At Davies Wealth Management, we understand the importance of finding the right financial advisor in Stuart, FL. The financial landscape in this vibrant city is diverse, offering numerous options for those seeking expert guidance.

In this post, we’ll reveal the best financial advisors in Stuart, FL, and provide you with essential information to make an informed decision. We’ll explore top-rated firms, key services offered, and crucial factors to consider when choosing a financial advisor that aligns with your unique needs and goals.

Stuart’s Top Financial Advisors: A Comprehensive Guide

The Financial Landscape in Stuart

Stuart, Florida, presents a dynamic financial advisory scene with numerous firms competing for clients’ attention. The city’s affluent population and retiree community have attracted a diverse range of financial services providers. This competitive environment offers clients a wide selection of advisors to choose from, each with unique strengths and specializations.

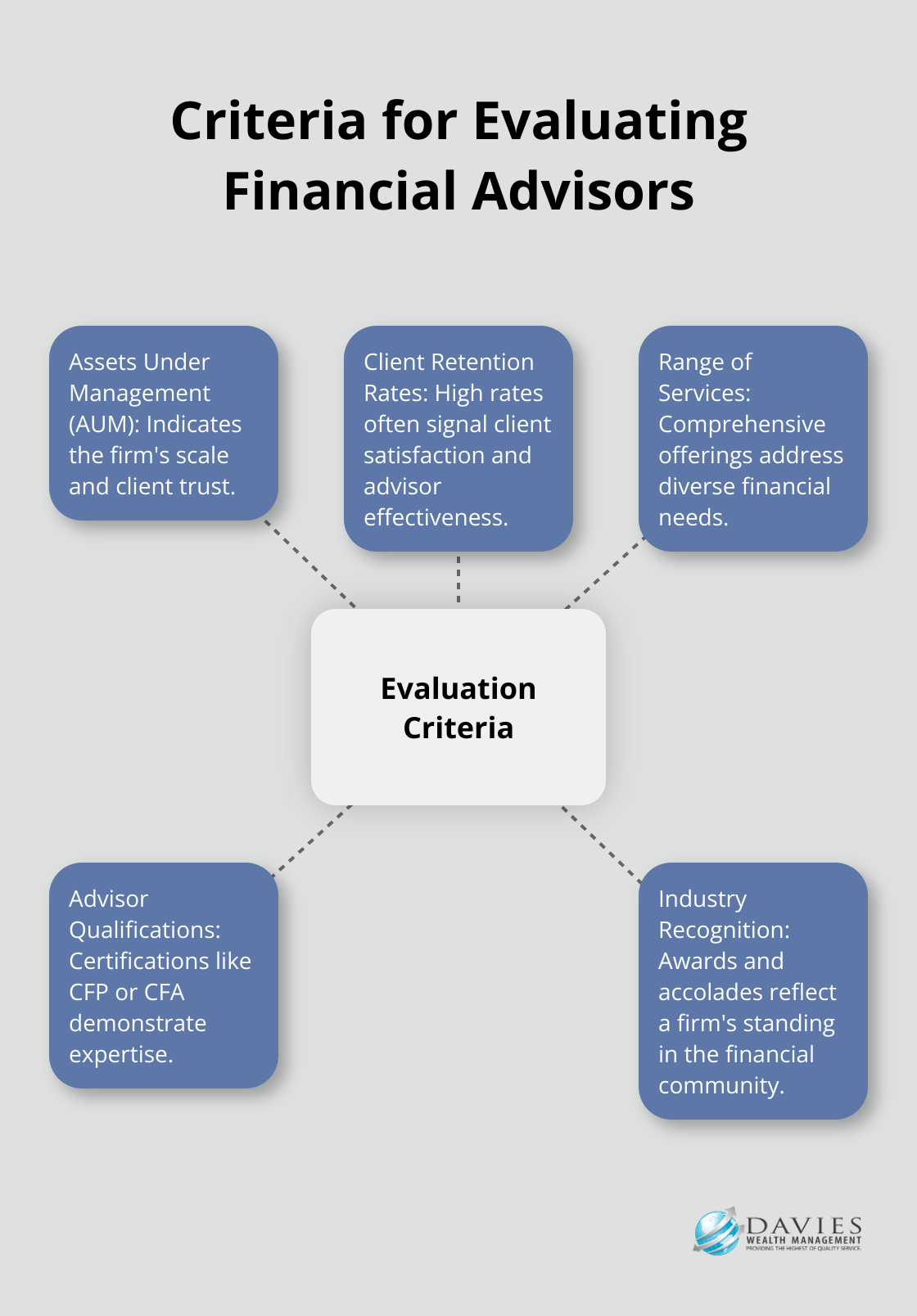

Criteria for Evaluating Financial Advisors

When assessing financial advisors in Stuart, several key factors come into play:

- Assets Under Management (AUM): This metric indicates the firm’s scale and client trust. Some firms, like Dunn Capital, use a systematic approach with data-driven strategies and diversified, quantitative programs.

- Client Retention Rates: High retention rates often signal client satisfaction and advisor effectiveness.

- Range of Services: Comprehensive service offerings can address diverse financial needs.

- Advisor Qualifications: Certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) demonstrate expertise.

- Industry Recognition: Awards and accolades can reflect a firm’s standing in the financial community.

Prominent Financial Advisory Firms in Stuart

Fogel Capital Management

Fogel Capital Management focuses on high-net-worth individuals and institutional clients. Their team offers comprehensive wealth management services, including investment strategy and retirement planning.

Victrix Investment Advisors

Victrix Investment Advisors employs a data-driven approach to portfolio management. They use advanced analytics to create tailored investment strategies for their clients.

Spectra Investment Management LLC

Spectra Investment Management LLC has gained recognition for its expertise in alternative investments and risk management strategies. Their approach often appeals to clients seeking diversification beyond traditional asset classes.

The Davies Wealth Management Advantage

While these firms offer valuable services, Davies Wealth Management distinguishes itself through its specialized focus on professional athletes and comprehensive approach to wealth management. Our deep understanding of the unique financial challenges faced by athletes (including short career spans and fluctuating income), combined with our expertise in investment management, retirement planning, and tax-efficient strategies, sets us apart in Stuart’s competitive landscape.

The Importance of Fiduciary Responsibility

When selecting a financial advisor in Stuart, it’s important to prioritize firms that operate under a fiduciary duty. This legal obligation requires advisors to put the interests of the beneficiary first, ahead of their own. At Davies Wealth Management, we take this responsibility seriously, ensuring that our recommendations always align with our clients’ financial goals and risk tolerance.

As we move forward, let’s explore the key services offered by Stuart’s financial advisors and how they can benefit your financial journey.

Key Services Offered by Stuart’s Top Financial Advisors

Comprehensive Investment Management

Stuart’s top financial advisors offer sophisticated investment management services. These professionals optimize client portfolios by balancing risk and return based on individual goals and risk tolerance. Some firms employ quantitative analysis and algorithmic trading to identify market inefficiencies, while others focus on fundamental analysis to select individual stocks and bonds for diversified portfolios.

Many advisors in Stuart also specialize in alternative investments. These options provide additional diversification and potentially higher returns, especially for high-net-worth individuals who seek to grow their wealth beyond traditional market offerings.

Retirement Planning and Pension Optimization

Retirement planning stands out as a critical service offered by Stuart’s financial advisors. Florida’s popularity as a retirement destination has led many local advisors to develop deep expertise in this area. They help clients calculate retirement needs, develop savings strategies, and create income plans for post-work years.

Pension optimization plays a key role in retirement planning for Stuart residents. Many retirees in the area have pensions from previous employers or government service. Financial advisors assist these clients in making informed decisions about pension options (e.g., choosing between lump-sum payouts and annuity payments). They also integrate pension income with other retirement sources like Social Security and personal savings to create comprehensive retirement income strategies.

Tax-Efficient Wealth Management

Tax planning forms an integral part of wealth management services offered by Stuart’s top advisors. Florida’s tax-friendly environment, with no state income tax, creates unique opportunities for tax optimization. Advisors help clients take advantage of these benefits while navigating federal tax obligations.

Stuart’s advisors often employ strategies such as tax-loss harvesting, where they strategically realize losses in investment portfolios to offset gains and reduce tax liabilities. They also guide clients on the tax implications of different investment vehicles, such as municipal bonds, which can provide tax-free income at the federal and sometimes state level.

For high-net-worth individuals, advisors may recommend more advanced tax strategies. These might include setting up charitable remainder trusts or donor-advised funds, which provide tax benefits while fulfilling philanthropic goals.

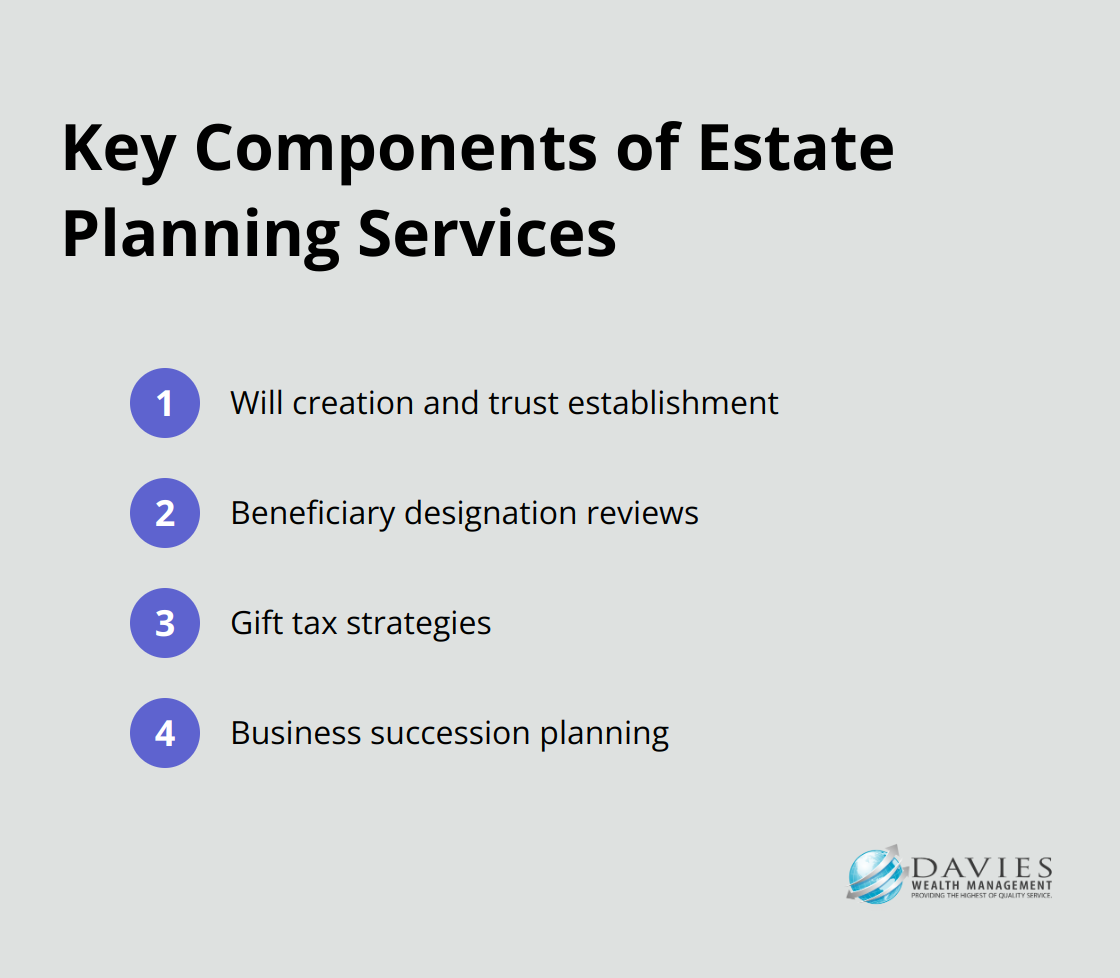

Estate Planning and Wealth Transfer

Estate planning and wealth transfer services round out the offerings of Stuart’s top financial advisors. These services help clients protect and efficiently transfer their assets to future generations or charitable causes. Advisors work closely with clients to develop comprehensive estate plans that minimize tax liabilities and ensure the smooth transfer of wealth.

Key components of estate planning services include:

As we explore the range of services offered by Stuart’s financial advisors, it becomes clear that choosing the right advisor requires careful consideration. In the next section, we’ll discuss the factors you should weigh when selecting a financial advisor in Stuart to ensure your unique needs are met.

How to Select Your Ideal Financial Advisor in Stuart

Prioritize Fiduciary Commitment

When you choose a financial advisor in Stuart, their fiduciary status should be a top priority. Fiduciary advisors must put your interests first, above their own or their firm’s interests. This commitment ensures unbiased advice focused solely on your financial well-being. Many top advisors in Stuart uphold this fiduciary standard.

To verify an advisor’s fiduciary status, ask them directly if they adhere to the fiduciary standard at all times. Request this confirmation in writing, as it provides an additional layer of protection and demonstrates the advisor’s commitment to transparency.

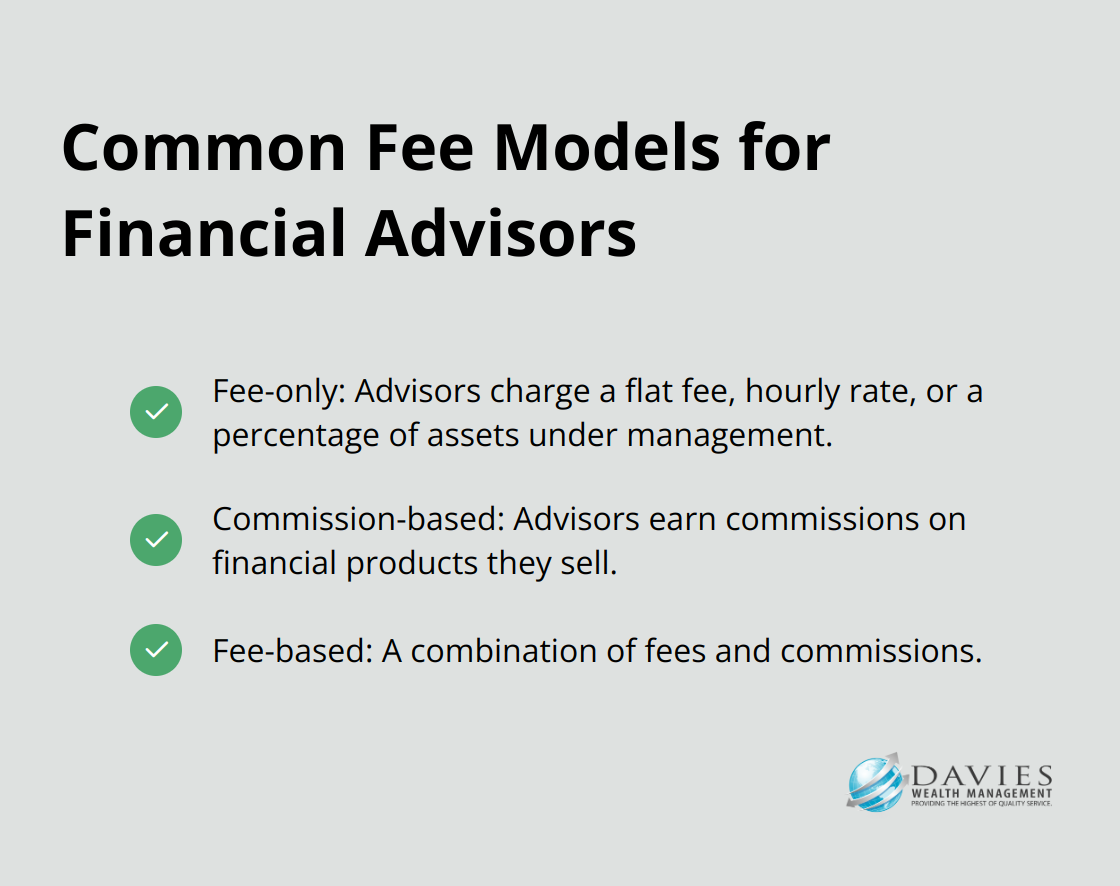

Understand Fee Structures

Financial advisors in Stuart typically use various fee structures. Understanding these can help you make an informed decision. Common fee models include:

Fee-only advisors are not inherently more expensive than commission-based advisors, and they have access to a wide range of investment options. They have no incentive to recommend specific products for commissions, potentially reducing conflicts of interest.

When you discuss fees with potential advisors, ask for a detailed breakdown of all costs associated with their services. This transparency will help you understand the full scope of your investment and avoid unexpected charges down the line.

Assess Qualifications and Expertise

The financial advisory landscape in Stuart boasts professionals with diverse qualifications and specializations. Look for advisors with recognized credentials such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA). Unfortunately, little prior experience or formal education is required to sit for the exam or hold oneself out as a fiduciary financial advisor.

Additionally, consider the advisor’s experience in areas relevant to your financial situation. For instance, if you’re a professional athlete, you might benefit from working with a firm that has specialized expertise in managing the unique financial challenges faced by athletes (such as short career spans and fluctuating income).

Ask Probing Questions

When you interview financial advisors in Stuart, ask pointed questions to gauge their suitability for your needs:

- What is your investment philosophy, and how do you tailor it to individual clients?

- How often do you communicate with clients, and what does this communication entail?

- Can you provide references from clients with similar financial situations to mine?

- What resources does your firm have to support its advisory services?

- How do you measure and report on the progress towards my financial goals?

These questions will help you assess the advisor’s approach, communication style, and ability to meet your specific needs.

Evaluate Long-Term Compatibility

Your relationship with a financial advisor should be a long-term partnership. Consider factors such as:

- Communication style: Does the advisor explain complex concepts in a way you understand?

- Availability: How accessible is the advisor when you need them?

- Technology: Does the firm use modern tools and platforms to manage and report on your investments?

- Team approach: Will you work with a single advisor or have access to a team of specialists?

A thorough evaluation of these aspects will help you select an advisor who not only possesses the necessary expertise but also demonstrates a genuine interest in your financial well-being and long-term success.

Final Thoughts

Stuart’s financial advisory landscape offers numerous options for individuals who seek expert guidance. The best financial advisors in Stuart, FL provide comprehensive services to help clients achieve their financial goals. These services include investment management, retirement planning, tax optimization, and estate planning.

Personalized financial guidance proves invaluable in today’s complex economic environment. Every individual’s financial situation requires unique solutions that address specific needs and aspirations. A skilled financial advisor offers tailored strategies that align with personal goals, risk tolerance, and life circumstances.

Davies Wealth Management stands out as a premier choice for those who seek comprehensive financial guidance. Our firm’s dedication to personalized service, combined with our expertise in managing financial challenges, sets us apart from other advisors in Stuart. We focus on building long-term relationships with our clients, providing clear solutions that evolve with their changing needs.

Leave a Reply