At Davies Wealth Management, we understand that preserving wealth is a top priority for many investors. Wealth preservation means safeguarding your assets against market volatility, inflation, and other financial risks.

In this blog post, we’ll explore effective strategies to help you protect and grow your wealth over time. From diversification techniques to advanced preservation methods, we’ll provide practical insights to guide your investment decisions.

How to Diversify Your Portfolio for Wealth Preservation

The Foundation of Asset Allocation

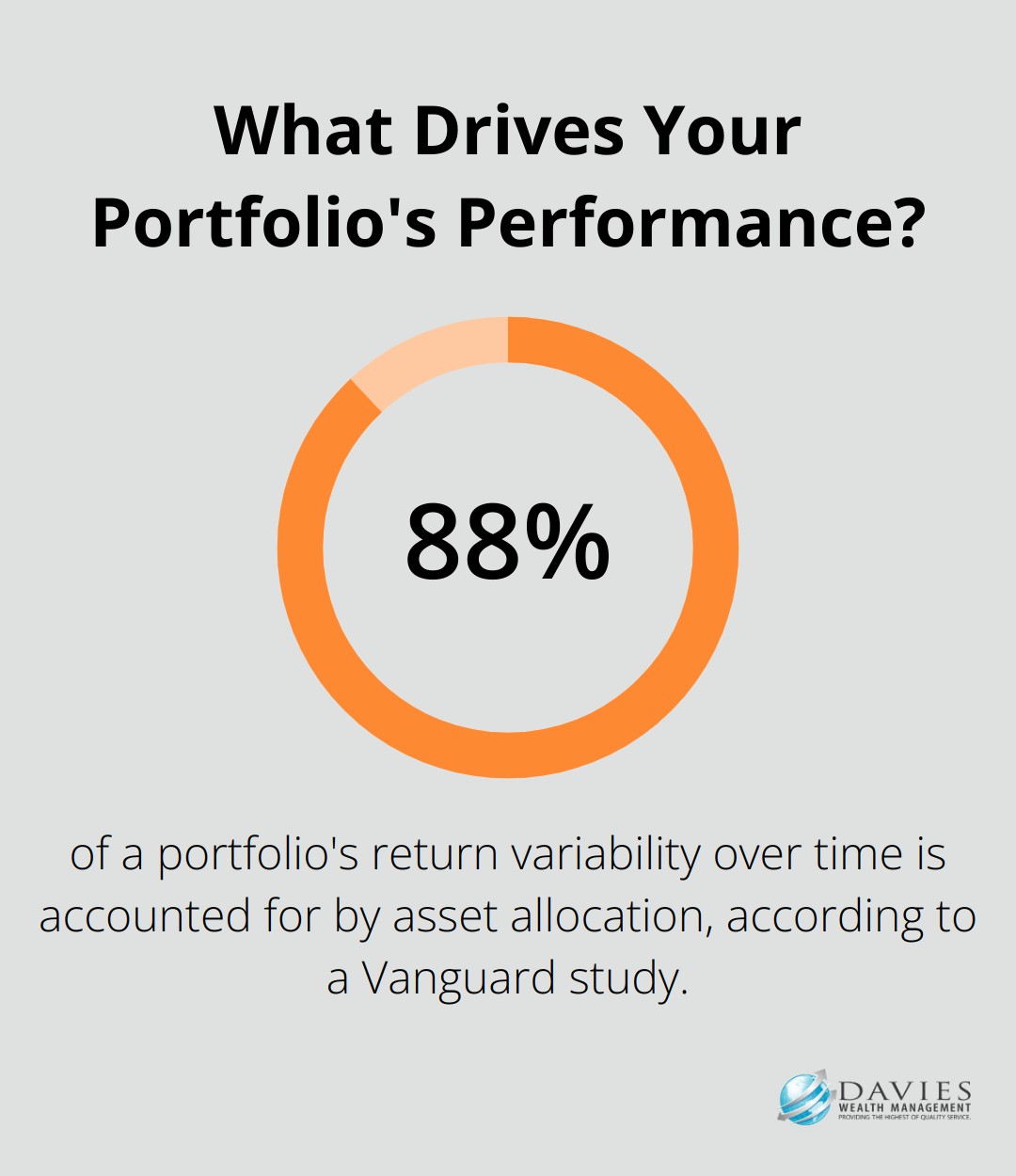

At Davies Wealth Management, we view diversification as the cornerstone of effective wealth preservation. Asset allocation involves distributing your investments across various asset classes such as stocks, bonds, real estate, and cash equivalents. The goal is to find the right mix that aligns with your risk tolerance and financial goals. A study by Vanguard found that asset allocation accounts for about 88% of a portfolio’s return variability over time.

We often recommend a mix of 60% stocks and 40% bonds for moderate-risk investors. However, this ratio can shift based on individual circumstances. Younger investors might benefit from a higher percentage of stocks to capitalize on long-term growth potential.

Striking the Balance: Risk and Return

Each asset class carries its own risk-return profile. Stocks generally offer higher potential returns but come with greater volatility. Bonds provide more stability but typically lower returns. By combining these assets, you can create a portfolio that smooths out market fluctuations while still pursuing growth.

Consider this example: During the 2008 financial crisis, a portfolio with 100% stocks (S&P 500) lost about 37%, while a balanced portfolio of 60% stocks and 40% bonds only declined by about 22% (according to data from Morningstar).

The Necessity of Regular Rebalancing

Markets change constantly, and over time, your portfolio’s asset allocation can drift from its original targets. Regular rebalancing maintains your desired risk level and capitalizes on market movements. A study by Vanguard showed that annual rebalancing can add up to 0.35% in returns over time.

We recommend you review your portfolio at least annually or when your allocation drifts more than 5% from your targets. This disciplined approach ensures you sell high and buy low, a fundamental principle of successful investing.

Diversification Beyond Traditional Assets

To further enhance your wealth preservation strategy, consider expanding your portfolio beyond stocks and bonds. Alternative investments such as real estate investment trusts (REITs), commodities, or even private equity can provide additional diversification benefits.

Real estate, for instance, often moves independently of stock markets and can offer both income (through rent) and potential appreciation. Commodities (like gold or oil) can serve as a hedge against inflation and currency fluctuations.

The Role of International Investments

Don’t limit your investments to your home country. International diversification can reduce your portfolio’s overall risk and expose you to growth opportunities in emerging markets. However, be mindful of currency risks and geopolitical factors when investing abroad.

As we move forward to discuss low-risk investment options, keep in mind that diversification serves as the foundation for any robust wealth preservation strategy. The next section will explore specific investment vehicles that can further enhance your portfolio’s stability and resilience in various market conditions.

Safeguarding Wealth with Low-Risk Investments

The Power of High-Yield Savings Accounts

High-yield savings accounts offer a safe haven for your cash while providing better interest rates than traditional savings accounts. As of November 2024, some online banks offer annual percentage yields (APYs) as high as 5% on savings accounts. Notable options include the Barclays Tiered Savings Account, SoFi Checking and Savings, and CIT Bank Platinum Savings.

For those who want to lock in rates for a specific period, certificates of deposit (CDs) can be an excellent choice. However, it’s important to consider your liquidity needs, as CDs typically penalize early withdrawals.

Government Bonds: A Pillar of Stability

U.S. Treasury securities are considered one of the safest investments available. The U.S. Department of the Treasury provides daily updates on various Treasury rates, including Daily Treasury Par Yield Curve Rates, Daily Treasury Bill Rates, Daily Treasury Long-Term Rates, and Daily Treasury Par Real Yield Curve Rates.

For those concerned about inflation, Treasury Inflation-Protected Securities (TIPS) offer an attractive option. TIPS adjust their principal value based on changes in the Consumer Price Index, which ensures your purchasing power is preserved over time.

Blue-Chip Stocks: Balancing Growth and Stability

While stocks are generally considered higher-risk investments, blue-chip companies with strong financials and consistent dividend payments can play a role in wealth preservation. The S&P 500 Dividend Aristocrats (companies that have increased their dividends for at least 25 consecutive years) have historically provided steady income and capital appreciation. As of 2024, there are 66 Dividend Aristocrats, providing investors with a concise list of S&P 500 stocks that have demonstrated consistent dividend growth.

Creating a Balanced Portfolio

A balanced portfolio incorporates these low-risk options alongside growth-oriented investments. This approach aims to preserve wealth while still capitalizing on long-term market growth opportunities. The right mix of investments will depend on your individual financial goals, risk tolerance, and time horizon.

As we move forward to explore advanced wealth preservation techniques, it’s important to consider how these low-risk investments can complement more sophisticated strategies to create a robust, diversified portfolio that stands the test of time.

Advanced Wealth Preservation Techniques

At Davies Wealth Management, we recognize that effective wealth preservation often requires sophisticated strategies. This chapter explores advanced techniques that can significantly enhance your wealth protection efforts.

Tax-Efficient Investing Strategies

Tax-efficient investing stands as one of the most impactful ways to preserve wealth. Strategic management of investments with taxes in mind can potentially save thousands of dollars annually.

Tax-loss harvesting exemplifies this approach. This strategy involves selling investments that have experienced a loss to offset capital gains taxes on profitable investments. Tax-loss harvesting is a widely used strategy in personal wealth management, often lauded for its potential to improve an investor’s after-tax returns.

Asset location presents another effective strategy. This method places investments in accounts that offer the most tax advantages for specific asset types. For example, high-yield bonds might suit tax-advantaged accounts like IRAs, while growth stocks could prove more tax-efficient in taxable accounts due to their lower dividend yields and potential for long-term capital gains treatment.

Trusts as Wealth Protection Tools

Trusts offer powerful benefits for wealth preservation, ranging from tax efficiency to asset protection. The irrevocable life insurance trust (ILIT) stands out as a popular option. An ILIT can remove the value of a life insurance policy from a taxable estate, potentially saving heirs significant estate taxes.

Asset protection trusts provide invaluable protection for those concerned about creditor claims. These trusts, when properly structured, can shield assets from future creditors. However, it’s essential to establish these trusts well in advance of any potential claims to avoid fraudulent transfer issues.

Diversification Through Alternative Investments

Alternative investments play a vital role in wealth preservation by providing diversification beyond traditional stocks and bonds. Real estate offers steady income streams and potential appreciation. REITs have outperformed the S&P 500 over the past 20-, 25-, and 50-year periods, although stocks have delivered higher returns in recent years.

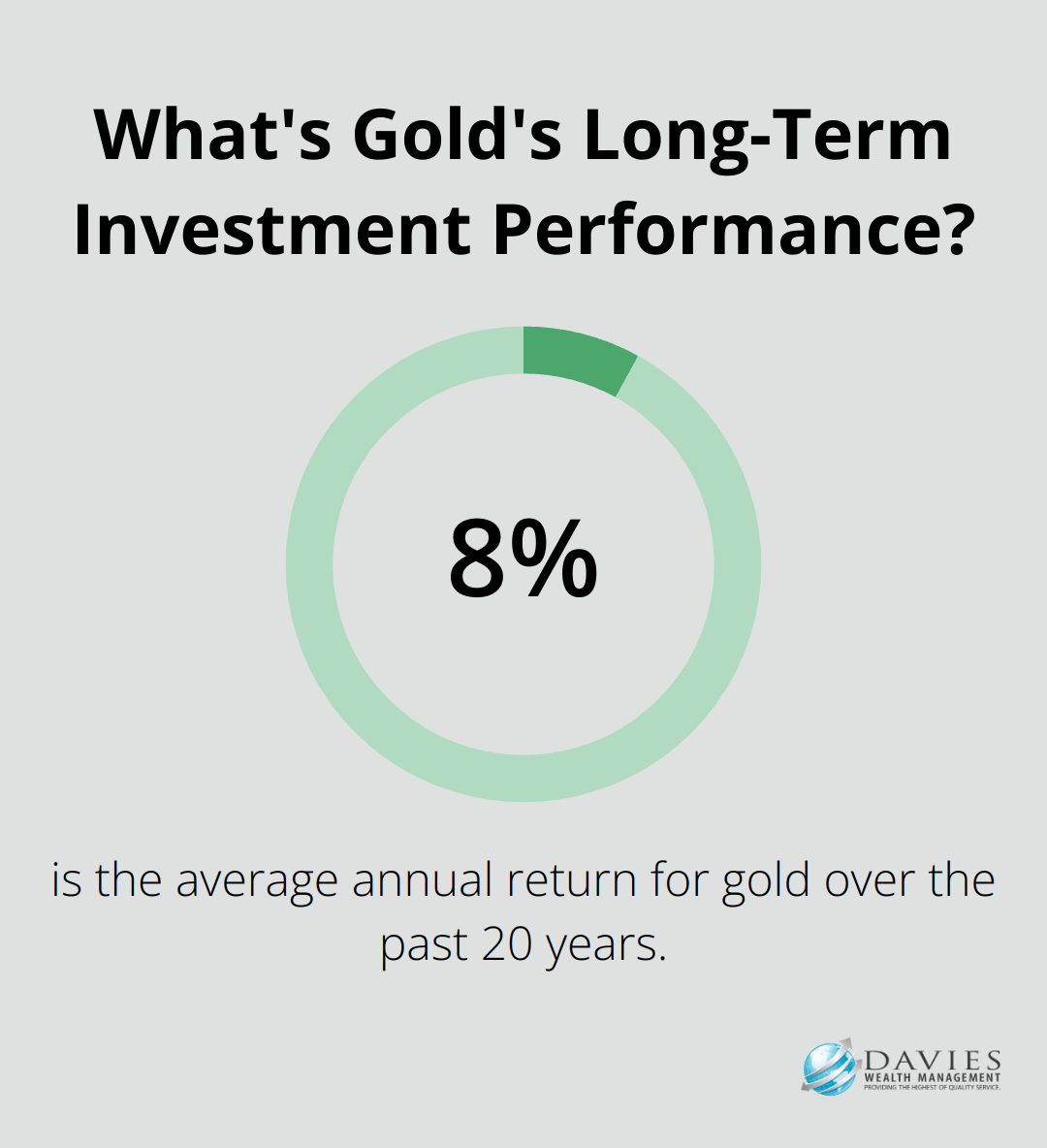

Precious metals, particularly gold, have long served as a hedge against inflation and economic uncertainty. Over the past 20 years, gold has provided an average annual return of around 8%, significantly outpacing inflation.

Private equity presents another alternative worth considering for accredited investors. While more volatile than public markets, private equity has historically outperformed over long periods. Cambridge Associates reports that U.S. private equity returned 14.2% annualized over the 25 years ending in 2020, compared to 9.9% for the S&P 500.

Professional Guidance for Advanced Strategies

Implementation of these advanced wealth preservation techniques requires careful planning and often, expert guidance. Davies Wealth Management specializes in crafting personalized strategies that incorporate these advanced methods, ensuring wealth is not just preserved, but optimized for growth and transfer to future generations.

Final Thoughts

Wealth preservation involves protecting and growing assets over time. The meaning of wealth preservation encompasses strategies that shield wealth from risks while enabling sustainable growth. Diversification, low-risk investments, and advanced techniques like tax-efficient investing form the core of a robust wealth preservation strategy.

A personalized approach to wealth preservation is essential. Your individual financial goals, risk tolerance, and life circumstances should guide your strategy. Professional financial advice can provide invaluable guidance in navigating the complexities of financial planning.

At Davies Wealth Management, we specialize in crafting tailored wealth preservation strategies. Our team of experts can help you build, protect, and transfer your wealth with confidence. We provide clear, actionable solutions that empower you to secure your financial future and focus on what matters most in life.

Leave a Reply