At Davies Wealth Management, we believe it’s never too early to start planning for retirement. Your 20s are the perfect time to lay the foundation for a secure financial future.

Starting early gives you a significant advantage, thanks to the power of compound interest and the time value of money. In this post, we’ll explore essential strategies and tips from the Retirement Planning Council to help you kickstart your retirement savings journey in your 20s.

Why Start Early? The Power of Time

The Magic of Compound Interest

Starting your retirement planning journey in your 20s is one of the smartest financial decisions you can make. Compound interest becomes your greatest ally when saving for retirement. Early planning allows your money more time to grow exponentially. Try calculations with monthly and annual contributions to see how your savings can grow over time.

Developing Financial Discipline

Your 20s provide the perfect opportunity to establish good financial habits that will serve you well throughout your life. Prioritizing retirement savings early trains you to live below your means and make smart financial decisions. This discipline will prove invaluable as your income grows and your financial responsibilities increase.

Adapting to Life’s Curveballs

Life is unpredictable, and early retirement planning gives you more flexibility to adapt to changes. Starting to save as soon as possible gives compound interest more time to work, which can significantly impact your long-term financial goals.

Real-World Impact

Many young professionals have benefited from early retirement planning. For instance, a 28-year-old software engineer started maxing out her 401(k) contributions at her first job. By age 35, she had already accumulated over $200,000 in her retirement accounts, giving her the freedom to take a sabbatical and start her own business without compromising her long-term financial security.

It’s not about how much you can save right away, but about consistently setting aside what you can. Even small contributions can grow significantly over time. The key is to start now and make retirement planning a priority.

As we move forward, let’s explore the essential steps you can take to kickstart your retirement planning journey in your 20s. These practical strategies will help you build a strong financial foundation for your future.

Essential Steps for Retirement Planning in Your 20s

Set Clear Financial Goals

Define what retirement means to you. Do you want to retire early? Travel the world? Start a business? Translate your vision into specific financial targets. For example, try to save $500,000 by age 40 or $2 million by age 65. These concrete goals will guide your saving and investment strategies.

Create a Realistic Budget

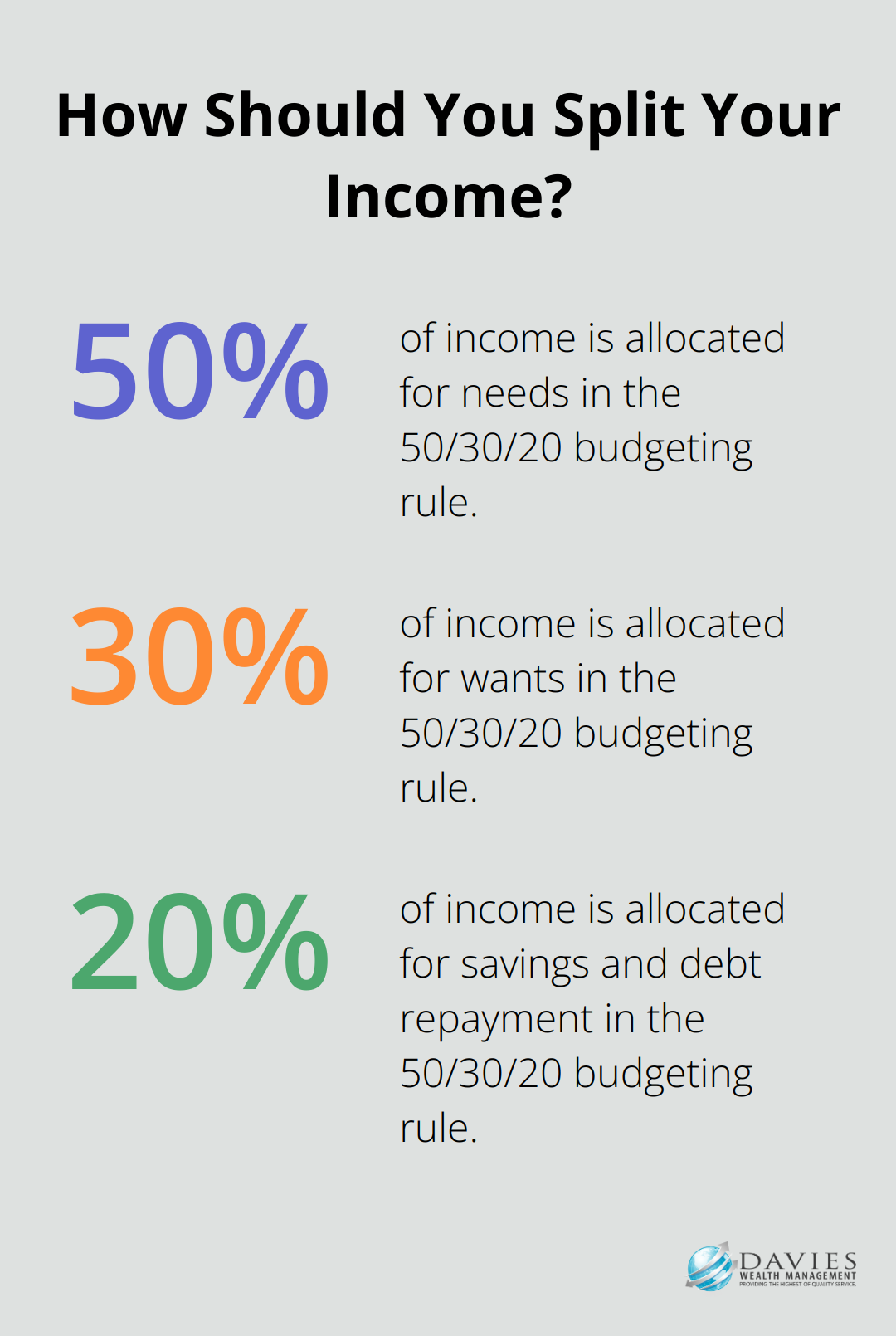

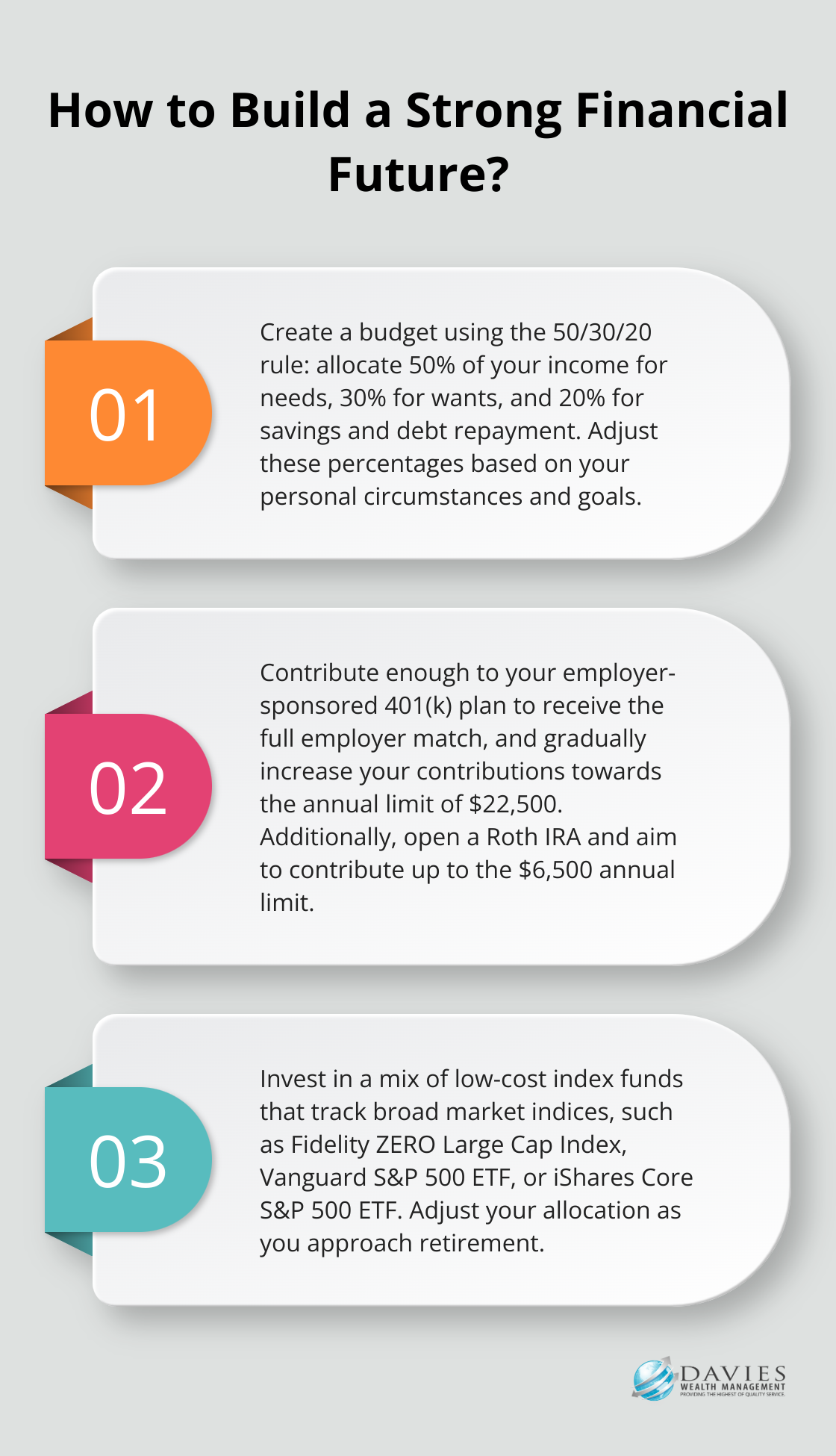

A budget serves as your roadmap to financial success. Track your income and expenses for a month to get a clear picture of your spending habits. Then, allocate your income using the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Adjust these percentages based on your personal circumstances and goals.

Build Your Safety Net

Before you focus on retirement savings, establish an emergency fund. Try to save 3-6 months of living expenses in a high-yield savings account. This fund will protect your long-term investments from unexpected financial shocks. Start small if necessary – even $50 per month can add up over time.

Maximize Employer-Sponsored Plans

If your employer offers a 401(k) plan, take full advantage of it. At minimum, contribute enough to receive the full employer match – it’s essentially free money. An employer match is when your employer contributes a certain amount to your retirement savings plan based on how much you contribute. As your income grows, gradually increase your contributions towards the annual limit ($22,500 in 2023).

Explore Individual Retirement Accounts (IRAs)

In addition to your 401(k), consider opening an IRA. A Roth IRA can be particularly beneficial in your 20s when you’re likely in a lower tax bracket. Withdrawals from a Roth IRA can be tax-free in retirement, which is not the case with a traditional IRA. In 2023, you can contribute up to $6,500 to an IRA. If you max out both your 401(k) and IRA, you’ll set aside $29,000 annually for retirement – a significant step towards your long-term goals.

Diversify Your Investments

Don’t just save – invest wisely. In your 20s, you can afford to be more aggressive with your investment strategy due to your long time horizon. Consider a mix of low-cost index funds that track broad market indices. Some popular options include Fidelity ZERO Large Cap Index, Vanguard S&P 500 ETF, and iShares Core S&P 500 ETF. Adjust your allocation as you approach retirement.

The key to successful retirement planning in your 20s is consistency and patience. Start small if you need to, but start now. Your future self will thank you for the financial foundation you’re building today. As you embark on this journey, you’ll likely face some challenges along the way. Let’s explore how to overcome these common obstacles in the next section.

Overcoming Financial Obstacles in Your 20s

Managing Student Loan Debt

Student loan debt can seem insurmountable, but it shouldn’t hinder your retirement plans. Federal borrowers aged 25 to 34 owe an average of $14,063 each. To tackle this:

- Explore income-driven repayment plans to reduce monthly payments.

- Investigate loan forgiveness programs for public service or education sectors.

- Use windfalls (tax refunds, bonuses) for debt repayment.

- Consider refinancing high-interest loans to potentially lower rates.

It’s possible to pay off debt and save for retirement at the same time. Even small contributions to retirement accounts can grow significantly over time.

Balancing Immediate Needs and Future Goals

Striking a balance between short-term needs and long-term goals requires strategy:

- List your goals in order of importance.

- Assign percentages of your income to each goal.

- Set up automatic savings for both short-term and long-term objectives.

- Review and adjust your strategy every three months.

For instance, you could allocate 10% of your income to retirement, 5% to a house down payment fund, and 5% to travel savings.

Navigating Job Market Volatility

Job instability can impact your retirement savings. Stay on track with these steps:

- Establish a robust emergency fund covering 6-9 months of expenses.

- Create multiple income streams through side gigs or freelance work.

- Invest in continuous learning to remain competitive in your field.

- Roll over your 401(k) when changing jobs to avoid penalties.

The Bureau of Labor Statistics indicates that men without a college degree change jobs more frequently in their early career compared to later years. Preparation for these transitions is key.

Avoiding Lifestyle Inflation

As your income increases, resist the urge to boost spending. Maintaining a modest lifestyle can significantly enhance your retirement savings. Consider these strategies:

- Adhere to your budget, even after pay raises.

- Boost your retirement contributions with each salary increase.

- Prioritize experiences over material possessions.

- Implement a 30-day rule for major purchases to curb impulse buying.

A Fidelity study found that increasing retirement savings by just 1% of your salary can add up to $330 per month in retirement income.

These challenges require discipline and strategic planning. Professional financial advisors (like those at Davies Wealth Management) can help create personalized plans that address these hurdles while keeping your long-term goals in focus. Every small step you take today can lead to significant financial security in the future.

Final Thoughts

Starting retirement planning in your 20s sets a strong foundation for your financial future. The Retirement Planning Council emphasizes the importance of early action to harness compound interest and develop robust financial habits. These steps will provide you with more flexibility and peace of mind as you progress through different life stages.

Key strategies include setting clear goals, budgeting, and maximizing retirement accounts. Overcoming challenges like student loan debt and job market volatility will strengthen your financial position. The long-term benefits of early planning are significant, giving you more time to grow wealth and adjust strategies as needed.

While self-education is valuable, professional financial advice can enhance your retirement planning efforts. At Davies Wealth Management, we offer tailored financial solutions to help individuals navigate their unique financial journeys. Our expertise can help you build, protect, and grow your wealth with confidence.

Leave a Reply