At Davies Wealth Management, we understand the importance of effective project portfolio management in driving business success. In today’s complex business landscape, choosing the right PPM model is crucial for organizations to align their projects with strategic goals.

This blog post explores various project portfolio management models, from traditional approaches to agile methodologies and hybrid solutions. We’ll also discuss how these models can be applied using an ETF portfolio management tool, enhancing decision-making and resource allocation processes.

Traditional PPM Models: Proven Approaches for Success

The Power of Weighted Scoring

The weighted scoring model offers organizations a versatile tool to evaluate projects based on multiple criteria. This model assigns weights to factors such as strategic alignment, financial return, and risk, enabling more informed decisions. A study examined actual cases from Australia, New Zealand, and the United States to evaluate the benefits of using organizational project management maturity models.

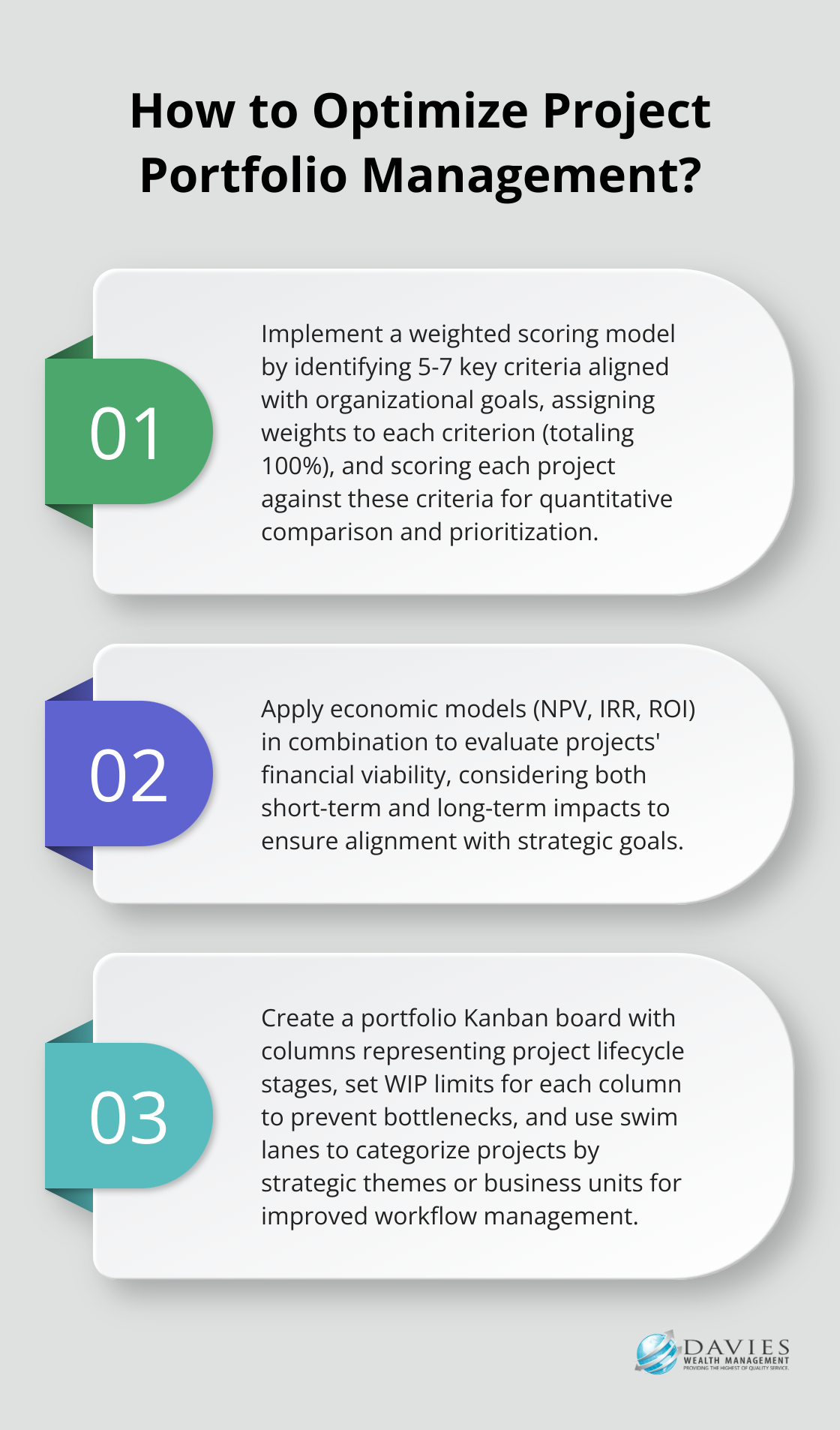

To implement this model effectively:

- Identify 5-7 key criteria aligned with organizational goals

- Assign weights to each criterion (total should equal 100%)

- Score each project against these criteria

This approach provides a quantitative basis for comparing diverse projects, simplifying prioritization and resource allocation.

Economic Models: Financial Lens for Project Evaluation

Economic models (Net Present Value, Internal Rate of Return, and Return on Investment) offer a financial perspective for project evaluation. These models prove particularly useful for organizations focused on maximizing financial returns.

- NPV calculates the present value of future cash flows, accounting for the time value of money

- IRR represents the expected annual rate of return

- ROI measures investment efficiency by comparing cost to expected return

When applying these models, consider both short-term and long-term impacts. A project with a high short-term ROI might not align with long-term strategic goals. Using a combination of these metrics provides a comprehensive view of a project’s financial viability.

Balanced Scorecard: A Holistic Approach

The balanced scorecard approach takes a holistic view of project performance by considering four perspectives: financial, customer, internal processes, and learning and growth. This model effectively balances short-term financial goals with long-term strategic objectives.

To implement a balanced scorecard:

- Identify key performance indicators (KPIs) for each perspective

- Include metrics such as customer satisfaction scores, process efficiency, and employee skill development rates

- Review KPIs regularly to ensure projects contribute to overall organizational health

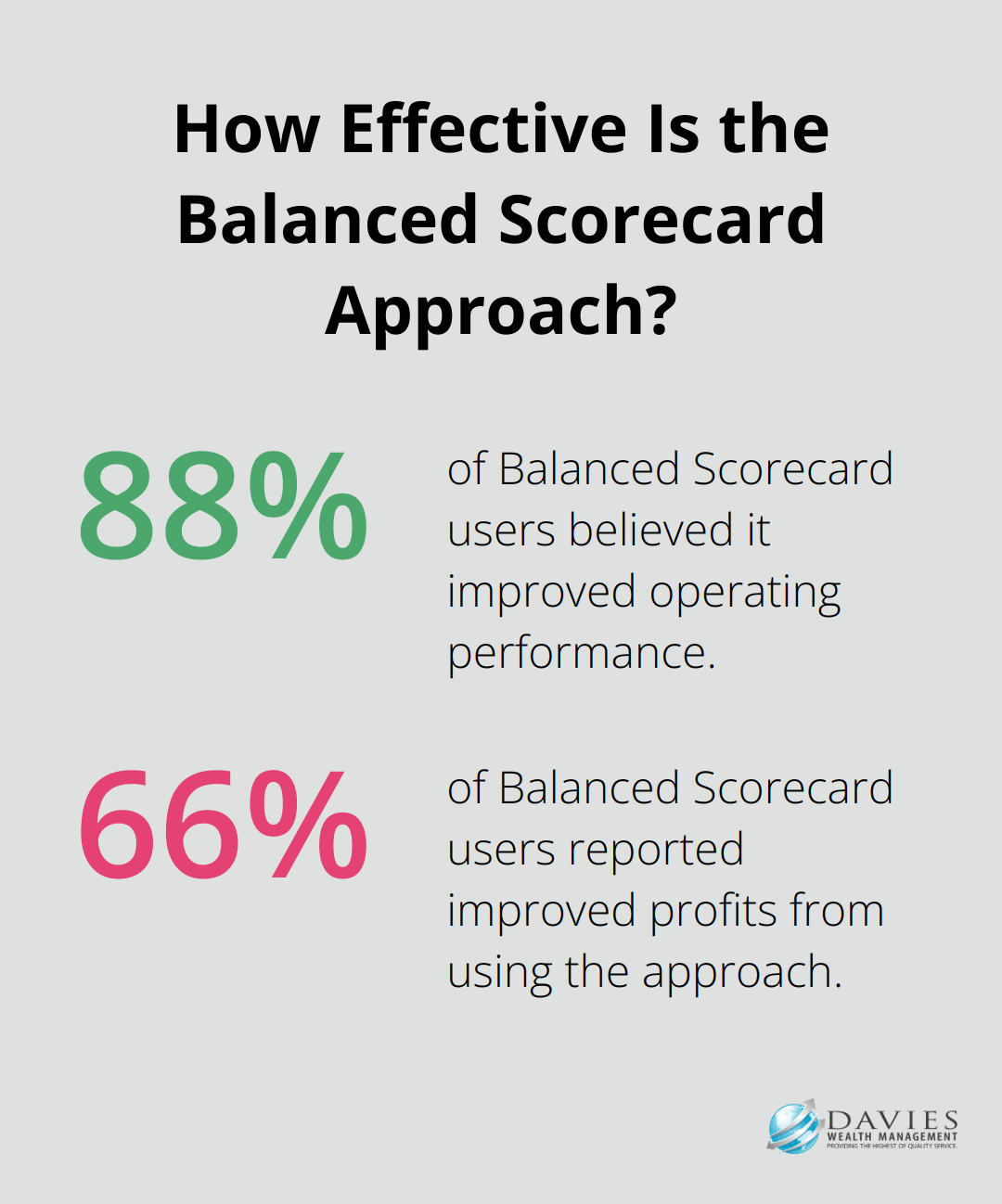

A 2005 IMA survey indicated that 88% of BSC users believed it improved operating performance, and 66% reported improved profits from using the balanced scorecard approach. This underscores the value of a multi-dimensional approach to project evaluation and management.

Traditional PPM models offer robust frameworks for project evaluation and selection. The key lies in choosing the model that best aligns with your organization’s goals and culture. Many organizations find that a combination of these models yields the best results, providing a comprehensive view of project value and strategic alignment.

As we move forward, it’s important to consider how these traditional models can adapt to more agile environments. The next section will explore Agile Project Portfolio Management Models and how they address the need for flexibility and rapid response in today’s fast-paced business landscape.

Agile PPM Models: Adapting to Change

In today’s fast-paced business environment, agile project portfolio management models have become increasingly popular. These models offer flexibility and responsiveness, allowing organizations to adapt quickly to changing market conditions and customer needs. Let’s explore three prominent agile PPM models and their practical applications.

Kanban Portfolio Management

Kanban Portfolio Management applies the principles of visual workflow management to the portfolio level. This model focuses on visualizing work, limiting work in progress (WIP), and optimizing flow.

To implement Kanban Portfolio Management:

- Create a portfolio Kanban board with columns representing different stages of project lifecycle

- Set WIP limits for each column to prevent bottlenecks

- Use swim lanes to categorize projects by strategic themes or business units

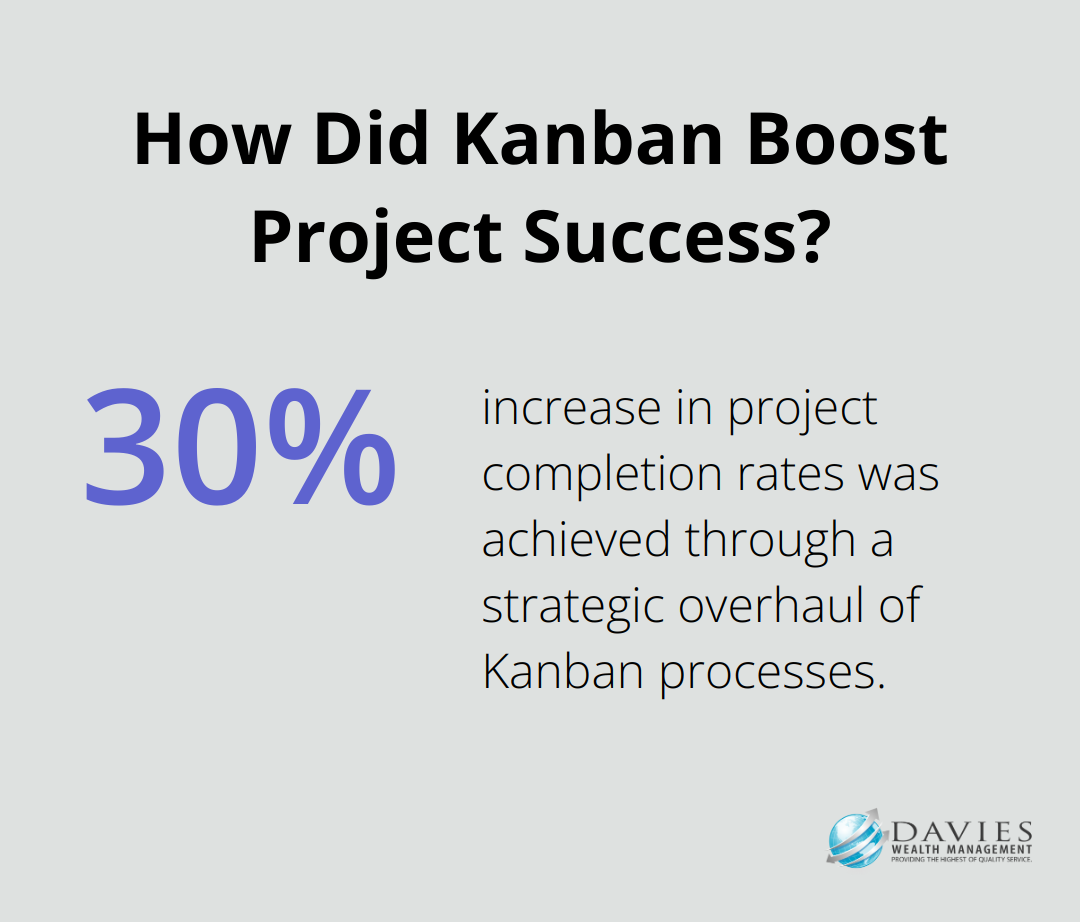

A strategic overhaul of Kanban processes led to a 25% reduction in project lead times and a 30% increase in project completion rates.

Lean Portfolio Management

Lean Portfolio Management (LPM) emphasizes value delivery, waste reduction, and continuous improvement. This model aligns well with organizations seeking to maximize efficiency and customer value.

Key practices in LPM include:

- Strategy and investment funding: Allocate resources based on value streams rather than projects

- Agile portfolio operations: Use lean budgeting and capacity allocation

- Lean governance: Implement decentralized decision-making and lightweight approval processes

LPM unleashes all portfolio members’ creative and productive energy toward achieving its goals and unlocks people’s intrinsic motivation.

SAFe Portfolio Management

The Scaled Agile Framework (SAFe) provides a comprehensive approach to scaling agile practices across the enterprise, including portfolio management. SAFe Portfolio Management focuses on aligning execution with business strategy through a set of lean-agile principles and practices.

Key components of SAFe Portfolio Management include:

- Strategic themes: Define business objectives that guide portfolio decisions

- Portfolio backlog: Maintain a prioritized list of epics (large, complex initiatives)

- Lean budget guardrails: Establish funding and governance models that support agile execution

The SAFe Business Agility assessment is designed for business and portfolio stakeholders to assess their overall progress in achieving true business agility.

Adapting Agile PPM to Financial Services

While these models often associate with software development, financial services firms can successfully adapt them to manage diverse portfolios of services and products. This approach allows organizations to respond more quickly to market changes and client needs, ultimately delivering better results for clients.

When selecting an agile PPM model, organizations must assess their culture, goals, and current processes. Each model offers unique benefits, and the best choice often depends on specific needs and challenges. Many organizations find success in combining elements from different models to create a tailored approach that works best for them.

As we move forward, it’s important to consider how traditional and agile models can work together. The next section will explore Hybrid Project Portfolio Management Models and how they bridge the gap between established practices and modern agile methodologies.

Bridging the Gap: Hybrid PPM Models

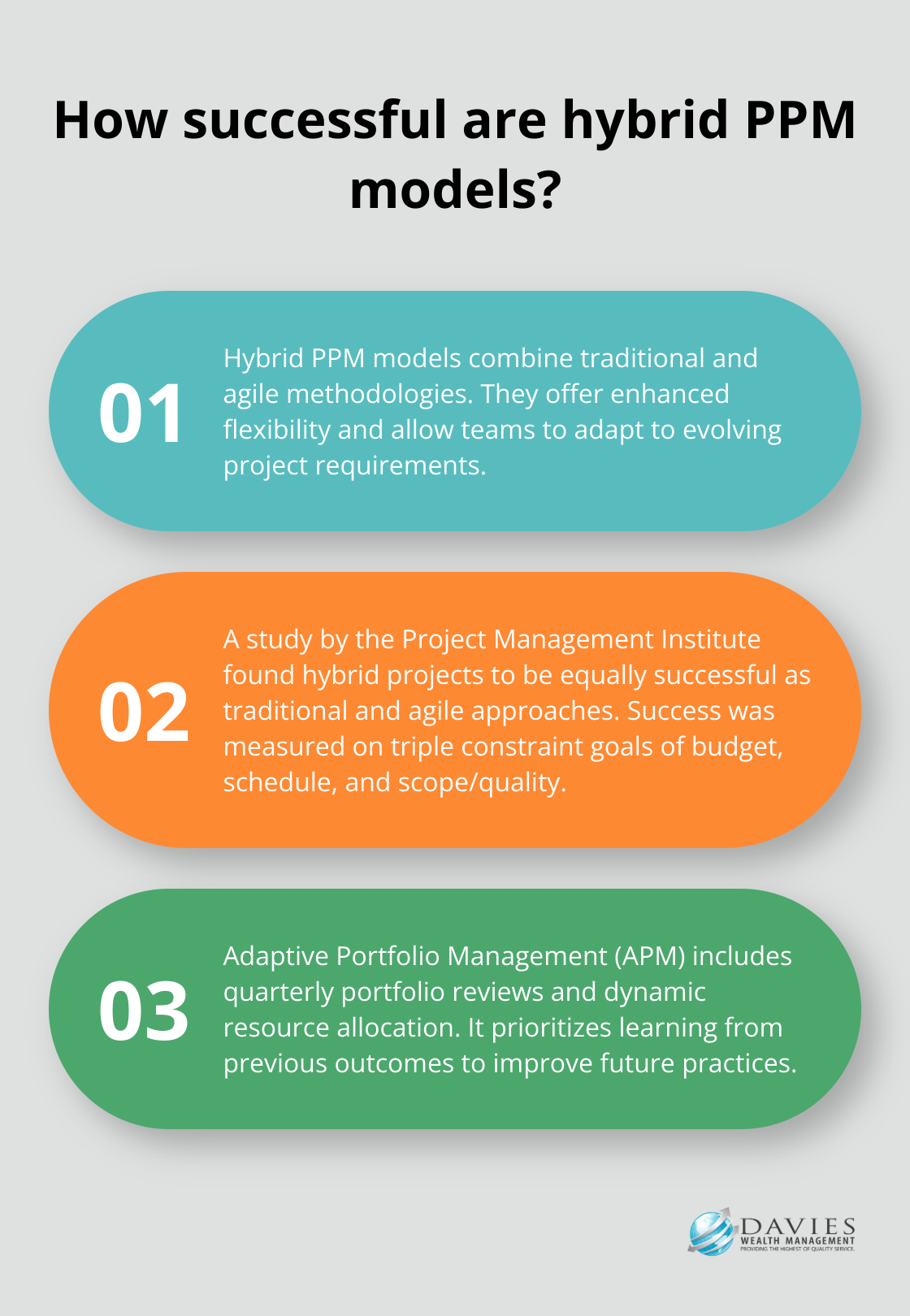

In the ever-evolving landscape of project portfolio management, hybrid PPM models have emerged as a powerful solution for organizations seeking to balance traditional methodologies with agile approaches. These hybrid models often provide the best of both worlds, offering enhanced flexibility by integrating traditional and agile practices, allowing teams to adapt to evolving project requirements and stakeholder needs.

The Power of Combining Traditional and Agile

Hybrid PPM models integrate elements from both traditional and agile methodologies, allowing organizations to tailor their approach based on project requirements. For instance, a financial services firm might use traditional methods for long-term investment strategies while employing agile techniques for developing new digital banking products.

A study by the Project Management Institute found that hybrid projects delivered the same level of success on triple constraint goals (budget, schedule, and scope/quality) as traditional and agile approaches.

Adaptive Portfolio Management: Flexibility Meets Structure

Adaptive Portfolio Management (APM) is an approach that prioritizes learning from previous outcomes and decisions to improve future practices. This approach allows for regular reassessment of project portfolios, ensuring alignment with strategic goals.

Key components of APM include:

- Regular portfolio reviews (quarterly)

- Dynamic resource allocation

- Continuous stakeholder feedback loops

Bimodal Portfolio Management: Two Speeds, One Goal

Gartner’s concept of Bimodal IT has been adapted to portfolio management, resulting in Bimodal Portfolio Management. This approach recognizes that different types of projects require different management styles.

Mode 1 focuses on predictability and efficiency, suitable for well-understood, stable projects. Mode 2 emphasizes agility and speed, ideal for exploratory, innovative initiatives.

Implementing Hybrid PPM Models

Implementing hybrid PPM models requires careful consideration of organizational culture, project types, and strategic objectives. It’s not a one-size-fits-all solution, but rather a customizable approach that can be tailored to specific needs.

Organizations that successfully implement these models are better positioned to navigate the complexities of modern project portfolios and deliver value consistently. As the business landscape continues to evolve, hybrid PPM models offer a promising path forward, combining the rigor of traditional methods with the flexibility of agile approaches.

Final Thoughts

Project portfolio management models offer diverse approaches to align projects with strategic goals. Organizations must select the right model based on their culture, project types, and objectives to enhance decision-making and optimize resource allocation. At Davies Wealth Management, we understand the importance of effective project portfolio management in achieving financial goals and maximizing investment returns.

The future of project portfolio management will likely involve artificial intelligence and machine learning for project selection and resource optimization. ETF portfolio management tools integrated with PPM systems may provide enhanced capabilities for financial services firms to manage diverse investment portfolios. We expect a continued emphasis on adaptability and value-driven decision-making in PPM practices.

Organizations must remain agile in their approach to project portfolio management as the business landscape evolves. Companies can position themselves for success in an increasingly competitive environment by staying informed about different PPM models and emerging trends. At Davies Wealth Management, we help our clients navigate these complexities and achieve their financial objectives through tailored wealth management solutions.

Leave a Reply