Retirement planning in Stuart, Florida presents unique opportunities and challenges for those looking to enjoy their golden years in this picturesque coastal town. At Davies Wealth Management, we understand the local economic factors and cost of living considerations that impact retirement savings in our community.

Our expert team is dedicated to helping you navigate the complexities of retirement planning, from assessing your current financial situation to creating a diversified investment portfolio tailored to your goals. We’ll guide you through Florida-specific retirement considerations, ensuring you make the most of the Sunshine State’s tax advantages while preparing for potential healthcare costs and natural disaster risks.

What Makes Stuart Unique for Retirees?

A Coastal Haven with Small-Town Charm

Stuart, Florida, known as the “Sailfish Capital of the World,” offers a distinctive retirement experience. This charming coastal town blends small-town atmosphere with big-city amenities, attracting retirees who seek a balance between relaxation and activity.

A Thriving Local Economy

Stuart’s economy stands out as diverse and robust, which directly affects retirement planning. The town’s economic foundations include tourism, marine industries, and healthcare. The healthcare sector has seen significant changes, with Cleveland Clinic Tradition Hospital being rebranded from Martin Health System Tradition Medical Center. This growth not only provides part-time work opportunities for retirees but also ensures access to quality healthcare services.

Cost of Living Considerations

Stuart’s cost of living is 5% higher than the national average. This fact underscores the need for careful budgeting and strategic financial planning for retirees.

Housing costs in Stuart warrant special attention. As of July 2025, the average home value in Stuart stands at $382,217, down 5.6% over the past year. Retirees must factor these housing costs into their retirement budget and weigh the decision to rent or buy carefully.

Environmental Factors and Financial Planning

Stuart’s location on Florida’s Treasure Coast necessitates the consideration of potential environmental risks in financial planning. Hurricane insurance becomes a necessity, with annual premiums averaging $2,000 to $3,000 for a standard home. Financial advisors often recommend including these costs in retirement budgets and setting aside an emergency fund specifically for potential natural disaster-related expenses.

Recreational Opportunities Abound

Stuart offers an array of recreational activities that appeal to retirees. The town boasts beautiful beaches, world-class fishing (hence its “Sailfish Capital” moniker), and numerous golf courses. These amenities contribute to an active and engaging retirement lifestyle, but also require consideration in financial planning (e.g., budgeting for golf club memberships or fishing equipment).

As we transition to the next chapter, we’ll explore how these unique aspects of Stuart influence the key components of expert retirement planning. Understanding the local context sets the foundation for creating a tailored retirement strategy that maximizes the benefits of living in this Florida gem.

Mastering Your Retirement Strategy

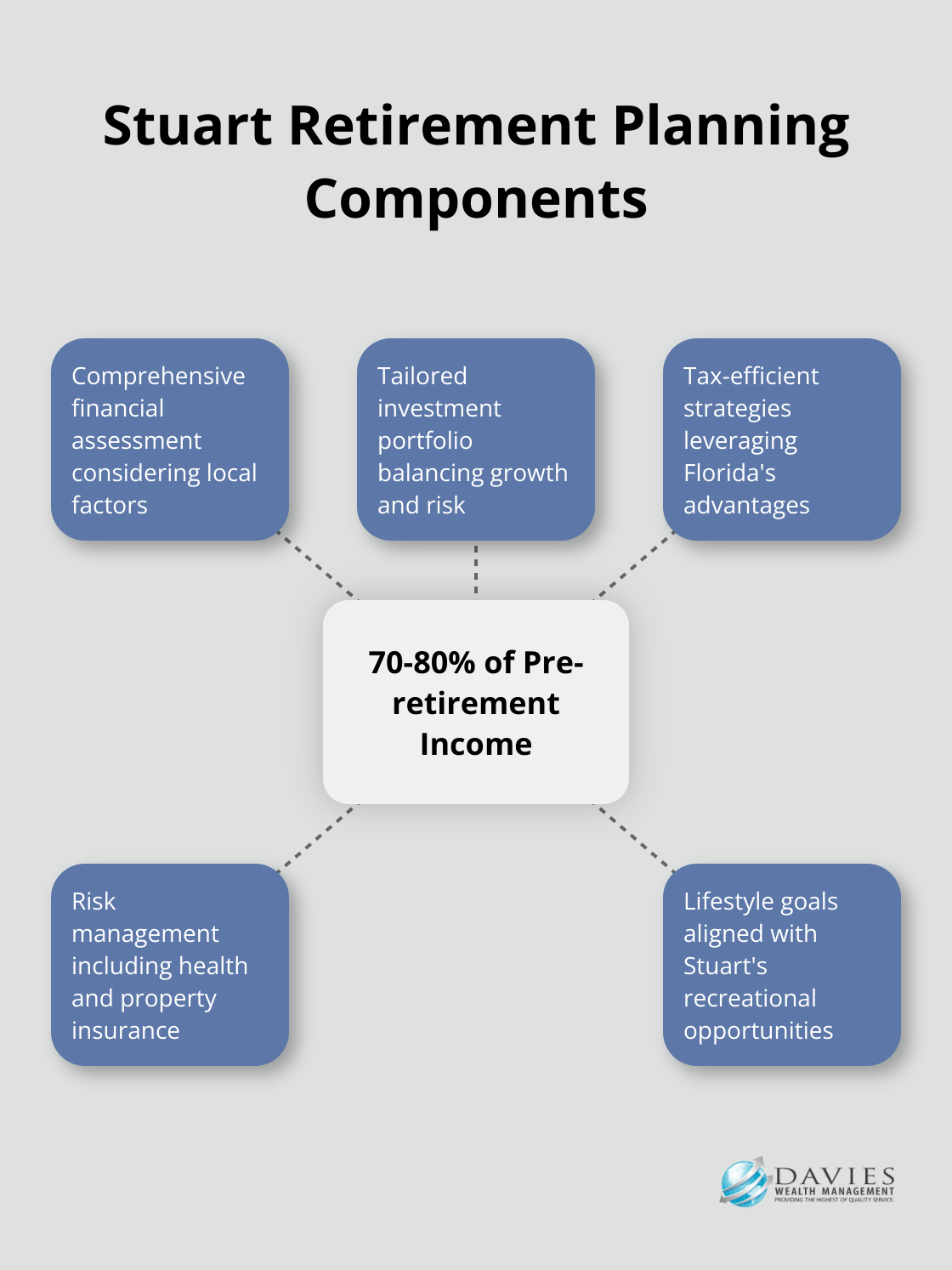

Comprehensive Financial Assessment

The first step in crafting an effective retirement plan involves a thorough assessment of your current financial situation. This process goes beyond a simple tally of assets and liabilities. It requires an in-depth analysis of income sources, spending patterns, and potential future expenses. For Stuart residents, this might include an examination of property taxes or the cost of hurricane insurance.

Financial modeling tools project future financial needs, taking into account Stuart’s unique economic factors. These projections consider local inflation rates and factor in the potential for increased healthcare costs as you age. According to a recent financial report, there’s a 6.70% net pension plan investment expense, including inflation, which is administered by the Florida Department of Insurance.

Defining Your Retirement Lifestyle

Setting realistic retirement goals is about more than numbers. It’s about envisioning your ideal retirement lifestyle in Stuart. Will your days involve golfing at one of Stuart’s renowned golf clubs? Or perhaps you’re interested in frequent fishing trips, which might require a budget for boat maintenance and fuel costs?

These lifestyle goals translate into concrete financial targets. This often means aiming for a retirement income that’s 70-80% of pre-retirement earnings, adjusted for Stuart’s cost of living. The plan should also factor in potential part-time work opportunities in Stuart’s growing sectors, which can supplement retirement income. Stuart offers attractive options for retirees, with Willoughby Golf Club being named in the top 10 Best Florida Retirement Communities.

Building a Robust Investment Portfolio

A diversified investment portfolio is essential for long-term financial security. Portfolios should balance growth potential with risk management, tailored to Stuart’s economic landscape. This might include allocating a portion of the portfolio to real estate investments, capitalizing on Stuart’s steady property market.

Florida’s unique tax environment impacts investment strategy. With no state income tax, the focus shifts to maximizing after-tax returns through strategic asset allocation and tax-efficient investment vehicles.

The investment approach must also consider Stuart’s potential environmental risks. Portfolios should have sufficient liquidity to cover unexpected expenses, such as hurricane damage repairs.

Tax-Efficient Strategies

Tax planning plays a critical role in retirement strategy. Florida’s tax-friendly environment for retirees offers opportunities to maximize income. Strategies might include Roth IRA conversions, tax-loss harvesting, or strategic charitable giving.

It’s important to understand how different types of retirement accounts (traditional IRAs, Roth IRAs, 401(k)s) are taxed. This knowledge allows for the creation of a tax-efficient withdrawal strategy in retirement. Converting to a Roth IRA, especially during low-income years, can mean tax-free income later – often outside the reach of high state taxes.

Risk Management and Insurance

A comprehensive retirement plan must address potential risks. This includes evaluating health insurance options, considering long-term care insurance, and ensuring adequate property insurance coverage (particularly important in hurricane-prone Stuart).

Life insurance needs often change in retirement. A review of existing policies and potential adjustments can ensure that coverage aligns with current goals and family situations.

As we move forward, we’ll explore how these retirement planning strategies intersect with Florida-specific considerations, providing a roadmap for a secure and enjoyable retirement in Stuart.

Florida’s Retirement Landscape: Navigating Opportunities and Challenges

Tax Advantages for Florida Retirees

Florida offers significant tax benefits for retirees. The state has no state income tax, which means Social Security retirement benefits, pension income and income from an IRA or a 401(k) are all untaxed (though federal taxes still apply).

Property taxes in Stuart deserve attention. Martin County’s average property tax rate is 0.97%, lower than the national average. Homeowners aged 65 and older may qualify for additional exemptions, potentially saving thousands each year.

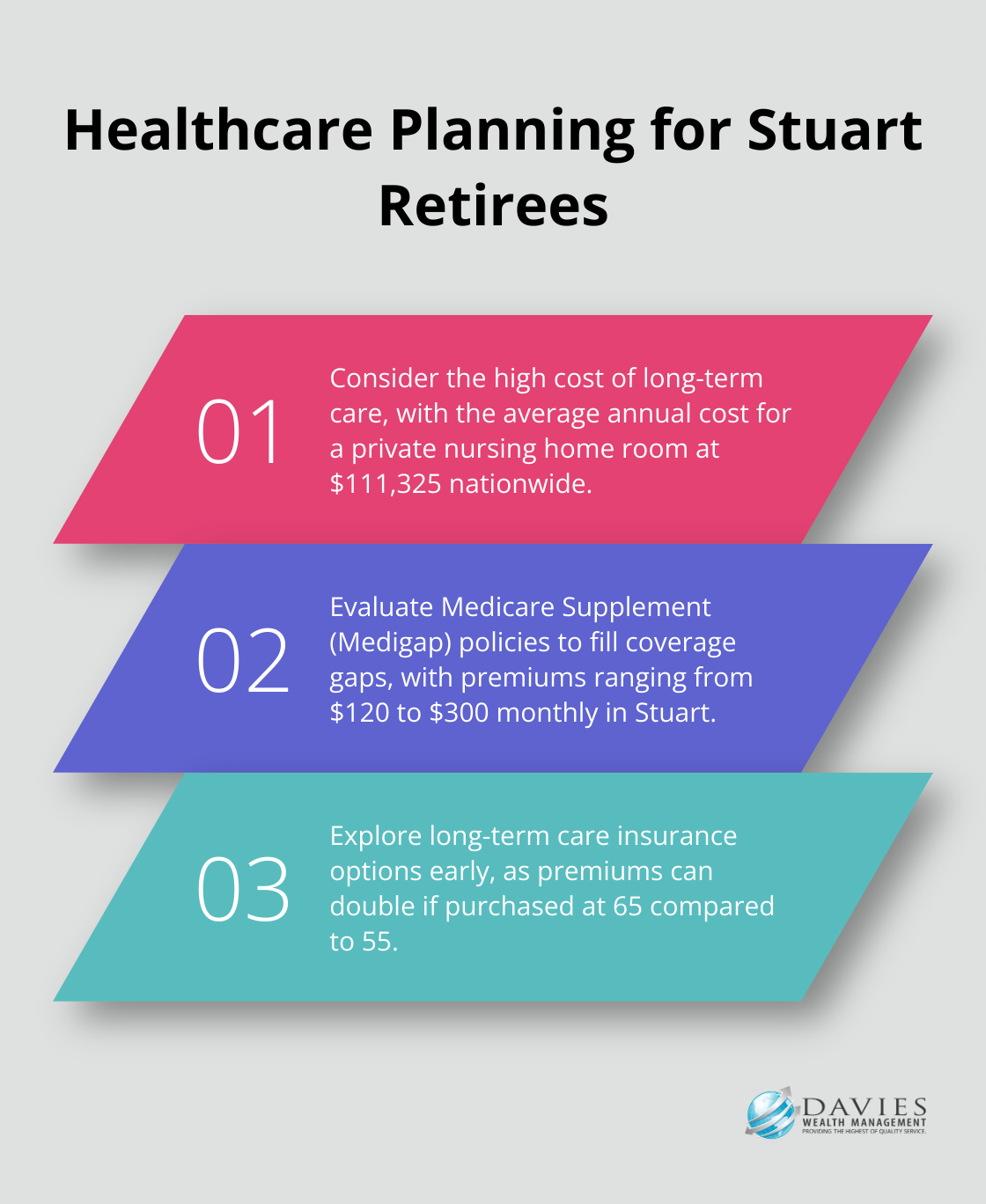

Healthcare Costs and Planning

While Florida provides tax advantages, healthcare costs can be substantial. The nationwide average annual cost for a private room in a nursing home is $111,325 as of June 2025. This fact highlights the need for thorough healthcare planning.

Medicare forms the foundation of retirement healthcare but doesn’t cover all expenses. Many retirees choose Medicare Supplement (Medigap) policies to fill coverage gaps. In Stuart, monthly premiums for a Medigap Plan G policy range from $120 to $300, varying based on age and health status.

Long-Term Care Options in Stuart

Stuart presents various long-term care options, from in-home care to assisted living facilities. The Cost of Care Survey tool can help you and your family calculate the cost of long-term care across the US, now and in the future.

Long-term care insurance warrants consideration, especially when purchased early. A 55-year-old in good health might pay $2,000-$2,500 annually for a policy providing a $150 daily benefit for three years. Delaying until age 65 could double these premiums.

Protecting Assets from Natural Disasters

Living in Stuart necessitates preparation for potential natural disasters, particularly hurricanes. Standard homeowners insurance doesn’t cover flood damage, making flood insurance essential. The average annual premium for flood insurance in Stuart is $700 but can increase in flood-prone areas.

We suggest creating an emergency fund specifically for disaster-related expenses. Try to set aside at least $5,000-$10,000, separate from regular emergency savings. This fund can cover insurance deductibles and immediate repair costs.

Leveraging Professional Guidance

Navigating Florida’s retirement landscape requires expert knowledge and strategic planning. Professional financial advisors can help you maximize Florida’s benefits while safeguarding against potential risks. They can assist in creating a comprehensive plan tailored to Florida’s unique retirement environment, whether you’re a long-time Stuart resident or considering relocation for retirement.

Final Thoughts

Retirement planning in Stuart, Florida presents unique opportunities and challenges for retirees. Our team at Davies Wealth Management understands the local economic factors and cost of living considerations that impact retirement savings in our community. We offer personalized strategies to help you maximize the benefits of retiring in Stuart while addressing potential risks.

Our approach to retirement planning in Stuart, Florida includes investment management, tax planning, estate planning, and risk management. We work closely with you to develop a tailored plan that aligns with your retirement goals and lifestyle aspirations. Our commitment to building long-term relationships means we support you throughout your retirement journey, adapting your plan as your needs and circumstances evolve.

Successful retirement planning requires regular reviews and adjustments to ensure your plan remains aligned with your goals and the changing economic environment. With the right strategy and professional guidance, you can look forward to a fulfilling retirement in Stuart, Florida. You will enjoy all that this beautiful coastal town has to offer while maintaining financial security.

Leave a Reply