At Davies Wealth Management, we understand the critical balance between wealth preservation and wealth accumulation. While building wealth is essential, safeguarding your hard-earned assets is equally crucial for long-term financial security.

In this post, we’ll explore the best practices for preserving and managing wealth, offering insights into strategies that can help protect your financial legacy. From diversification techniques to advanced preservation methods, we’ll cover key approaches to ensure your wealth stands the test of time.

What is Wealth Preservation?

Definition and Importance

At Davies Wealth Management, we define wealth preservation as the strategic protection and growth of assets to maintain and enhance their value over time. This concept extends beyond simple savings; it involves active management to shield your wealth from various risks while ensuring it continues to work for you. Diversification can be a cornerstone of wealth preservation strategies for high-net-worth individuals, spreading investments across a spectrum of asset classes.

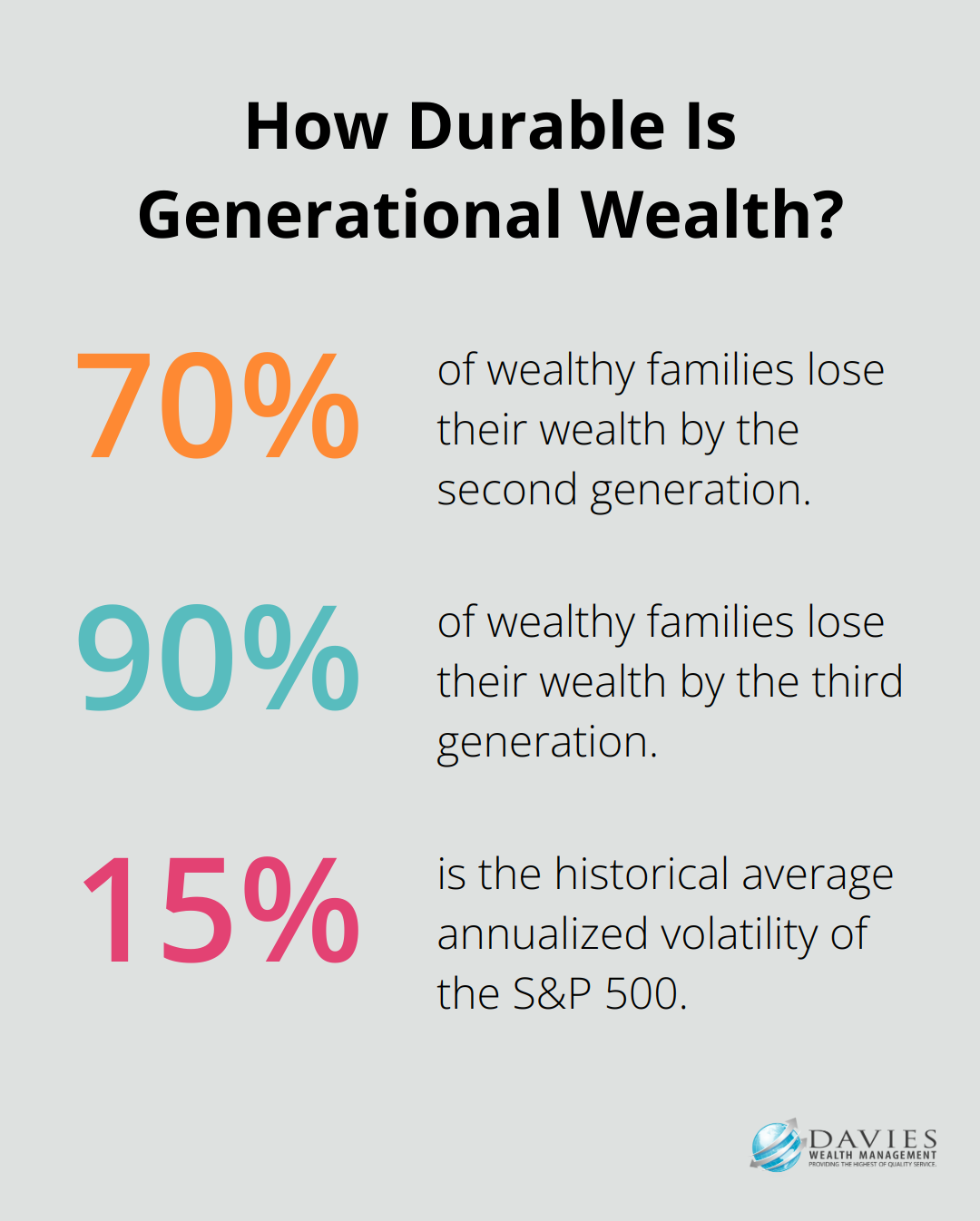

Preserving wealth is essential for long-term financial security. It’s not just about maintaining your current lifestyle, but also about securing your future and that of your loved ones. A study by the Williams Group wealth consultancy revealed that 70% of wealthy families lose their wealth by the second generation, and 90% by the third. This statistic highlights the need for robust wealth preservation strategies.

Common Wealth Preservation Challenges

Inflation

One of the primary challenges in wealth preservation is inflation. The U.S. Bureau of Labor Statistics reported an average annual inflation rate of 2.3% over the past decade. This means that if your wealth doesn’t grow at least at this rate, you’re effectively losing purchasing power. Developing strategies to outpace inflation and preserve the real value of your wealth is crucial.

Market Volatility

Another significant challenge is market volatility. The S&P 500’s annualized volatility has averaged around 15% historically. This level of market fluctuation can pose risks to unprepared investors. Diversification serves as a key strategy to mitigate these risks. Spreading investments across various asset classes, sectors, and geographic regions can help reduce the impact of market swings on your overall portfolio.

Tax Implications

Tax implications present a substantial challenge to wealth preservation. The Tax Policy Center notes that the top 1% of earners pay an average federal income tax rate of 30.2%. Without proper tax planning, a significant portion of your wealth could erode. Developing tax-efficient strategies helps you keep more of what you earn. One effective approach is fully funding tax-advantaged accounts, which can help reduce your taxable income for the year.

Unique Challenges for Professional Athletes

For professional athletes, wealth preservation presents unique challenges. The average career span in major sports leagues is relatively short. This brief earning window necessitates careful planning to stretch earnings over a lifetime. Strategies that account for this compressed earning timeline and potential post-career income fluctuations are essential. Expert guidance on wealth management and retirement planning can help professional athletes overcome their unique financial challenges.

As we move forward, we’ll explore specific strategies for effective wealth management, building on these foundational concepts of wealth preservation. These strategies will address the challenges we’ve discussed and provide actionable steps to protect and grow your wealth.

Mastering Wealth Management Strategies

At Davies Wealth Management, we have refined our approach to wealth management through years of experience. Our strategies protect and grow your assets, ensuring long-term financial stability. Let’s explore some key techniques that form the backbone of effective wealth management.

Diversification: The Foundation of Stability

Diversification is not just a buzzword; it’s a vital strategy for risk mitigation. A diversified portfolio reduces overall risk while still allowing for long-term growth potential. We recommend spreading investments across various asset classes, including stocks, bonds, real estate, and alternative investments.

Risk Management: Safeguarding Your Wealth

Effective risk management involves more than just diversification. It includes strategies like stop-loss orders, which automatically sell a security when it drops to a certain price. We also advocate for regular stress testing of portfolios (simulating various market scenarios to understand potential performance under different conditions).

Tax-Efficient Investing: Optimizing Returns

Tax-efficient investing is a powerful tool for wealth preservation. It involves selecting investment strategies and accounts that minimize the taxes owed on your returns. We employ strategies like tax-loss harvesting (selling underperforming investments to offset capital gains taxes). Another effective approach utilizes municipal bonds, which offer tax-free income at the federal level and potentially at the state level too.

Portfolio Rebalancing: Maintaining Optimal Asset Allocation

Regular portfolio rebalancing maintains your desired risk level and investment strategy. Rebalancing always leads to higher profits if two assets have identical long-term total returns. We recommend rebalancing at least annually or when your asset allocation drifts more than 5% from your target. This disciplined approach helps maintain the risk-return profile that aligns with your financial goals.

As we move forward, we’ll explore advanced wealth preservation techniques that complement these core strategies, providing a comprehensive approach to protecting and growing your assets over the long term.

Advanced Wealth Protection Strategies

Estate Planning and Trusts

Estate planning protects your wealth and ensures its distribution according to your wishes. A well-structured estate plan can reduce estate taxes and avoid probate. Irrevocable trusts shield assets from creditors and potentially reduce estate tax liability. To help high net worth clients understand their estate’s future and potential tax savings, consider using an estate planning software.

We recommend a review and update of your estate plan every 3-5 years or after major life events. This practice keeps your plan aligned with your current situation and takes advantage of any changes in tax laws.

Insurance as a Wealth Protection Tool

Insurance plays a vital role in wealth preservation. High-net-worth individuals often benefit from umbrella policies, which provide additional liability coverage beyond standard homeowners or auto insurance. The cost of umbrella insurance can range anywhere from $200 on the low end to over $1,000 for a high limit, according to Trusted Choice, with an average cost of around $500 per year.

Life insurance can also serve as a powerful wealth transfer tool. Permanent life insurance policies, such as whole life or universal life, provide both death benefits and cash value accumulation. The cash value grows tax-deferred and can be accessed tax-free through policy loans, offering a tax-efficient way to supplement retirement income.

Philanthropic Strategies

Charitable giving supports causes you care about and can offer significant tax benefits. Donor-advised funds (DAFs) have gained popularity due to their flexibility and tax efficiency. The compound annual growth rate in contributions to donor-advised funds at Community Foundations from 2019 to 2023 is 3.5 percent.

Another effective strategy is the charitable remainder trust (CRT). This allows you to donate appreciated assets, receive an income stream for life, and potentially reduce your tax burden. The remainder of the trust then goes to your chosen charity upon your death.

Global Diversification

International diversification can provide additional protection against domestic economic downturns. However, it requires careful navigation due to complex tax implications and regulatory requirements.

One approach invests in U.S.-based multinational companies with significant international exposure. This strategy provides global diversification without the complexities of direct foreign investment. Another option uses American Depositary Receipts (ADRs), which allow you to invest in foreign companies through U.S. financial markets.

For those considering offshore accounts, it’s essential to work with experienced professionals who understand the intricate reporting requirements. The Foreign Account Tax Compliance Act (FATCA) imposes strict reporting obligations on U.S. citizens with foreign financial accounts.

Final Thoughts

Wealth preservation and wealth accumulation form a delicate balance in effective wealth management. Your financial situation, goals, and risk tolerance require a personalized approach to safeguard your assets. What works for one individual may not suit another, emphasizing the need for tailored strategies.

The financial landscape constantly evolves, making wealth preservation a complex task. Professional guidance becomes essential to navigate these challenges effectively. At Davies Wealth Management, we create personalized wealth management solutions that address specific needs and goals, including those of professional athletes.

Effective wealth management demands an ongoing process of review and adjustment. Your strategy must align with your objectives and respond to market changes. We help you protect and grow your wealth, securing your financial legacy for years to come.

Leave a Reply