At Davies Wealth Management, we understand the critical role a well-structured finance business plan plays in the success of any venture. Whether you’re a startup seeking funding or an established company aiming for growth, a comprehensive plan is your roadmap to financial success.

This step-by-step guide will walk you through creating a robust finance business plan, complete with a finance business plan example to illustrate key concepts. We’ll cover everything from crafting realistic financial projections to outlining essential sections that investors and stakeholders expect to see.

What Is a Finance Business Plan?

Definition and Purpose

A finance business plan serves as a strategic document that outlines the financial objectives, projections, and strategies of a business. This comprehensive plan provides a clear picture of a company’s current financial state and future financial goals.

Key Components

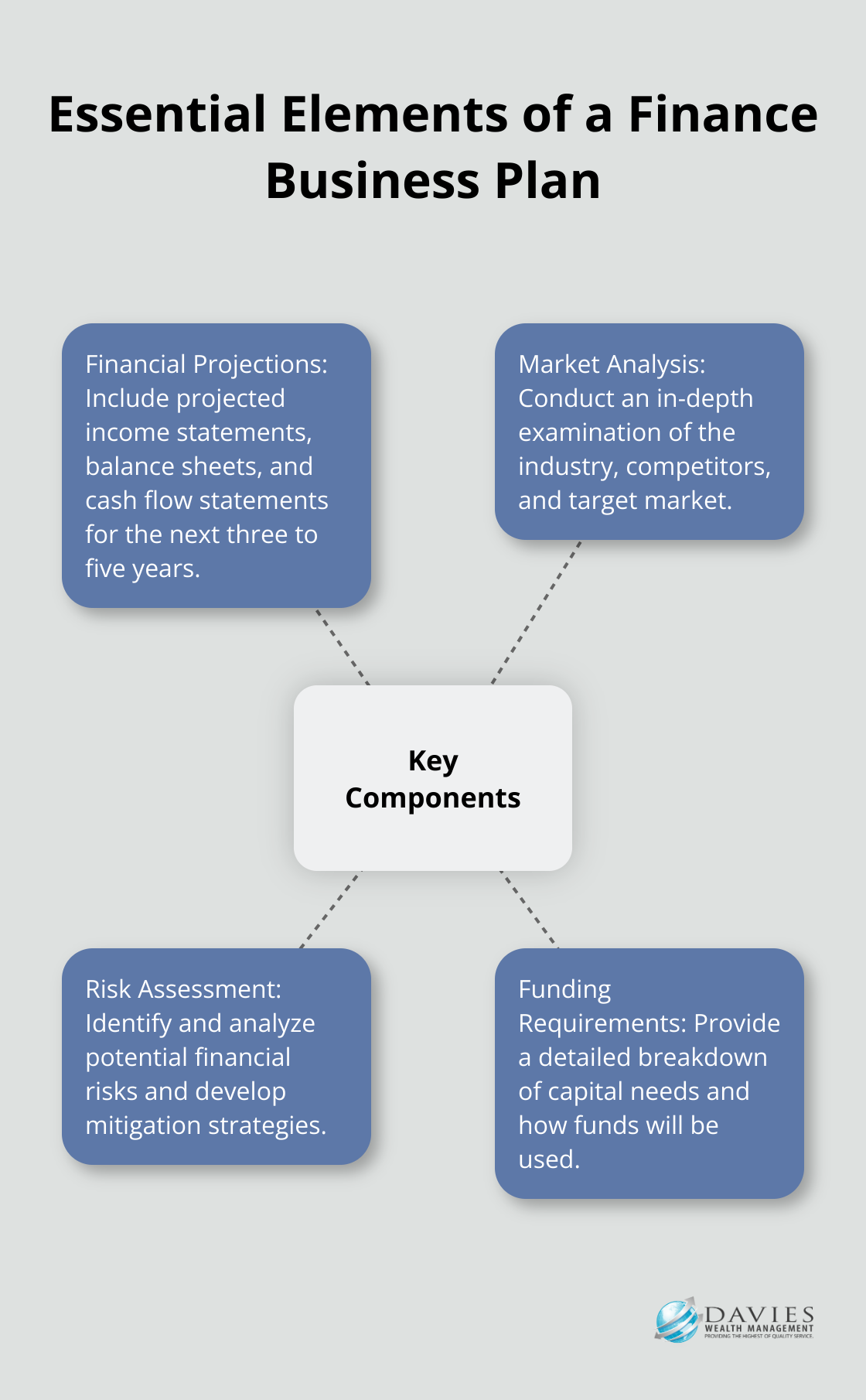

A well-structured finance business plan includes several essential elements:

- Financial Projections: This section should contain projected income statements, balance sheets, and cash flow statements for the next three to five years (at minimum).

- Market Analysis: An in-depth examination of the industry, competitors, and target market.

- Risk Assessment: Identification and analysis of potential financial risks and mitigation strategies.

- Funding Requirements: A detailed breakdown of capital needs and how funds will be used.

Importance for Startups

For new businesses, a finance business plan often acts as the key to securing funding. Investors and lenders require a clear, data-driven plan that demonstrates the business’s potential for profitability and growth. A comprehensive business plan can significantly improve a startup’s chances of securing funding.

Value for Established Businesses

Established companies also reap significant benefits from a finance business plan. It functions as a roadmap for growth, helping to identify potential financial pitfalls and opportunities. Regular updates to the plan can keep a business agile and responsive to market changes.

Tailoring Your Plan

While common elements exist in most finance business plans, it’s important to customize your plan to your specific business and industry. For example, a professional athlete might include strategies for managing variable income or planning for a post-athletic career in their finance business plan.

Living Document

A finance business plan should not remain static. It should evolve with your business, reflecting changes in your financial strategies, market conditions, and business goals. Regular reviews and updates (quarterly or annually) ensure that your financial strategies remain aligned with your business objectives and market realities.

As we move forward, we’ll explore how to craft realistic financial projections, a critical component of any finance business plan.

How to Create Accurate Financial Projections

At Davies Wealth Management, we know that accurate financial projections form the foundation of any solid finance business plan. These projections allow businesses to estimate their future income and expenses, enabling effective budget management and resource allocation.

Forecast Revenue Realistically

Start by analyzing your historical sales data, if available. For new businesses, research industry benchmarks and market trends. Consider factors like seasonality, economic conditions, and your marketing efforts. Create multiple scenarios – optimistic, pessimistic, and most likely – to account for various possibilities.

Estimate Expenses and Cash Flow

List all your fixed and variable costs. Don’t overlook often-forgotten expenses like insurance, taxes, and equipment maintenance. For cash flow projections, consider the timing of payments and receipts. Many businesses fail due to cash flow issues, not lack of profitability.

Use the bottom-up approach for more accurate expense estimates. This involves listing every expense item individually rather than using broad categories. A bottom-up financial model can help you create more accurate forecasts about your near-term and long-term performance.

Develop Financial Statements

Create projected income statements, balance sheets, and cash flow statements for at least the next three years. These should align with your revenue and expense forecasts. Your projections should tell a cohesive story about your business’s financial future.

For balance sheets, project how your assets, liabilities, and equity will change over time. This includes factoring in depreciation of assets and any planned debt repayments or equity investments.

Leverage Financial Modeling Tools

While spreadsheets like Excel can work for basic projections, specialized financial modeling software can provide more sophisticated analysis. The finance department typically creates forecasts to build more accurate and realistic budgets.

The goal isn’t perfect accuracy – it’s to create a well-informed estimate of your financial future. Regular reviews and updates of your projections are essential as your business evolves and market conditions change.

Now that we’ve covered how to create accurate financial projections, let’s explore the key sections you should include in your finance business plan to make it comprehensive and compelling to potential investors and stakeholders.

What Should Your Finance Business Plan Include?

Executive Summary: Your Plan’s First Impression

We at Davies Wealth Management know the importance of a strong executive summary. This section provides a snapshot of your entire plan, highlighting key financial projections, market opportunities, and your unique value proposition. A study by the Harvard Business Review found that investors spend an average of 3 minutes and 44 seconds reviewing a business plan. Make those minutes count with a concise, informative summary.

Market Analysis: Know Your Playing Field

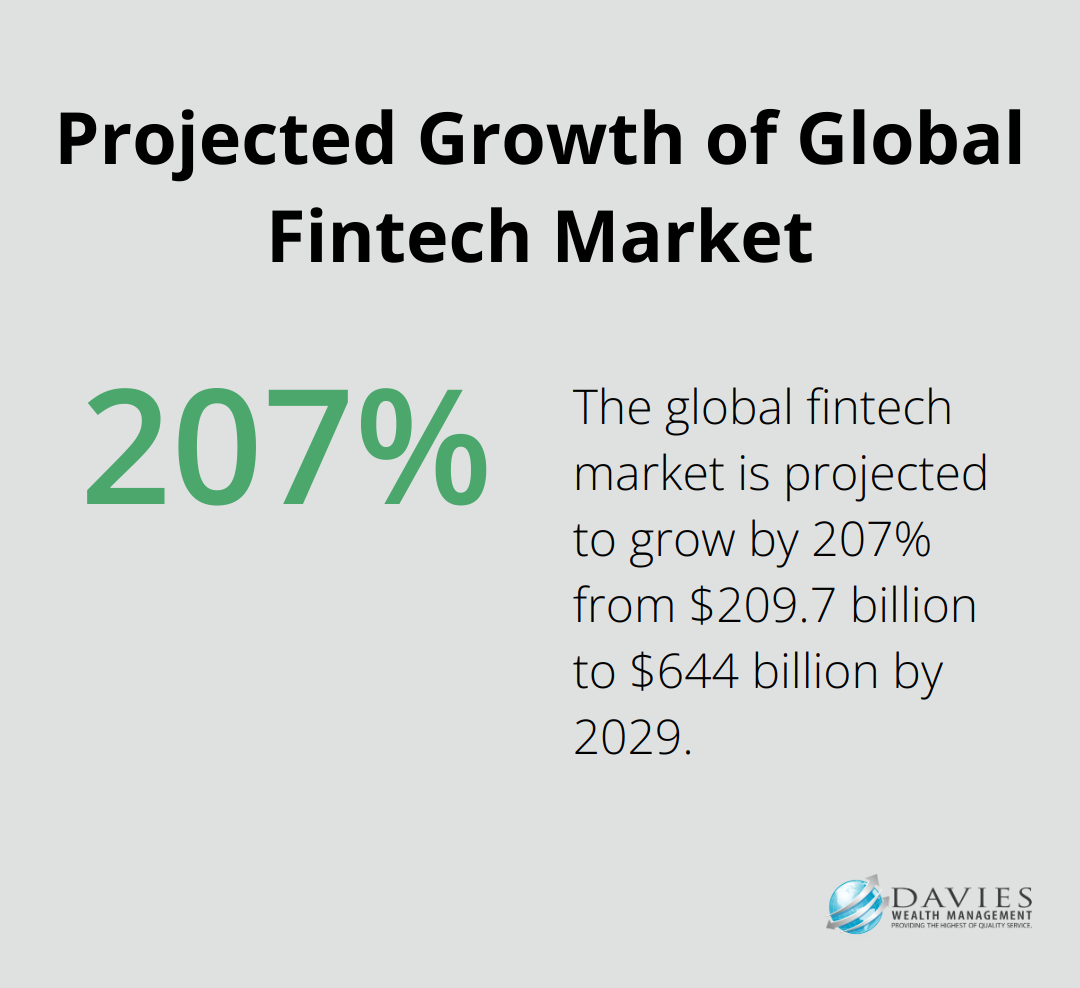

A thorough market analysis demonstrates your understanding of the industry landscape. Include market size, growth trends, and your target audience. For example, if you’re in the fintech sector, you might note that the global fintech market is estimated to be worth $209.7 billion and is set to surpass $644 billion by 2029.

Financial Projections: The Core of Your Plan

Your financial projections should be detailed and realistic. Include projected income statements, balance sheets, and cash flow statements for at least the next three years. Prepare to explain your assumptions. The four types of financial forecasts typically include sales forecasts, expense forecasts, breakeven analysis and cash flow projections.

Funding Requirements and Use of Funds

Outline how much funding you need and how you plan to use it. Be specific – instead of saying “marketing expenses,” break it down into categories like “digital advertising,” “content creation,” or “trade show participation.” Survey data shows that bank credit standards for small business loans have tightened over the last three years, reflecting larger trends in the lending landscape.

Risk Analysis and Mitigation Strategies

Every business faces risks. Identify potential financial risks and outline strategies to mitigate them. This shows investors you’re prepared for challenges. For example, if you’re in a cyclical industry, explain how you’ll manage cash flow during downturns. Or if you rely heavily on a single supplier, detail your plans to diversify your supply chain.

We at Davies Wealth Management advise our clients to review and update their financial strategies regularly (typically quarterly for startups and annually for established businesses). This ensures your financial strategies remain aligned with your business goals and market realities.

Final Thoughts

A comprehensive finance business plan acts as a financial roadmap for businesses of all sizes. It guides decision-making and showcases potential to investors and stakeholders. Regular reviews and updates of your plan will ensure it stays relevant to your objectives and market conditions.

A finance business plan example can provide valuable insights into structure and content. However, your plan should be tailored to your specific business and industry needs. Professional advice can help navigate complex financial landscapes and create a realistic, comprehensive plan.

At Davies Wealth Management, we offer personalized financial planning strategies for individuals, businesses, and professional athletes. Our expertise can help you create a strong finance business plan that sets the foundation for sustainable growth and financial stability in the years ahead.

Leave a Reply