As we step into 2024, the investment landscape is evolving rapidly. At Davies Wealth Management, we’re closely monitoring the shifts in economic conditions and emerging opportunities.

This year promises a mix of challenges and potential for growth, making it crucial to consider the best investment strategies for 2024. We’ll explore value investing, emerging technologies, and key sectors poised for expansion to help you make informed decisions in this dynamic market.

What’s Shaping the 2024 Investment Landscape?

Economic Resilience and Inflation Concerns

The U.S. economy has demonstrated unexpected strength in early 2024, defying earlier recession predictions. This resilience reinforces the outlook for a persistently higher-interest-rate environment. Falling interest rates can benefit stock market investors in a few ways, allowing companies to borrow more money to fuel their growth. The Consumer Price Index (CPI) report indicates larger price increases than anticipated, although Federal Reserve data shows real-time rent prices dropping at a record pace.

Shifting Bond Market Dynamics

Bond interest rates now outpace inflation for the first time in many years, creating opportunities for long-term investors. Vanguard research has found that the equilibrium level of the real interest rate, also known as r-star or r*, has increased, driven primarily by shifts in capital demand and supply. This change potentially leads to sustained higher interest rates in the long term.

Global Market Variations

Global equity and fixed income markets experience varied forecasts. U.S. equity valuations negatively impact global outlooks, while developed markets sovereign bond yields have predominantly risen in 2024. This suggests better long-term returns for bond investors but also highlights the importance of diversification across different markets and asset classes.

Technological Disruption and Investment Opportunities

Rapid advancements in artificial intelligence (AI) and machine learning reshape industries and create new investment opportunities. McKinsey Digital projects that generative AI could increase global corporate profits by $2.6 trillion to $4.4 trillion annually. This technological disruption particularly affects the technology and healthcare sectors, which are predicted to continue their strong performance due to supportive long-term trends and potential earnings growth.

Geopolitical Tensions and Market Volatility

Ongoing geopolitical tensions continue to influence market volatility. Historical data indicates that U.S. equity volatility typically rises significantly in the 90 days prior to elections (a factor to consider as we approach the upcoming U.S. presidential election). These tensions have also contributed to a surge in gold prices, potentially driven by strong central bank demand.

In this complex environment, a well-informed, diversified investment strategy becomes essential. Professional guidance can help navigate these intricate market conditions, offering personalized advice to make informed investment decisions. This expertise proves particularly valuable for individuals with unique financial needs (such as professional athletes), especially in areas like tax-efficient strategies and long-term wealth preservation.

As we move forward, it’s important to consider how these market dynamics influence specific investment strategies. Let’s explore how value investing can provide stability in this volatile market environment.

Navigating Value Investing in 2024

Value investing remains a potent strategy for long-term wealth accumulation in the current volatile market. Identifying undervalued assets in promising sectors can yield substantial returns, even in uncertain times.

Uncovering Hidden Gems

The key to successful value investing lies in thorough research and analysis. We look for companies with strong fundamentals, consistent cash flows, and solid balance sheets that trade below their intrinsic value. In 2024, opportunities exist in sectors that have been overlooked due to short-term market fluctuations.

For instance, the financial sector presents compelling value propositions. Many banks and insurance companies trade at attractive price-to-earnings ratios despite their strong underlying businesses. The potential for interest rate cuts in 2024 could further boost their profitability.

Sectors Poised for Growth

While value investing often focuses on established companies, it’s important to consider sectors with strong growth potential. The healthcare sector underperformed in 2024 as investors favored high-growth tech stocks over more defensive sectors.

Another area worth exploring is the industrial sector, especially companies involved in infrastructure development. As governments worldwide invest in upgrading their infrastructure, companies in this space could see significant growth in the coming years.

Strategies for Long-Term Stability

To maximize the benefits of value investing, we recommend a patient, long-term approach. This strategy allows investors to weather short-term market volatility and benefit from the compounding effect of reinvested dividends.

Diversification remains important. While focusing on undervalued assets, it’s necessary to spread investments across different sectors and geographical regions. This approach helps mitigate risk and capture growth opportunities in various market segments.

We also advise clients to consider dollar-cost averaging when implementing a value investing strategy. With this technique, you invest a set amount at regular intervals, no matter how stock prices change. It can help reduce the impact of market volatility and potentially lower the average cost of shares over time.

Tailored Approaches for Unique Circumstances

Value investing requires discipline and expertise. Financial advisors should stay abreast of market trends and economic indicators to identify the most promising value opportunities for their clients. A tailored approach that aligns with each individual’s risk tolerance and financial goals (especially for those with unique circumstances) is essential.

For professional athletes, who often have a limited window of high earnings, building a diversified portfolio with a strong foundation in value investments is particularly important. This approach can provide stability and long-term growth potential, helping to secure their financial future beyond their playing careers.

As we transition to exploring emerging technologies and growth opportunities, it’s clear that value investing continues to offer a path to long-term wealth creation in 2024. The next section will examine how these technological advancements are reshaping investment landscapes and creating new avenues for growth.

Where Are the Best Tech Investment Opportunities?

The tech sector continues to power growth, with emerging technologies reshaping industries and creating new investment frontiers. Exciting opportunities exist in artificial intelligence (AI), clean energy, and biotech innovations.

AI and Machine Learning: The New Gold Rush

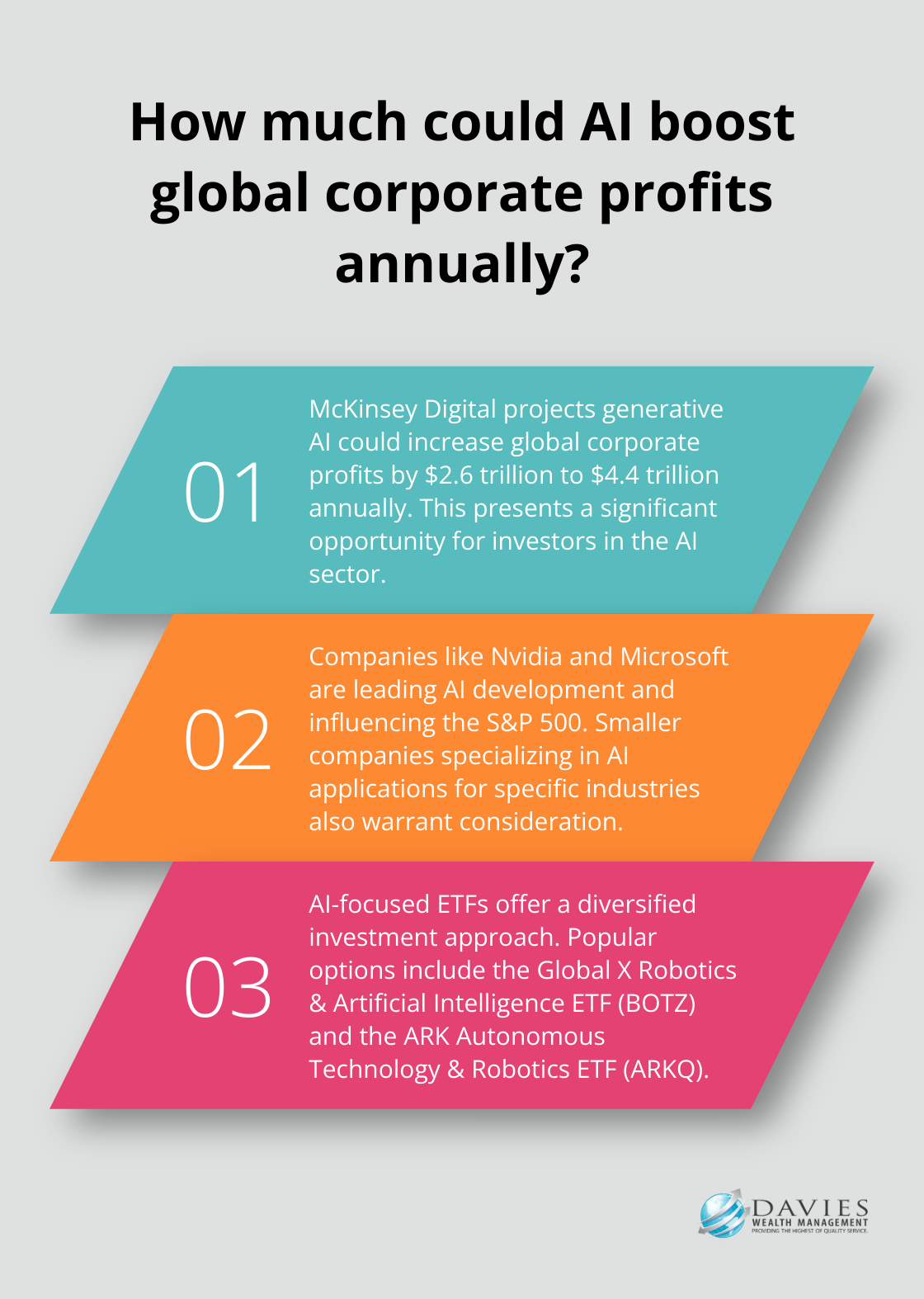

AI and machine learning drive real economic value. McKinsey Digital projects that generative AI could boost global corporate profits by $2.6 trillion to $4.4 trillion annually. This presents a significant opportunity for investors.

Companies like Nvidia and Microsoft lead AI development, significantly influencing the S&P 500. However, smaller companies specializing in AI applications for specific industries also warrant consideration.

For those who prefer not to pick individual stocks, AI-focused ETFs offer a diversified approach. Popular options include the Global X Robotics & Artificial Intelligence ETF (BOTZ) and the ARK Autonomous Technology & Robotics ETF (ARKQ).

Sustainable Investments: Riding the Green Wave

Clean energy investments are gaining momentum as governments and corporations commit to reducing carbon emissions. The International Energy Agency provides a global benchmark for tracking capital flows in the energy sector and examines how investors are assessing risks and opportunities.

Solar and wind energy companies attract attention, as installation costs decrease and efficiency improves. Electric vehicle manufacturers and their supply chain partners also present compelling investment opportunities as the automotive industry shifts towards electrification.

Biotech Breakthroughs: The Future of Healthcare

The biotech sector experiences a renaissance, driven by advancements in gene editing, personalized medicine, and drug discovery technologies. The emergence of GLP-1 drugs for weight loss is giving rise to a secondary market with large revenue potential, and companies are vying for a piece of this opportunity within the healthcare sector.

Investors should watch companies that develop innovative treatments for chronic diseases, as well as those that leverage AI for drug discovery. The SPDR S&P Biotech ETF (XBI) offers broad exposure to the biotech sector for those who prefer a diversified approach.

Balancing Risk and Reward

While these emerging technologies offer exciting growth potential, a balanced investment strategy remains important. Professional guidance can help navigate these opportunities while maintaining a diversified portfolio aligned with long-term goals and risk tolerance.

The Role of Expert Advice

For individuals with unique financial situations (such as professional athletes), expert advice becomes particularly valuable. A wealth management firm with experience in both emerging technologies and specialized financial planning can provide tailored strategies to capitalize on these opportunities while addressing specific financial challenges.

Final Thoughts

The best investment strategies for 2024 require a multifaceted approach in today’s dynamic market. Value investing offers stability and long-term growth potential, while emerging technologies like AI, clean energy, and biotech present exciting opportunities. Diversification across various sectors and asset classes helps mitigate risks and positions investors to capitalize on growth opportunities.

Risk management and diversification work together to navigate geopolitical tensions and market volatility. Strategies such as dollar-cost averaging and maintaining a long-term perspective help weather short-term fluctuations and achieve sustainable growth. Expert guidance proves invaluable in crafting personalized investment strategies that align with unique financial goals and risk tolerance.

Davies Wealth Management specializes in tailored investment strategies for individuals with specific financial challenges. We offer comprehensive wealth management solutions, including investment management, retirement planning, and tax-efficient strategies. To learn more about how we can help you implement effective investment strategies for 2024, contact Davies Wealth Management today.

Leave a Reply