Professional athletes face unique financial challenges that require specialized guidance. Their careers are often short-lived, with high earnings concentrated in a brief period, making long-term financial planning crucial.

At Davies Wealth Management, we understand the complexities of managing wealth for pro athletes. A skilled pro athlete financial advisor can help navigate the intricacies of sports contracts, endorsement deals, and post-career financial strategies, ensuring athletes maintain financial stability long after they leave the field.

Why Pro Athletes Need Specialized Financial Advice

The Career Clock Ticks Fast

Professional athletes face a unique set of financial challenges that demand specialized guidance. The average career span of a professional athlete is shockingly short. The average career length of an NFL player is 3.3 years. NBA players fare slightly better with an average career of 4.5 years (according to Business Insider). This brief window of high earnings creates an urgent need for strategic financial planning.

The Income Rollercoaster

Athletes often experience extreme income fluctuations. A rookie might suddenly sign a multi-million dollar contract, followed by years of uncertain earnings due to injuries or performance issues. This volatility makes budgeting and long-term planning particularly challenging.

Complex Tax Situations

The tax situation for pro athletes is notoriously complex. They may owe taxes in multiple states due to the “jock tax,” which requires athletes to pay taxes in states where they play games. Additionally, income from various sources (salaries, bonuses, endorsements, and appearance fees) each come with their own tax implications.

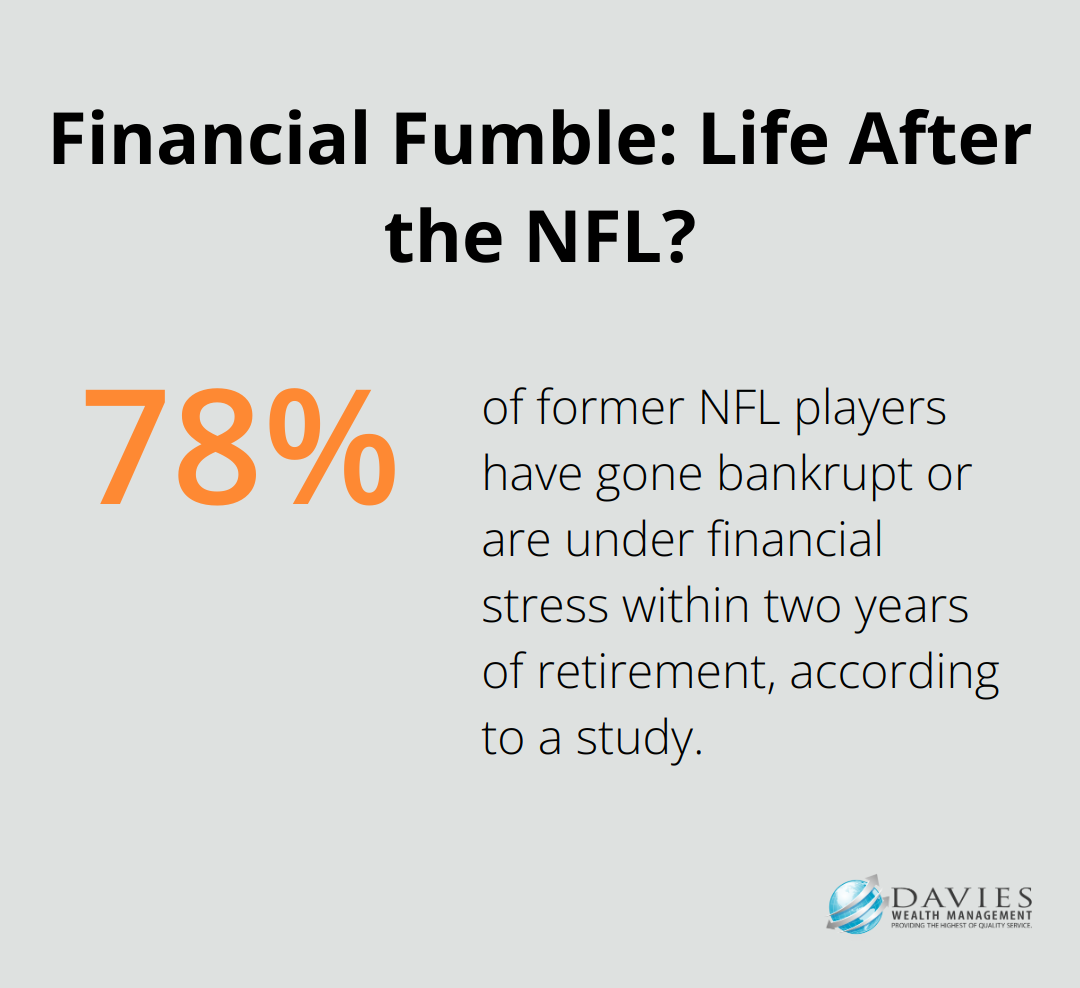

Life After the Game

Perhaps the most critical challenge is preparation for life after sports. Many athletes struggle to transition to new careers and maintain their lifestyle once their playing days end. A study found that 78% of former NFL players have gone bankrupt or are under financial stress within two years of retirement.

The Need for Specialized Financial Advice

These unique challenges underscore the importance of working with financial advisors who understand the specific needs of professional athletes. Specialized advisors can create comprehensive financial strategies that address these complexities and help secure an athlete’s financial future both during and after their sports careers.

Financial advisors with expertise in serving professional athletes (like those at Davies Wealth Management) focus on long-term wealth preservation and growth. They help athletes avoid the financial pitfalls that have befallen many of their peers and create personalized plans that account for the unpredictable nature of a sports career.

As we move forward, we’ll explore the key services that a professional athlete’s financial advisor should offer to effectively manage these unique challenges and ensure long-term financial success.

Essential Services for Pro Athletes’ Financial Success

Professional athletes require specialized financial services to navigate their unique financial landscape. A comprehensive suite of services tailored to meet the specific needs of athletes throughout their careers and beyond is essential.

Customized Investment Strategies

Financial advisors develop personalized investment portfolios that align with an athlete’s risk tolerance, career stage, and long-term goals. The approach focuses on diversification to mitigate risk and capitalize on growth opportunities. Private equity or venture capital investments can potentially offer higher returns, and some athletes have found great success through smart investments.

Strategic Tax Planning

Tax optimization is a key component for athletes who often face complex tax situations. Charitable donations, either one-time or over a lifetime, not only help those in need but can also reduce the donor’s taxes. Financial teams stay up-to-date with the latest tax laws affecting athletes (including the “jock tax”) to ensure compliance while maximizing after-tax income.

Comprehensive Risk Management

Protecting an athlete’s wealth is paramount. Thorough risk assessments and tailored insurance strategies safeguard an athlete’s financial future against unforeseen circumstances that could derail their career and financial stability. Disability insurance for athletes is designed to provide financial protection if they suffer an injury or illness that prevents them from competing.

Post-Career Financial Planning

Planning for life after sports is a critical component of financial services for athletes. Advisors help athletes develop sustainable income streams and career transition strategies. This includes the creation of business plans for post-career ventures, identification of investment opportunities that align with their interests, and establishment of retirement income plans that maintain their desired lifestyle long after they leave the playing field.

Ongoing Education and Support

Financial literacy is a cornerstone of long-term financial success. Top-tier financial advisors provide ongoing education to empower athletes to make informed financial decisions. This includes regular workshops, one-on-one sessions, and access to resources that help athletes understand complex financial concepts and stay informed about market trends.

The next chapter will explore how athletes can choose the right financial advisor to navigate these complex financial waters and secure their financial future.

Selecting Your Financial MVP: Choosing the Right Advisor for Pro Athletes

Experience in the Sports Arena

Professional athletes need financial advisors with a proven track record in the sports industry. These advisors understand the unique challenges athletes face, from short career spans to complex contracts. An advisor experienced with NFL players, for example, will know the intricacies of signing bonuses, performance incentives, and the potential for career-ending injuries.

Solid Credentials and Qualifications

Athletes should not be swayed by flashy promises or celebrity endorsements. Instead, they should focus on solid credentials. A Certified Financial Planner (CFP) designation is a good starting point, demonstrating a commitment to ongoing education and adherence to ethical standards.

Sports Contract Expertise

The ideal financial advisor for athletes possesses a deep understanding of sports contracts and endorsement deals. They should analyze contract fine print, negotiate favorable terms, and help maximize earnings potential. Financial planning for professional athletes can turn short-term high earnings into a lifetime of steady income.

Tailored Financial Strategies

Athletes should avoid advisors who offer one-size-fits-all solutions. Each athlete’s financial situation is unique, and advisors should tailor their approach accordingly. They should take time to understand personal goals, risk tolerance, and lifestyle aspirations. A good advisor will create a comprehensive financial plan that addresses both current needs and long-term objectives.

Commitment to Financial Education

The best advisors don’t just manage money; they empower athletes to understand their finances. Athletes should look for advisors who are committed to improving financial literacy. These advisors should explain complex financial concepts in understandable terms and provide regular updates on the athlete’s financial situation. To enhance financial literacy, athletes should hire a qualified team experienced in working with pro athletes and set up their financial infrastructure, starting with a budget.

Choosing a financial advisor is a critical decision for professional athletes. They should take time, conduct thorough research, and ask tough questions (including about fees and potential conflicts of interest). The right advisor can make a significant difference in an athlete’s financial future, both during their playing career and long after retirement.

Final Thoughts

Professional athletes face unique financial challenges that require specialized guidance. A pro athlete financial advisor plays a vital role in navigating these complexities and securing long-term financial stability. From strategic investment portfolios to tax optimization, risk management, and post-career planning, the right financial advisor can significantly impact an athlete’s financial future.

Athletes should seek professionals with experience in the sports industry, solid credentials, and a deep understanding of sports contracts. The ideal advisor will provide personalized strategies and improve the athlete’s financial literacy. Choosing the right advisor is a critical decision that can transform short-term high earnings into lasting financial security.

We at Davies Wealth Management specialize in providing tailored financial solutions for professional athletes. Our team understands the unique needs of athletes and offers comprehensive wealth management services (including pro athlete financial advisor services). Athletes who partner with experienced financial professionals can focus on their performance while ensuring their financial success off the field.

✅ BOOK AN APPOINTMENT TODAY: https://davieswealth.tdwealth.net/appointment-page

===========================================================

SEE ALL OUR LATEST BLOG POSTS: https://tdwealth.net/articles

If you like the content, smash that like button! It tells YouTube you were here, and the Youtube algorithm will show the video to others who may be interested in content like this. So, please hit that LIKE button!

Don’t forget to SUBSCRIBE here: https://www.youtube.com/channel/UChmBYECKIzlEBFDDDBu-UIg

✅ Contact me: TDavies@TDWealth.Net

====== ===Get Our FREE GUIDES ==========

Retirement Income: The Transition into Retirement: https://davieswealth.tdwealth.net/retirement-income-transition-into-retirement

Beginner’s Guide to Investing Basics: https://davieswealth.tdwealth.net/investing-basics

✅ Want to learn more about Davies Wealth Management, follow us here!

Website:

Podcast:

Social Media:

https://www.facebook.com/DaviesWealthManagement

https://twitter.com/TDWealthNet

https://www.linkedin.com/in/daviesrthomas

https://www.youtube.com/c/TdwealthNetWealthManagement

Lat and Long

27.17404889406371, -80.24410438798957

Davies Wealth Management

684 SE Monterey Road

Stuart, FL 34994

772-210-4031

#Retirement #FinancialPlanning #wealthmanagement

DISCLAIMER

Davies Wealth Management makes content available as a service to its clients and other visitors, to be used for informational purposes only. Davies Wealth Management provides accurate and timely information, however you should always consult with a retirement, tax, or legal professionals prior to taking any action.

Leave a Reply