At Davies Wealth Management, we understand that choosing the right investment approach can be overwhelming.

In this post, we’ll explore three types of investment strategies that have stood the test of time.

From value investing to growth and income strategies, we’ll break down the key principles and benefits of each approach.

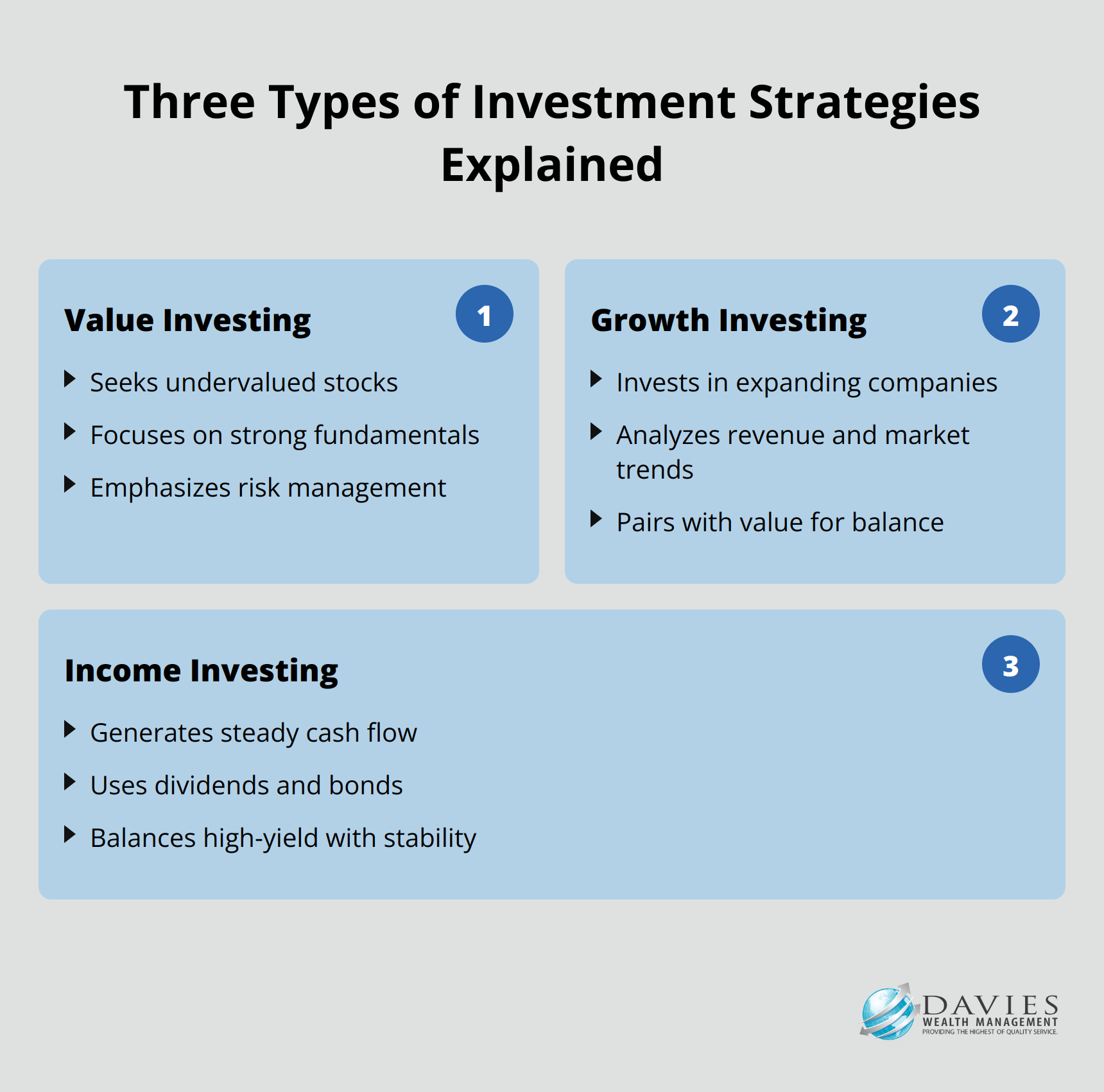

1. Value Investing: The Warren Buffett Approach

Value investing, popularized by Warren Buffett, stands as a powerful strategy for long-term wealth creation. This approach involves the identification of stocks that trade below their intrinsic value and holding them until the market recognizes their true worth. Successful value investors analyze financial statements, industry trends, and competitive advantages to spot hidden gems. They focus on companies with strong fundamentals, consistent cash flows, and durable competitive moats.

Patience plays a key role in value investing, as it often takes time for the market to recognize a stock’s true value. This strategy also emphasizes risk management through a margin of safety, which involves buying stocks at a significant discount to their intrinsic value. While value investing presents challenges, it has proven effective over time.

Value investing lays a solid foundation for long-term wealth accumulation, but it’s not the only strategy investors should consider. Growth investing, which focuses on companies with high potential for future expansion, offers a different approach to portfolio growth. Let’s explore how this strategy complements value investing in the next section.

2. Growth Investing Targets Future Stars

Growth investing is essentially the process of investing in companies, industries, or sectors that are currently growing and are expected to continue their expansion. This strategy seeks businesses with strong revenue growth, increasing market share, and the ability to disrupt established markets. Investors who use this approach typically look for companies that reinvest profits into research and development, expansion, or acquisitions rather than pay dividends.

To evaluate growth stocks, investors analyze several key factors:

- Competitive advantage

- Management quality

- Industry trends

- Financial metrics (e.g., earnings per share growth rate, price-to-earnings growth ratio, return on equity)

Growth investing carries higher risks due to the often-inflated valuations of these stocks. To balance risk and reward, investors should diversify across sectors and company sizes, and consider pairing growth stocks with more stable value investments. While growth investing offers exciting opportunities, it’s essential to understand its risks and rewards before incorporating it into your portfolio. The next section will explore income investing, a strategy that focuses on generating steady cash flow for investors.

3. Income Investing Delivers Steady Cash Flow

Income investing centers on the creation of consistent cash flow from a portfolio. This strategy typically incorporates a blend of dividend-paying stocks, bonds, and real estate investment trusts (REITs). Dividend-paying stocks, especially from established companies with a track record of increasing payouts, provide a reliable income stream while offering potential capital appreciation. Fixed-income securities, such as government and corporate bonds, offer regular interest payments and act as a stabilizing force in portfolios during market volatility.

REITs allow investors to participate in real estate without the complexities of property management, often generating a steady income stream. A well-constructed income portfolio balances higher-yielding options with more stable choices to ensure steady cash flow while managing risk. The key components of a successful income investing strategy include:

- Diversification across asset classes

- Selection of quality, income-producing investments

- Regular portfolio reviews and adjustments

- Alignment with individual financial goals and risk tolerance

As we transition to the conclusion, it’s important to recognize that each investment strategy offers unique benefits and considerations. The next section will explore how to choose the right approach (or combination of approaches) for your specific financial objectives.

Final Thoughts

The three types of investment strategies we explored offer distinct advantages when applied correctly. Your choice should align with your risk tolerance, investment timeline, and financial objectives. A combination of different approaches can lead to a well-rounded portfolio that balances risk and reward.

Regular portfolio review ensures your investments remain aligned with your goals as markets change and your financial situation evolves. You can make necessary adjustments to optimize your strategy for long-term success. Professional guidance can prove invaluable in navigating the complexities of financial markets and investment strategies.

At Davies Wealth Management, we specialize in creating tailored investment plans that consider your unique circumstances. Our expertise can help you make informed decisions and optimize your investment strategy (whether you’re a professional athlete, business owner, or individual seeking financial security). The key to successful investing lies in choosing the right strategy, consistently applying it, and adapting as necessary.

Leave a Reply