Are you looking to optimize your investment strategy and minimize your tax burden? Net Investment Income Tax (NIIT) can significantly impact your returns, but there are effective strategies to mitigate its effects.

At Davies Wealth Management, we’ve compiled a comprehensive guide to Net Investment Income Tax strategies that can help you save money and maximize your wealth. In this post, we’ll explore practical tips and advanced techniques to reduce your NIIT liability and enhance your overall financial picture.

Understanding Net Investment Income Tax (NIIT)

What is Net Investment Income Tax?

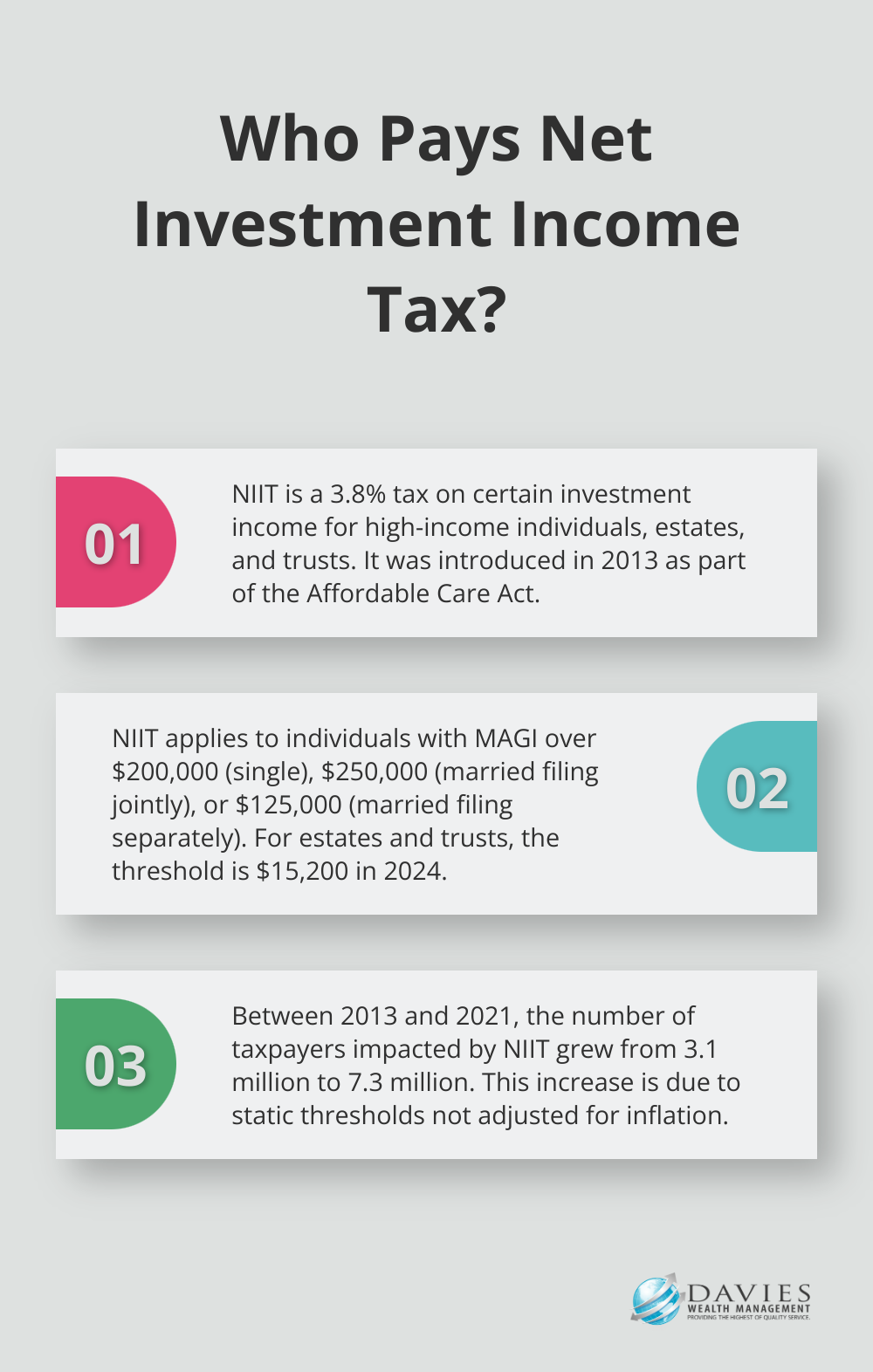

Net Investment Income Tax (NIIT) is a 3.8% tax imposed on certain investment income for high-income individuals, estates, and trusts. The Affordable Care Act introduced NIIT in 2013 to generate additional revenue for Medicare.

Who Pays NIIT?

NIIT applies to individuals with Modified Adjusted Gross Income (MAGI) exceeding specific thresholds:

- $200,000 for single filers

- $250,000 for married couples filing jointly

- $125,000 for married individuals filing separately

For estates and trusts, the threshold is much lower, at only $15,200 for the 2024 tax year.

These thresholds are not indexed for inflation, which means more taxpayers may become subject to NIIT over time as incomes rise. The impact of this static threshold is evident: Between the 2013 and 2021 tax years, the number of taxpayers impacted by the NIIT has grown from 3.1 million to 7.3 million.

What Income is Subject to NIIT?

NIIT applies to the lesser of your net investment income or the amount by which your MAGI exceeds the applicable threshold. Net investment income includes:

- Interest, dividends, and capital gains

- Rental and royalty income

- Non-qualified annuities

- Income from businesses involved in trading financial instruments or commodities

- Income from businesses that are passive activities to the taxpayer

What’s Excluded from NIIT?

Not all income falls under the NIIT umbrella. Exclusions include:

- Wages and self-employment income

- Social Security benefits

- Alimony

- Tax-exempt interest

- Operating income from nonpassive businesses

- Distributions from certain qualified retirement plans and IRAs

Understanding these inclusions and exclusions is essential for effective tax planning. Professional financial advisors (like those at Davies Wealth Management) specialize in creating strategies that help clients minimize their NIIT exposure while maximizing their investment returns.

The Growing Impact of NIIT

The financial impact of NIIT is significant and continues to grow. This substantial rise underscores the importance of proactive tax planning, especially for high-income individuals and families.

Professional athletes, who often have high but fluctuating incomes, face unique challenges when it comes to NIIT. Their distinctive financial situations require specialized strategies to manage tax liabilities effectively while building long-term wealth.

As we move forward, we’ll explore specific strategies to reduce net investment income and minimize your NIIT liability. These techniques can help you optimize your investment strategy and keep more of your hard-earned money.

How to Reduce Your Net Investment Income

Maximize Tax-Advantaged Accounts

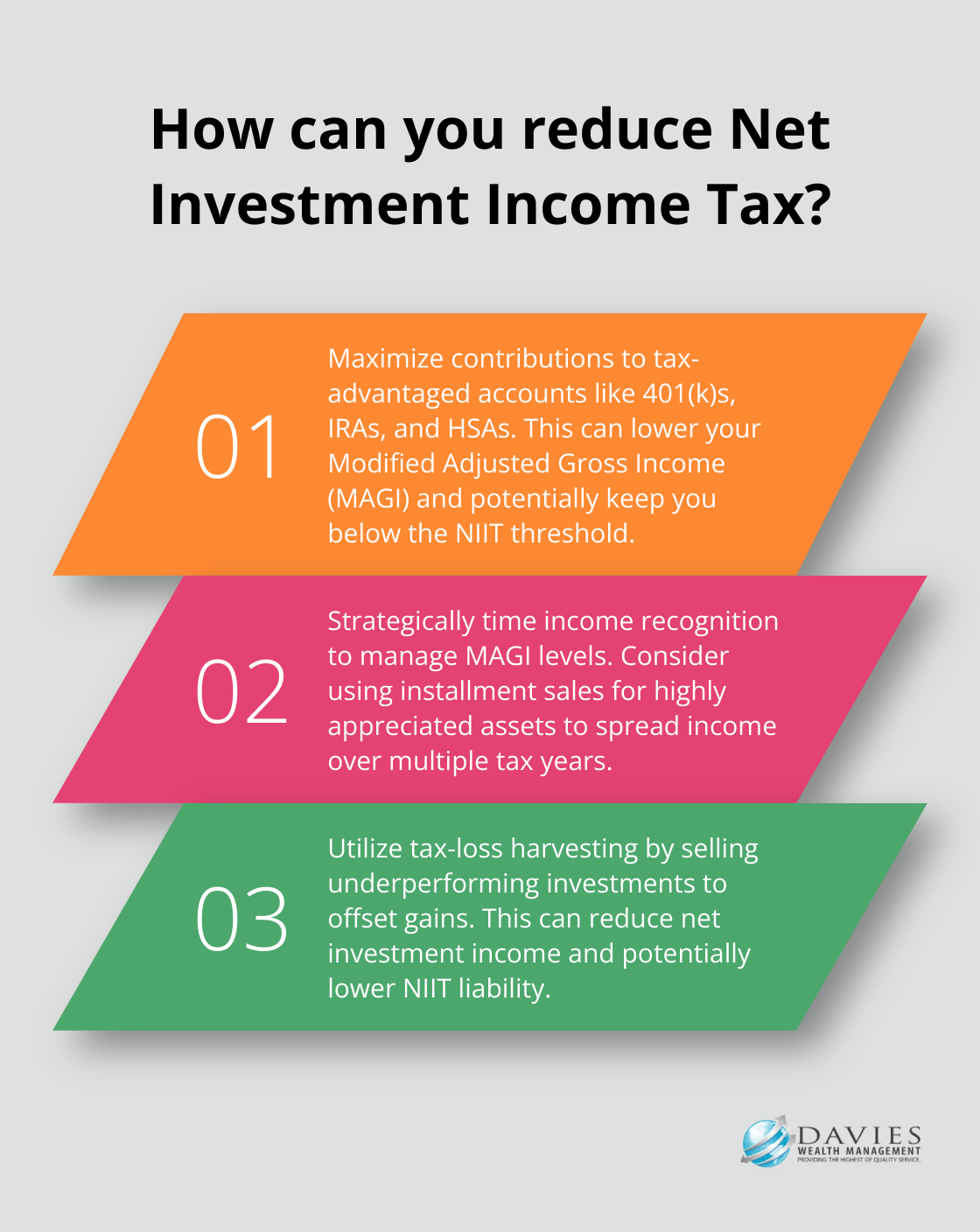

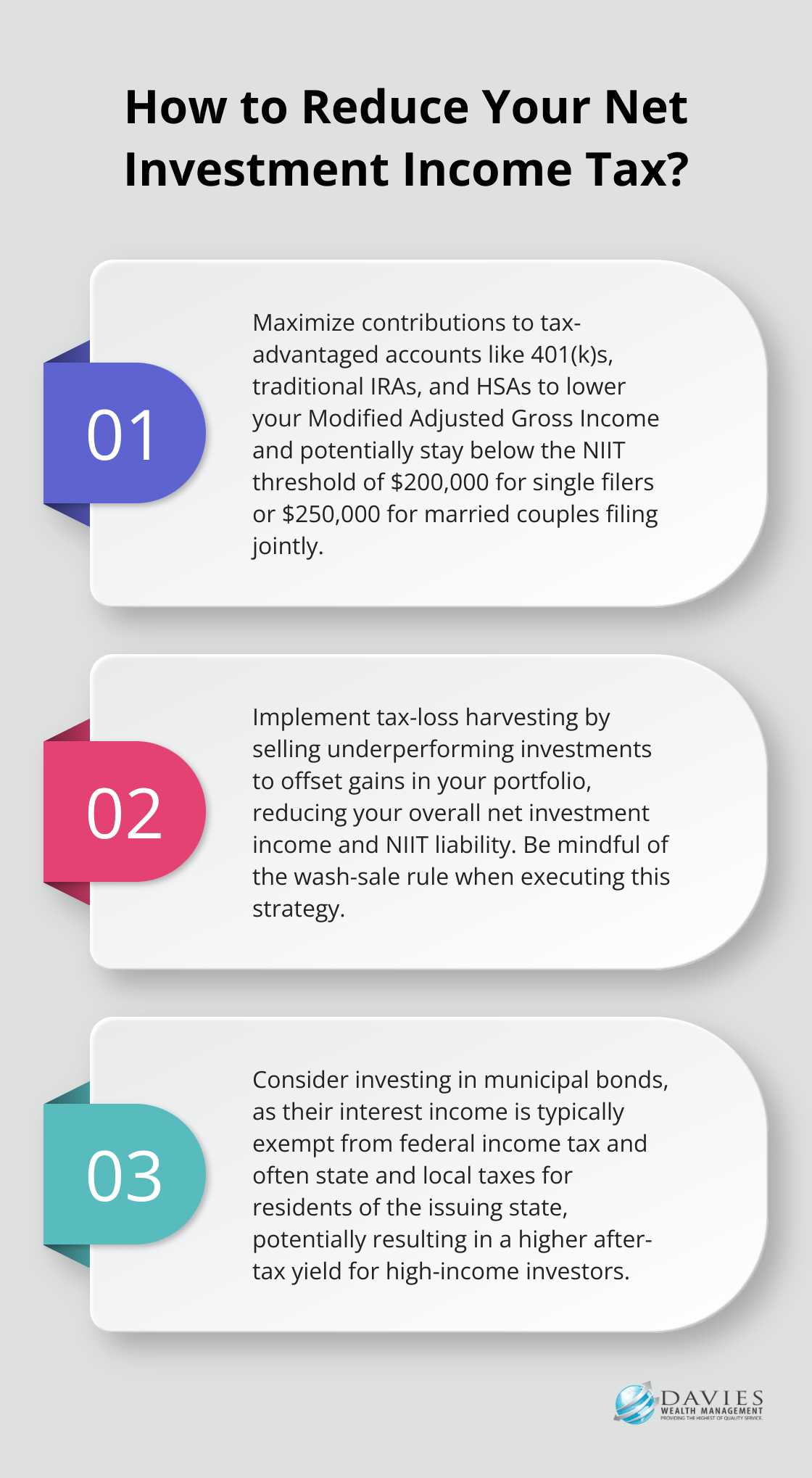

One of the most effective tools to reduce your Net Investment Income Tax (NIIT) liability is the strategic use of tax-advantaged accounts. You can lower your Modified Adjusted Gross Income (MAGI) and potentially stay below the NIIT threshold by maximizing contributions to accounts such as 401(k)s, traditional IRAs, and Health Savings Accounts (HSAs).

Time Your Income Recognition Strategically

The timing of when you recognize investment income can significantly impact your NIIT liability. You can potentially keep your MAGI below the NIIT threshold in any given year through careful planning of when you realize capital gains.

For example, if you plan to sell a highly appreciated asset, you might spread the sale over multiple tax years using an installment sale. This approach allows you to manage your annual income levels and potentially avoid or reduce your NIIT liability.

Use Tax-Loss Harvesting

Tax-loss harvesting is a powerful strategy that involves selling underperforming investments to offset gains in your portfolio. This technique can reduce your overall net investment income and, consequently, your NIIT liability.

For instance, if you have $50,000 in capital gains and $30,000 in realized losses, your net capital gain would be $20,000, potentially lowering your NIIT exposure. (Remember to be aware of the wash-sale rule, which prohibits claiming a loss on a security if you buy the same or a “substantially identical” security within 30 days before or after the sale.)

Invest in Municipal Bonds

Municipal bonds can be an excellent addition to your investment strategy when you try to reduce NIIT. The interest income from most municipal bonds is exempt from federal income tax (and often from state and local taxes for residents of the issuing state).

While municipal bonds typically offer lower yields compared to taxable bonds, their tax-exempt status can result in a higher after-tax yield, especially for high-income investors. For example, a municipal bond yielding 3% could be equivalent to a taxable bond yielding 4.7% for someone in the 37% tax bracket, factoring in the NIIT.

Consider Roth Conversions

Roth conversions can be a strategic move in managing your NIIT liability. When you convert traditional IRA assets to a Roth IRA, you pay taxes on the conversion amount in the current year. While this may increase your tax liability in the short term, it can lead to tax-free growth and withdrawals in the future, potentially reducing your NIIT exposure in retirement.

These strategies offer powerful tools to minimize your NIIT liability, but their effectiveness depends on your unique financial situation. In the next section, we’ll explore advanced planning techniques that can further enhance your NIIT mitigation efforts.

Advanced NIIT Mitigation Techniques

Roth IRA Conversion Ladder

A Roth IRA conversion ladder serves as a potent tool for NIIT mitigation. This strategy involves rolling over an old 401k to a Traditional IRA, maxing out the 401k at a new job, and maxing out the Roth IRA. The spread of conversions can potentially keep your income below the NIIT threshold each year.

Strategic Charitable Giving

Charitable giving can effectively reduce your NIIT liability while supporting causes you value. Donor-Advised Funds (DAFs) stand out as a particularly powerful strategy.

A DAF allows you to set up and fund a charitable account before you retire, turning your currently high tax bracket into an advantage. This method enables you to concentrate several years’ worth of charitable giving into a single year, potentially pushing your income below the NIIT threshold in subsequent years.

Installment Sales and Opportunity Zones

For business owners or individuals with significant appreciated assets, installment sales can serve as a valuable NIIT mitigation tool. The spread of gain over multiple tax years can potentially keep your annual income below the NIIT threshold.

Additionally, the investment of capital gains in Qualified Opportunity Zones can defer and potentially reduce your tax liability. This program allows investors to defer tax on any prior eligible gain to the extent that a corresponding amount is timely invested in a Qualified Opportunity Fund (QOF).

Professional Guidance

The implementation of these advanced techniques requires careful planning and execution. The tax implications can prove complex, and the optimal approach depends on your individual financial situation. Professional financial advisors specialize in creating comprehensive strategies that leverage these advanced techniques to minimize NIIT and optimize overall tax efficiency.

Final Thoughts

Net Investment Income Tax strategies empower investors to optimize their financial health and preserve wealth. These approaches reduce tax burdens and enhance overall investment returns. Investors can leverage tools such as tax-advantaged accounts, strategic income timing, and municipal bond investments to mitigate NIIT effectively.

Advanced techniques expand options for managing NIIT liability, but their effectiveness depends on individual financial situations. What works for one investor may not suit another, highlighting the need for personalized financial planning. Professional guidance proves invaluable in navigating the complexities of NIIT and implementing comprehensive plans.

Davies Wealth Management specializes in crafting tailored investment strategies that align with specific goals and circumstances. Our team of experts helps clients navigate NIIT complexities and implement tax-efficient investment plans. Visit Davies Wealth Management to learn how we can help you build, protect, and transfer your wealth while minimizing tax liabilities (and maximizing investment potential).

Leave a Reply