Financial planning is often touted as a crucial step towards financial success. However, at Davies Wealth Management, we believe it’s essential to consider the potential drawbacks as well.

The disadvantages of financial planning can include significant costs, time commitments, and inherent uncertainties. Understanding these challenges helps individuals make more informed decisions about their financial futures.

The Hidden Price Tag of Financial Planning

Professional Fees: More Than Meets the Eye

Financial planning often comes with a hefty price tag that many overlook. When you engage a financial planner, you pay for their expertise, not just their time. A 2024 report reveals that the average fee for a financial advisor ranges from 0.59% to 1.18% of assets under management annually. For a $500,000 portfolio, this translates to $2,950 to $5,900 per year. Some advisors charge flat fees, which can range from $1,500 to $7,500 for a comprehensive financial plan.

Uncovering the Hidden Costs

Beyond advisor fees, financial planning involves additional expenses that can catch you off guard. These include:

- Transaction costs for buying and selling investments

- Mutual fund expense ratios (averaging 0.5% to 1% annually)

- Account maintenance fees for brokerage or retirement accounts

- Tax preparation costs for complex financial situations

A study by the Securities and Exchange Commission found that these hidden costs can reduce investment returns by up to 2% per year.

Short-Term Cash Flow Squeeze

Implementing a financial plan often requires upfront investments or changes in spending habits. This can strain your immediate cash flow. For instance, increasing retirement contributions gradually, such as 1% per year, can be less of a shock to your budget than immediately jumping to a higher percentage.

The Real Cost of Expertise

While the costs associated with financial planning can seem daunting, it’s important to weigh them against the potential benefits. Professional guidance can help you avoid costly mistakes and maximize your financial potential. However, it’s essential to understand and budget for these expenses to ensure they don’t derail your financial goals.

As we move forward, it’s crucial to consider not just the monetary costs, but also the time and effort required for effective financial planning. The next section will explore these often-overlooked aspects of the planning process.

The Time Investment in Financial Planning

Initial Information Gathering: A Deep Dive

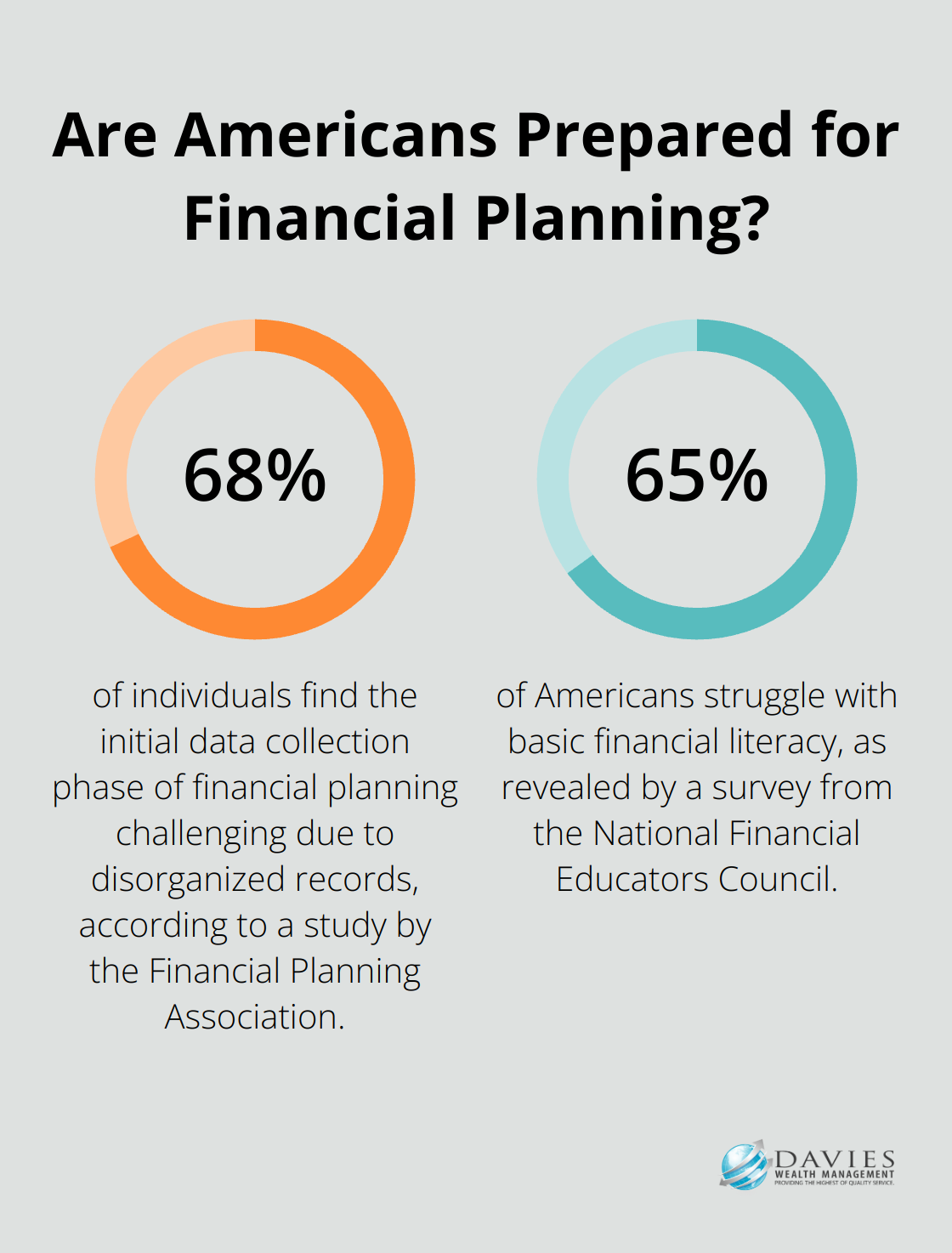

Financial planning requires a significant time commitment, especially during the initial stages. The first phase involves an extensive information gathering process. This typically takes 15-20 hours spread over several weeks. You’ll need to collect and organize all your financial documents, including bank statements, investment accounts, insurance policies, and tax returns. A study by the Financial Planning Association found that 68% of individuals find this initial data collection phase challenging, often due to disorganized records.

Ongoing Monitoring and Adjustments

Once your initial plan is in place, the work doesn’t end. Financial plans require regular monitoring and adjustments. The Division of Corporation Finance at the SEC selectively reviews filings made under the Securities Act of 1933 and the Securities Exchange Act of 1934. This ongoing process can consume 5-10 hours per month for the average individual.

Navigating the Financial Learning Curve

Financial planning involves complex concepts that take time to understand. A survey by the National Financial Educators Council revealed that 65% of Americans struggle with basic financial literacy. Learning about investment strategies, tax laws, and retirement planning can take hundreds of hours of study. Many individuals spend 2-3 hours per week (or more) educating themselves on financial topics to make informed decisions.

Streamlining the Process

The time investment in financial planning is substantial, but it’s essential for long-term financial success. While it may seem daunting, professional guidance can significantly reduce the time burden. Firms like Davies Wealth Management specialize in streamlining this process, particularly for busy professionals and athletes who may not have the luxury of time to dedicate to financial planning.

As we consider the time investment required for effective financial planning, it’s important to also examine the limitations and uncertainties inherent in the process. The next section will explore these challenges and their potential impact on your financial strategy.

The Unpredictable Nature of Financial Planning

Market Volatility: The Wild Card

The stock market’s inherent volatility can significantly affect financial plans. Such fluctuations can derail retirement savings and investment strategies. To mitigate this risk, we recommend diversification across various asset classes and regular portfolio rebalancing. A mix of stocks, bonds, and alternative investments can help cushion against market shocks.

Economic Shifts: Adapting to Change

Economic conditions can change rapidly, affecting interest rates, inflation, and employment. The Federal Reserve’s actions, such as raising interest rates to combat inflation, can impact mortgage rates and investment returns. Inflation can affect the value of your savings in the long run. We suggest incorporating inflation-protected securities and real estate investments into portfolios. Additionally, maintaining an emergency fund covering 3-6 months of expenses can provide a buffer against economic downturns.

Life’s Curveballs: Planning for the Unexpected

Unforeseen life events such as job loss, health issues, or family emergencies can disrupt financial plans. To prepare for such situations, we advise clients to:

- Maintain adequate insurance coverage (including health, life, and disability insurance).

- Review and update estate planning documents regularly.

- Consider long-term care insurance for later life stages.

The Projection Paradox

Financial plans often rely on projections and assumptions about future income, expenses, and investment returns. However, these projections can be inaccurate. To address this, we recommend:

- Use conservative estimates in financial projections.

- Review and adjust plans based on actual performance regularly.

- Employ scenario analysis to prepare for different potential outcomes.

Final Thoughts

Financial planning offers powerful tools for achieving long-term financial success, but it comes with challenges. The disadvantages of financial planning include costs, time commitments, and inherent uncertainties. These drawbacks should be carefully weighed against potential benefits to make informed decisions about financial futures.

At Davies Wealth Management, we believe successful financial planning requires a balance between thorough preparation and flexibility. This approach allows clients to navigate market volatility, economic shifts, and unexpected life events with greater confidence. We recommend strategies to address the disadvantages of financial planning, such as considering costs, streamlining processes, and using conservative estimates.

Davies Wealth Management specializes in creating personalized financial plans that address these challenges head-on. Our team of experts helps clients navigate the complexities of financial planning (whether you’re a professional athlete, business owner, or individual seeking financial security). We strive to minimize the disadvantages of financial planning while maximizing its benefits for our clients.

Leave a Reply