@davieswealthmanagement Estate Planning Activities: What’s Not Included?

♬ original sound – davieswealthmanagement – davieswealthmanagement

Estate planning is a critical component of financial management, but it’s often misunderstood. At Davies Wealth Management, we’ve noticed many clients are unsure about what estate planning actually covers.

With the introduction of the SECURE Act 2.0, estate planning has become even more complex. This blog post will clarify what’s not included in estate planning activities, helping you better understand its scope and limitations.

What Does Estate Planning Really Cover?

Dispelling Common Myths

Estate planning often falls victim to misconceptions. At Davies Wealth Management, we encounter clients who misunderstand its scope and purpose. Let’s address some common misunderstandings.

Not Exclusive to the Wealthy

A prevalent myth suggests estate planning is only for the rich. This notion couldn’t be more incorrect. Everyone (regardless of net worth) can benefit from estate planning. Whether you own a modest savings account or multiple properties, estate planning ensures your assets are distributed according to your wishes. It also covers vital decisions about healthcare and guardianship for minor children.

More Than Asset Distribution

While asset distribution is a key component, estate planning encompasses a broader range of considerations. It includes:

- Making healthcare decisions through advance directives

- Appointing powers of attorney for financial and medical matters

- Planning for potential incapacity

These elements are essential for individuals across all income levels.

Not a Comprehensive Financial Plan

It’s crucial to understand that estate planning doesn’t automatically cover every aspect of your financial life. Several areas typically fall outside its scope:

- Day-to-day budgeting

- Short-term investment decisions

- Regular income tax planning

These areas require separate attention and often different expertise.

Estate planning forms a critical component of overall financial health, but it’s not a one-size-fits-all solution. Understanding its limitations helps you make informed decisions about your comprehensive financial strategy. As we move forward, let’s explore the specific financial activities that lie outside the realm of estate planning.

What Financial Activities Are Not Part of Estate Planning?

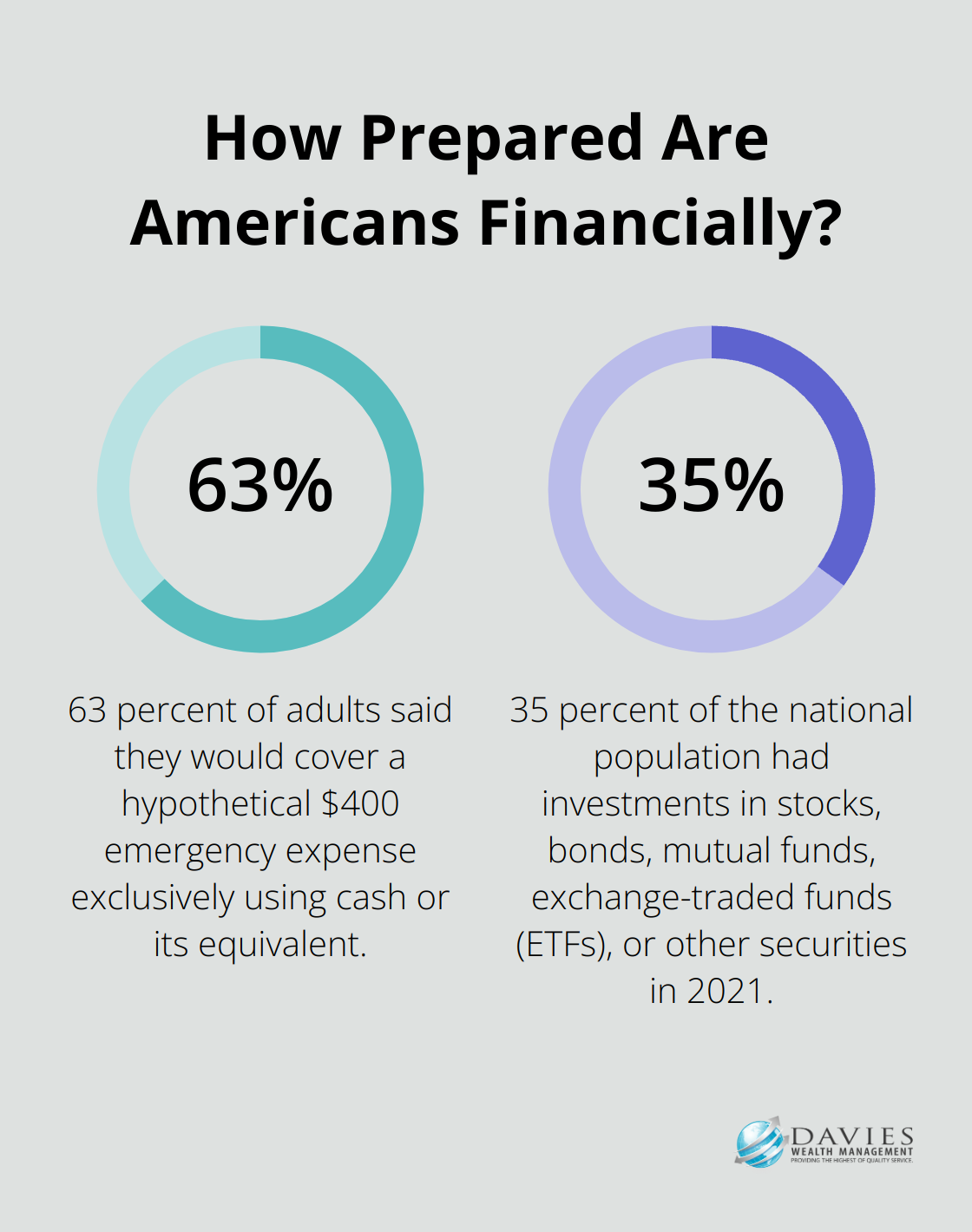

Daily Budgeting and Expense Tracking

Estate planning does not cover your daily financial management. 63 percent of adults said they would cover a hypothetical $400 emergency expense exclusively using cash or its equivalent. We recommend the use of budgeting apps or spreadsheets to track your expenses. This practice will help you maintain financial discipline and identify areas where you can save or invest more effectively.

Short-Term Investment Strategies

While estate planning considers long-term asset distribution, it typically excludes short-term investment decisions. 35 percent of the national population had investments in stocks, bonds, mutual funds, exchange-traded funds (ETFs), or other securities in 2021. Short-term investment strategies require regular monitoring and adjustments based on market conditions and personal financial goals. These decisions benefit from the guidance of a financial advisor who can help you balance risk and reward in your investment portfolio.

Annual Tax Planning

Estate planning addresses estate taxes but does not cover your annual income tax planning. The Internal Revenue Service (IRS) reports that about 60% of taxpayers use tax preparation software to file their returns. However, tax planning extends beyond just filing returns. It involves strategies to minimize your tax liability throughout the year. This might include maximizing deductions, timing income recognition, or making strategic charitable contributions. A tax professional or financial advisor can help you develop a comprehensive tax strategy that aligns with your overall financial goals.

Retirement Account Management

While estate planning considers how to distribute retirement accounts after death, it does not typically involve the active management of these accounts during your lifetime. This includes decisions about contribution levels, investment allocations, and required minimum distributions (RMDs). Active management of retirement accounts (such as 401(k)s and IRAs) is crucial for ensuring financial security in your later years.

Credit Management and Debt Reduction

Estate planning does not address ongoing credit management or debt reduction strategies. Managing credit, improving credit scores, and implementing debt reduction strategies are essential components of overall financial integrity. These activities require ongoing attention and often benefit from professional guidance to create effective repayment plans and avoid costly interest charges.

As we move forward, it’s important to understand that while these financial activities fall outside the scope of estate planning, they play a significant role in your overall financial well-being. Let’s now explore the legal and personal matters that estate planning doesn’t typically cover.

Beyond Estate Planning Boundaries: Legal and Personal Matters

Divorce Proceedings and Settlements

Estate planning does not cover divorce proceedings and settlements. Between 1990 and 2010, the divorce rate for U.S. married couples over 50 doubled and more than doubled for married couples aged 65 and older. This trend highlights the need to understand how divorce affects your financial landscape. During a divorce, you must:

- Revise your estate plan to reflect your new marital status

- Update beneficiary designations on retirement accounts and life insurance policies

- Reassess your overall financial strategy

While estate planning excludes the complexities of divorce settlements, you should update your estate plan after a divorce to align with your new circumstances.

Business Operations and Management

Estate planning typically does not involve the day-to-day operations and management of your business. The U.S. Small Business Administration reports that small businesses account for 99.9% of all U.S. businesses. As a business owner, you need separate strategies for:

- Succession planning

- Business continuity

- Employee management

- Operational decision-making

Your estate plan may include provisions for the transfer of business ownership upon your death, but it does not guide the ongoing management of your company. For comprehensive business planning, you should work with a business advisor in addition to your estate planning professional.

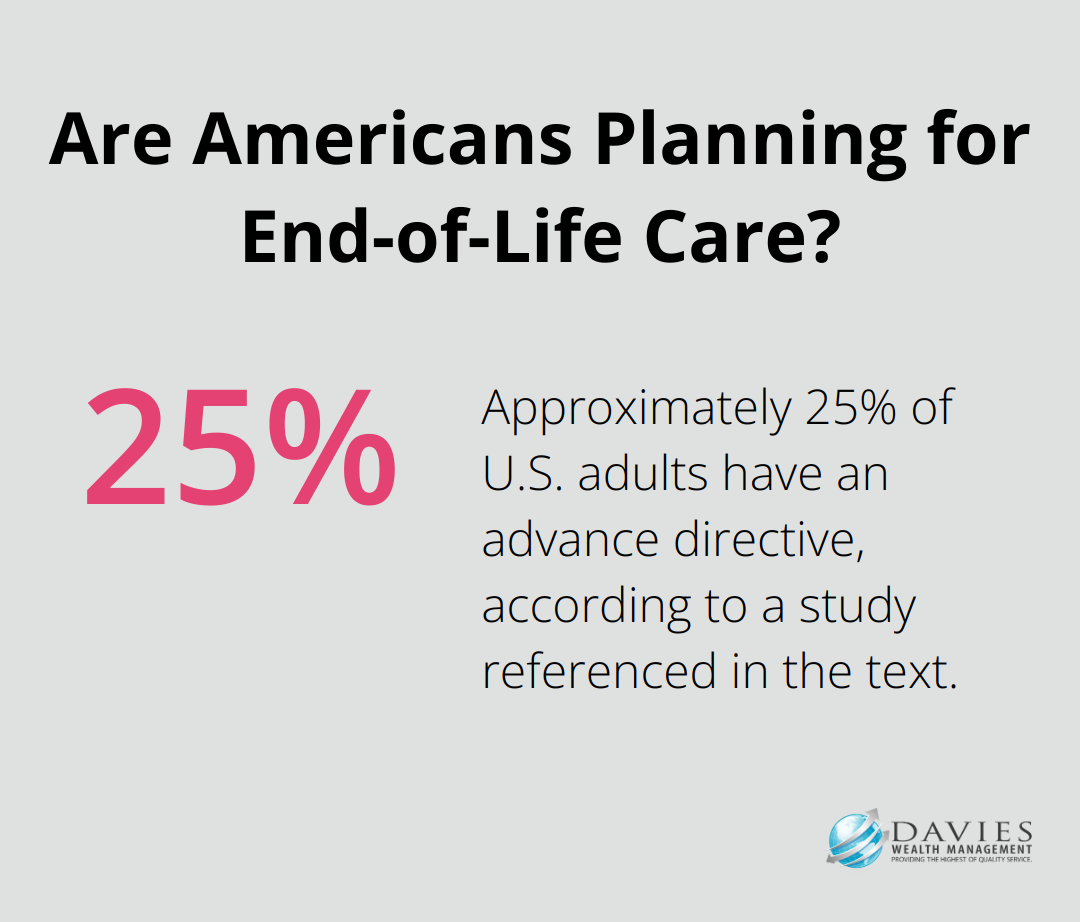

Personal Healthcare Decisions

Estate planning includes advance directives for end-of-life care, but it does not cover all personal healthcare decisions. Approximately 25% of U.S. adults have an advance directive, with lack of awareness being the most frequently reported reason for not having one. However, many healthcare decisions fall outside this scope (e.g., choosing healthcare providers, making decisions about non-life-threatening treatments, managing chronic conditions).

For these ongoing healthcare decisions, you must stay actively involved and consult with medical professionals as needed. Your estate plan can provide guidance for incapacity or end-of-life scenarios, but it does not substitute for ongoing healthcare management.

Financial Activities Outside Estate Planning

Estate planning does not encompass several important financial activities. These include:

- Day-to-day budgeting and expense tracking

- Short-term investment strategies

- Annual tax planning

- Active management of retirement accounts

- Credit management and debt reduction

These financial activities require ongoing attention and often benefit from professional guidance. While they fall outside the scope of estate planning, they play a significant role in your overall financial well-being. For professional athletes, intelligent planning is crucial to achieve lasting financial success and secure their future beyond their sports careers.

Final Thoughts

Estate planning focuses on asset distribution, healthcare directives, and power of attorney appointments, but it doesn’t cover daily financial activities or short-term investment decisions. The SECURE Act 2.0 has added new complexities to estate planning, particularly for retirement accounts. This legislation emphasizes the need to stay informed and review your estate plan regularly to align with current laws and personal circumstances.

Davies Wealth Management offers a range of services to help you navigate all aspects of your financial life, including investment management and retirement planning. Our team specializes in addressing the unique financial challenges faced by professional athletes, ensuring effective wealth management during and after their careers. We encourage you to seek professional advice for comprehensive financial planning to secure your financial future and achieve your long-term goals.

For personalized guidance on estate planning and comprehensive wealth management solutions, contact our team at Davies Wealth Management. We will help you build, protect, and transfer your wealth with confidence, ensuring your financial security at every stage of life.

Leave a Reply