Personal financial planning starts by creating a plan of action, and it’s a crucial step towards achieving your financial goals. At Davies Wealth Management, we’ve seen firsthand how a well-crafted action plan can transform your financial future.

This guide will walk you through the essential steps to create your own personal financial planning action plan, empowering you to take control of your finances and build a secure financial future.

Where Do You Stand Financially?

Assess Your Net Worth

To create an effective personal financial planning action plan, you must start with a clear picture of your current financial situation. Calculate your net worth by listing all your assets (what you own) and subtracting your liabilities (what you owe). Include everything from savings accounts and investments to home equity and outstanding debts. This calculation provides a snapshot of your overall financial health.

Review Income and Expenses

Examine your income and expenses meticulously. Track every dollar that comes in and goes out for at least a month. Many individuals discover they spend more than they realize on discretionary items. Use a budgeting app or spreadsheet to categorize your expenses, which will help you identify potential areas for reduction.

Evaluate Debt and Credit

List all your debts, including credit cards, student loans, and mortgages. Note the interest rates and monthly payments for each. This overview will help you prioritize which debts to address first in your action plan.

Your credit score plays a critical role in your financial health. Check your credit report for free at AnnualCreditReport.com and review it for any errors or areas for improvement. A good credit score can save you thousands in interest over your lifetime (and potentially open doors to better financial opportunities).

Analyze Savings and Investments

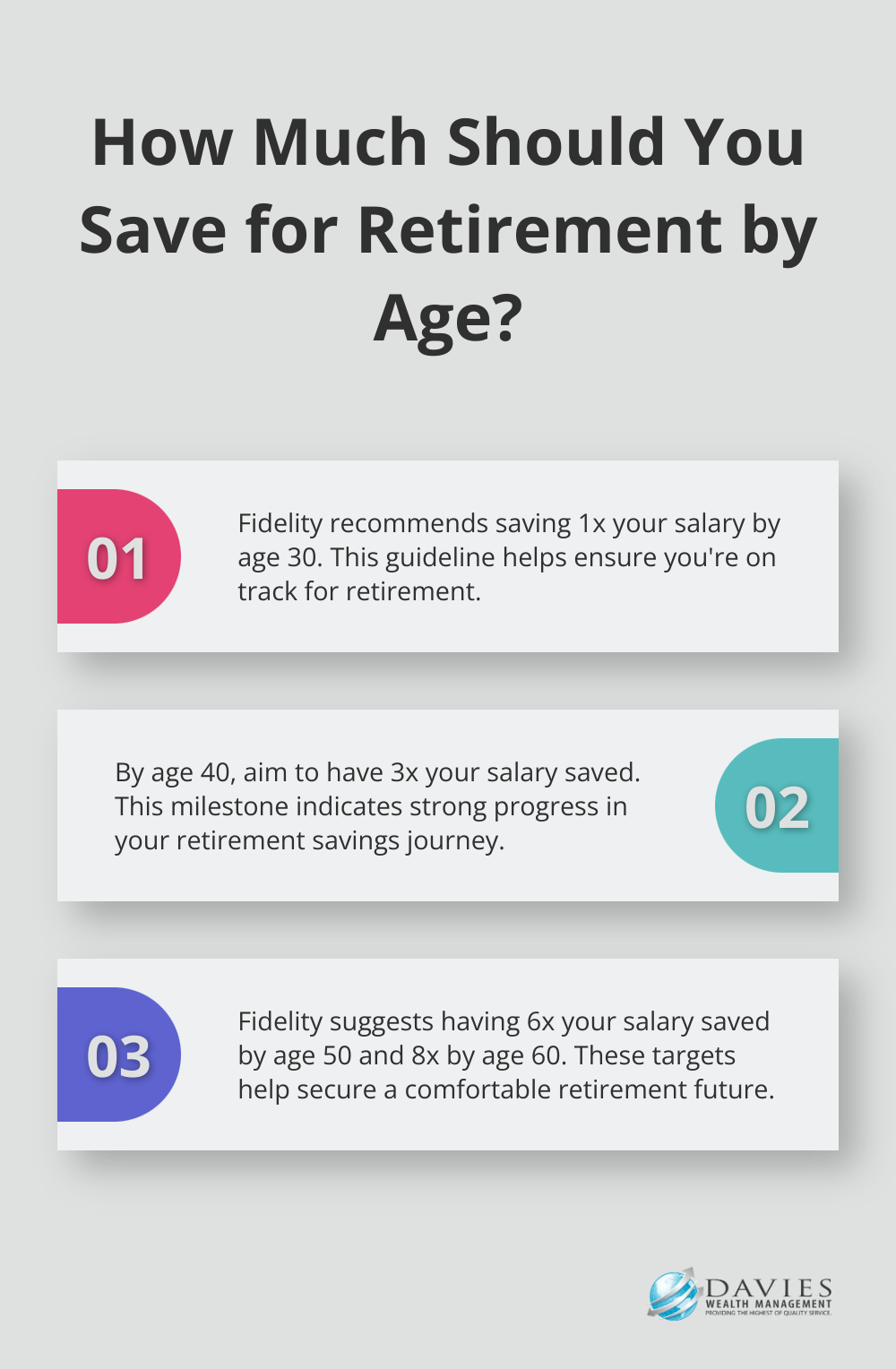

Take stock of your savings and investments. How much have you set aside for emergencies? Are you on track with your retirement savings? According to Fidelity, you should try to have 1x your salary saved by age 30, 3x by 40, 6x by 50, and 8x by 60. If you fall short, don’t panic – this awareness marks the first step toward improvement.

Many clients express surprise at what they uncover during this assessment phase. It’s not uncommon to find untapped opportunities for growth or areas where small changes can lead to significant improvements. This comprehensive financial snapshot serves as the foundation for the rest of your action plan, ensuring that the goals you set and the strategies you develop align with your financial reality.

Now that you have a clear understanding of your current financial situation, it’s time to set clear financial goals that will guide your journey towards financial success. Let’s explore how to define and prioritize these objectives in the next section.

What Are Your Financial Goals?

Define Your Financial Objectives

Start by identifying your short-term and long-term financial objectives. Short-term goals might include paying off credit card debt within six months or saving for a vacation next year. Long-term goals could be retiring at 60 with $2 million in savings or purchasing a home in five years.

Be specific when defining these goals. Instead of saying “save more money,” set a target like “save $10,000 for a down payment on a house by December 2025.” This level of specificity makes your goals more actionable and easier to track.

Prioritize Your Financial Goals

Once you’ve identified your goals, prioritize them. Not all financial objectives carry equal weight or urgency. For instance, building an emergency fund might take precedence over saving for a luxury vacation.

A useful approach is to rank your goals based on importance and timeline. High-priority, short-term goals should be addressed first, while longer-term objectives can be worked towards consistently over time.

Make Your Goals SMART

To increase the likelihood of achieving your financial goals, make them SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Key short-term goals include setting a budget, reducing debt, and starting an emergency fund. Medium-term goals should include key insurance policies.

This framework provides clarity and helps you stay motivated. It also makes it easier to track progress and make adjustments as needed.

Factor in Life Events

Your financial goals should account for significant life events that may impact your finances. These could include getting married, having children, buying a home, or changing careers.

For example, if you plan to start a family in the next few years, you might need to adjust your savings goals to account for increased expenses or potential changes in income. Similarly, if you’re considering a career change, factor in potential retraining costs or temporary income reductions.

Professional athletes (a key client group for Davies Wealth Management) often face unique financial challenges, such as planning for post-career income or managing sudden windfalls from contracts or endorsements. These life events require careful consideration in the goal-setting process.

Setting clear, prioritized, SMART goals that account for potential life changes lays a solid foundation for your personal financial planning action plan. This thoughtful approach to goal-setting will guide your financial decisions and help you stay focused on what truly matters to you financially. Now that you’ve established your goals, it’s time to develop strategies to achieve them. Let’s explore how to create a budget, establish an emergency fund, and implement effective debt reduction strategies in the next section.

How to Turn Your Financial Goals into Reality

Build a Budget That Works

Create a realistic budget based on your income and expenses. Allocate your money using the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Use budgeting apps like Mint or YNAB to track your spending automatically. Review your budget monthly and adjust as needed to stay on track.

Fortify Your Financial Foundation

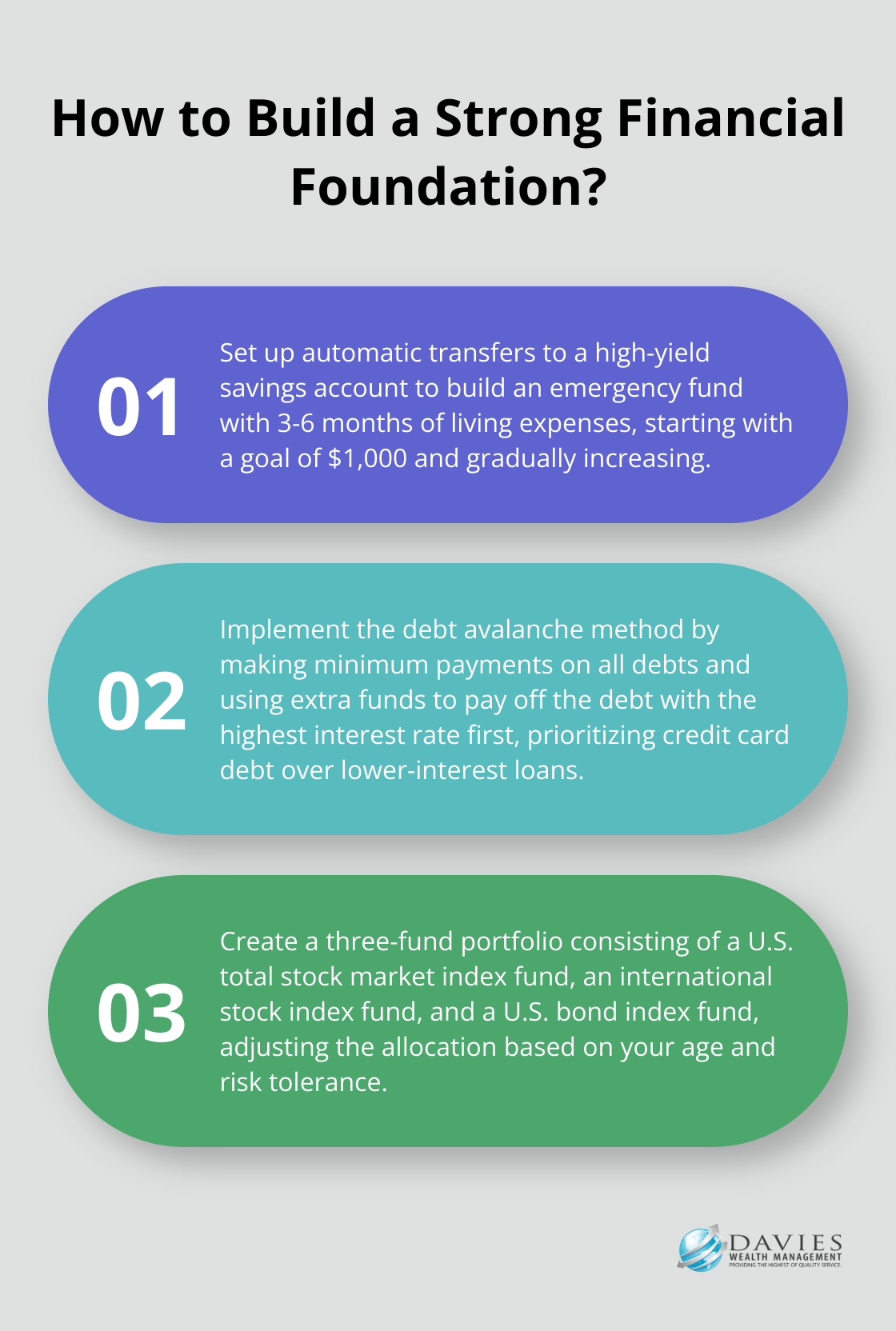

Set up an emergency fund with 3-6 months of living expenses. Start small by saving $1,000, then gradually increase. Set up automatic transfers to a high-yield savings account to make saving effortless. A 2023 Bankrate survey revealed that only 44% of Americans could cover a $1,000 emergency expense from savings, highlighting the critical need for this financial buffer.

Tackle Debt Strategically

Use the debt avalanche method to eliminate high-interest debt efficiently. This method involves making minimum payments on all debt and using any extra funds to pay off the debt with the highest interest rate. For example, if you have a credit card with 18% APR and a student loan at 5%, prioritize the credit card debt. This approach can save you thousands in interest over time.

Supercharge Your Retirement Savings

Maximize your retirement contributions. If your employer offers a 401(k) match, contribute at least enough to get the full match – it’s essentially free money. For 2024, you can contribute up to $23,000 to a 401(k), or $30,500 if you’re 50 or older. Don’t forget about IRAs – you can contribute up to $7,000 ($8,000 if 50+) in 2024. If you’re self-employed or a small business owner, consider a SEP IRA or Solo 401(k) for even higher contribution limits.

Diversify Your Investment Portfolio

Spread your investments across different asset classes to manage risk. A common starting point is the three-fund portfolio, which offers a simple approach to investing. It typically consists of a U.S. total stock market index fund, an international stock index fund, and a U.S. bond index fund. Adjust the allocation based on your risk tolerance and time horizon. For example, a younger investor might have 80% in stocks and 20% in bonds, while someone nearing retirement might opt for a 60/40 split. Setting clear financial goals can help create a roadmap towards your desired financial outcomes.

Final Thoughts

Personal financial planning starts by creating a plan of action, which this guide has outlined in essential steps. Your financial plan should adapt to life changes, economic fluctuations, and evolving goals. We recommend you review and adjust your plan annually or after significant life events to keep your strategies aligned with your current circumstances and long-term objectives.

Complex financial situations often benefit from professional expertise. At Davies Wealth Management, we offer personalized wealth management services tailored to your unique goals. Our team provides comprehensive financial advisory services, including cash flow optimization, retirement planning, tax minimization strategies, and investment management.

Take the first step towards financial empowerment today. Whether you choose to go it alone or seek professional guidance, the most important action is to begin. Your future self will thank you for the financial foundation you build now.

Leave a Reply