Divorce can be a challenging life event, often leaving individuals feeling overwhelmed and uncertain about their financial future. At Davies Wealth Management, we understand the importance of financial planning after divorce to help you regain stability and confidence.

This guide will walk you through the essential steps to reassess your financial situation, rebuild your financial foundation, and plan for your future goals. By taking proactive measures, you can navigate this transition and emerge stronger on the path to financial independence.

Assessing Your Financial Landscape After Divorce

Divorce reshapes your financial world, and understanding your new financial landscape is essential. A thorough assessment of your post-divorce finances will lay the groundwork for your future financial stability.

Taking Stock of Your Assets and Liabilities

Create a comprehensive list of all your assets and liabilities. This includes bank accounts, investment portfolios, retirement accounts, real estate, vehicles, and any other valuable possessions. Account for debts such as mortgages, car loans, credit card balances, and any other outstanding obligations.

If you or your ex-spouse owned digital assets, include these in your financial inventory.

Analyzing Your New Income and Expense Structure

Your income and expenses will look different post-divorce. Create a detailed budget that reflects your new financial reality. Include all sources of income (salary, alimony, child support, and investment returns). Then, list all your expenses, from essential costs like housing and utilities to discretionary spending.

Track your expenses for at least three months to get an accurate picture of your spending patterns.

Navigating Tax Implications

Divorce can significantly impact your tax situation. Your filing status will change, and you may face new tax implications related to alimony, property transfers, and retirement account distributions.

Beginning January 1, 2019, alimony or separate maintenance payments are not deductible from the income of the payer spouse, or includable in the income of the receiving spouse if made under a divorce or separation agreement executed after December 31, 2018.

Be aware of potential capital gains taxes if you sell assets received in the divorce settlement. The step-up in basis rules for inherited property don’t apply to divorce-related property transfers.

Consult with a tax professional to fully understand and plan for these changes. A proactive approach to tax planning can help you avoid surprises and maximize your financial resources as you move forward.

Reevaluating Insurance Needs

Your insurance needs will likely change after divorce. Review your health insurance coverage (you may need to obtain your own policy if you were previously covered under your spouse’s plan). Reassess your life insurance policies and update beneficiaries. Consider disability insurance to protect your income, especially if you’re now the sole provider for your household.

As you complete this financial assessment, you’ll gain a clear picture of your new financial situation. This knowledge will serve as the foundation for rebuilding your financial future and setting new goals. The next step involves using this information to create a solid financial foundation that aligns with your post-divorce life.

Working with a financial planner who specializes in divorce financial planning can help you navigate the complexities of dividing assets, managing debts, and planning for your future financial well-being.

Rebuilding Your Financial Foundation After Divorce

Craft a Sustainable Budget

Your new budget should reflect your current income and expenses. List all sources of income, including salary, alimony, child support, and investment returns. Then, categorize your expenses into fixed (like rent or mortgage) and variable (like groceries or entertainment) costs.

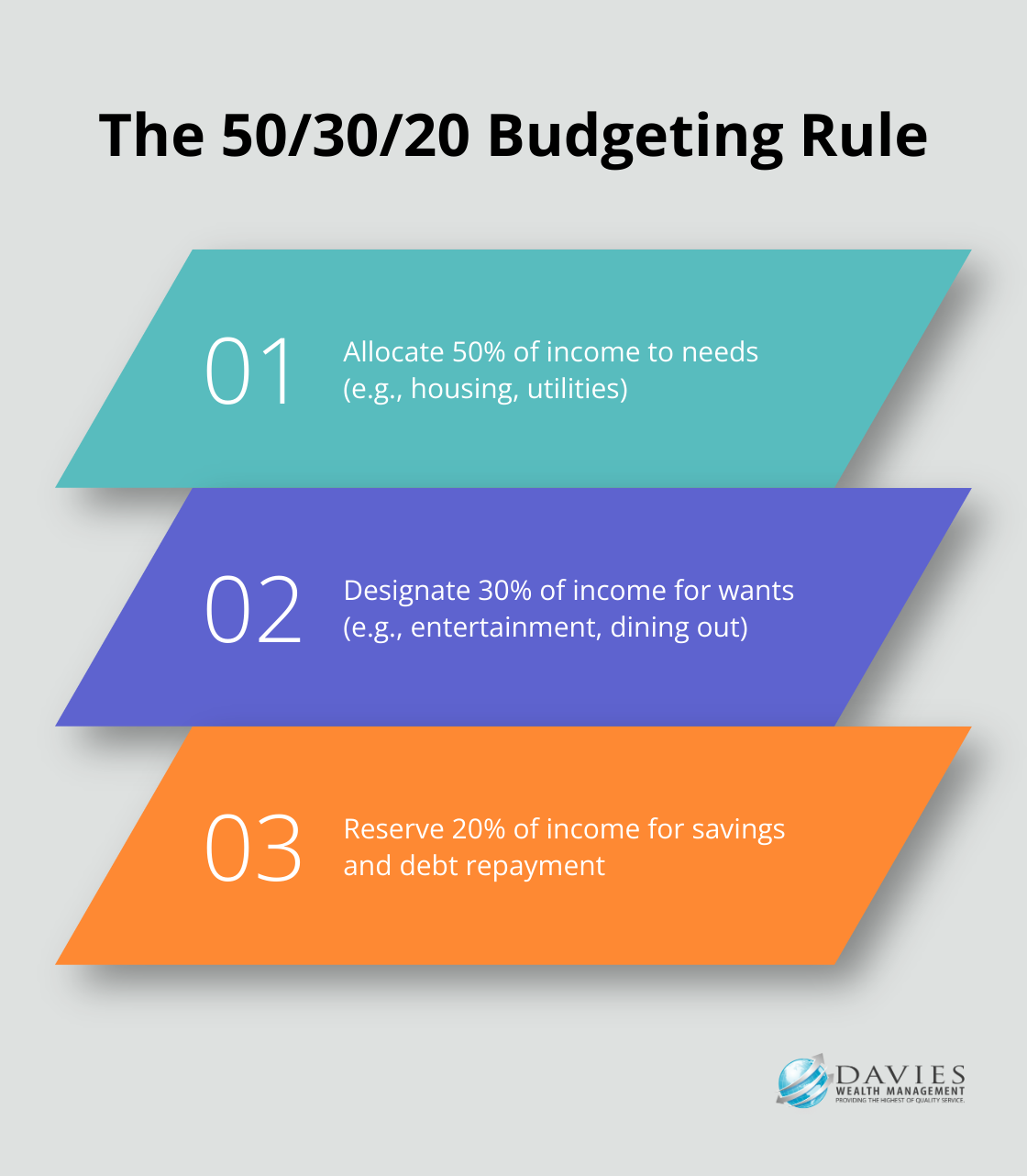

The 50/30/20 rule offers a balanced framework for managing your finances. Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This approach allows for both necessities and enjoyment.

Digital tools simplify budget tracking. Apps like Mint or YNAB (You Need A Budget) provide user-friendly interfaces to monitor spending and identify areas for potential savings.

Build Your Financial Safety Net

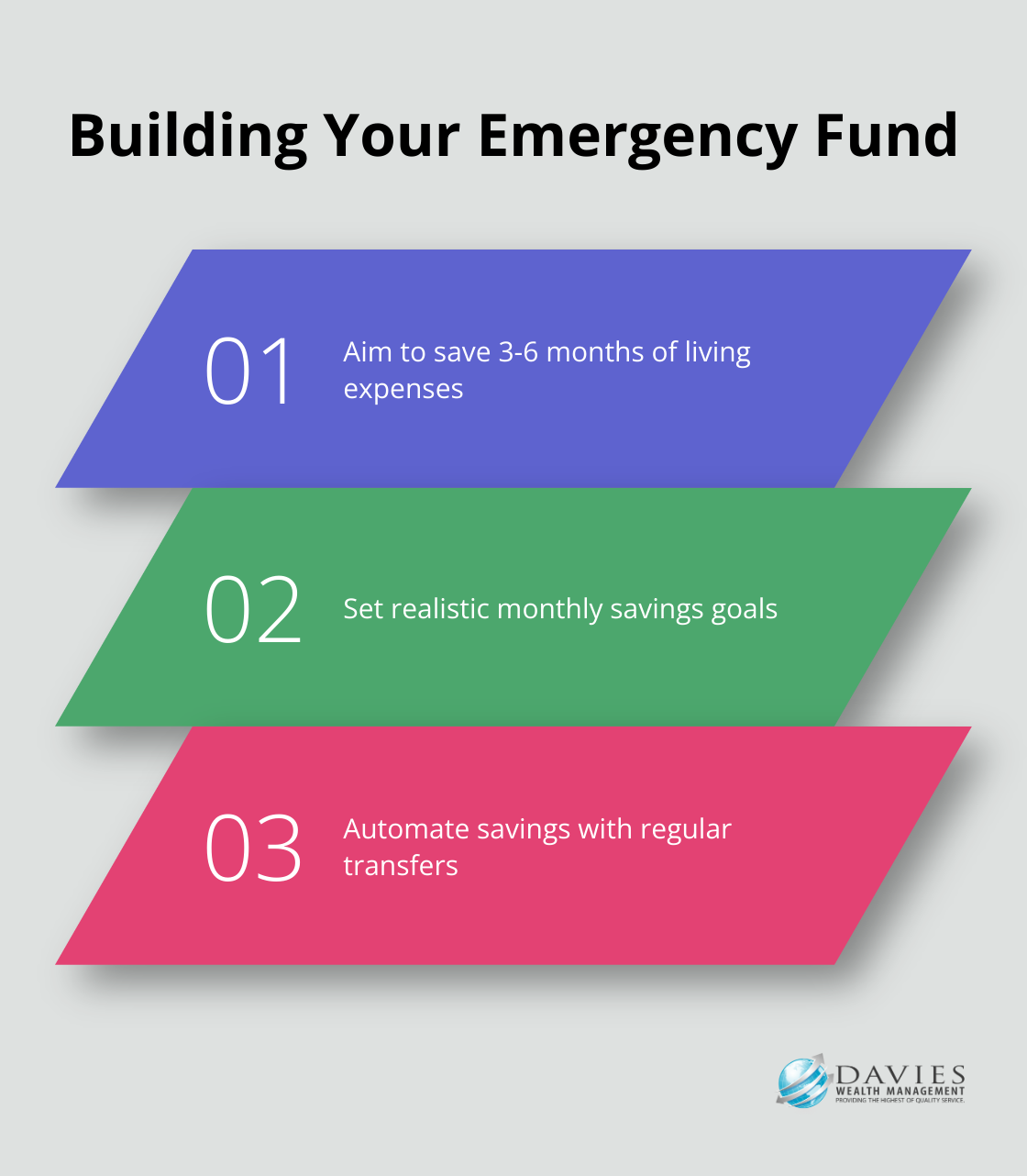

An emergency fund is essential for financial stability, especially after a major life change like divorce. Try to save 3-6 months of living expenses in a readily accessible account. If you’re starting from scratch, set a realistic monthly savings goal. Even small, consistent contributions can accumulate over time.

Consider automating your savings by setting up automatic transfers from your checking to your savings account each payday. This “pay yourself first” approach prioritizes your financial security.

Align Investments with Your New Reality

Your risk tolerance and investment strategy may need adjustment post-divorce. Factors like age, income, and financial goals all play a role in determining the right investment mix for you.

If you’re closer to retirement, you might want to shift towards more conservative investments. Younger individuals with a longer time horizon might take on more risk for potentially higher returns.

Diversification remains key to managing risk. A mix of stocks, bonds, cash and other investments can help protect your portfolio from market volatility. Exchange-traded funds (ETFs) offer an easy way to achieve diversification, even with smaller investment amounts.

Revise Your Estate Plan

Updating your estate plan is a critical step often overlooked after divorce. Start by reviewing and updating beneficiary designations on all accounts (including retirement accounts and life insurance policies).

Create or update your will to reflect your new circumstances. If you have minor children, clearly state your wishes regarding guardianship. Consider establishing a trust to provide for your children’s future needs.

Healthcare directives and power of attorney documents should also be revised to reflect your current preferences and relationships.

Estate planning can be complex. Working with an experienced estate planning attorney ensures your wishes are properly documented and legally binding.

As you rebuild your financial foundation, you’ll set the stage for long-term stability and success. The next phase involves looking ahead and planning for your future financial goals in this new chapter of your life.

Charting Your Financial Future After Divorce

Reimagine Your Retirement

Divorce requires a complete overhaul of your retirement strategy. Review your current retirement accounts and understand how they were divided in the divorce settlement. If you received a portion of your ex-spouse’s retirement account through a Qualified Domestic Relations Order (QDRO), consider rolling it into your own IRA to maintain tax-deferred growth.

Reassess your retirement timeline and goals. You may need to adjust your target retirement age or modify your lifestyle expectations. Use retirement calculators to estimate how much you need to save based on your new circumstances. Many financial institutions offer these tools for free on their websites.

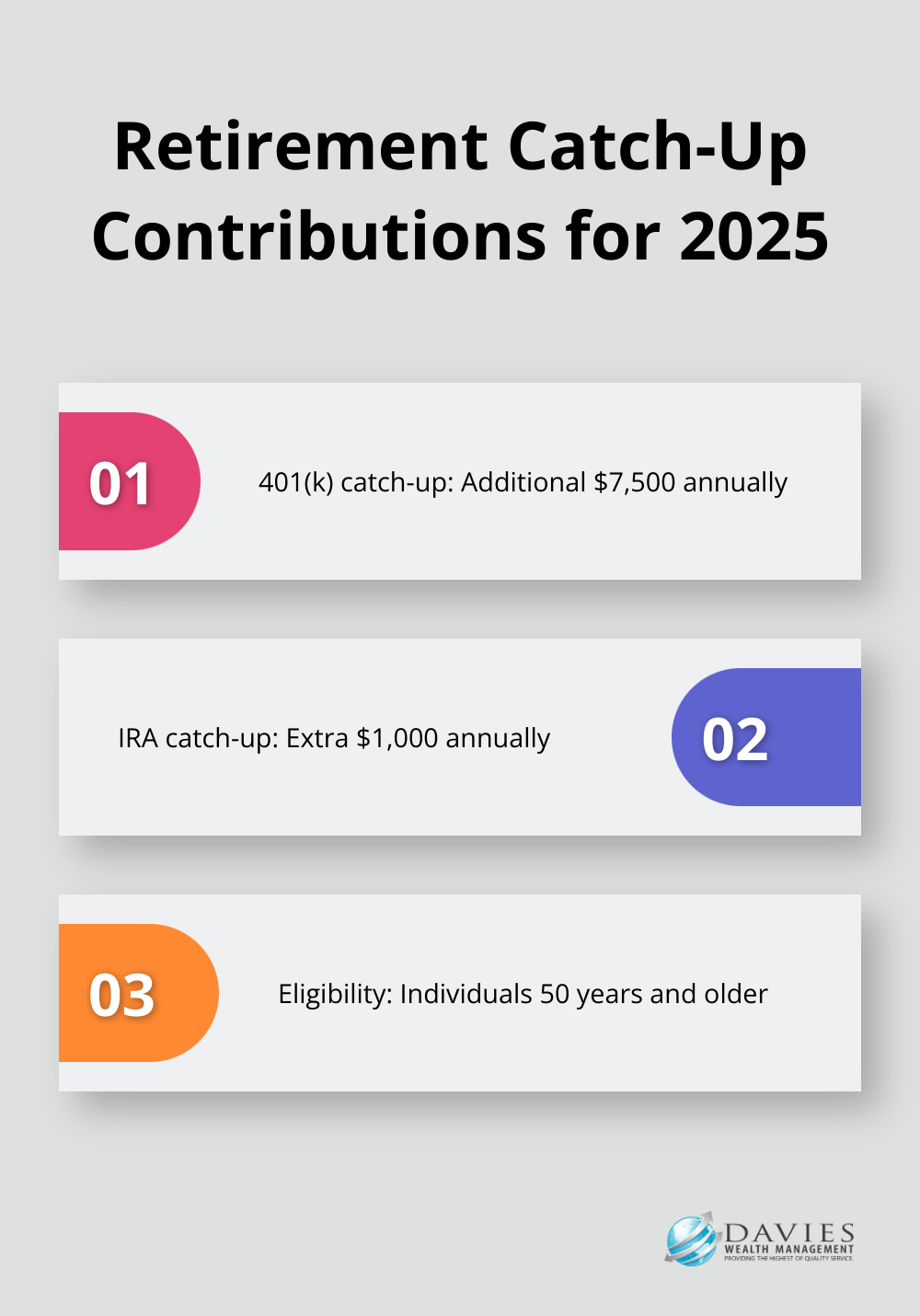

If you’re behind on retirement savings, explore catch-up contributions. As of 2025, individuals 50 and older can contribute an additional $7,500 to their 401(k) plans and an extra $1,000 to their IRAs annually. These higher contribution limits can help you accelerate your savings.

Navigate New Housing Realities

Your housing situation will likely change post-divorce, and it’s important to make financially sound decisions. If you’re keeping the marital home, ensure you can afford the mortgage, property taxes, and maintenance costs on your own.

If you’re selling the marital home, consider the tax implications. The IRS allows an exclusion of up to $250,000 of capital gains on the sale of a primary residence for single filers. Plan your sale timing accordingly to maximize this benefit.

When looking for a new home, explore all options. Renting might be a smart short-term solution as you stabilize your finances. If you decide to buy, research first-time homebuyer programs in your area (which you may qualify for as a newly single individual).

Fund Your Children’s Education

If you have children, their education expenses remain a priority. Review any existing college savings plans and adjust contributions based on your new financial situation. Consider opening a 529 plan if you don’t already have one. These plans offer tax-advantaged growth and can be used for qualified education expenses.

Explore financial aid options thoroughly. Your changed marital status may affect your children’s eligibility for need-based aid. The Free Application for Federal Student Aid (FAFSA) considers the income and assets of the custodial parent, which could work in your favor if you’re the lower-earning spouse.

Don’t sacrifice your own financial security for your children’s education. There are loans available for college, but not for retirement. Strike a balance between saving for your children’s education and securing your own financial future.

Rebuild Your Credit Profile

Establish a strong credit profile in your own name for your financial independence. Start by obtaining a free copy of your credit report from each of the three major credit bureaus through AnnualCreditReport.com. Review these reports carefully for any errors or joint accounts that need to be closed or transferred.

If you don’t have much credit history in your own name, consider applying for a secured credit card. These cards require a cash deposit and can help you build credit over time. Use the card responsibly by making small purchases and paying the balance in full each month.

Consistently pay bills on time to improve your credit score. Set up automatic payments for recurring bills to ensure timely payments. Try to keep your credit utilization ratio (the amount of credit you’re using compared to your credit limits) below 30% for the best impact on your credit score.

Final Thoughts

Financial planning after divorce requires patience and a forward-looking perspective. You can emerge from this transition with renewed financial strength by assessing your new landscape, rebuilding a solid foundation, and planning strategically for your future. Every action you take contributes to your financial well-being, from creating a sustainable budget to reevaluating your retirement plans.

This new chapter presents an opportunity to take control of your finances and shape them according to your personal goals. With careful planning and informed decision-making, you can build a secure and prosperous financial future. At Davies Wealth Management, we understand the complexities of financial planning after divorce and offer personalized guidance tailored to your unique situation.

Our team of experienced professionals can help you navigate the intricacies of post-divorce finances. We provide objective insights, help you avoid common pitfalls, and offer strategies you might not have considered. Your financial independence is within reach, and with the right support, you can transform this challenging time into an opportunity for financial growth and empowerment.

Leave a Reply