At Davies Wealth Management, we often receive inquiries about financial planning as a career. It’s a field that offers unique opportunities and challenges for those passionate about helping others achieve their financial goals.

In this post, we’ll explore the advantages, required skills, and potential hurdles of pursuing a career in financial planning. Whether you’re considering a career change or just starting out, this guide will help you make an informed decision about your future in finance.

Why Financial Planning Is a Thriving Career Path

Rapid Industry Growth

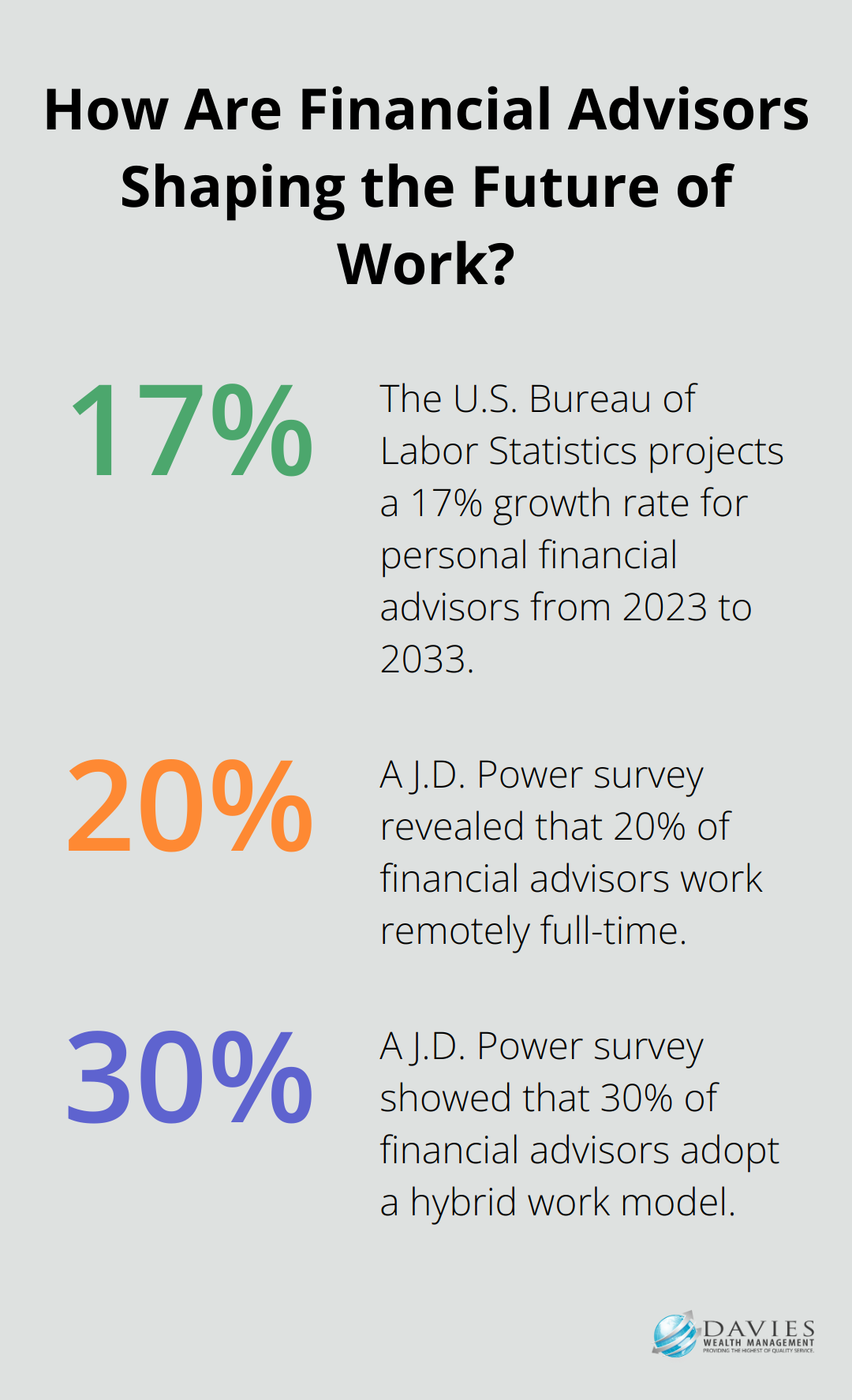

Financial planning has become one of the most sought-after professions in the finance industry. The U.S. Bureau of Labor Statistics projects a 17% growth rate for personal financial advisors over the decade from 2023 to 2033 (much faster than the average for all occupations). This surge in demand stems from several factors, including an aging population seeking retirement advice and a growing awareness of the importance of financial literacy.

Lucrative Earnings Potential

A career in financial planning offers the potential for high earnings. The U.S. Bureau of Labor Statistics reports that the median annual pay for personal financial advisors varied widely in May 2023. The top 10% of earners in this field made more than $239,200 annually. This substantial income potential often comes with performance-based bonuses and commissions, allowing ambitious professionals to increase their earnings as they expand their client base and expertise.

Positive Impact on Clients’ Lives

Financial planners have a unique opportunity to positively impact their clients’ lives. They help individuals and families navigate complex financial decisions, alleviate stress, secure futures, and enable clients to achieve their life goals. A sense of purpose derived from helping clients contributes significantly to job satisfaction in this field.

Flexible Work Arrangements

The financial planning industry offers considerable flexibility in work arrangements. A survey by J.D. Power revealed that 20% of financial advisors work remotely full-time, with an additional 30% adopting a hybrid work model. This flexibility extends to career paths as well. Planners can choose to work for large financial institutions, boutique firms (such as Davies Wealth Management), or even start their own practices. The ability to specialize in niche areas like retirement planning, estate planning, or working with specific demographics (e.g., professional athletes) further enhances career customization.

As the financial planning industry continues to evolve, those who enter this field with the right skills and dedication position themselves for a rewarding and impactful career. The next section will explore the essential skills and qualifications required to succeed in this dynamic profession.

What Skills Do You Need for Financial Planning?

Educational Foundation and Certifications

Financial planning requires a solid educational foundation. A bachelor’s degree (typically in finance, economics, business, or accounting) provides a strong base. However, professional certifications set planners apart in this industry.

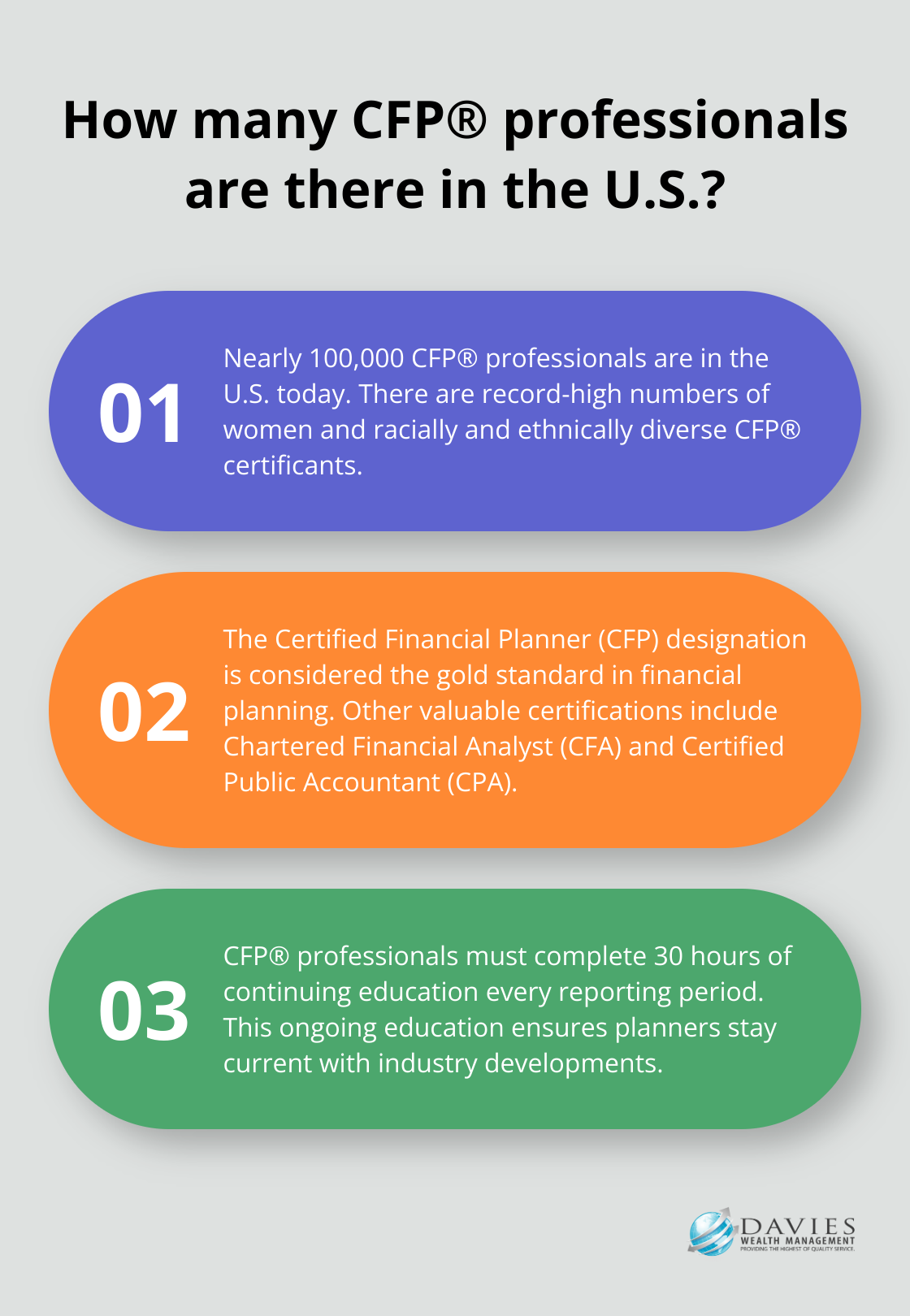

The Certified Financial Planner (CFP) designation stands as the gold standard. Today, there are nearly 100,000 CFP® professionals in the U.S., with record-high numbers of women and racially and ethnically diverse CFP® certificants. Other valuable certifications include the Chartered Financial Analyst (CFA) for investment-focused planners and the Certified Public Accountant (CPA) for those specializing in tax planning.

The Art of Communication

Technical knowledge alone doesn’t guarantee success in financial planning. The ability to explain complex financial concepts in simple terms is essential. This skill becomes particularly important when working with clients from diverse backgrounds (such as professional athletes).

Active listening plays an equally important role. Understanding a client’s goals, fears, and risk tolerance enables the creation of tailored financial strategies. Empathy and emotional intelligence contribute significantly to building trust and long-term relationships with clients.

Analytical Prowess and Technical Acumen

Financial planners must excel at analyzing complex financial data and market trends. Being a financial analyst requires a combination of technical skills, financial acumen, and a commitment to helping organizations achieve their financial goals. Familiarity with financial planning software and tools is also critical in today’s tech-driven environment.

Understanding how to use Monte Carlo simulations for retirement planning or leveraging tax optimization software can significantly enhance the value provided to clients. Top firms (like Davies Wealth Management) continuously invest in cutting-edge tools to ensure their planners offer the most accurate and comprehensive advice.

Commitment to Continuous Learning

The financial industry evolves constantly, with regulations, tax laws, and investment products changing regularly. Successful financial planners commit to lifelong learning. This involves staying updated on industry trends, attending conferences, and regularly pursuing professional development opportunities.

For example, every reporting period, Certified Financial Planner® professionals are required to complete 30 hours of continuing education (CE). This ongoing education ensures that financial planners remain at the forefront of industry developments and provide the most current and relevant advice to their clients.

As we explore the skills necessary for success in financial planning, it’s important to also consider the challenges and considerations that come with this career path. The next section will shed light on these aspects, helping you make an informed decision about pursuing a career in financial planning.

Navigating the Challenges of Financial Planning

Financial planning offers a rewarding career path, but it comes with its share of obstacles. Let’s explore some key hurdles you might face in this profession.

Balancing Client Expectations and Market Realities

One significant challenge in financial planning involves managing client expectations, especially during market volatility. Clients often expect consistent high returns, which isn’t always feasible. For example, during the 2008 financial crisis, the S&P 500 dropped by 38.5%, catching many investors off guard. As a financial planner, you’ll need to educate clients about market cycles and help them maintain a long-term perspective.

To address this challenge, you can implement regular client education sessions. Quarterly market updates and annual financial reviews help keep clients informed and reduce panic during market downturns.

Navigating Complex Regulations

The financial industry faces heavy regulation, and compliance is essential. For instance, the Department of Labor’s fiduciary rule, which expands the definition of who qualifies as an Investment Advice Fiduciary under the Employee Retirement Income Security Act, significantly impacts how financial advisors interact with retirement accounts. Keeping up with these changes requires constant vigilance and education.

To stay ahead, you should allocate time each week for regulatory updates. Joining professional associations like the Financial Planning Association (FPA) offers resources and updates on regulatory changes. Non-compliance can result in severe penalties and damage to your reputation.

Building a Robust Client Base

Attracting and retaining clients presents a persistent challenge in financial planning. A study found that the typical financial advisor spends no more than about 50% of their time on direct client activity-related tasks, and barely 20% of their time actually meeting with clients. This time investment plays a vital role in growing your practice.

To build your client base effectively, you can focus on niche marketing. For instance, if you’re passionate about sports, you might specialize in serving professional athletes. This targeted approach can help you stand out in a crowded market and attract clients who value your specific expertise.

Adapting to Technological Advancements

The rapid pace of technological change in the financial industry presents both opportunities and challenges. Robo-advisors and AI-powered tools are transforming the financial services industry, offering numerous benefits, from enhanced investment strategies to improved risk management.

To thrive in this evolving landscape, you’ll need to embrace technology while emphasizing the value of human insight and personalized advice. Try to stay updated on the latest fintech trends and incorporate relevant tools into your practice (without losing the personal touch that clients value).

Managing Work-Life Balance

Financial planning can be a high-pressure career, often requiring long hours and constant availability to clients. This intensity can lead to burnout if not managed properly.

To maintain a healthy work-life balance, you should establish clear boundaries with clients and prioritize self-care. Some strategies include setting specific “office hours,” delegating tasks when possible, and taking regular breaks to recharge. Remember, a well-rested and balanced financial planner is better equipped to serve clients effectively.

Final Thoughts

Financial planning as a career offers a unique blend of challenges and rewards. The potential for high earnings and the opportunity to impact clients’ lives positively make it an attractive choice for those passionate about finance and helping others. The growing demand for financial planning services ensures a robust job market for skilled professionals.

Success in this field requires more than just financial acumen. It demands a combination of technical knowledge, strong communication skills, empathy, and a commitment to continuous learning. Those who thrive in financial planning often possess a genuine interest in both numbers and people, finding fulfillment in solving complex financial puzzles while building lasting relationships with clients.

At Davies Wealth Management, we’ve witnessed how a career in financial planning can be immensely rewarding. Our team finds deep satisfaction in guiding clients through their financial journeys (including professional athletes seeking financial security). The ability to make a tangible difference in people’s lives while continuously growing professionally makes financial planning a career worth serious consideration for those with the right aptitude and passion.

Leave a Reply