Stuart, Florida, is a retirement haven with its beautiful beaches and vibrant community. However, personal finance retirement planning in this coastal paradise comes with unique considerations.

At Davies Wealth Management, we understand the specific challenges and opportunities that Stuart residents face when preparing for their golden years. This guide will provide you with essential strategies to secure your financial future in this charming Treasure Coast city.

What Makes Stuart Unique for Retirees?

A Growing Retirement Community

Stuart, Florida, stands out as a distinctive retirement destination with its coastal charm and vibrant community. The city’s population continues to grow, with retirees forming a significant portion of new residents. The U.S. Census Bureau reports that as of 2023, approximately 25% of Stuart’s population is 65 and older. This demographic shift has sparked an increase in retirement-focused amenities and services throughout the city.

It’s worth noting that the national annual median cost of a semi-private room in a skilled nursing center rose to $111,325 in 2024, an increase of 7%.

Cost of Living Considerations

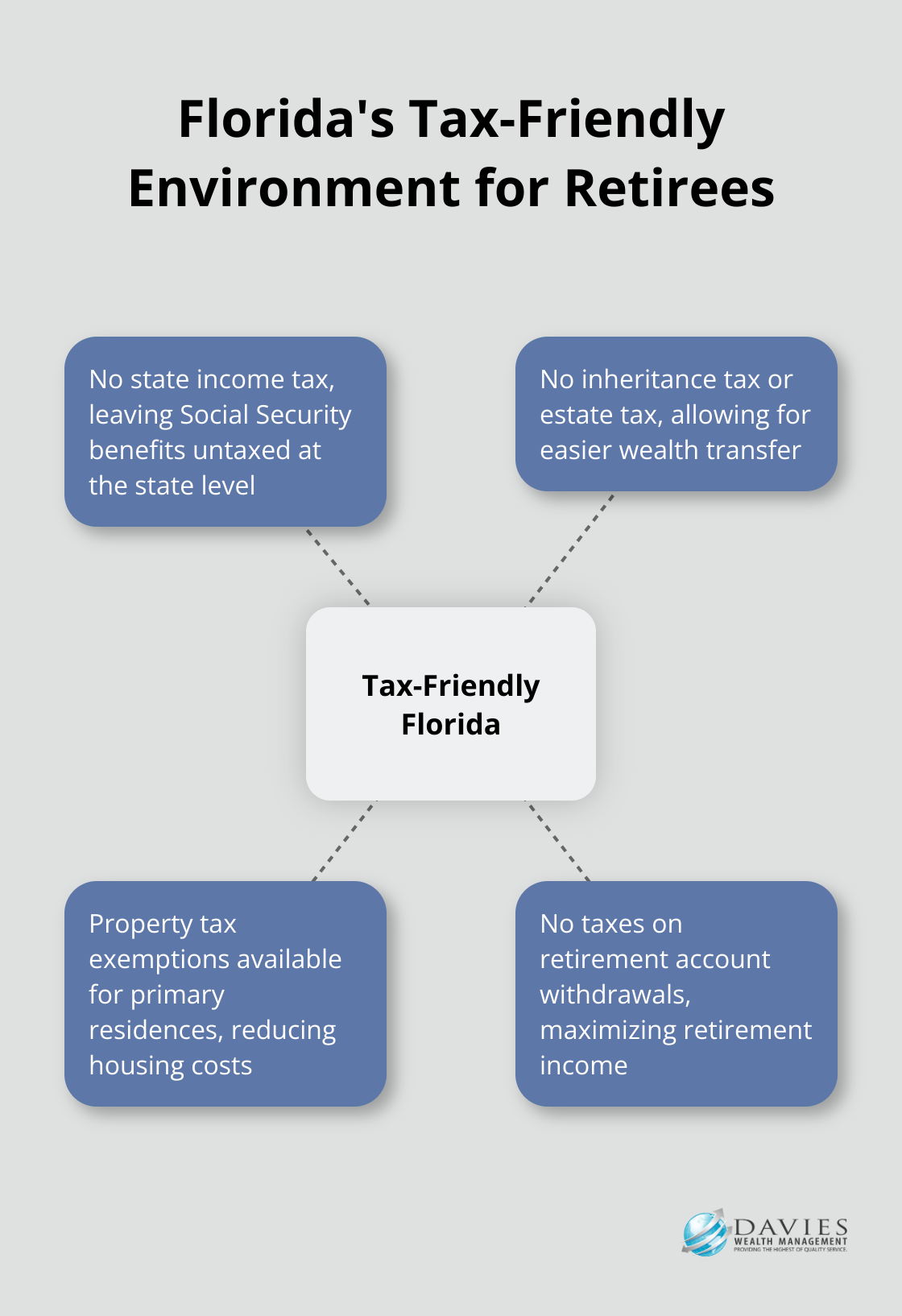

Florida’s tax-friendly environment, with no state income tax, attracts many retirees, but other cost factors require consideration. Housing costs in Stuart exceed the national average slightly, with median home prices around $350,000 as of 2025. However, utility costs fall below the national average, which helps offset some expenses.

Property taxes in Stuart remain relatively moderate, with an average effective property tax rate of about 0.9%. Retirees should also account for flood and hurricane insurance costs, which can add to annual housing expenses (often ranging from $1,500 to $3,000 per year).

Local Resources and Amenities

Stuart offers an array of resources tailored to seniors. The Martin County Parks and Recreation offers free recreational programs for seniors ages 50 and up, Monday through Friday at the Log Cabin Senior Center. The city’s parks and recreation department also offers senior-specific activities and outings.

For healthcare, Martin North Hospital provides a 24-hour Emergency Department for urgent care, as well as primary and specialty services. The city also houses numerous specialists and clinics that cater to senior health needs.

Lifestyle and Recreation

Stuart’s location on Florida’s Treasure Coast provides ample opportunities for an active retirement. The city boasts numerous golf courses, marinas, and beaches. The downtown area, with its charming shops and restaurants, offers a vibrant social scene for retirees.

Financial Planning in Stuart

Retirement planning in Stuart requires a nuanced approach that takes into account these unique local factors. Financial advisors in the area specialize in developing personalized strategies that help retirees make the most of Stuart’s retirement landscape while ensuring financial security.

As we move forward, we’ll explore essential retirement planning strategies tailored specifically for Stuart residents. These strategies will help you navigate the financial aspects of retirement in this coastal paradise.

How to Optimize Your Retirement Plan in Stuart

Aligning Your Retirement Goals with Stuart’s Lifestyle

Retirement planning in Stuart requires a tailored approach that considers the local lifestyle. Many retirees in Stuart enjoy an active outdoor lifestyle, which impacts budget and savings strategies. If you plan to spend time golfing or boating, you should factor these activities into your retirement budget.

Leveraging Social Security in a Tax-Friendly State

Florida’s tax-friendly environment for retirees presents unique opportunities to maximize Social Security benefits. With no state income tax, Social Security income remains untaxed at the state level. This results in significant savings compared to retirees in other states.

Diversifying Your Portfolio for Coastal Living

Stuart’s coastal location and potential for natural disasters necessitate a well-diversified investment portfolio. We recommend allocation of a portion of investments to sectors that thrive in Florida’s economy, such as tourism and healthcare. Additionally, consider investments that can withstand potential market volatility caused by natural disasters.

Tax-Efficient Strategies for Stuart Retirees

While Florida’s lack of state income tax benefits retirees, additional tax-efficient strategies exist. Roth IRA conversions can be particularly advantageous for Stuart retirees. Florida has no state or local income taxes, making it one of the most inexpensive places to make a Roth conversion.

Local Economic Considerations

Stuart’s unique economic landscape offers both opportunities and challenges for retirees. The city’s diverse economic sectors provide potential investment opportunities. Understanding these local economic factors allows for more informed financial decisions and a retirement plan that aligns with Stuart’s economic realities.

As we move forward, we’ll explore the critical aspects of healthcare and long-term care planning in Stuart, which form an essential part of a comprehensive retirement strategy.

Healthcare Planning for Stuart Retirees

Medicare and Supplemental Insurance Options

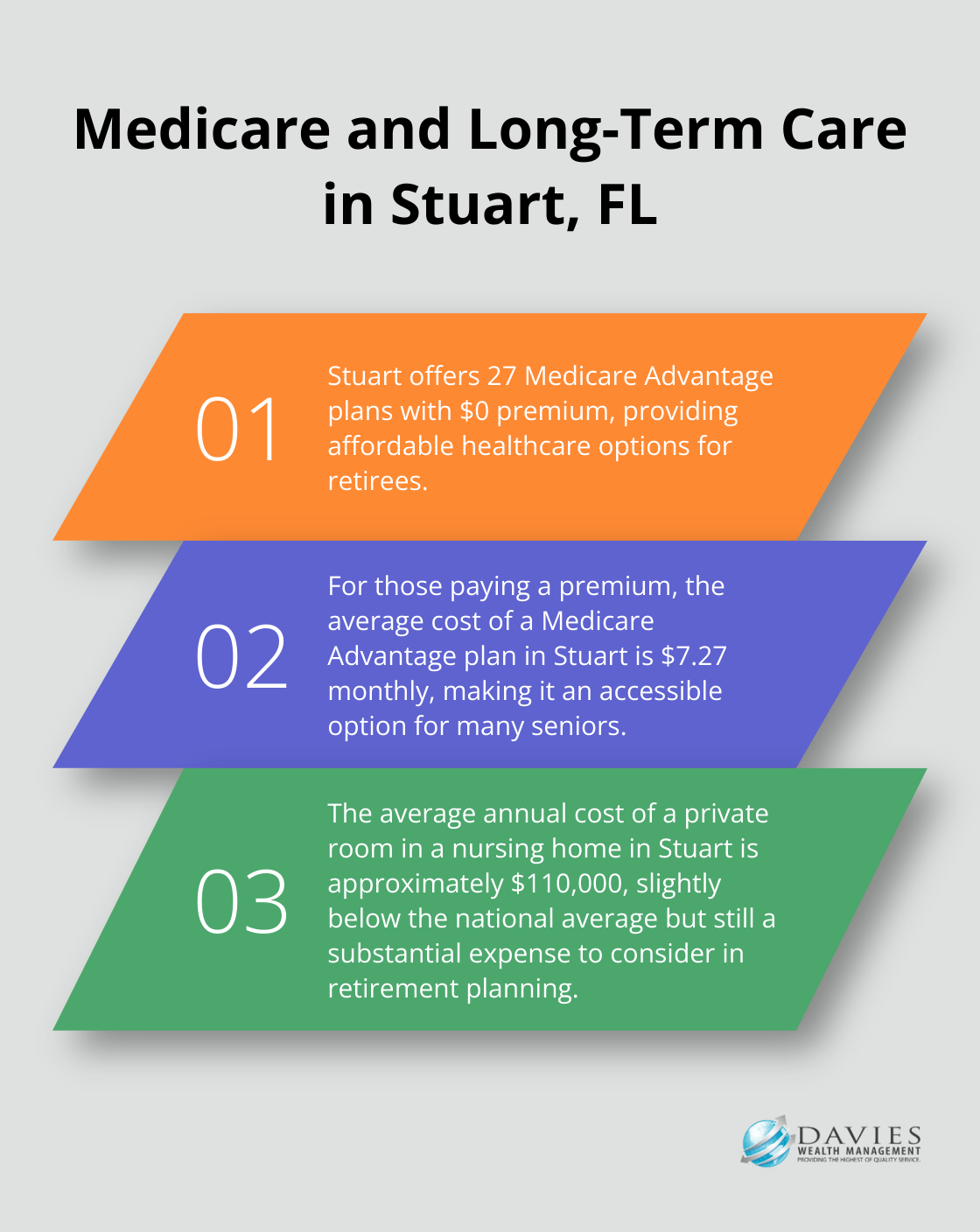

Stuart retirees must understand their Medicare options. Original Medicare (Parts A and B) provides basic coverage, but many find value in Medicare Advantage plans or Medigap policies. These offer additional benefits tailored to Florida’s healthcare needs, such as coverage for prescription drugs, dental care, and vision services.

27 $0 premium Medicare Advantage plans are available in Stuart. For those paying a premium, the average is $7.27 monthly. These plans often include extra perks like gym memberships (which align well with Stuart’s active lifestyle). However, network restrictions may limit your choice of healthcare providers.

Medigap policies offer greater flexibility in choosing healthcare providers but typically cost more. In Stuart, the average monthly premium for a Medigap Plan G (a popular choice) ranges from $120 to $300, depending on age and health status.

Long-term Care Planning Strategies

Long-term care is a significant concern for Stuart retirees. The average annual cost of a private room in a nursing home in Stuart is approximately $110,000 (slightly below the national average but still a substantial expense).

Long-term care insurance can help mitigate these costs. Stuart residents should explore these policies in their 50s or early 60s when premiums are more affordable. Some policies offer 5% compound inflation protection, which is particularly valuable given Florida’s rising healthcare costs.

Another option gaining popularity among Stuart retirees is a hybrid life insurance policy with long-term care benefits. These policies provide a death benefit if long-term care isn’t needed, offering more flexibility than traditional long-term care insurance.

Stuart’s Healthcare Facilities

Stuart boasts a robust healthcare infrastructure catering to its senior population. Cleveland Clinic Martin Health, with its main campus in Stuart, offers comprehensive medical services, including specialized geriatric care. Patients have reported excellent experiences with kind nurses and staff, and surprisingly good food.

For outpatient care, Stuart hosts numerous specialized clinics. The Martin Health Physician Group has over 100 providers across various specialties, ensuring that most healthcare needs can be met locally.

Senior-Specific Services

Senior-specific services in Stuart extend beyond medical care. The Kane Center, a comprehensive senior center, offers adult day care, memory care programs, and various wellness activities. Their services can complement your healthcare plan, promoting overall well-being and social engagement.

Integrating Healthcare into Financial Planning

Healthcare planning is a complex and personal process. We at Davies Wealth Management work closely with Stuart retirees to integrate healthcare considerations into their overall financial strategy. This ensures a comprehensive approach to retirement planning that addresses both financial and health-related concerns.

Final Thoughts

Retirement planning in Stuart, Florida requires a tailored approach that considers the city’s unique characteristics and opportunities. Stuart residents must balance lifestyle aspirations with financial realities when preparing for their golden years. Personal finance retirement planning in this coastal paradise involves maximizing Social Security benefits, diversifying investment portfolios, and exploring tax-efficient strategies like Roth IRA conversions.

Healthcare planning plays a vital role in retirement strategies for Stuart residents. Options range from Medicare Advantage plans to long-term care insurance, all tailored to Florida’s healthcare landscape. Expert guidance becomes invaluable as every retiree’s situation differs (what works for one may not suit another).

We at Davies Wealth Management specialize in creating customized retirement strategies for Stuart residents. Our team understands the local economic landscape, tax implications, and lifestyle considerations that impact retirement planning in this area. We offer comprehensive wealth management solutions to help you navigate the complexities of personal finance retirement planning in this vibrant coastal community.

Leave a Reply