At Davies Wealth Management, we understand that serious investors require sophisticated strategies to maximize their portfolio’s potential. Advanced investment planning techniques can significantly enhance returns while managing risk effectively.

This blog post explores cutting-edge approaches to portfolio construction, alternative investments, and tax-efficient strategies. We’ll provide insights that can help elevate your investment game and potentially boost your long-term financial success.

How Modern Portfolio Theory Can Enhance Your Investments

Understanding the Risk-Return Tradeoff

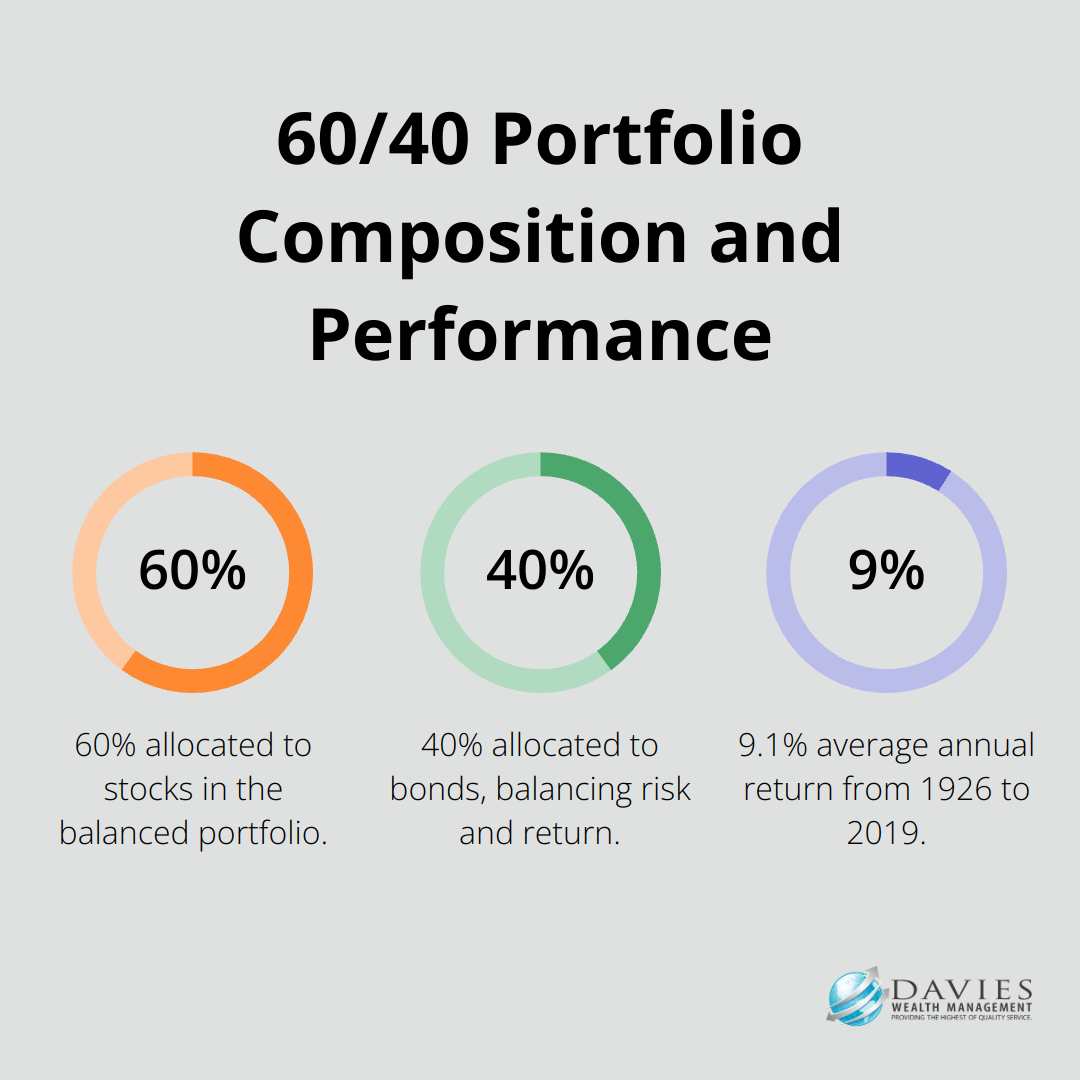

Modern Portfolio Theory (MPT) revolutionized investment strategies by emphasizing portfolio composition over individual stock selection. MPT teaches investors that higher returns typically accompany increased risk. However, the goal isn’t to chase high returns or avoid all risk. The key lies in finding the right balance for each investor. A Vanguard study found that a portfolio with 60% stocks and 40% bonds had an average annual return of 9.1% from 1926 to 2019, with significantly less volatility than an all-stock portfolio.

Diversification: The Portfolio’s Best Friend

Diversification forms the cornerstone of MPT. Spreading investments across various asset classes, sectors, and geographical regions can reduce portfolio risk without necessarily sacrificing returns. A BlackRock report showed that a globally diversified portfolio outperformed a U.S.-only portfolio in 96% of rolling 10-year periods from 1950 to 2020. This statistic underscores the power of diversification in long-term investment strategies.

The Impact of Regular Rebalancing

Regular portfolio rebalancing maintains your desired risk-return profile. A Morningstar study found that portfolios rebalanced annually outperformed those left untouched by an average of 0.4% per year over a 20-year period. Financial advisors typically recommend quarterly or semi-annual rebalancing, depending on market conditions and individual client needs.

Practical Implementation of MPT

Implementing MPT principles doesn’t require complex strategies. The process starts with determining your risk tolerance and investment goals. Next, create a diversified portfolio that aligns with these factors. For example, a conservative investor nearing retirement might consider a portfolio with 30% stocks, 60% bonds, and 10% alternative investments. In contrast, a younger investor with a higher risk tolerance might opt for 70% stocks, 20% bonds, and 10% alternatives.

Adapting MPT to Changing Markets

While MPT provides a solid framework for investment planning, it’s not infallible. Market conditions change, and new investment opportunities emerge. Continuous monitoring and adjustment of strategies ensure they remain effective in the ever-evolving financial landscape. This adaptive approach (which many financial advisors employ) helps investors navigate market fluctuations and capitalize on new opportunities.

As we explore the role of alternative investments in the next section, you’ll discover how these non-traditional assets can further enhance your portfolio’s diversification and potentially boost returns.

Exploring Alternative Investments for Portfolio Enhancement

Private Equity and Venture Capital Opportunities

Private equity and venture capital investments offer access to companies not listed on public exchanges. These investments can yield high returns but involve increased risk and reduced liquidity. Private equity has quietly outperformed the S&P 500 over the past 5-, 10-, 15-, and 20-year periods.

Accredited investors should consider allocating 5-15% of their portfolio to private equity to potentially enhance overall returns. It’s essential to thoroughly research the specific investment strategy, management team, and track record of any private equity fund before investing.

Real Estate Investment Trusts (REITs) for Diversification

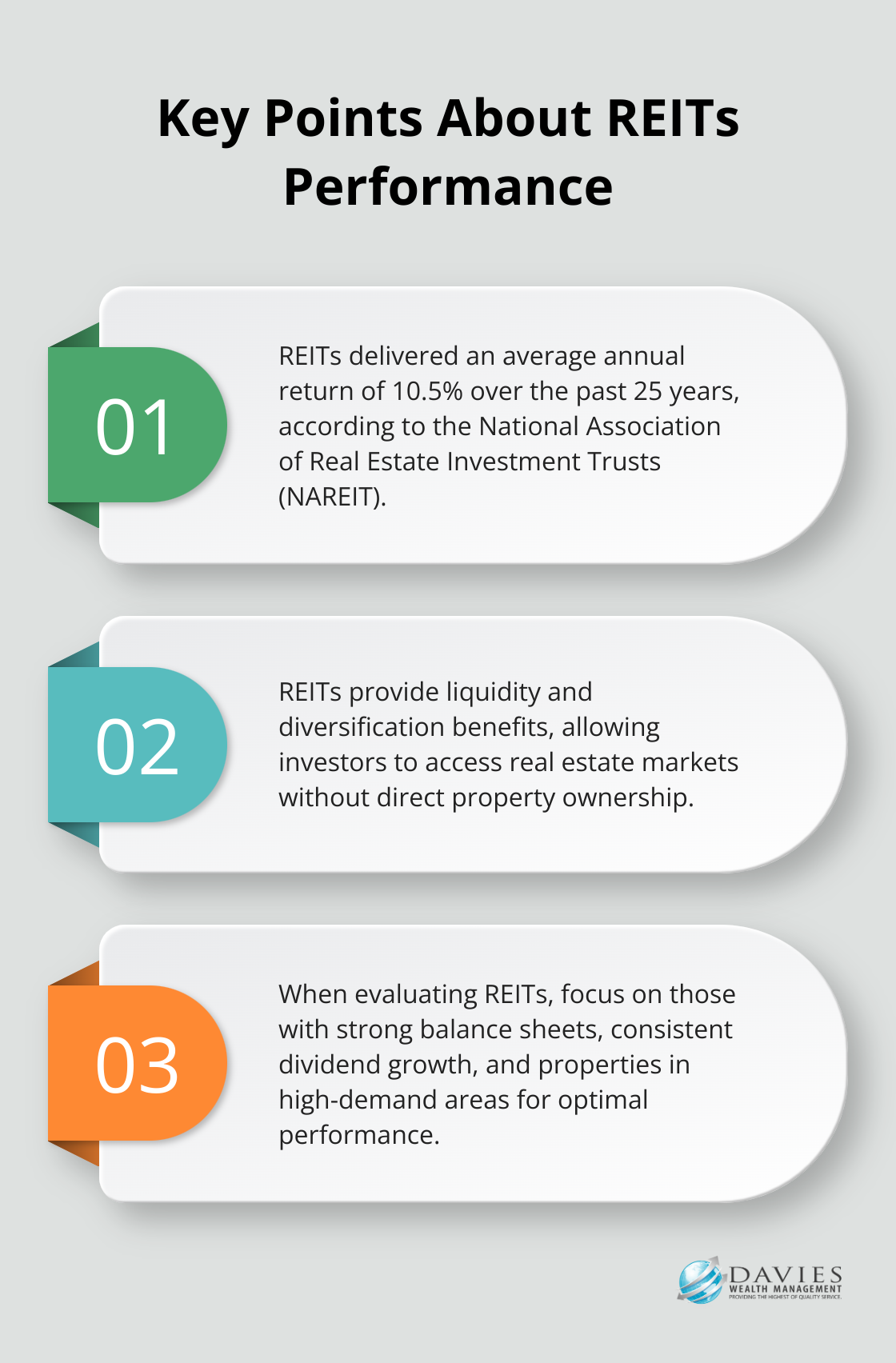

REITs provide a method to invest in real estate without direct property ownership. They offer liquidity, diversification, and potential for steady income. The National Association of Real Estate Investment Trusts (NAREIT) reported that REITs delivered an average annual return of 10.5% over the past 25 years.

When evaluating REITs, investors should focus on those with strong balance sheets, consistent dividend growth, and properties in high-demand areas. Try to allocate 5-10% in a diversified portfolio, depending on individual risk tolerance and investment goals.

Commodities and Precious Metals as Portfolio Stabilizers

Commodities and precious metals can serve as effective portfolio diversifiers and inflation hedges. The S&P GSCI (a broad commodity index) has shown a negative correlation with stocks and bonds over long periods, making it valuable for reducing overall portfolio risk.

Gold, often considered a safe-haven asset, stands out as a persevering source of portfolio diversification. However, its performance can fluctuate in the short term. A modest allocation of 3-5% to gold or a broader commodities index can provide diversification benefits without overexposing the portfolio to commodity price fluctuations.

Tailoring Alternative Investments to Individual Needs

Alternative investments require careful consideration and should align with an investor’s unique financial situation and objectives. Factors such as career length, income volatility, and long-term financial goals play a significant role in determining appropriate alternative investment allocations.

Professional athletes, for example, face distinct financial challenges due to their short career spans and potentially volatile income streams. A tailored approach to alternative investments can help address these unique circumstances and contribute to long-term financial security.

As we transition to our next topic, we’ll explore tax-efficient investing strategies that can further optimize your portfolio’s performance and help you retain more of your investment gains.

How to Minimize Taxes on Your Investments

Tax-efficient investing plays a key role in maximizing your portfolio’s performance. Smart tax strategies allow you to keep more of your investment gains and compound your wealth more effectively over time.

The Power of Tax-Loss Harvesting

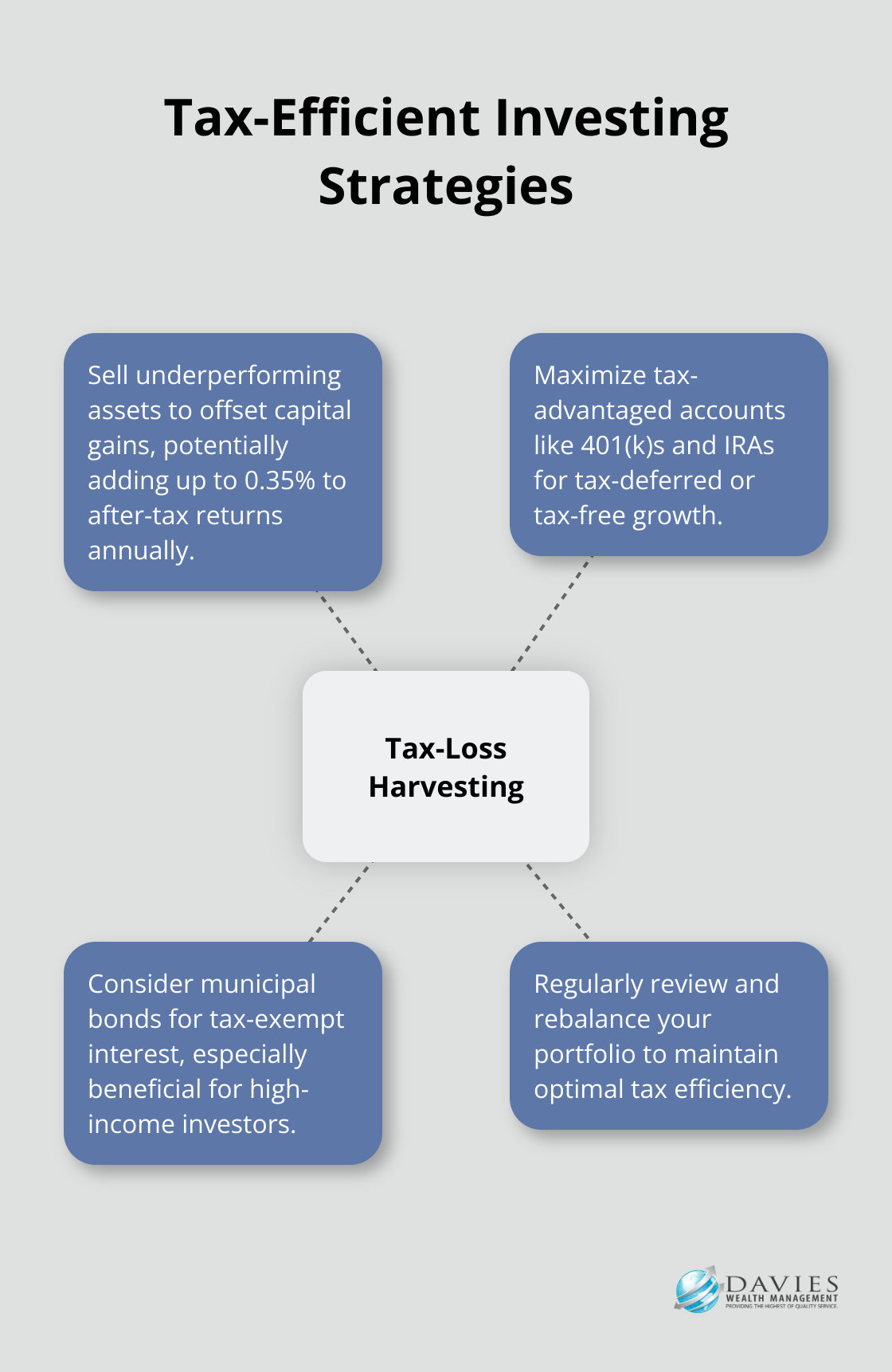

Tax-loss harvesting reduces your tax burden. This strategy involves selling investments that have experienced a loss to offset capital gains from other investments. A Vanguard study shows that tax-loss harvesting can add up to 0.35% to after-tax returns annually.

To implement this strategy, review your portfolio regularly for underperforming assets. When you identify losses, sell these assets and use the losses to offset gains. Exercise caution with the wash-sale rule, which prohibits repurchasing the same or substantially identical security within 30 days of the sale.

Maximizing Tax-Advantaged Accounts

Tax-advantaged accounts form a cornerstone of tax-efficient investing. These accounts (such as 401(k)s, IRAs, and Roth IRAs) offer significant tax benefits that can boost your long-term returns.

Traditional 401(k)s and IRAs allow for tax-deferred growth, meaning you don’t pay taxes on your investments until withdrawal. Roth accounts offer tax-free growth, allowing you to withdraw funds in retirement without paying taxes on the gains.

A T. Rowe Price study found that investors who maxed out their 401(k) contributions over a 30-year period could potentially have 42% more money in retirement compared to those who didn’t use tax-advantaged accounts.

The Role of Municipal Bonds in Tax-Efficient Portfolios

Municipal bonds can enhance a tax-efficient investment strategy, especially for high-income investors. The interest from these bonds typically avoids federal taxes and often state and local taxes for residents of the issuing state.

While municipal bonds generally offer lower yields than taxable bonds, their tax-exempt status can make them more attractive on an after-tax basis. Consider using a tax equivalent yield calculator to determine the yield required by a fully taxable bond to earn the same after-tax income as a municipal bond.

Consider your overall investment strategy and risk tolerance when incorporating municipal bonds. They shouldn’t comprise your entire fixed-income allocation, but rather serve as a tax-efficient component of a diversified portfolio.

Tailoring Tax-Efficient Strategies

Tax efficiency matters, but it shouldn’t drive all your investment decisions. Always consider your overall financial goals, risk tolerance, and investment timeline when making portfolio decisions. A financial advisor can help ensure your tax strategy aligns with your broader financial objectives.

Professional athletes, for instance, face unique financial challenges due to short career spans and potentially volatile income streams. A tailored approach to tax-efficient investing can address these distinct circumstances and contribute to long-term financial security.

Final Thoughts

Advanced investment planning techniques empower serious investors to enhance their portfolios and achieve financial goals. These strategies include Modern Portfolio Theory, alternative investments, and tax-efficient approaches. Each investor’s unique situation demands a personalized strategy, as no single solution fits all circumstances.

Professional guidance proves invaluable when navigating complex investment techniques. Davies Wealth Management specializes in crafting tailored strategies that align with clients’ specific needs and goals. Our team can help you develop a comprehensive plan that maximizes your financial potential.

Successful investing transcends the implementation of sophisticated techniques. It requires a personalized strategy that adapts to changing needs and market conditions. Advanced investment planning techniques (combined with expert guidance) position investors for long-term financial success and security.

Leave a Reply