Divorce can be an emotionally and financially challenging experience. At Davies Wealth Management, we understand the importance of financial planning during divorce to protect your future stability.

This guide will walk you through essential steps to safeguard your finances and make informed decisions during this difficult time. We’ll cover key aspects of financial planning, from understanding your current situation to protecting your interests and navigating complex considerations.

What’s Your Financial Picture?

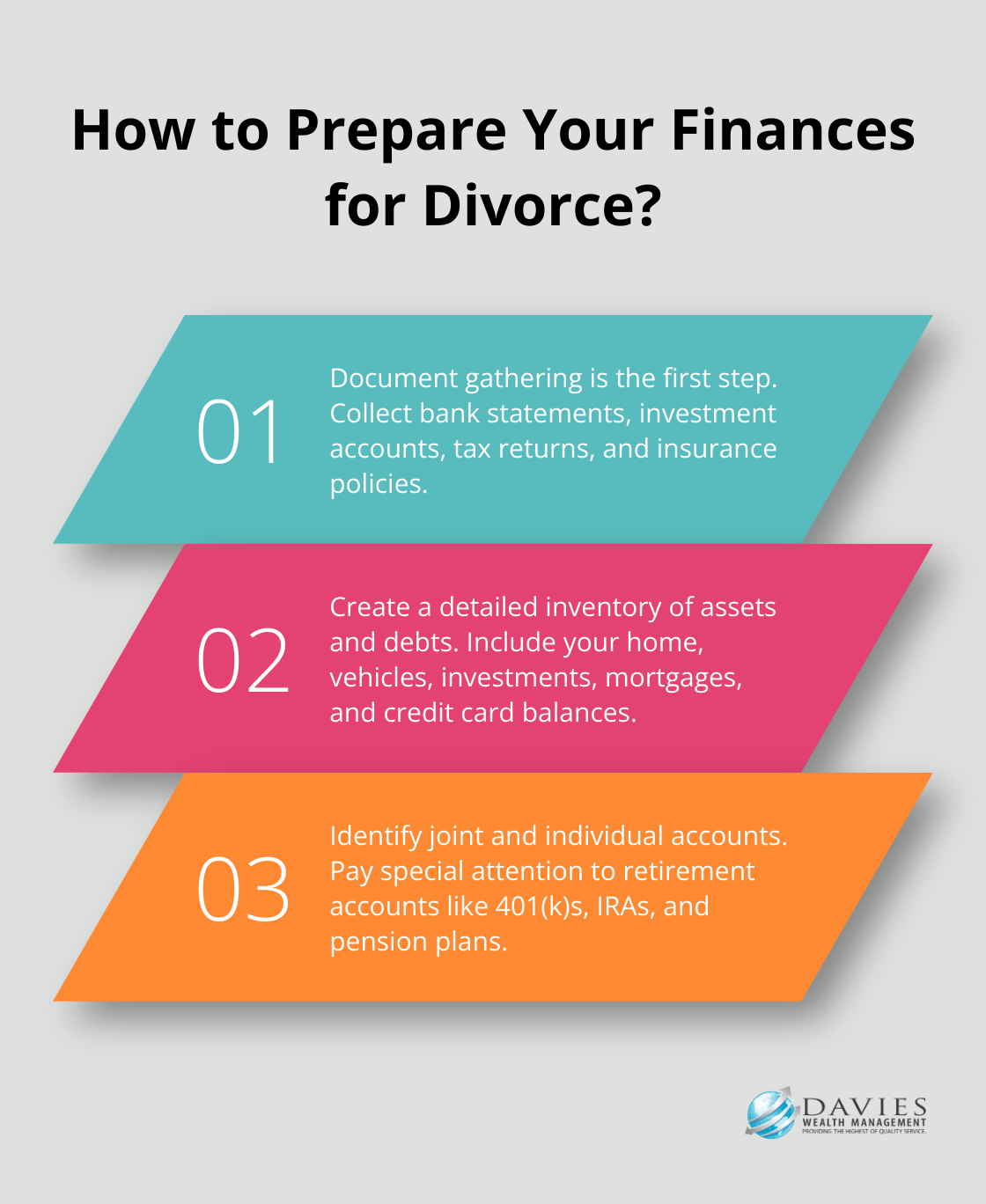

Document Gathering: Your Financial Foundation

Start by collecting all relevant financial documents. This includes bank statements, investment accounts, retirement plans, tax returns, mortgage papers, and credit card statements. Don’t overlook less obvious items like insurance policies, vehicle titles, and business ownership documents. Having these documents readily available will save time and reduce stress as you move forward.

Asset and Debt Inventory: Know What You Have and Owe

Create a detailed list of your assets, debts, income sources, and expenses. This inventory is an important part of the financial planning process during divorce. Assets might include your home, vehicles, investments, and personal property. Debts could range from mortgages and car loans to credit card balances and personal loans. Be thorough – even small items can add up and impact your financial future.

Account Analysis: Separating Yours, Mine, and Ours

Identify which accounts are joint and which are individual. This step is essential for understanding your financial entanglements and planning for separation. Pay special attention to retirement accounts, as these often have complex rules for division during divorce (e.g., 401(k)s, IRAs, and pension plans).

Income and Expense Evaluation: Your Financial Flow

Evaluate asset division and plan for long-term financial stability. This includes assessing your income sources and regular expenses. Track everything from housing costs and utilities to groceries and entertainment. This exercise will give you a clear picture of your current financial health and help you plan for post-divorce budgeting.

Accuracy and completeness are key in this process. If you’re unsure about any aspect of your finances, don’t hesitate to seek professional help. Many financial advisors (including those at Davies Wealth Management) specialize in guiding clients through these complex financial situations, ensuring no stone is left unturned in securing your financial future.

As you gather this information, you’ll begin to see a clearer picture of your financial situation. This knowledge will prove invaluable as you move forward in protecting your financial interests during the divorce process.

Safeguarding Your Financial Future

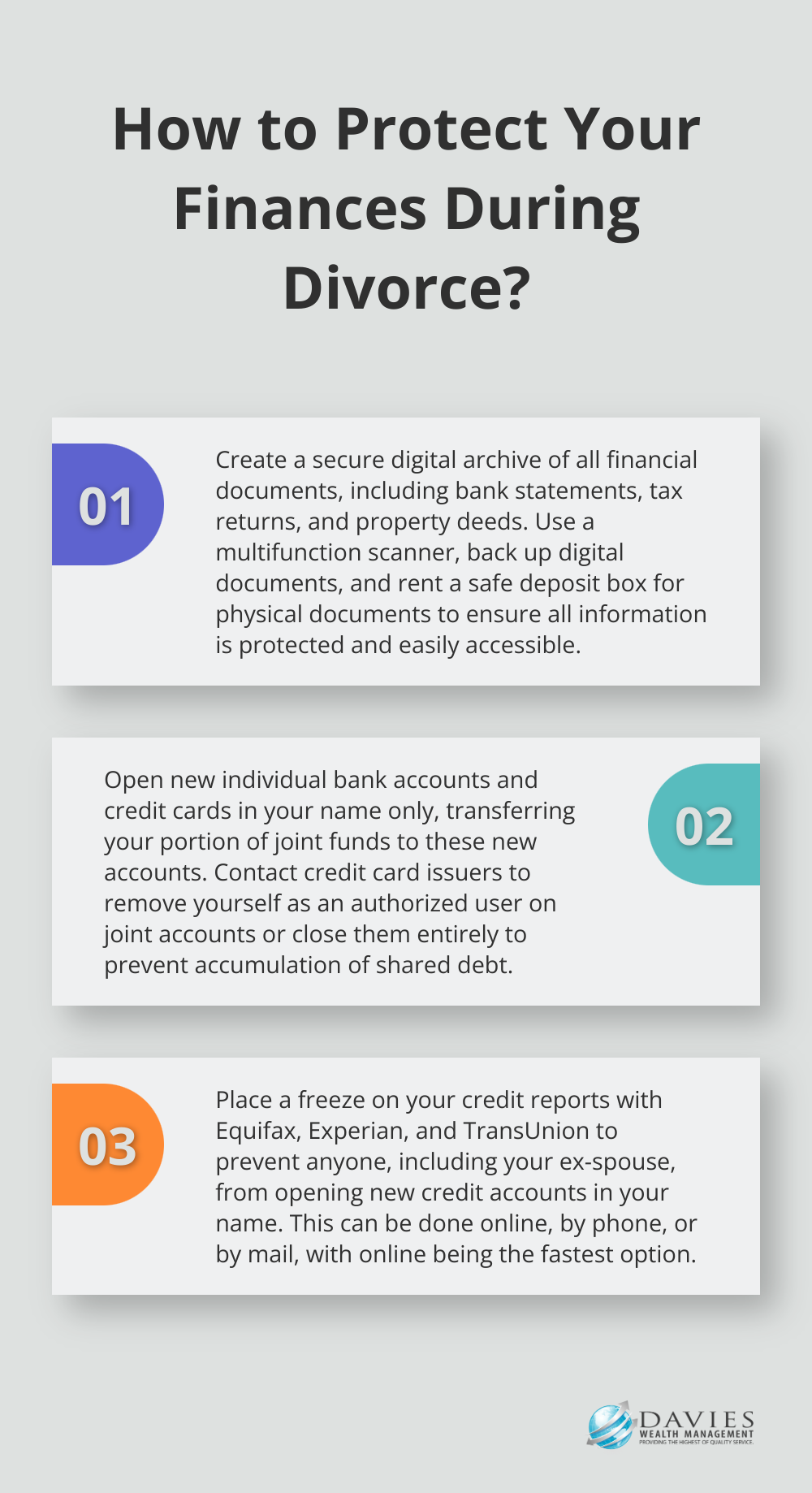

Secure Your Financial Documents

Protect your financial information by creating a secure digital archive of all important documents. This includes bank statements, tax returns, investment records, and property deeds. Invest in a multifunction scanner, back up digital documents, make copies, create a cloud storage account, and secure the data on your mobile devices. For physical documents, rent a safe deposit box that only you can access. This step ensures you have all necessary information at your fingertips and prevents potential loss or tampering.

Establish Financial Independence

Separate your finances from your soon-to-be ex-spouse as soon as possible. Open new individual bank accounts and credit cards in your name only. Transfer your portion of joint funds to these new accounts. Update direct deposits for your income to go into your new personal account.

For joint credit cards, contact the issuer to remove yourself as an authorized user or close the account entirely. This prevents your ex-spouse from accumulating debt that you might be partially responsible for. If you’re concerned about your credit score, apply for a new credit card before closing joint accounts to maintain your credit utilization ratio.

Update Your Beneficiaries

Update beneficiary designations on all your financial accounts and insurance policies. This includes retirement accounts, life insurance policies, and investment accounts. Many people overlook this step, which can lead to unintended consequences if not addressed promptly. Regularly updating your estate plans is crucial to avoid potential issues and ensure your wishes are carried out.

Protect Your Credit

Place a freeze on your credit reports with all three major credit bureaus: Equifax, Experian, and TransUnion. This prevents anyone (including your ex-spouse) from opening new credit accounts in your name. You can freeze and unfreeze your credit reports online, by phone, or by mail, with the online option being the fastest and easiest. It’s a free service that adds an extra layer of protection during this vulnerable time. Lift the freeze when you need to apply for credit yourself.

Taking these protective measures early in divorce proceedings can prevent significant financial headaches down the road. While the process may seem daunting, you don’t have to navigate it alone. Professional guidance can ensure you’re covering all bases and making informed decisions to protect your financial future.

As we move forward, it’s important to consider the key financial aspects that will shape your divorce settlement and post-divorce financial landscape. Let’s explore these critical elements in the next section.

Navigating Financial Complexities in Divorce

Dividing Assets: Beyond a Simple Split

Asset division in divorce requires careful consideration. It’s not just about splitting everything 50-50. You must assess the true value of each asset, considering tax implications, liquidity, and long-term growth potential. For example, keeping the family home might seem appealing, but it could lead to financial strain if you can’t afford the mortgage and maintenance costs on a single income.

A common error is opting for a larger share of illiquid assets (like real estate) while giving up a larger portion of retirement accounts. This decision can have severe long-term consequences. Try to achieve a balanced mix of assets that provides both immediate liquidity and long-term growth potential.

Support Payments: Crunching the Numbers

Alimony and child support calculations significantly impact your financial future. These payments typically depend on factors such as income disparity, length of marriage, and custody arrangements. In Canada, the Federal Child Support Guidelines provide a framework for determining child support amounts, while spousal support is more discretionary.

You need to understand how these payments will affect your budget both in the short and long term. Consider scenarios where your income or your ex-spouse’s income might change. Financial projections that account for various support payment scenarios can help you prepare for different outcomes.

Tax Implications: Avoiding Costly Surprises

The tax consequences of divorce can be substantial and often overlooked. For example, alimony payments are no longer tax-deductible for the payer or taxable for the recipient for divorces finalized after 2018 in the United States. In Canada, spousal support payments remain tax-deductible for the payer and taxable for the recipient.

Asset transfers can also trigger unexpected tax events. Selling a home or liquidating investments might result in capital gains taxes. It’s essential to factor these potential tax liabilities into your settlement negotiations. Understanding and planning for these tax implications can potentially save you thousands of dollars in the long run.

Retirement Accounts: Safeguarding Your Future

Dividing retirement accounts requires special attention. These accounts often represent a significant portion of a couple’s wealth and come with complex rules for division. For example, dividing a 401(k) or pension plan requires a Qualified Domestic Relations Order (QDRO), a legal document that allows for the tax-free transfer of retirement assets.

Don’t overlook the long-term impact of dividing these accounts. Losing a portion of your retirement savings means you’ll need to adjust your retirement strategy. This might involve increasing your savings rate or adjusting your retirement timeline. Developing a new retirement plan that accounts for these changes can help keep you on track for a secure financial future.

Professional Guidance: A Valuable Asset

Navigating these financial complexities during divorce can overwhelm you, but you don’t have to do it alone. Professional guidance can make a significant difference in securing your financial future. While many financial advisors offer divorce planning services, Davies Wealth Management stands out with our comprehensive approach and deep understanding of complex financial situations (including those faced by professional athletes and high-net-worth individuals).

Final Thoughts

Financial planning during divorce requires careful consideration and strategic decision-making. Each step, from gathering documents to navigating asset division, shapes your post-divorce financial landscape. Professional advice plays a critical role in this process, helping you avoid costly mistakes and make informed choices aligned with your long-term goals.

A forward-looking perspective is essential when making financial decisions during divorce. Your choices today will affect your future financial situation, including retirement planning and potential career changes. It’s important to prioritize long-term financial stability while addressing immediate concerns.

Davies Wealth Management offers expert guidance for financial planning during divorce. Our team provides personalized strategies to address your specific needs, whether you’re a professional athlete, business owner, or individual seeking financial security. We strive to help you build a solid financial foundation for your future.

Leave a Reply