,000 annually on subscription services they rarely use. By uncovering these hidden expenses, you can redirect funds towards savings or investments, accelerating your progress towards financial goals.

Debunking Budgeting Myths

Myth 1: Budgeting is Only for Those Struggling Financially

This is far from the truth. Budgeting is crucial for everyone, regardless of income level. Even high-earning professional athletes use budgets to manage their finances effectively and prepare for life after their sports careers.

Myth 2: Budgeting is Time-Consuming and Complicated

With modern tools and apps, creating and maintaining a budget has never been easier. Many people find that spending just 15 minutes a week on their budget yields significant financial benefits.

Myth 3: Budgeting Means Never Indulging in Luxuries

This couldn’t be further from the truth. A good budget actually allows for guilt-free spending on things you enjoy, as long as it’s planned and accounted for.

The Power of Budgeting

Understanding the true nature of budgeting and its benefits allows you to harness its power to improve your financial health and achieve your long-term goals. Budgeting is not about limitation, but about maximization – maximizing the value you get from every dollar you earn.

Now that we’ve established why budgeting is essential, let’s explore the key components that make up an effective budget. These elements will form the foundation of your financial planning strategy and set you on the path to financial success.

Key Components of an Effective Budget

Income Tracking: The Foundation

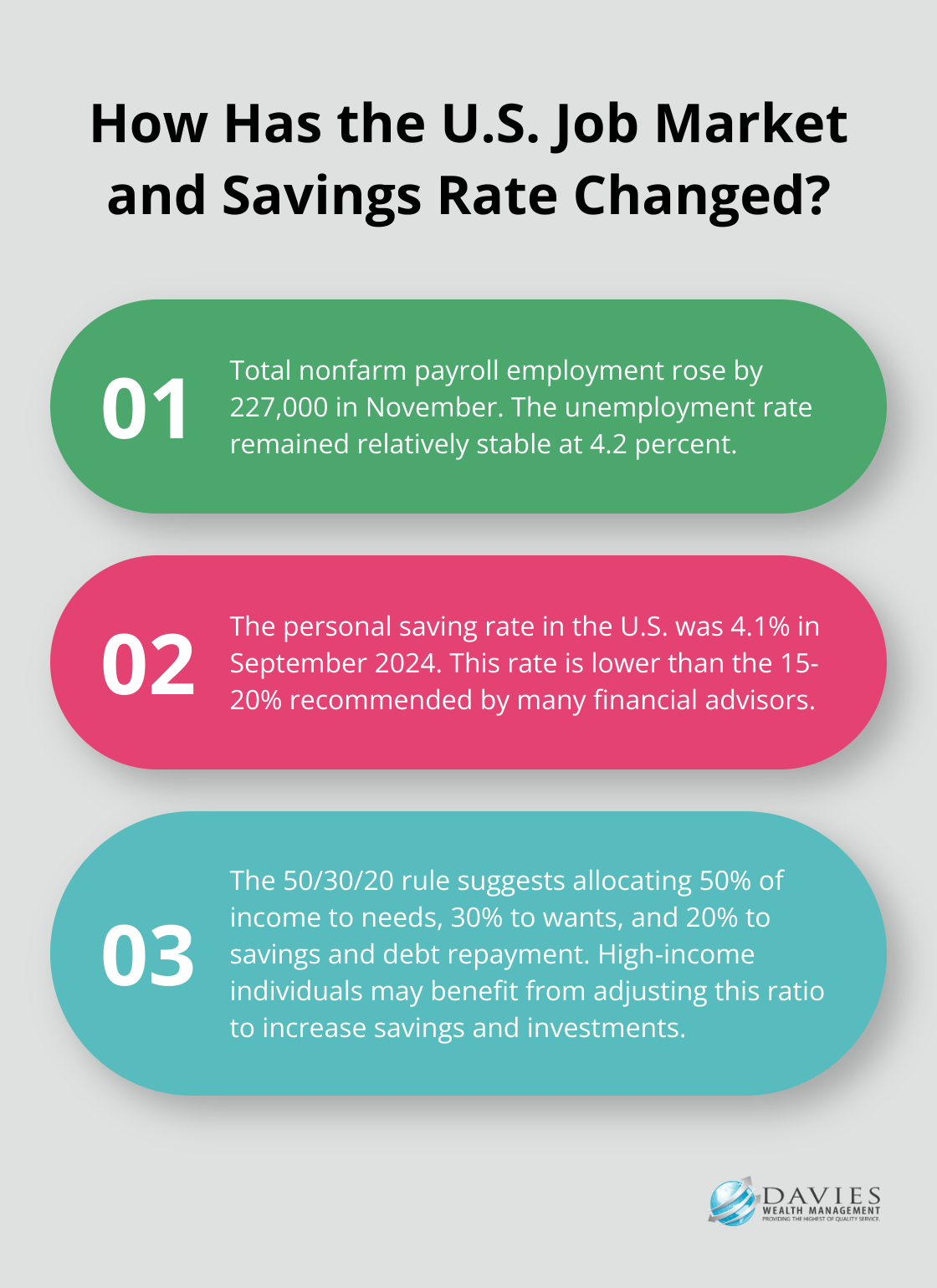

The first step to create a robust budget is to track your income accurately. This extends beyond noting your salary. You should include all revenue sources, such as investment returns, rental income, or side gigs. The U.S. Bureau of Labor Statistics reported that total nonfarm payroll employment rose by 227,000 in November, and the unemployment rate changed little at 4.2 percent, which underscores the importance of capturing all income streams.

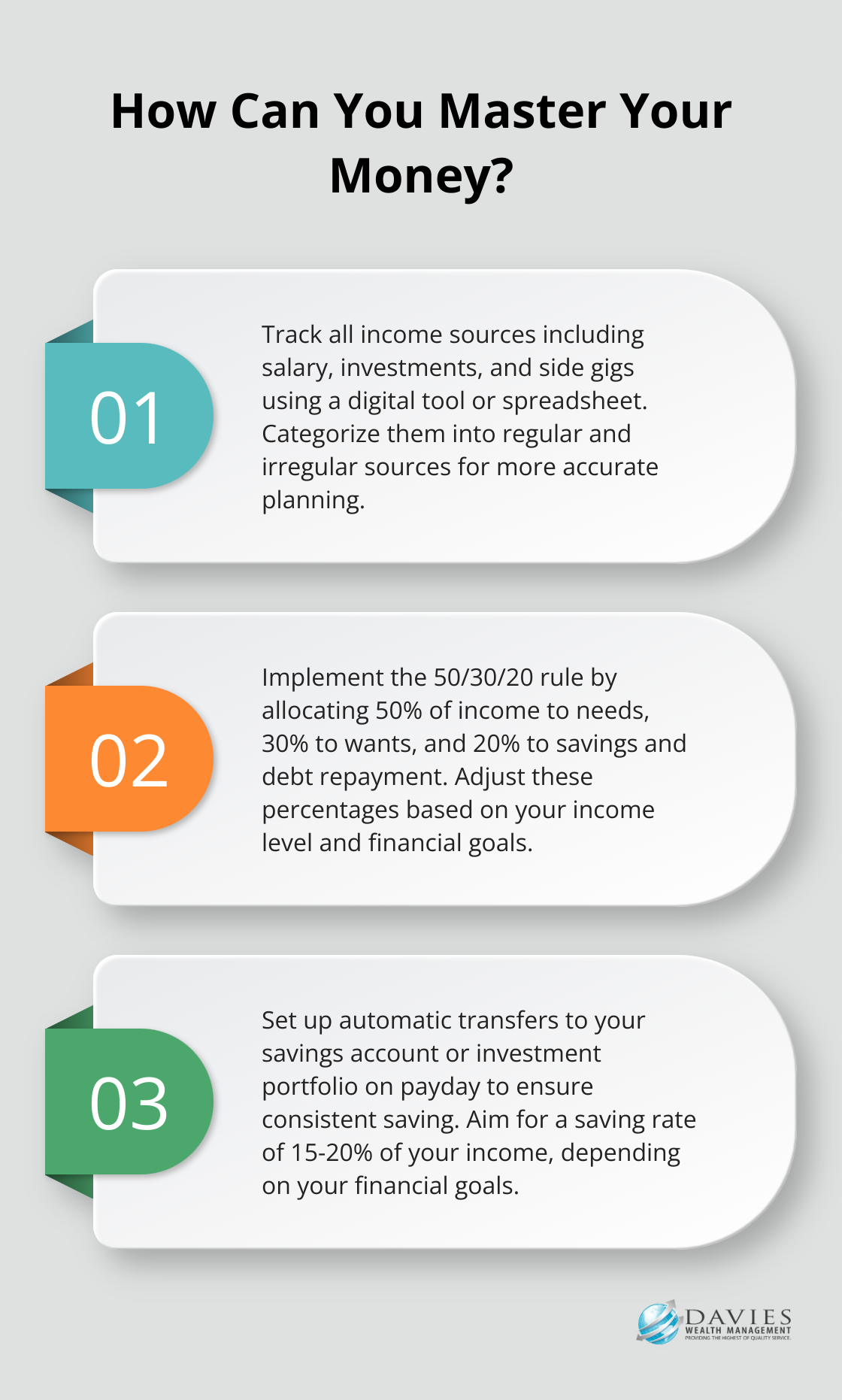

To categorize your income effectively, consider using a digital tool or spreadsheet. Break down your income into regular and irregular sources. This distinction will help you plan more accurately, especially if you have a variable income (like many professional athletes or freelancers).

Strategic Expense Management

After you map out your income, it’s time to tackle expenses. We recommend you categorize your spending into fixed, variable, and discretionary expenses. Fixed expenses (like rent or mortgage payments) remain constant. Variable expenses (such as utilities) fluctuate but are necessary. Discretionary expenses are non-essential and offer the most flexibility for adjustment.

A practical tip is to use the 50/30/20 rule as a starting point. Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. However, high-income individuals often benefit from adjusting this ratio, increasing the percentage allocated to savings and investments.

Prioritize Savings and Investments

Paying yourself first is a key principle in effective budgeting. This means you allocate a portion of your income to savings and investments before addressing other expenses. The U.S. Bureau of Economic Analysis reports that the personal saving rate was 4.1% in September 2024. However, many financial advisors recommend aiming for a higher percentage (typically 15-20%), depending on your financial goals and income level.

Consider automating your savings to ensure consistency. Set up automatic transfers to your savings account or investment portfolio on payday. This approach aligns with behavioral economics principles, making saving a default action rather than a conscious decision each month.

Tackle Debt Strategically

Effective debt management plays a vital role in financial health. You should incorporate debt repayment into your budget as a non-negotiable expense.

For those juggling multiple debts, consider either the avalanche method (focusing on high-interest debts first) or the snowball method (paying off smaller debts for psychological wins). The right approach depends on your financial situation and personal motivation factors.

As we move forward, let’s explore practical tips for creating and sticking to your budget. These strategies will help you transform these key components into a personalized, effective financial plan.

How to Make Budgeting Work for You

Choose Your Ideal Budgeting Method

Budgeting isn’t a one-size-fits-all solution. You need to find a method that matches your financial habits and goals. The envelope system suits those who prefer cash transactions. This method involves allocating cash to different envelopes for various expense categories, which helps you track your spending visually.

For tech-savvy individuals, the zero-based budgeting method can prove highly effective. This approach assigns every dollar a specific job, ensuring that your income minus your expenses equals zero.

Use Technology to Your Advantage

Numerous tools can simplify the budgeting process in today’s digital age. Apps like Mint, Personal Capital, and PocketGuard offer features such as automatic expense tracking, bill reminders, and customized reports. These tools sync with your bank accounts and credit cards, providing real-time updates on your financial status.

For those managing complex finances (including professional athletes), more sophisticated software like Quicken or specialized wealth management platforms might be more appropriate. These tools offer advanced features for investment tracking and tax planning.

Create SMART Financial Goals

Setting Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) goals is essential for effective budgeting. Instead of a vague goal like “save more money,” try something specific like starting an emergency fund, reducing debt, or increasing savings.

Break down your long-term goals into short-term milestones. This approach makes your goals more tangible and allows you to track progress regularly.

Maintain Motivation and Accountability

Staying motivated often presents the biggest challenge in sticking to a budget. One effective strategy involves visualizing your goals. If you’re saving for a vacation, keep a picture of your destination as your phone wallpaper. For retirement savings, use a retirement calculator to see how your efforts today impact your future financial security.

You might consider finding an accountability partner for budgeting. Sharing your goals with others can provide encouragement and helpful advice. Some individuals have found success in forming small groups to discuss financial strategies and share progress.

Regular review and adjustment of your budget is also important. Set aside time each month to assess your progress and make necessary tweaks. Celebrate small wins along the way – perhaps treat yourself to a small reward when you hit a savings milestone.

Final Thoughts

Budgeting and financial planning form the cornerstone of a secure financial future. These tools empower individuals to make informed decisions about their money, reduce stress, and work towards their goals. We at Davies Wealth Management believe that effective budgeting maximizes the value of every dollar earned, rather than imposing restrictions.

Our team specializes in creating personalized financial strategies that align with your specific goals and circumstances. We understand that everyone’s financial situation is unique, whether you’re a professional athlete with complex income streams or an individual looking to secure your future. Our wealth management services can support your financial planning efforts and help you build lasting financial security.

Starting or improving your budgeting practices marks a powerful step towards financial freedom. The benefits of taking control of your finances today are immeasurable. Set yourself on the path to a more secure and prosperous future with a well-crafted budget and financial plan.

Leave a Reply